Submissions – Payments System Submission to Payments System Review

Submission to the Review of the Australian Payments System

Key Points

The Bank considers that the existing regulatory arrangements for the payments system in Australia have worked well and have helped shape a payments system that in most regards is providing high-quality services for Australian households, businesses and government entities. However, key aspects of the regulatory architecture have been in place for more than two decades and there are various changes that have occurred or are underway in the payments system that suggest a review of the regulatory arrangements is timely. This submission makes a number of key points:

- Inertia and coordination problems can hold back systemic innovation in networks such as payments. Overcoming this relies on a combination of factors: having private incentives to innovate, a regulatory environment that promotes competition and access, effective industry self-governance mechanisms, widely accepted strategic objectives that act as a focal point for collective action, and pressure on the payments industry from regulators and the government to cooperate in the public interest.

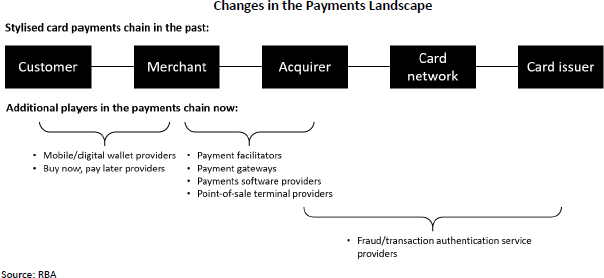

- The payments ecosystem is now more complex and there are many more entities in the payments chain than when the current regulatory arrangements were put in place in the late 1990s. There is merit in establishing arrangements that would allow all entities that play a material role in facilitating payments (e.g. possibly including payment gateways, mobile wallet providers and operators of BNPL systems) to be regulated where doing so would promote competition and efficiency and control risk in the payments system. One option here would be to clarify how these entities should be treated under the Payment Systems (Regulation) Act 1998 (Cth).

- While crypto-assets and stablecoins do not currently play a significant role in the Australian payments system, it will be important that they are considered as part of any changes to the regulatory framework.

- Industry self-governance arrangements play an important role in the regulatory framework for payments in Australia and have generally worked well in recent years. However, given the various changes in the payments landscape, it is worth considering whether these arrangements are sufficiently supportive of competition and innovation from new players, while appropriately dealing with the risks associated with participation in payment systems.

- Non-ADI payment service providers are playing a bigger role in the payments system and there is merit in considering whether a tailored licensing and oversight regime for these entities could help to promote access and competition while appropriately controlling risk.

- Oversight of payment systems to minimise financial stability risks and the potential for disruptions to economic activity from outages has become more important over time as operational and cyber-security risks have increased. Consideration could be given to clarifying the Bank's ability to set regulatory requirements to promote the financial and operational resilience of payment systems.

- Further work needs to be done to address the cost, availability and speed of cross-border payments. There is merit in examining whether there are aspects of the regulatory regime and market practices that are currently limiting competition by non-bank participants in the market for cross-border payments and international money transfers.

- While supporting innovation and the development of new payment services and functionality to meet the needs of end-users is important, it is also important that the decline, and eventual closure, of legacy payments systems (such as cheques) is carefully managed. Industry self-governance arrangements have an important role to play in managing these transitions.

1. Introduction

The Reserve Bank of Australia (the Bank) welcomes the Treasury's Payments System Review (the Review) as an opportunity to ensure that Australia has an appropriate regulatory framework and governance arrangements to support the continued development and safety of the payments system in the future.

The current regulatory framework for payments in Australia was put in place more than two decades ago. Since then, there has been substantial change in the Australian payments system, both to the way in which households and businesses make and receive payments and to the range of payment services that are offered and the entities that provide them. There has been substantial development and innovation in the payments system over this time and, in many respects, Australia has a world-class payments system that is delivering effective services for end-users. The regulatory framework for payments has contributed to this outcome by promoting both competition and innovation in the payments system and effective risk management.

While the regulatory arrangements to date have served Australia well, there are changes underway that suggest a review of those arrangements is timely. The needs of end-users are evolving, with the growing digitalisation of the economy increasing demands for more convenient, cost-effective, reliable and safe electronic payment services. The structure of the payments industry is also changing, as new technologies have supported the entry of a broad range of players which are disrupting parts of the payments value-chain and changing the role of traditional providers of payment services. The risk environment for payments is also becoming more challenging as increased systems complexity and heightened cyber risks are posing greater threats to operational resilience and security.

These changes in the payments landscape demonstrate that competition and innovation in the payments system are alive and well. But they could also have implications for the design of effective regulatory and governance arrangements. A key issue for the Review will be to ensure that the regulatory regime continues to encourage competition and innovation, while retaining the objective that the payments market is efficient, reliable and safe.

This submission discusses a number of inter-related challenges that, in the Bank's view, are relevant for considering the future regulatory framework:

- Encouraging competitors to continue to cooperate effectively on the development of new payments system infrastructure and capabilities to support the evolving needs of end-users.

- Supporting the entry of new participants in the payments industry (some of them very large, others smaller and more specialised), and addressing any access, competition or risk issues they raise.

- Having proportionate and ‘fit-for-purpose’ regulatory arrangements for new entrants in the payments system, including new forms of digital payment methods, such as digital wallets, ‘buy now, pay later’ (BNPL) arrangements and ‘stablecoins’.

- Having effective industry self-governance arrangements that control risk and promote efficiency in payment systems, while also being supportive of competition and innovation from new players.

- Supporting the operational resilience and security of electronic payments, which have become increasingly important for the smooth functioning of the economy.

- Promoting competition and efficiency in the market for cross-border retail payment services as more international payments are made in an increasingly globalised and digital world.

- Managing the transition away from, and eventual closure of, legacy payment systems such as cheques.

This submission will not cover the regulation of clearing and settlement facilities. The Council of Financial Regulators has been consulting separately on this issue and will engage with the Government on its proposals in due course.

The Bank welcomes the opportunity to engage with the Review on the contents of this submission and any other issues where the Bank's input may be helpful.

2. The Current Regulatory Framework

The Australian payments system is regulated by a combination of regulators, self-regulatory bodies, and the federal government. The main elements of the current regulatory framework were established following the recommendations of the Wallis Inquiry in the late 1990s.

The Reserve Bank and the Payments System Board

The Reserve Bank is the principal regulator of the Australian payments system, with the Bank's payment system policy determined by the Payments System Board (PSB).[1] The PSB is comprised of up to eight (mostly external) members: the Governor, another representative of the Bank, a representative from the Australian Prudential Regulation Authority (APRA), and up to five other members appointed by the Treasurer. The creation of the PSB as a dedicated payments system regulator was a central element of the reforms recommended by the Wallis Inquiry in 1998.[2]

The payments system mandate, powers and responsibilities of the Bank and the PSB are set out in various pieces of legislation:

- Reserve Bank Act 1959 (Cth)

- Payment Systems (Regulation) Act 1998 (Cth) (PSRA)

- Payment Systems and Netting Act 1998 (Cth) (PSNA)

- Part 7.3 of the Corporations Act 2001 (Cth).

