Bulletin – June 2019 Payments Cash Withdrawal Symptoms

Abstract

Most Australians don't have to travel more than a few kilometres to deposit or withdraw cash. Cash use is declining, however, and with it the number of ATMs and other cash access points. This trend seems likely to continue. While it will probably have relatively little impact on those living in metropolitan areas, it is important that reasonable access to cash services is maintained for people in regional or remote locations as long as such access is needed.

Background

The number of ATMs per person increased three-fold over the 15 years to 2011, although it has started to fall more recently (Graph 1). Meanwhile, the total value of cash withdrawals made via Australia's ATM network peaked a decade ago, and has fallen by around 20 per cent since then, while the number of daily withdrawals per ATM has been falling since the mid 1990s (Graph 2). This increase in ATM numbers, coupled with generally falling use, is likely to have reduced the economic viability of some machines and is likely to prompt further rationalisation of the ATM network in future. While a fall in the number of ATMs or other cash access points may be warranted from an efficiency perspective, it may raise public concerns if there were to be a significant decline in coverage that makes it difficult for people to access cash, particularly in regional or remote locations.

This article considers this distributional aspect of access to cash withdrawal and deposit services, making use of:

- the Australian Prudential Regulation Authority's (APRA's) Authorised Deposit-taking Institutions' (ADIs') Points of Presence publication, which gives the geographic coordinates of all ADI ATMs and branches, and all Australia Post Bank@Post outlets, as at June 2018;[1]

- data from independent ATM deployer Banktech on the location of its roughly 2,500 ATMs (accounting for around 15 per cent of independently deployed ATMs);[2] and

- the Australian Bureau of Statistic's (ABS's) Australian Population Grid 2017 release, which presents the population data from the 2016 Census in one square kilometre grids.

