Reserve Bank of Australia Annual Report – 1984 The Bank's Market operations[*]

Financial markets at the outset of 1983/84 remained nervous following the turbulent conditions surrounding the March devaluation of the Australian dollar. After that episode foreign exchange transactions had a tendency to surplus, prompting a gradual upward movement of the exchange rate of the Australian dollar. There was no certainty that this would persist into 1983/84 and the main influence on liquidity as the year opened was the projected deficit in the Commonwealth's financial transactions.

July to October

The Bank's market strategy for 1983/84 was defined against the prospect of a budget deficit of over $8 billion, which would involve a substantial injection of liquidity into the financial system. There was a need for the Bank's market operations along with primary issues of Commonwealth securities to seek firm financial conditions without provoking heavy inflows of funds from abroad.

The dimensions of this task became apparent early. In the first four months of the year, the deficit in the Commonwealth's accounts was almost double that in the same period of 1982/83. Heavy issues of Commonwealth securities were arranged to help absorb the injections of funds. The general plan was to press bond sales in this period while government net spending was heavy and before private demand for credit revived. Four bond tenders were conducted for $4.9 billion (face value). It was envisaged that a relatively steep yield curve would result which would attract non-bank funds into longer-dated Commonwealth securities, rather than into shorter Commonwealth or private obligations.

Efforts to absorb excess liquidity in the early part of this period proceeded free of problems from the external accounts. From the middle of August, however, net foreign exchange inflows had an increasing bearing on financial conditions. This coincided with a change in market sentiment about the likely direction of U.S. interest rates and the U.S. dollar. After rising for some months, U.S. interest rates began to fall around mid August, creating expectations that the U.S. dollar would weaken against other currencies including the Australian dollar. This pattern of expectations, which was conducive to short-term capital inflows to Australia, became quite firmly entrenched over much of the following months. The trade-weighted index of value of the Australian dollar was shifted more vigorously than usual in an attempt to discourage these inflows. In September, the index was changed on all but five business days, encompassing adjustments in both directions but producing a net appreciation overall. Despite this approach, which had the effect among other things of reducing the predictability of rate movements, the Bank made some heavy day-to-day purchases of foreign exchange from banks. These almost offset large net sales to the Government, leaving only a small deficit in foreign exchange transactions for the September quarter as a whole. This is shown in Graph 2.

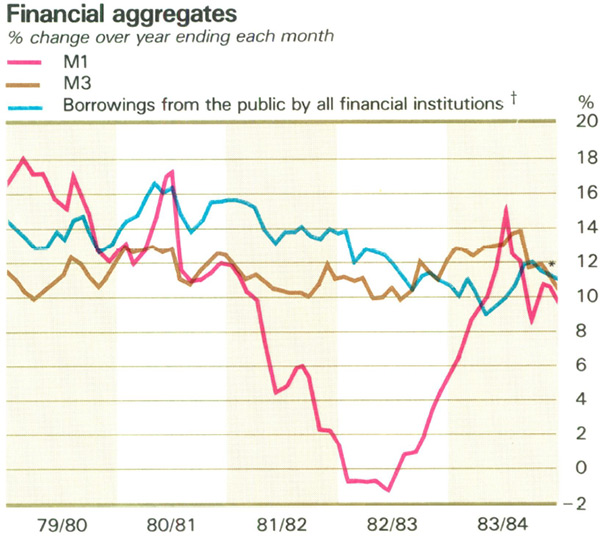

1 Financial Aggregates And Interest Rates

In October, there was a strong surge in private foreign exchange inflows as confidence grew that the U.S. dollar would continue on its downward path in international markets. Funds were attracted by prospects of speculative profits from the expected appreciation of the Australian dollar or to avoid potential losses. Covered flows were attracted by the prospect of arbitrage profits or by availability of cheaper funds, as currency hedge margins fell below interest differentials on a number of days. Political and financial disturbances in some other countries around that time added to Australia's attractiveness as a haven for funds. The policy of active management of the exchange rate was continued and the trade-weighted index of value of the Australian dollar was changed on eleven occasions. There was a net rise in the index overall although five of the adjustments were downwards. Movements in exchange rates and the costs of covering exchange risks are shown in Graph 3.

Market expectations were also reflected in the Bank's dealings in the official forward exchange market. Except for August, when new forward business was close to balance, the Bank was a substantial net purchaser of forward exchange during the four months to end October. As a result, the Bank's net forward position had turned around from about $170 million oversold to about $370 million overbought.