The PSB has a general duty to direct the Bank's payments system policy to the greatest advantage of the people of Australia. The PSB has a specific duty to ensure that the Bank exercises its powers under the PSRA and the PSNA in a way that best contributes to:

- controlling risk in the financial system;

- promoting the efficiency of the payments system; and

- promoting competition in the market for payment services, consistent with the overall stability of the financial system.

The Bank has a range of powers to pursue these goals, including the ability to ‘designate’ a payment system as being subject to its regulation and then to impose standards and/or an access regime on participants in that system, if warranted on public interest grounds.[3]

The Bank does not impose licensing or authorisation requirements for any payment service providers, with the exception of currently having powers to do so for some purchased payment facilities (also known as stored-value facilities or SVFs). Entities wishing to provide retail payment services in Australia are therefore not required to obtain any licence or authorisation from the Bank to operate, although they typically will have general conduct or prudential licensing requirements with other regulators. Payment service providers are only regulated by the Bank if they are participants in designated payment systems for which the Bank has imposed standards and/or an access regime.

Other domestic regulators

Several other regulators also have roles in the regulation of the payments system. The Australian Competition and Consumer Commission (ACCC) has a broad mandate to promote market competition and access, which includes payments system arrangements. APRA, as the prudential regulator, licenses and supervises a range of financial institutions, many of which provide payment services. The Australian Securities and Investments Commission (ASIC) is responsible for market conduct and consumer protection across the financial system, which includes oversight of providers of non-cash payment products and clearing and settlement facilities. ASIC also administers the ePayments Code, which is currently a voluntary code of practice applying to consumer electronic payment transactions.

While there are some potential overlaps between the responsibilities of the various regulators, these have been effectively managed or are being addressed:

- Both the Bank and the ACCC have a mandate to promote competition in the market for payment services. However, the potential for regulatory overlap is resolved by the legislation setting out their respective responsibilities. The effect, as noted in a Memorandum of Understanding (MOU) between the two agencies, is that the ACCC retains responsibility for competition and access in a payment system, unless the Bank has designated the payment system and imposed an access regime and/or set standards for that system.[4]

- The Bank, APRA and ASIC currently have shared responsibilities for the regulation of SVFs – facilities in which pre-paid funds can be used to make payments. In practice, this has resulted in complex and overlapping regulation. Recognising this, the Government has recently agreed to implement the CFR recommendations for simplifying the regulatory framework for SVFs; this includes making APRA and ASIC responsible for regulating and licensing individual SVF providers, with the Bank no longer involved.[5] The regulators are currently working with the Government to implement the recommendations.

Given their common interest in payments regulation, the domestic regulators have developed a range of coordination and information-sharing arrangements (some of which are set out in MOUs). For example, the heads of the Reserve Bank and the ACCC meet at least annually, and the staff meet every three months, to discuss payments system competition issues and share relevant information; additional ad hoc meetings are also held between the RBA and ACCC staff to discuss specific issues in detail. Both agencies also notify each other, and provide an opportunity for comment and discussion, when considering policies relating to competition in the payments system. The two agencies have also worked together on particular issues, including most recently in a 2018–19 review of access arrangements for the New Payments Platform (NPP). More generally, the Bank has long-established and collegiate working relationships with all of the regulatory agencies, and there is frequent dialogue and close cooperation at all levels. The CFR also plays an effective role as the coordinating body for the main financial regulators. The Bank's view is that these various arrangements have been effective at delivering consistent and well-informed payments–related policy and avoiding regulatory gaps.

Government

The Parliament determines the regulators' objectives and the overarching regulatory framework for payments policy through legislation. The Reserve Bank and the PSB, as well as other domestic regulators, have broad discretion over how they use their powers to achieve their objectives. This is similar to the arrangements for monetary policy, where the broad goals are set by legislation and a Statement agreed with the Treasurer, with the Bank having independence as to how it sets interest rates and uses other monetary policy tools to achieve those goals.

Consistent with arrangements for other financial sector regulators, the Government has issued a Statement of Expectations for the PSB.[6] This outlines the Government's expectations for how the PSB will balance its objectives and respond to changing circumstances in the context of the Government's policy priorities. To the extent they are consistent with its statutory obligations, the PSB takes into account the Government's policy priorities in discharging its responsibilities. The PSB also informs the Government of its policies through a number of channels. The Bank's staff maintain a close dialogue with staff at Treasury, both bilaterally and through forums such as the CFR and the Governor discusses payments matters with the Treasurer as required. In the Bank's view, these arrangements have been effective, ensuring that the Government's policy priorities are appropriately factored into the PSB's decision making and that the Government is well informed of the PSB's policy decisions. Nevertheless, in the event of a difference of opinion, there is a mechanism in the Reserve Bank Act 1959 for the Government to determine a particular policy to be adopted by the Bank.

Regulatory independence must be accompanied by high levels of transparency and accountability. The PSB is accountable to the Parliament, and ultimately to the public. The PSB's Statement of Intent, published in response to the Government's Statement of Expectations, sets out a range of accountability mechanisms, including:[7]

- The composition of the PSB, particularly the majority of independent members.

- The publication of an Annual Report, which provides details on the Board's activities over the previous year.

- The twice-yearly appearance of the Governor and other senior officials of the Bank before the House of Representatives Standing Committee on Economics.

The work of the Reserve Bank overseen by the PSB is also subject to the requirements of the whole-of-government performance management framework under the Public Governance, Performance and Accountability Act 2013.[8] Further, in relation to its powers and functions overseen by the PSB, the Bank complies with the Regulator Performance Framework, which requires regulators to make an annual assessment of their performance in minimising compliance costs arising from the administration, monitoring and enforcement of their regulation.[9] This process includes a structured mechanism for regulated entities to express their views on the Bank's regulatory performance.

Industry self-regulation

Formal regulation of the Australian payments system is complemented by significant industry self-regulation. In principle, self-regulation can be effective, especially in a highly specialised and rapidly changing industry like payments. It may be more responsive to changing circumstances and can leverage participants' industry-specific knowledge and expertise. While participants have a common incentive to ensure that systems are efficient, safe, reliable, and that they meet the needs of end-users, the network nature of payment systems means that these goals cannot be achieved solely through competition. Significant cooperation among participants, including competitors, is also often required. Accordingly, self-regulatory mechanisms that facilitate cooperation among payment system participants have tended to develop naturally.

The main self-regulatory body for the payments industry is the Australian Payments Network (AusPayNet). AusPayNet develops and administers rules and standards governing payments clearing and settlement in Australia, specifically in relation to cards, cheques, direct debits and credits, and high-value payments, as well as the distribution of bulk cash. Its members include financial institutions, majorretailers, payment system operators and technology providers. Individual payment schemes (such as the card schemes) also have their own rules and standards that members of those schemes must follow.

Industry collaboration is also facilitated by the Australian Payments Council (APC), which is the main strategic coordinating body for the payments industry. It has an independent chair, with members comprising senior executives from a wide range of payments organisations, including financial institutions, card schemes, major retailers and other payments service providers, as well as AusPayNet and the Reserve Bank.[10] The APC's work is guided by a strategic agenda that is periodically updated in consultation with the industry and the Bank.

One concrete example of self-regulation in payments is in the area of fraud prevention. Payment system operators and participants will generally have an incentive to manage payment fraud and to balance the cost of fraud detection and prevention techniques against the cost (including the reputational cost) of fraud itself. But there is also a need for coordination across different systems on some aspects of fraud prevention. Over recent years, the payments industry has successfully collaborated on a number of initiatives to address card payment fraud. This includes implementing ‘chip and pin’ technology for the authentication of card transactions at the point-of-sale and, more recently, implementing a coordinated framework to address rising card-not-present payment fraud.

The PSB's approach to payments regulation

In its policymaking and regulation of the payments system, the PSB has a longstanding publicly stated presumption in favour of self-regulation by the industry, consistent with the intent of the PSRA.[11] In practice, this means that the PSB initially seeks to address any public interest concerns relevant to its mandate by encouraging and sometimes working with the industry to find a solution. The PSB only introduces formal regulation if it becomes clear that a self- or co-regulatory solution is unlikely to emerge and it is in the public interest to regulate. Industry-driven solutions can have a range of benefits over formal regulation, but one advantage is that they can be quicker and more flexible to respond to new issues and risks, which is important in a rapidly changing environment.

As a result of this approach, the scope of the Bank's regulation to date has been relatively narrow. It has largely focused on:

- interchange fees and scheme rule restrictions relating to merchants in card systems, with regulation aimed at improving efficiency in the payments system by making price signals more transparent to end-users[12]

- access regimes for several card systems and the ATM system, to facilitate participation and competition from new players.

Consistent with its statutory obligations, the PSB consults widely before introducing any formal regulatory requirements. As part of a structured consultation process, the Bank issues a detailed consultation document on any proposal and invites feedback from all stakeholders, allowing a reasonable period of time for responses to be provided. Bank staff make themselves available for discussions with any and all parties that may be affected by, or have an interest in, the Bank's regulatory actions. The PSB is also conscious of the need to allow sufficient time for affected entities to implement any regulatory changes.[13]

As well as consulting on specific regulatory proposals, the Bank and PSB have a number of formal arrangements for regular engagement with industry stakeholder groups. For instance:

- The PSB has an MOU with the APC to support regular engagement, which includes an annual meeting between the two bodies.

- The Bank has an MOU with AusPayNet that supports regular liaison, and senior staff from the Bank's payments policy and settlements areas meet with the AusPayNet Board at least once a year.

- The Bank has an MOU with NPP Australia Limited (NPPA), which sets out arrangements for engagement and information sharing. Although the Bank does not regulate NPPA, the arrangements are intended to address any actual or perceived conflicts associated with the Bank's policy role in the payments system and its operational and business involvement in the NPP.

- The Bank has established a Payments Consultation Group with the aim of providing a more structured mechanism for users of the payments system – including organisations representing consumers, businesses and government agencies – to convey their views on payments system issues as input to the Bank's policymaking process. This group meets at least twice a year.

The payments system is constantly evolving and new issues and risks can emerge that require a shift in regulatory focus. To ensure that it is appropriately forward looking, the PSB periodically discusses and endorses strategic priorities that guide the Bank's payments policy work, and these are published in the PSB's Annual Report.[14] These priorities reflect the PSB's assessment of trends and developments in payments that could have the most significant implications for competition, efficiency and risk over the coming years. The Bank's medium-term payments-related work agenda is focused on addressing these priorities.

The PSB also conducts comprehensive reviews of the Bank's regulatory settings every five years or so, to ensure that they remain fit for purpose. The latest review is currently underway, with Bank staff engaging in extensive consultation with stakeholders on a wide range of policy issues. The review is set to conclude in 2021.[15]

As noted above, formal regulation is only one way in which the Bank seeks to facilitate competition and efficiency in the Australia payments system. Section 4 highlights some of the strategies the Bank has employed to encourage innovation in the payments system. But it is worth noting that the ability of the Bank to encourage industry-based solutions and self-regulation is bolstered by its regulatory powers and the knowledge that they could be used.

3. The Evolving Payments and Regulatory Landscape

The payments landscape in Australia, as in many countries, is evolving rapidly because of changing end-user preferences, technological innovation in the supply of payments and the entry of new players in the payments market. Innovation and new market entrants are resulting in payment services that better meet end-user demands for convenient, cheap, reliable and secure means of payment. But they are also increasing the complexity of the payments system and raising many issues for both the payments industry and for regulators. It is important that regulatory arrangements remain suitable for Australia's modern, dynamic payments system, striking a balance between the objectives of supporting innovation and ensuring that the payments market remains competitive, efficient, reliable and safe.

Changes in payment behaviour

The way in which Australians make and receive payments has changed considerably in the past decade or so. The overarching development has been a trend rise in the use of electronic payment methods for retail transactions and a decline in ‘paper-based’ methods such as cash and cheques (Graph 1). The shift to electronic payments reflects consumer preferences for, and greater acceptance of, electronic payments for a range of transactions, including a move towards more transactions taking place online. This trend has also been driven by the innovations in the supply of payment services (discussed further below). Changes in payment behaviour induced by the COVID-19 pandemic have reinforced the shift to electronic payments and online transactions.[16]

The use of cash for payment transactions has continued to decline. The Bank's most recent Consumer Payments Survey (CPS) undertaken in late 2019 indicated that cash was used for 27 per cent of the number of consumer payments in 2019, compared with 69 per cent in 2007.[17] In recent years, the decline in the share of consumer cash payments in Australia has been particularly pronounced for lower-value purchases made in person. A shift away from cash has also been apparent internationally over recent years, although there are also some notable differences in the level of cash use across countries.[18]

The use of cheques has fallen rapidly over the past decade (Graph 2). There were less than 1.9 cheque transactions per person in 2019/20 (compared with around 14 per person a decade ago) and cheques accounted for less than ½ per cent of all non-cash payments by number. Part of the recent sharp decline in the value of cheques has been driven by a sharp fall in financial institution (bank) cheques as more property settlements have moved to electronic conveyancing platforms.

Debit cards are the most frequently used payment method, having overtaken cash in recent years. In the latest CPS, debit cards accounted for 44 per cent of the number of payments, up from 22 per cent in 2010. Debit card use per person in Australia is higher than in just about all other comparable countries (Graph 3).

When making a card payment, Australians are more likely to use a debit card than a credit card. Furthermore, the number of domestic personal credit card accounts has fallen by 11 per cent over the past couple of years. The reduced popularity of credit cards is likely to reflect a range of factors, including reductions in the generosity of credit card rewards programs and changing attitudes towards this type of personal debt. The recent emergence of new ways to smooth spending and fund consumer purchases (such as BNPL services) may have also played a role.