The net foreign exchange inflows in October together with the very large net deficit in the Commonwealth's financial transactions gave a considerable boost to growth in private holdings of liquid assets and Commonwealth Government securities (LGS). Between July and October, LGS increased by $5.6 billion, more than double the corresponding figure for the previous year. Primary issues of Commonwealth securities and the Bank's sales from its own portfolio ensured that almost ninety per cent of this increase in LGS was in the form of conventional bonds and Australian Savings Bonds (ASBs). The take-up of Commonwealth securities by non-banks was historically high and savings banks also absorbed a significant volume.

There were occasional periods of tightness in money markets during the first four months of the financial year. These were generally associated with sporadic net foreign exchange outflows or settlement periods for bond tenders. The timing of foreign exchange inflows meant that the August instalment of company taxes did not create the sharp pressures in financial markets that it had the previous year. The Bank was fairly active in liquidity management throughout the period, buying and rediscounting short-term Commonwealth securities and making loans to authorised dealers at times of excessive tightness, and selling securities to supplement primary issues when surplus cash was available.

Bond yields rose prior to the first tender in early July but then declined, although not smoothly, until early December. At that time yields on two-year bonds were around 11 per cent, compared to about 13.7 per cent at the end of June 1983. Yields on 15-year bonds (the longest offered at tender) fell from around 15 per cent to around 13.6 per cent over this same period. The decline in yields was consistent with an environment of sluggish business demand for credit, an improved inflation performance and, from mid August, the downward drift in interest rates overseas. In this environment local and semi-government authorities pushed ahead with their borrowing programmes, although not at the pace of the previous year.

Late in July, the Bank announced that it would be seeking to expand its operations in the secondary bond market. With the tender system well established, the Bank judged it was appropriate to resume more active use of its portfolio (both buying and selling) to help develop the bond market and to support monetary policy. It was made clear that any sales by the Bank would have regard to the operation of the tender system and would mainly involve short bonds, i.e. bonds with maturity less than the shortest being offered at tenders. The Bank also indicated its willingness to consider maturity switches where they served a useful purpose and did not undermine the tender arrangements. Some modest sales (and some switches) were made from the Bank's portfolio in August and September.

Lead-up to the float

The heavy foreign exchange inflows in October presaged a brief period in which the balance of payments dominated financial conditions and undermined monetary management. On 28 October, some technical adjustments were made to Australia's foreign exchange arrangements (see inset) aimed at strengthening market competition and improving the management of external flows. The Bank began to set its exchange rate for the U.S. dollar at the end of the day, which overcame the artificiality of a rate held constant during the day while exchange rates for major currencies were moving in Asian markets. The Bank also withdrew from day-to-day forward exchange operations, allowing forward exchange rates to respond directly to supply and demand forces.

This “package” of changes fell into place smoothly. Markets overseas were relatively calm at that time, and the banks themselves were initially able to absorb most of the business offered, both spot and forward, within their new limits. The Bank's transactions were minimal. Around the middle of November, however, the complex of exchange rate expectations which had shaped capital flows in the previous month reasserted itself. The Bank's net purchases of foreign exchange increased sharply. These reflected heavy overseas borrowings by the private sector and the effect of the changed forward exchange arrangements which brought some of the banks' forward commitments to the Bank on a spot basis. The Australian dollar was appreciated by increases in the trade-weighted index over this period. Markets calmed briefly in the last week of November, and there was some respite from foreign exchange inflows.

2 Selected Contributions to Change in Money (M3)

Changes in Foreign Exchange Arrangements Effective 31 October

Spot transactions

- The Bank continued to announce the trade-weighted index of value of the Australian dollar (TWI) at 9.30 a.m. Eastern time each day and an “indicative” $A/US$ rate based on the TWI.

- Banks were free to deal with their customers at mutually negotiated rates (outer limits on telegraphic transfer transactions in U.S. dollars were removed).

- Banks cleared to the Bank any net currency positions beyond “open position” limits established for each bank. Settlement was to be at rates based on the announced TWI and rates of exchange in international (mainly Asian) markets at the end of the day.

Forward transactions

- The Bank ceased quoting forward margins; banks were free to deal in forward exchange with their customers at mutually negotiated rates.

- Banks no longer cleared their net forward positions each day with the Bank, but were permitted to absorb these, within limits, on a “spot against forward” basis.

- The requirement that eligible forward risks be covered within seven days of first being acquired was removed; the exclusion of non-trade-related risks was retained for the time being.

Following the end-October measures, the $A/US$ rate quoted by banks for large customer transactions varied more during the day than formerly and, as intended, there was less speculation based on movements in currency relationships during Australia's trading day. Clearly, however, the changes were not able (nor were they expected) to remove other sources of speculative pressure on Australia's currency.