Consumers now mostly use contactless ‘tap-and-go’ card functionality when making in-store payments. In the latest CPS, survey participants made 55 per cent of their in-person payments by tapping a card or mobile device on a compatible terminal (Graph 4, left panel). While the majority of contactless payments were made with a physical plastic card, the CPS indicated that the use of devices such as mobile phones or watches to make tap-and-go payments had grown strongly over recent years, to be about 5 per cent of point-of-sale card payments in 2019 (Graph 4, right panel). Anecdotally, the share of contactless payments appears to have risen further during the COVID-19 pandemic.[19]

Australian households and businesses are increasingly making and receiving payments remotely. The share of card payments made remotely (rather than in person) is currently about 17 per cent, up from 12 per cent in 2010 (Graph 5). During the pandemic people made more use of online shopping and it would not be surprising if some of this uplift becomes permanent. The increased consumer use of remote payments has been accompanied by more businesses selling goods or services on their websites or via mobile apps. Payments often happen automatically ‘in the background’ now, with payment services facilitating seamless transactions using stored payment credentials and automated direct debit transactions becoming more common. The latest CPS indicated that 81 per cent of respondents had an automatic payment arrangement in 2019 (compared with 65 per cent in 2013), and automatic payments represented 21 per cent of the value of total spending.

Consumers have adopted a number of new payment methods in recent years. Around one fifth of consumers indicated in the latest CPS that they had recently used a BNPL service, and a somewhat higher share had used a mobile device to make tap-and-go payments or an in-app payment (Graph 6). Despite relatively high awareness, less than one per cent of consumers reported having used a cryptocurrency such as Bitcoin to make a consumer payment in the previous 12 months.

Innovation in the supply of payments

Changes in the way Australians make and accept payments has been spurred by the development of more convenient electronic payment services and the introduction of new payment methods by both existing participants and new technology-focused market entrants. While much of this innovation has been to customer-facing services driven by competition between participants, there has also been innovation in the infrastructure supporting payments that has required strong cooperation between participants.

Key innovations in the supply of payments over the past decade include:

- New technology (terminals and chip-based cards) rolled out by card issuers and acquirers to enable contactless tap-and-go card payments. This has contributed to contactless payments being adopted much faster in Australia than in many other countries.

- Card payment security measures, including ‘chip and pin’ technology for the authentication of card transactions, fraud detection tools, and initiatives to improve the security of how card details are stored at merchants, including through tokenisation.

- In-app payments that embed the payment in a transaction, obtaining customer details once and then removing the need for customer authorisation of subsequent individual transactions. These payment methods are commonly used for app-based ride-hailing and meal delivery services, for example.

- Digital wallets, which are applications on smartphones and other devices that store electronic representations of payment cards. These applications can be used to make contactless payments when shopping online, and at the point-of-sale using the near-field communication (NFC) or quick response (QR) code functionality of the mobile device to communicate with a payment terminal. Mobile payment applications offer both convenience and security to cardholders.

- BNPL services, which enable consumers to make purchases by paying a portion of the purchase price upfront and then paying the remainder to the BNPL provider in a series of low- or zero-interest instalments. These services have become increasingly accepted by merchants in a number of retail segments, both online and in person.

- The introduction of real-time payments with the establishment of the NPP in 2018. The NPP is a new payment infrastructure that provides consumers, businesses and government agencies with the ability to make and receive real-time, data-rich, account-to-account transfers 24 hours a day, every day of the year, and to address these payments in a relatively simple way. For more information on the NPP see Box A.

A key factor driving innovation in the payments system has been the increasing involvement of technology-focused businesses (as opposed to more traditional participants such as banks) in the provision of payment services. However, in most cases, these new players still rely heavily on existing payment system infrastructure and payments system participants to facilitate payments.

New entrants to the Australian payments market include ‘fintechs’, which often develop services focused on particular elements of the payments value-chain. In recent years, fintechs in Australia have driven innovation in areas such as online payments, point-of-sale acceptance technology, cross-border retail payments and BNPL services. Large multinational technology companies, often known as the ‘big techs’, are also increasingly incorporating payments functionality into their technology platforms and range of services. Mobile wallets such as Apple Pay and Google Pay are the most prominent examples of this in Australia.[20] With their very large user bases, data sources and superior technology capabilities, big techs have the potential to overcome network effects and make inroads into payments very quickly. Figure 1 describes some of the changes that have been occurring in the cards payments landscape over the past decade or so.

Another type of innovation that has attracted considerable attention in recent years is the development of cryptocurrencies and so-called stablecoins. These initiatives are purported to enable cheap peer-to-peer transactions with reduced reliance on intermediaries and traditional payment networks. But while cryptocurrencies such as Bitcoin have gained a lot of attention as a possible investment, they have not yet gained traction in consumer payments. Internationally, issues around digital ‘currencies’ and their potential use in consumer digital wallets gained greater prominence following Facebook's announcement that it was developing a global stablecoin (originally called Libra, but recently rebranded as Diem). Since the original announcement, the Swiss-based Libra Association (now the Diem Association) has announced plans to launch single-currency stablecoins intended for use in consumer digital wallets and is currently applying for a payment system licence from the Swiss Financial Market Supervisory Authority (FINMA), which would be required to launch the initiative.

Implications for payments system regulation

The structure of the payments system is changing. In some respects, it is now better described as a payments ecosystem. In this ecosystem, the payment chains can be longer and there are more entities involved and new technologies are being used to facilitate payments. This more complex and dynamic environment is clearly providing benefits to end-users of the payments system. However, it also raises questions about the ability of regulators to continue to meet their public interest objectives in the future.

As noted earlier, a key piece of legislation governing the Bank's regulatory responsibilities – the PSRA – was put in place over 20 years ago, at a time when the payments landscape was much simpler. This legislation gives the Bank specific powers in relation to payment systems and participants in those systems. In particular, it allows the Bank to designate ‘payment systems’ as being subject to its regulation and then to impose standards and/or access regimes on ‘participants’ in those designated payment systems. ‘Payment system’ is defined under section 7 of the PSRA to mean ‘a funds transfer system that facilitates the circulation of money, and includes any instruments and procedures that relate to the system’ and a ‘participant’ in a payment system is defined as a constitutional corporation that is either ‘an administrator of the system’ or ‘a participant in the system in accordance with the rules governing the operation of the system.’ Subsequent case law has provided some interpretation of these definitions in the specific context of card schemes.[21] However, there is still uncertainty about how the definitions would apply to the wider range of payment arrangements now available and the entities that now play, or may in the future come to play, a material role in facilitating payments.

Since it was given its responsibilities as the principal regulator of the Australian payments system, the Bank has pursued its mandate through the use of its regulatory powers in conjunction with its ability to persuade and to help solve coordination problems in payments networks. In light of the developments in payments over the past two decades, it is worth considering what the right balance is here and whether the regulatory arrangements could be modified to better reflect the complexities of Australia's modern payments ecosystem and the pace of technological innovation. In particular, many of the new players in the payments ecosystem may not fit within the existing regulatory framework. This could make it challenging for the Bank (or other regulators) to take appropriate regulatory action if it were in the public interest and consistent with its mandate. Some examples of potential regulatory challenges posed by recent changes in the payments landscape include:

- No-surcharge rules imposed by BNPL arrangements. The Bank has long been of the view that the ability of merchants to levy a surcharge on more expensive payment methods helps put downward pressure on merchant payment costs. Experience with the removal of no-surcharge rules in card schemes – most notably in the cases of American Express and Diners Club (Graph 7) – has borne this out. As part of its current Review of Retail Payments Regulation, the Bank is therefore considering whether there is a public policy case to require BNPL providers to also remove their rules that prevent merchants from recovering the cost of acceptance from BNPL users. The PSB has not reached any conclusions on this issue yet. However, some BNPL providers are of the view that the Bank may not have the power to regulate in this area because BNPL arrangements may not meet the definition of a ‘payment system’ and/or providers of those arrangements may not be ‘participants’ in payment systems.

- Mobile wallet providers. As noted, the use of mobile wallets such as Apple Pay and Google Pay has grown strongly in recent years. It is, however, unclear whether mobile wallet providers are in the scope of the regulatory framework; that is, they may not meet the definition of being a ‘participant’ in a payment system, despite the fact that they play an increasingly important role in facilitating payments. This could become an issue if, for example, competition or access concerns were to arise from the involvement of firms in this segment of the market. In this context, it is worth noting that competition regulators and governments in a number of foreign jurisdictions have recently been paying closer attention to the competitive implications of restrictions on third-party access to technologies (such as the NFC chip) that support payments on mobile devices and other conditions that providers place on the use of their mobile wallets.

- Participants in the online payments ecosystem. As more payments migrate online, a potential policy issue that could emerge is how to support the operation of least-cost routing in the online (or card-not-present) environment where a wider range of entities (including gateways and payment facilitators) are involved in the payments chain, but may not meet the definition of ‘participant’ in the relevant payment system.

- The regulatory framework applying to crypto-assets and stablecoin arrangements, some of which could be used to facilitate payments. This area is developing rapidly and there may be a lack of clarity about how these arrangements fit within the broader regulatory framework. While it remains to be seen whether the proposed Diem stablecoin system will launch internationally, and there is no indication that Australia is an early target market, there may be a need to consider the domestic regulatory treatment of the Diem system at some point and of digital wallets that use Diem, such as Facebook's proposed Novi.

These examples highlight the importance of having a regulatory framework that is flexible and adaptable to support innovation in a competitively neutral way, while also being clear about how new forms of payment and new entities in the payments ecosystem fit within it. In this regard, it is worth noting that uncertainty about the scope of the regulatory framework can actually discourage innovation and the entry of new players. The Bank believes there is merit in establishing arrangements that would allow all entities that play a material role in facilitating payments to be regulated where doing so would promote competition and efficiency and control risk. One option here would be to consider amendments to the PSRA that would confer appropriate powers to ensure that these entities can be the subject of regulation under the PSRA where that is in the public interest.

The changes in the payments landscape also suggest there may be a case to review the arrangements for industry self-regulation. The Bank's view is that the self-regulation arrangements have generally worked well in Australia in recent years and the Bank continues to have a strong working relationship with AusPayNet, the main self-regulatory body for the payments system (see above). AusPayNet has made some changes to its membership requirements in recent years to reflect changes in the payments landscape and is currently considering other governance changes that could increase the influence of smaller players. Similarly, when the Bank was encouraging the establishment of the APC in 2014 it sought to ensure a broad range of representation. It is worth considering whether these self-regulatory arrangements are working as intended and whether they are sufficiently supportive of competition and innovation and provide adequate representation for smaller players. This could include considering the implications (if it goes ahead) of the proposed consolidation of the three domestic payment schemes (see section 4) for industry self-governance arrangements.

4. Encouraging Innovation in the Payments System

The Bank has had a longstanding interest in promoting innovation, to support efficiency and competition in the payments system. It has done this through a combination of strategies:

- suasion and pressure on industry participants to innovate and invest to improve services to end-users

- using its position and influence to overcome coordination problems, which can act as barriers to cooperative innovation in networks such as payments that have many participants

- regulation to promote competition and access

- helping to establish strategic objectives for the industry, which can serve as a focal point for cooperative innovation.

A prominent example of the work the Bank has done to promote cooperative innovation was the Strategic Review of Innovation in the Payments System that the Bank undertook over 2010 to 2012. This Review was motivated by the observation that while there had been significant customer-facing innovation in the payments system, it was often difficult to achieve system-wide or cooperative innovation, where decisions were not just in the hands of a single player. The Review sought to identify areas in which innovation in the payments system could be improved through more effective cooperation between stakeholders and regulators and to identify gaps in the payments system that could be filled over the medium term.[22]

One major outcome of the Strategic Review was that the PSB decided to set out high-level strategic objectives for the payments system, which would represent capabilities that the PSB believed the payments system should be able to deliver, and the time frame in which they should be achieved. The industry would then be expected to determine how those objectives could be met most efficiently. The strategic objectives coming out of the Review included the ability to make real-time retail payments on a 24/7 basis using simpler payment addressing methods and the ability to send more detailed remittance information with payments. The development of the NPP, in which the Bank also played a major role, was the main industry response to this initial set of strategic objectives (see Box A).

Another significant outcome of the Strategic Review was the Bank's encouragement of the formation of the APC as an enhanced industry coordination body that could address the strategic needs of the payments system and engage directly with the PSB. The role of the APC was discussed in section 2.

The changes reviewed in section 3 show that there has been significant development and innovation in the Australian payments system over the past few decades. While there may still be gaps that need addressing, by global standards Australia has quite an advanced payment system that, for the most part, is providing effective services to end-users. The development of the NPP, in particular, demonstrated the ability of the industry to cooperate on a large and complex project, which has significantly modernised Australia's payments infrastructure. However, end-user expectations regarding security, reliability, functionality and privacy are continually rising alongside the rapid digitalisation of the economy, which means the payments system must continue to adapt and innovate. This raises the question of what more can be done, or done differently, to support continued innovation of the payments system in the future. A few points are relevant in this context:

- One challenge that industry participants say they often face is the significant and sometimes conflicting investment demands from the various payment schemes they are involved in, with no way of agreeing investment priorities between the schemes. If parties cannot agree on the projects to support, the result may be that some projects that would yield significant benefits do not occur or they move slowly. The Bank highlighted this issue in the context of its Review of Retail Payments Regulation and in response the shareholders and members of the three domestically focused payment schemes, namely NPPA, BPAY and eftpos, initiated a process to explore whether some form of cooperation or consolidation might improve efficiency and innovation. In December, NPPA, BPAY and eftpos jointly announced a plan to amalgamate under a new company with a single board, with each scheme continuing to operate separately within the combined entity. The proposal is subject to ACCC authorisation, with a formal application expected to be lodged with the ACCC during the first half of 2021. The stated benefits of the amalgamation would include the ability to better coordinate and enable more payments innovation by having a unified roadmap for innovation and investment across the three schemes.

- In the past, the Bank has mainly sought to encourage system-wide innovation and the development of new capabilities in the payment system (for example, the provision of least-cost routing) using suasion rather than more direct approaches, such as regulation. There are pros and cons of the different approaches, and it is not clear that better outcomes would have been achieved through a more prescriptive approach. In particular, in recent years banks appear to have had limited capacity to take on additional projects because of competing priorities and existing backlogs of work. In some cases, this is exacerbated by having legacy information technology systems that are complex and fragile and therefore expensive and time consuming to modify. Given these constraints, if the Reserve Bank were to have pushed harder for the banks to develop new capabilities, it is not clear that they would have been completed much faster, and it could have created additional risks and come at the expense of other work that may have been a higher priority for other stakeholders.