Foreign exchange transactions contributed almost two-thirds of the $1.0 billion rise in LGS during November. Another large bond tender was held and the Bank was again active in its domestic market operations; these efforts reinforced the steepening of the yield curve which had developed over earlier months. Nevertheless, on some measures financial conditions had become considerably easier; for example, the increase in M3 in the five months to November was well above that in the comparable period of 1982/83.

Exchange rate expectations returned to centre stage in early December, as rumours of an impending large revaluation of the Australian dollar rapidly gained strength. Currency hedge margins moved heavily into discount, and foreign exchange inflows accelerated as traders and others sought to position themselves for an early appreciation of the exchange rate. To discourage these flows and to limit opportunities for arbitrage profits, the authorities did not provide interest-bearing assets to absorb the additional funds created by the foreign exchange inflows. Consequently, domestic money market yields fell sharply, particularly on overnight and short-term funds. This was supported by a series of small reductions in the trade-weighted index, which also resulted in a slight fall in the $A/US$ mid-rate. However, the impact on market expectations of a revaluation was limited and short-lived. Between 1 and 8 December the Bank purchased spot from banks a net $1.4 billion in foreign exchange.

With the tenor of monetary conditions already a concern, there were substantial risks in further inflows on this scale. The signs were that they were likely to continue. Following consultations with the Government, the Bank closed the foreign exchange market on Friday, 9 December to allow the Government to consider recent events and to finalise its views on the appropriate exchange rate system for Australia. That evening, the Treasurer announced that from Monday, 12 December the spot rate, as well as the forward rate, would be allowed to float and that a major part of the existing exchange controls would be abolished (see inset).

| Tender Number |

Held | Amount Offered and Allotted ($m) |

|---|---|---|

| 8 | 5 July 1983 | 1,000 |

| 9 | 30 August | 1,500 |

| 10 | 27 September | 1,200 |

| 11 | 25 October | 1,200 |

| 12 | 29 November | 1,200 |

| 13 | 10 January 1984 | 1,100 |

| 14 | 21 February | 700 |

| 15 | 13 March | 750 |

| 16 | 15 May | 1,000 |

Early experience with the float

Nervousness and some within-day volatility in exchange rates characterised market conditions in the first days of the float. This culminated in a sharp drop in the $A/US$ rate and a ballooning of dealing spreads in early trading on 20 December. During that morning, the Bank announced the first strand of its approach to foreign exchange operations over the remainder of 1983/84 (see below). Conditions settled from that point and trading over the March quarter, for the most part, was much steadier. Daily turnover built up progressively and dealing spreads narrowed to be generally comparable with those in major markets overseas. Banks mostly had little difficulty in clearing the market within their foreign currency limits.

Changes in Foreign Exchange Arrangements Effective 12 December

Exchange rates

- Banks were free to deal with their customers in currencies at mutually negotiated rates.

- Banks no longer cleared their spot positions daily to the Bank and could hold foreign currency positions within limits established for each bank.

- The Bank no longer published $A/US$ rates at which it was willing to deal with banks.

- The Bank would not generally be intervening in the foreign exchange market but retained discretion to do so.

Exchange controls

-

Exchange controls no longer applied to most transactions, except that:

– investments in Australia by foreign governments or foreign banks were still subject to exchange control;

– Australian banks remained the only institutions authorised to deal generally in foreign exchange;

– the range of transactions eligible for cover in the banks' forward exchange market was unchanged;

– to meet the Government's tax and foreign investment policies, Bank consent continued to be needed for certain foreign transactions.

There were, nonetheless, occasional bouts of exchange rate volatility, one briefly in February and another towards the end of March. Some large transactions and elements of speculation were the main ingredients; exchange rate instability in international markets was a backdrop in March. Despite these bouts, the course of the Australian dollar was not out of line with the experience of other floating rate regimes. In the March quarter, its average volatility both during the day and from one day to the next was comparable with that of most of the major currencies and below that of some.

In a series of press releases, the Bank announced that it would not be intervening generally in the foreign exchange market. However, it retained discretion to do so and outlined the most likely circumstances in which this discretion would be used. In particular, the Bank would be in the market from time to time to test market trends or to smooth large transactions. The Bank will also undertake foreign exchange transactions in the normal course to service its clients (mainly the Commonwealth Government, overseas central banks and international institutions) but in placing such transactions in the market the Bank will not be seeking to produce or defend any particular exchange rate. Over the second half of 1983/84, some specific actions were taken to support monetary policy objectives by absorbing some of the funds generated by earlier foreign exchange inflows. The Bank took advantage of some opportunities to sell foreign exchange in the market. In addition to using its accumulated foreign exchange reserves to fund the Commonwealth's overseas payments, the Bank decided to “sell off” the net forward commitments it had had (at 28 October) when it withdrew from the forward exchange market. It also sold in the market the equivalent of the proceeds of a Commonwealth borrowing received in February. These latter actions were largely completed by the end of February. The disturbed conditions late in March led to some further net sales of foreign exchange for testing and smoothing purposes; otherwise, the Bank's foreign exchange dealings in March were relatively light.