- The Bank's assessment is that the strategic objectives set following the 2010–2012 Strategic Review of Innovation have largely been met through the development of the NPP and some other initiatives. Looking ahead, the Bank will continue encouraging the industry to collaborate to determine and address strategic objectives through cooperative arrangements such as the APC and AusPayNet.

Box A: The New Payments Platform

The NPP provides consumers, businesses and government agencies with the ability to make and receive real-time, information-rich payments 24 hours a day, every day of the year. The NPP's PayID service also provides the option for payments to be addressed to the account owner's registered mobile phone number, email address or ABN rather than to a BSB and account number.

The NPP was built over a period of about five years and funded by a consortium of 13 financial institutions, including the Bank. These institutions also became shareholders in NPP Australia Limited (NPPA), the company that was established to own and operate the NPP.[23] In addition to participating in the development of the NPP as a potential user of the platform in providing payment services to the Government, the Bank also built and operates the Fast Settlement Service, which enables the settlement of NPP payments individually in real time across accounts that NPP participants hold at the Reserve Bank.

The NPP was launched in early 2018, and there are currently around 100 entities offering NPP payment services to their customers. Thirteen of these (the NPP shareholders) are direct participants in the NPP and clear and settle payments through the platform on their own behalf. The others, comprising smaller financial institutions and seven non-ADI providers, access the platform indirectly through the services of a sponsoring direct participant.

In the case of some participants, the initial rollout of NPP services, such as the ability for customers to make and receive NPP payments through different banking channels, was much slower than the Bank had expected. This prompted the Bank to put pressure on some of the larger banks to close the gaps in their ‘day one’ capabilities as quickly as possible. However, the banks that are connected to the platform have now largely completed their initial rollouts, and over 70 million accounts can send and/or receive NPP payments (representing around 95 per cent of all accounts that are expected to eventually be reachable). There has also been strong growth in the use of the platform, which now processes an average of 2.1 million transactions per day, with a total daily value of $2.0 billion (Graph 8). Over 5 million PayIDs have been registered. Overall, the adoption of the NPP since its launch, measured in terms of the number of transactions per capita, compares favourably with the more successful fast retail payment systems that have been launched in other countries in the past decade or so (Graph 9).

NPP Functionality and Access Consultation

The Bank has strongly supported open access to the NPP and encouraged NPP participants to cooperate on the development of new capabilities to extend the functionality of the platform. The Bank undertook a public consultation with the ACCC in 2018–19 that looked at issues associated with the functionality of, and access to, the NPP. This was partly motivated by some stakeholder concerns at the time that the services offered through the NPP, or the ways of accessing it, did not meet their needs. This consultation made a number of recommendations directed at NPPA and the NPP participants, which have since resulted in changes that have reduced barriers to access and strengthened the commitment of participants to develop new capabilities that will support further use and innovation on the platform:[24]

- In response to recommendations on access, NPPA lowered the cost of joining the platform as a direct participant, including by reducing the share subscription requirement for certain participants and introducing an option of partly paid shares, and committing to reduce the issue price of new shares by 75 per cent by the end of 2027. To reduce the risk of incumbent participants restricting access to new players for competitive reasons, NPPA changed its governance arrangements so that new applications are now approved by a committee comprising the CEO and independent directors, rather than by the full board. NPPA also appointed a third independent director, and agreed to increase transparency around application outcomes. Finally, NPPA relaxed its direct participation requirements, to allow non-ADIs to join the NPP as settlement participants (although it retained the requirement for participants that clear payments across the NPP to be ADIs, reflecting the importance it placed on prudential supervision in helping to manage the risks associated with direct connection to the infrastructure).

- The consultation noted that NPPA had an ambitious agenda to enhance the native capabilities of the NPP, which could address many of the functionality gaps identified by stakeholders, and have the potential to deliver significant value to consumers and businesses and support further innovation. In response to a recommendation from the Bank and ACCC, NPPA and its participants have committed to these enhancements publicly through the periodic publication of a capability roadmap, including timeframes for their delivery. NPPA also introduced a mandatory compliance framework (with penalties for non-compliance) to encourage the timely rollout of mandated functionality by individual participants.

Evidence since the conclusion of the consultation suggests that the access arrangements for the NPP are generally working well for entities (including non-ADIs) wishing to use the NPP to offer new and integrated ways for their customers to make fast payments. The Bank's focus now is on encouraging the further development of the NPP's capabilities in line with the NPP roadmap, and growing the use of the platform for innovative payment services that address evolving end-user needs.

The Bank had committed to undertake (together with the ACCC) a second public consultation on NPP functionality and access commencing by mid 2021, which would be another opportunity to review how the NPP's access arrangements are working in practice. However, there may be a case to delay this consultation depending on the outcomes of the Treasury Review and the proposed amalgamation of NPPA, BPAY and eftpos.

The NPP roadmap

The NPP currently allows for credit or ‘push’ payments only (that is, a customer must initiate the payment from their account, through their online or mobile banking portal). A key element of the current NPP roadmap is the development of a ‘Mandated Payments Service’ (expected to be implemented by end 2021), which will allow end-users to authorise third parties to initiate NPP payments from their accounts. This will provide a transparent, convenient and secure way for consumers and businesses to make and receive recurring and ‘direct debit-like’ payments through the NPP. Another initiative is the development of standardised messages to support automation and straight-through processing for payroll, tax, superannuation and e-invoicing payments sent through the NPP, which should improve the efficiency of a range of business processes. NPPA has also been continuing to extend its Application Programming Interface (API) framework during the past year, providing tools to assist participants and third parties to develop APIs that can automate interaction with the NPP. NPPA has also developed an international funds transfer (IFTI) service (mandatory from end 2022) which will support participants in their financial crimes screening and reporting of cross-border payments sent and received in real time through the NPP. While this service is already available for direct NPP participants to use, as yet none of them have completed the systems work required to do so, which means that incoming AUD legs of cross-border retail transactions are not currently able to be sent via the NPP.

5. Promoting Access to Payment Systems

Payment systems are networks that allow payments to be made between various groups in the economy – consumers, merchants, government and so on. The larger the network, the more valuable it is to those who want to make payments. Some of these networks are ‘closed loop’ in the sense that one organisation establishes relationships with all end-users, both payers and payees. Examples include PayPal and three-party card schemes such as American Express. But many other payment networks require a number of participants (each with their own end-user customers) to be connected to each other in some way. In these circumstances, existing participants may sometimes try to hinder access to the system by new players, perhaps citing the need to protect the safety and security of the system and minimise counterparty risks to other participants. In recent years, the rapid pace of innovation and emergence of a wider range of entities has increased the focus on arrangements for accessing payment systems, including whether more can be done to improve competition and facilitate access to payment systems and infrastructures by new entrants.

For its part, the Bank has had a longstanding focus on promoting access to payment systems as a way to support competition and innovation. For example, in the early 2000s the Bank imposed access regimes on the Visa and Mastercard credit card schemes, to give access to a wider range of entities; revisions to these regimes in 2014 expanded access further to non-ADIs. Similarly, the Bank introduced an access regime for the ATM system in 2009 that was partly aimed at making it easier for new entrants to become direct participants in the ATM system, thereby promoting competition in that market.

During the development of the NPP, the Bank pushed hard for its access arrangements to be as open and fair as possible to support the participation of a range of businesses from across the payments ecosystem. As noted in Box A, the Bank reviewed the NPP's access arrangements as part of its consultation with the ACCC on NPP access and functionality conducted in 2018–19. Balancing the competition benefits of open access against the need to maintain the safety and security of the platform, the review made a number of recommendations for NPPA to take action in relation to its participation requirements, the required capital contribution for participation and the governance arrangements for assessing new participants.

In addition to its regulatory and policy initiatives, the Bank has also sought to facilitate access to payment systems through its policy on access to Exchange Settlement Accounts.[25] While many central banks have traditionally restricted access to settlement accounts to banks, in 1999 the Bank was one of the first central banks to liberalise access by allowing non-ADI providers of third-party payment services to apply for an ESA to settle clearing obligations with other providers.[26] There are currently only a few non-ADI payment service providers (PSPs) that hold an ESA, although there has been increased interest in applying for ESAs in recent years, including from a variety of fintech firms involved in payments.[27]

Despite the steps taken to liberalise access, non-ADI PSPs may still face challenges in accessing some payment systems. Currently, payment systems and infrastructures, such as the NPP and the Bulk Electronic Clearing System overseen by AusPayNet, have eligibility criteria that make it difficult, if not impossible, for non-ADI PSPs to become direct participants. For example, an entity needs to be an ADI to become a direct clearing participant in the NPP. These access requirements are designed to protect the security of the system and to reduce counterparty risks to other participants; operators of payment systems do not have the capability to oversee participants and so effectively rely on the external regulatory oversight provided by APRA to mitigate these risks. However, some PSPs may not be eligible to become ADIs given the nature of their businesses, and so they are effectively restricted from becoming direct participants in certain payment systems. Submitting to the prudential oversight applicable to ADIs may also be viewed as a costly option for providers that are only processing payments (but not making significant financial promises).

However, there are usually options for non-ADIs to participate indirectly in payment systems and, for many PSPs, this may be the most efficient and preferred option. The model in which there is a relatively small group of direct participants providing access to a larger number of indirectly connected entities is quite common in payment systems; it is often the most efficient and secure way to structure access to a network where there are significant risks that need to be managed and where there are significant costs associated with direct connections. In the case of the NPP, there are a number of indirect access routes for non-ADIs and there are a number of direct participants (ASL, Cuscal, Indue, and some of the major banks) who provide indirect connectivity services on a competitive basis. These indirect access arrangements appear to be working quite well considering the large number of entities (over 90 as at end-2020, including seven non-ADI entities) that are now indirectly connected and providing NPP services to their customers.

However, as the payments landscape continues to evolve and as a broader range of PSPs emerge, it is worth considering whether other steps could be taken to improve access to payment systems while still balancing the associated risks. One possibility that might be worth exploring is the development of a tailored licensing and supervision framework for non-ADI PSPs as a way to provide these entities with greater flexibility and options to access and compete within payment systems.

In most cases, non-ADI PSPs are currently subject to financial service licensing, conduct and disclosure requirements administered by ASIC under Chapter 7 of the Corporations Act. However, these requirements are mostly focused on consumer protection and do not involve active oversight of the kinds of risk management issues that are likely to be of most concern to operators of payment systems. A new type of licensing and oversight framework for PSPs could provide an official status that may make it easier for new entrants to join payment systems or conduct other payments business, with regulatory obligations that could be tailored to the levels of risk involved in their activities.[28]

A number of other jurisdictions, including the United Kingdom and the European Union, have introduced licensing and supervision regimes for PSPs as a way of broadening access to payment systems, particularly for non-traditional players such as fintechs. In the United Kingdom, for example, certain types of non-ADI PSPs ‘authorised’ by the Financial Conduct Authority (FCA) are eligible for direct access to some of the payment systems that settle in the Bank of England's (BoE) real-time gross settlement system.[29] A key access requirement for each of those payment systems is the holding of a settlement account with the BoE, which in turn sets eligibility criteria specific for non-ADI PSPs, including that the FCA carries out a supervisory assessment.[30] The FCA assessment, which normally includes an on-site visit, assesses the non-ADI PSP's compliance with regulatory requirements on (i) governance; (ii) safeguarding of customer funds; and (iii) financial crime. In Australia, NPPA has indicated that it would consider amending its access requirements for direct participation in the NPP if there was a licensing/oversight framework for non-ADI PSPs similar to that in the United Kingdom.[31]

One possibility is that the CFR could be tasked with reviewing the regulatory framework applying to PSPs and providing recommendations to the Government. Such a review would need to carefully consider the potential benefits and costs of a specialised regulatory regime, the likely demand for it, and the appropriate structure of a regime if it was deemed appropriate. Consideration would also need to be given to the operation of existing access arrangements and the market for indirect connectivity services. Given the functional approach to regulation that exists in Australia, with the Bank focusing on system-wide competition, efficiency and risk concerns, the Bank does not see itself as having a role in licensing and supervising individual PSPs.[32],[33] Such a role might fit within APRA or ASIC's responsibilities, though some kind of industry accreditation process could also be explored. The Bank acknowledges that it would not be an easy task to be the oversight entity that licenses and supervises what could be quite a diverse range of entities, particularly given the range of risks (e.g. including anti-money laundering and counter-terrorism financing (AML/CTF) risks) that would likely need to be addressed to provide sufficient reassurance to operators of payment systems.

6. Supporting the Safety and Resilience of the Payments System

Safety and reliability are key features of an effective payment system. To achieve this, core payments infrastructure and participants need to be financially and operationally stable and resilient to shocks.

The PSB is responsible for the financial safety of payment systems for use by participants. This responsibility has traditionally focused on the stability of high-value payment systems. If a payment system is relied on by financial system participants for critical high-value transactions, then its financial or operational failure could trigger broader disruption in financial markets and transmit stress to financial institutions, in turn affecting the stability of the financial system as a whole. The Bank regularly assesses whether payment systems should be considered ‘systemically important’ and thus subject to its oversight.[34] To date, the only domestic system identified as a systemically important payment system is RITS – the system that settles inter-bank transactions on an individual basis in real time across Exchange Settlement Accounts held at the Bank. Since RITS is owned and operated by the Bank, independent oversight is provided by the separation of the Bank's operational and oversight functions, as well as the PSB's approval of annual assessments of RITS against the international standards set out in the Principles for Financial Market Infrastructures. The model in which the central bank is both the operator and overseer of the high-value payments system is common internationally.

While no privately owned payment systems are currently assessed by the Bank as being systemically important, it is possible that the growing use of an existing system or a new entrant could result in one or more becoming systemically important in the future. In principle, the Bank could designate and impose standards on a privately owned systemically important payment system. However, the nature of the powers available to the Bank under the PSRA would not be well suited to the imposition of principles-based (as opposed to ‘black letter’) standards of the sort that are commonly applied to financial market infrastructures, such as the financial stability standards the Bank imposes on licensed clearing and settlement facilities under the Corporations Act. Aligning the Bank's standard-setting and supervisory powers in respect of systemically important payment systems with its powers for clearing and settlement facilities would allow the Bank to appropriately supervise the systemic risks arising from the activities of any systemically important payment systems.