With the floating of the exchange rate, the substantial injections to liquidity from the balance of payments were arrested. Injections prior to the float and the large deficit in the Commonwealth accounts had meant a $3.0 billion addition to LGS in December, almost as much as in the previous two months combined. In the March quarter, however, the Bank's foreign exchange dealings – including sales of foreign exchange to the Commonwealth – moved the external accounts into deficit. Commonwealth net outlays also slowed, and the increase of LGS over the quarter was only $1.1 billion.

By the end of December, the Bank had resumed a more normal pattern in its domestic market operations and was seeking to restore appropriate firmness in financial conditions. During the March quarter, there were some large Treasury note tenders and three bond tenders, which more than absorbed the additions to liquidity. These were supplemented by the Bank's own market operations and by the sales of foreign exchange mentioned above. Financial conditions tightened over the course of the quarter, as reflected in higher domestic interest rates and a stronger exchange rate. There was also some slowing in the rate of growth of the main monetary aggregates. Growth of M3 in the year to March was around 12 per cent, the top of the Government's revised monetary projection.

3 Markets for Foreign Exchange 1983/84

The rise in interest rates was due initially to efforts to restore normality in monetary conditions after the float. As the March quarter proceeded, interest rates came under some added pressure reflecting, among other things, market uncertainties about the impending seasonal rundown. The new foreign exchange arrangements, which removed the system's discretionary access to external funds, meant that this rundown would differ in character from those of other recent years. The market in aggregate was able to accumulate ample supplies of LGS assets to handle the size of the rundown in prospect. However, these were not necessarily in the hands of the institutions on which calls would be made. Hence, aside from any underlying influences, interest rate movements during the rundown would depend importantly on the prices at which holders were prepared to give up IGS and on the willingness of the Bank to buy securities prior to maturity. Market uncertainties seemed to reach a peak in the first half of March, when interest rates and market yields rose sharply. In the following weeks, a growing market consensus that the rise in interest rates would be modest and short-lived removed some of the pressure.

The Australian dollar followed an uneven path during the March quarter. It regained the ground lost early in the period offloating and strengthened both against the U.S. dollar and on a trade-weighted basis up to mid March. This coincided with a generally weaker U.S. dollar in markets overseas; other factors were indications of some improvement in Australia's current account performance, the tightening in domestic financial conditions and uncertainties about the seasonal rundown. The trend was sharply reversed in the last two weeks of March. The Australian dollar weakened again as the U.S. dollar showed greater strength and U.S. interest rates rose, while Australian interest rates declined somewhat.

June quarter

As expected, the absence of net foreign exchange inflows meant that the seasonal decline in LGS was more marked than in 1982/83. In April and May, LGS fell by $1.8 billion, more than double the figure for the previous year when there was a substantial surplus in foreign exchange transactions.

Cash rates rose in the first half of April as payments of provisional and PAYE taxes were made. A factor in the rise was the initial reluctance of some holders to quit their short-term securities; the common view that the tightness in financial conditions would be only moderate and temporary made holders reluctant to lose the prospect of later gains if yields were to fall. Banks preferred to run down Rinds they were holding with authorised dealers; the dealers, in turn, made greater use of last resort loans from the Bank than was the case in 1982/83. The Bank also bought a substantial volume of near-maturing Commonwealth securities to help smooth the transfer of funds from the private sector.

In the event, cash rates remained high in the second half of April, and markets gradually revised their expectations of funding costs. Yields on short-term securities, which had fallen late in March and early in April, returned to mid-March levels. The tightness in financial conditions continued in May, influenced by the payment of company tax, a large bond tender and the firm approach to accommodation taken by the Bank in its market operations.

The Commonwealth's transactions were in moderate deficit for most of June; however, Treasury note tenders more than absorbed funds available. The Bank was active in smoothing daily cash imbalances but, in net terms, was only a moderate purchaser in its domestic market operations. Authorised dealers made use of central bank credit for the normal end-year flows of funds but pressures on financial markets from these flows did not prove troublesome. Short-term interest rates and bond yields fell a little over the month.

Over the course of 1983/84, LGS rose by $9.3 billion. The previous largest increase, a year earlier, had been around $6 billion.