Although work by central banks to support payments system safety and resilience has traditionally focused on high-value payment systems, the operational resilience of retail (low-value) payment systems is receiving more attention. Operational outages in retail payments can cause significant disruption to households and businesses, and economic activity more broadly, even though retail payment systems may not be considered to be systemically important from a financial stability perspective. With the increasing use of electronic payments and the reduction in the use of cash, the resilience of electronic retail payments systems is becoming increasingly critical to the smooth functioning of the economy.

Data collected by the Bank from financial institutions show a significant increase in the number and total duration of outages to retail payments in recent years (Graph 10).[35] To promote improved reliability in retail payments, the Bank began working with the industry in late 2019 to enhance quarterly data collection of retail payments incidents, and to develop a standard set of statistics on the reliability of retail payment services to be publicly disclosed by individual providers. The initiative has been endorsed by the PSB and supported by APRA, which is contributing to the development of the framework. Better and more transparent information about the reliability of retail payment services is intended to raise the profile of this issue among financial institutions and their customers, and enable improved measurement and benchmarking of operational performance. These benefits should encourage improved reliability of retail payment services and support public confidence in these services over the longer term.

Nevertheless, it is possible that in the future there could be a case for regulatory action to promote the operational resilience and security of retail payment systems, for example, if system complexity or cyber risks continue to grow. Given this, the Bank believes there is merit in clarifying whether the regulatory framework would allow the Bank or another relevant regulator to impose operational resilience or security standards on operators of and/or participants in retail payment systems, where operational incidents in those systems are likely to cause material disruption to economic activity. Such requirements would be aimed at promoting the continuity of, and public confidence in, these payment systems. Principles-based regulatory requirements for important retail payment systems have been introduced by central banks in a number of jurisdictions in recent years, including Canada, the European Union and the United Kingdom.[36]

7. Enhancing Cross-border Payments

Payments are increasingly crossing borders, whether that be investors executing financial transactions, businesses servicing foreign clients or buying supplies from abroad, or individuals sending money overseas or making purchases from foreign retailers. Having a competitive and efficient market for cross-border payment services is therefore becoming more important. Yet traditional services for cross-border payments have typically been more expensive, slower and more opaque than those for domestic payments, even considering the additional risks and complexities involved in processing these payments.[37] This is particularly the case for retail international money transfers (IMTs). High prices in this market partly reflect a lack of competition among traditional providers, as well as poor price transparency, which makes it difficult for consumers to compare prices and potentially switch providers.[38] In addition, longstanding frictions in the correspondent banking arrangements used to process these transfers raise input costs and slow down processing times for bank-intermediated transfers. Accordingly, the PSB has supported a focus on the efficiency of cross-border retail payment services as a strategic priority for the Bank's payments policy work.

In recent years we have seen the emergence of new technology-enabled providers of cross-border retail payment services seeking to expand quickly and disrupt the Australian market. New digital (online-only) providers of IMT services typically bypass traditional correspondent banking processes by holding bank accounts in many countries and collecting and dispersing funds across countries through those accounts, offering considerably cheaper and faster money transfers than many banks. An online price comparison exercise conducted by Bank staff in October 2020 indicated that the average cost of transferring A$1,000 from Australia to a range of countries (based on the upfront fee and the average mark-up over the wholesale exchange rate) was around 1½ per cent for select digital money transfer operators, compared with around 5½ per cent for the major banks (Graph 11). Other services offered by some new entrants are digital wallets that allow customer funds to be stored and then transferred between currencies at the prevailing wholesale exchange rate and used to make payments at domestic and overseas retailers. Recent gains in market share by digital providers of cross-border payment services have been a factor spurring incumbents to lower prices and improve the convenience of their offerings. The ACCC's 2019 Inquiry into Foreign Currency Conversion Services made a number of important recommendations to improve pricing practices and transparency in this market.[39]

Non-bank digital providers have nevertheless faced challenges in obtaining and retaining reasonable access to the core domestic banking services and payment infrastructures that they need to provide cross-border payment services to Australian customers. Traditional non-bank money transfer operators have experienced similar difficulties, including those servicing lower-income countries in the South Pacific. Increased ‘de-banking’ risks faced by non-banks in recent years appear to reflect a range of factors, including (but not limited to) financial institutions' greater focus on the profitability of their payments relationships, high ‘know your customer’ (KYC) compliance costs, and apparent heightened risk aversion and uncertainty among financial institutions about AML/CTF and sanctions obligations.[40]

The Bank believes that de-banking risks are a significant impediment to competition and innovation in the market for cross-border retail payment and IMT services – a point also emphasised by the ACCC in its 2019 Inquiry. There might, therefore, be merit in examining policy options to address the de-banking problem, and any other aspects of the regulatory regime or market practices that are limiting competition by non-bank participants in the market for cross-border payments and IMTs. A tailored licensing and oversight regime for non-ADI PSPs, as discussed in section 5, might address some of the specific risks posed by these entities and thereby help alleviate some of the de-banking and access issues in this market.

The high cost of remittances to the South Pacific is an aspect of the Australian cross-border payments market that the Bank is particularly focused on. It has tended to be more costly to transfer funds to South Pacific countries than other countries, which is a problem given that many people in the South Pacific rely heavily on remittances from family and friends in Australia and New Zealand. The Bank (together with the Reserve Bank of New Zealand, other South Pacific central banks and multilateral organisations) is working on a possible South Pacific regional KYC facility to help address this issue.[41] This initiative involves working with commercial banks, money transfer operators and other key stakeholders in the remittance sector. If successfully developed, the facility would support the flow of remittances from Australia and New Zealand to the South Pacific, and potentially also reduce the cost of these flows.

The need to address shortcomings in the provision of cross-border payments has also recently become a priority in international forums. In October 2020, the G20 endorsed a ‘roadmap’ – an ambitious program of coordinated actions, responsibilities and indicative timelines – to enhance the efficiency of retail and wholesale cross-border payments.[42] Although the full detail of the specific initiatives within the roadmap are still being developed, there are likely to be implications for the Australian payments system and regulatory framework in a number of areas. These include domestic AML/CTF requirements, data frameworks, payment message standards and payment system access arrangements. The Bank is already undertaking work in some of these areas, and will be engaging with relevant international organisations, Australian agencies and the payments industry about other ways in which Australia can contribute to the overall goals in the roadmap.

The Issues Paper for the Review asks how the better use of data can improve cross-border payments (as well as other payment types). The international roadmap identifies a number of ways in which data can be standardised and enhanced, such as a harmonised version of the ISO 20022 message format, the conversion and mapping of legacy message formats and establishing unique identifier registries. The adoption of common data and message formats across countries would enhance data quality and compliance processes, and allow straight-through-processing of transactions, which should improve the speed, transparency and potentially the price of cross-border payments.