The Australian dollar weakened considerably over the June quarter. Its path was dominated by sharp declines early in April and May and a sustained decline in June. This weakening, against the U.S. dollar and on a trade-weighted basis, was associated with further increases in U.S. interest rates and the strong performance of the U.S. dollar in international markets troubled by debt problems and military developments in the Middle East. Over the period there were some sharp day-to-day and within-day movements in the Australian dollar, although the range of fluctuations was not out of line with fluctuations in the value of the major currencies and needs to be viewed against the unsettled conditions in markets overseas. The occasional volatility in market conditions did not lead to any noticeable widening in dealing spreads. The Bank was in the market from time to time, both as a buyer and as a seller, testing market conditions and seeking to smooth the effects of large transactions occasionally. The amounts involved were not large. Since the main factor in the Australian dollar's uneven performance was the volatility in relationships between the major currencies and uncertainty about how they would develop, no justification was seen for a change in the Bank's approach to intervention.

Taking 1983/84 as a whole, the Australian dollar rose by 1.9 per cent on a trade-weighted basis; the $A/US$ rate fell from 0.8745 to 0.8613, or by 1.5 per cent.

Daily turnover in the foreign exchange market has continued to grow since the float. It averaged more than $1.6 billion in the June quarter and exceeded $2 billion on several days in June. Currency hedge market activity, which had tapered off in the initial floating period, subsequently rebounded strongly.

| Series Number |

Introduced | Coupon Rate |

Withdrawn | Gross Issues |

|---|---|---|---|---|

| (% p.a.) | ($m) | |||

| 25 | 1 July 1983 | 12.25 | 3 November 1983 | 1,668 |

| 26 | 4 November | 11.75 | 29 December | 1,121 |

| 27 | 30 December | 11.25 | 29 June 1984 | 777 |

In April, the Treasurer announced that foreign exchange dealing authorities would be given to non-bank financial institutions meeting certain basic criteria. These call for minimum shareholders' funds of $10 million plus competence in foreign exchange dealing. On 19 June, 40 companies were nominated by the Treasurer as meeting the criteria. Twenty of these had received formal authority from the Bank, in terms of the Banking (Foreign Exchange) Regulations, by year end. The remainder were to receive authority as soon as they were in a position to commence activities. The authorised companies are subject to certain on-going requirements but authorisation carries no undertaking by the Government or by the Bank as to the overall financial soundness or credit standing of the institutions.

From 25 June 1984, the restriction on covering non-trade-related risks in the banks' foreign exchange market was withdrawn, effectively removing the earlier regulatory distinction between the forward exchange and currency hedge markets. There were also changes from that date to the residue of Australia's exchange control arrangements (see inset). These were related to the Government's tax screening arrangements and had been foreshadowed when most exchange controls were discontinued in December 1983. The great bulk of foreign currency transactions, including virtually all inflows from abroad, are no longer subject to exchange control formalities. Apart from tax screening requirements (which apply to certain types of payment abroad or to non-residents) the only controls being retained in terms of the Regulations relate to investments in Australia by foreign governments and foreign banks and to the taking or sending of Australian notes and coin out of Australia.

In mid June, the Bank announced that as from 1 August 1984, major trading banks would be allowed to count their loans to authorised dealers (on the security of Commonwealth Government securities) as LGS assets for purposes of the LGS convention. This modification was consistent with the Martin Report which saw these loans as suitable, on grounds of quality and maturity, for inclusion in a bank's liquidity ratio.

The Bank has also discussed with market participants the prospect, in its liquidity management operations (essentially in securities maturing within a year), of trading directly only with authorised dealers. It would then handle any transactions it wished to do in Treasury bonds longer than one year with recognised market makers in bonds. These would be selected on the basis of their volumes of bond trading and would probably extend beyond authorised dealers and brokers.

Changes in Foreign Exchange Arrangements Effective 25 June 1984

- Banks ceased to be agents of the Bank for the purposes of the Banking (Foreign Exchange) Regulations.

-

The need to submit exchange control applications for approval was removed for all transactions except:

– investment in Australia by foreign governments or foreign banks;

– the taking or sending out of Australia of Australian notes and coin.

-

New tax screening arrangements were introduced to cover certain payments abroad or to non-residents. In particular cases, they called for

– production of a tax clearance certificate;

– submission of a declaration form for prior clearance by the Bank;

– completion of a declaration form to be passed to the Taxation Office.

- Details of the arrangements are available on request from any branch of the Bank.

Footnote

Detailed quarterly surveys of the Bank's market operation during 1983/84 appeared in the Bank's Bulletin in the October 1983, January, April and July 1984 issues. [*]