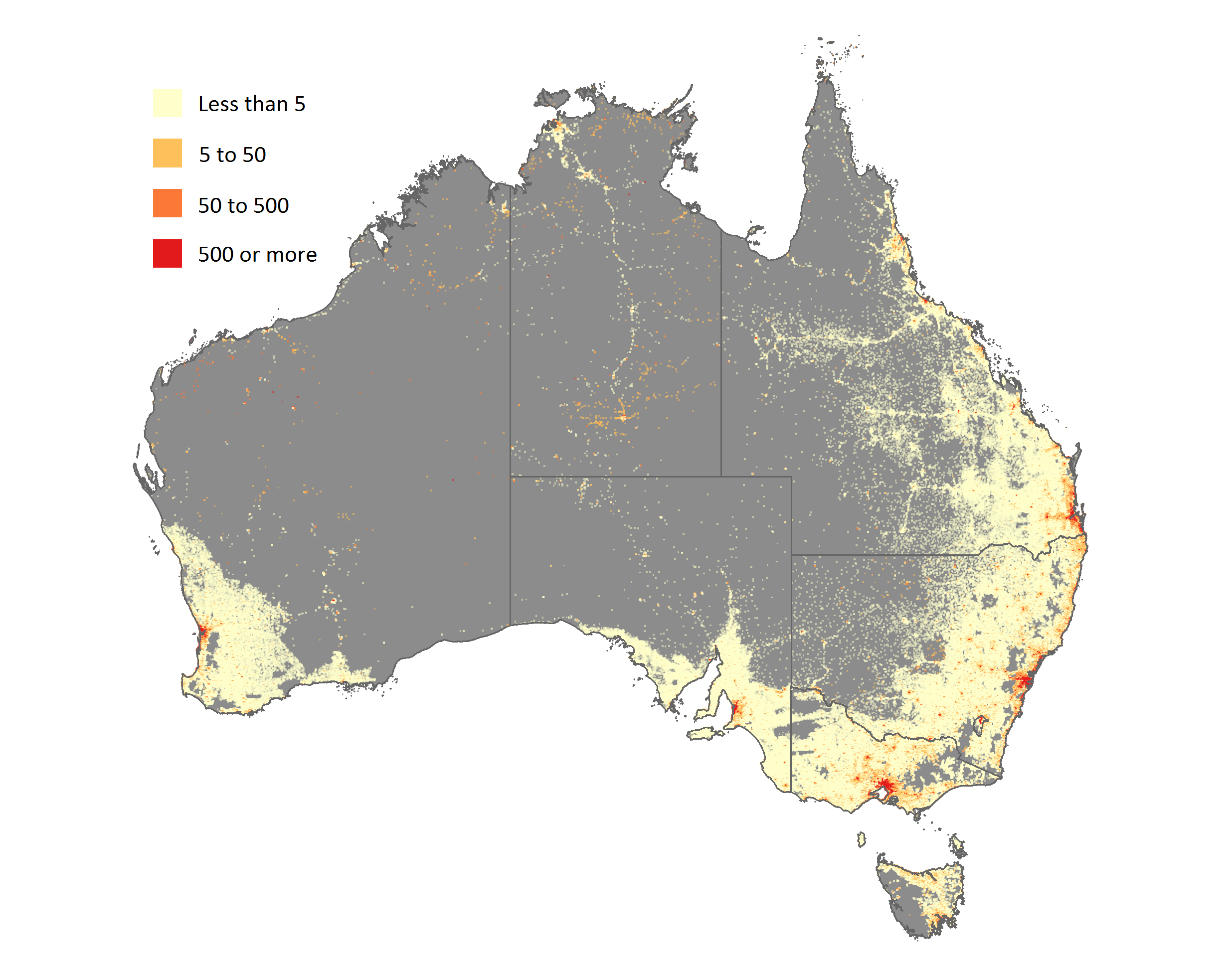

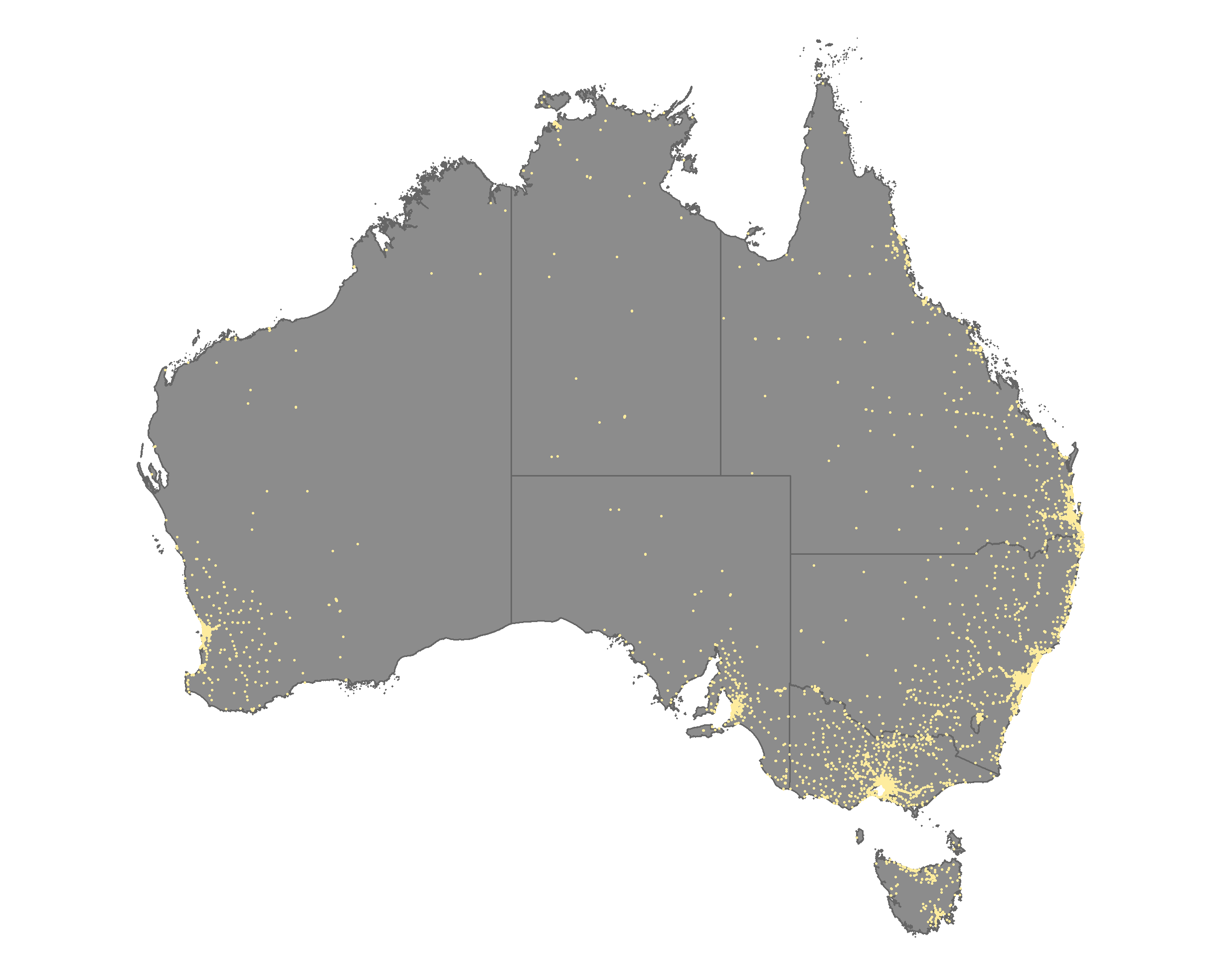

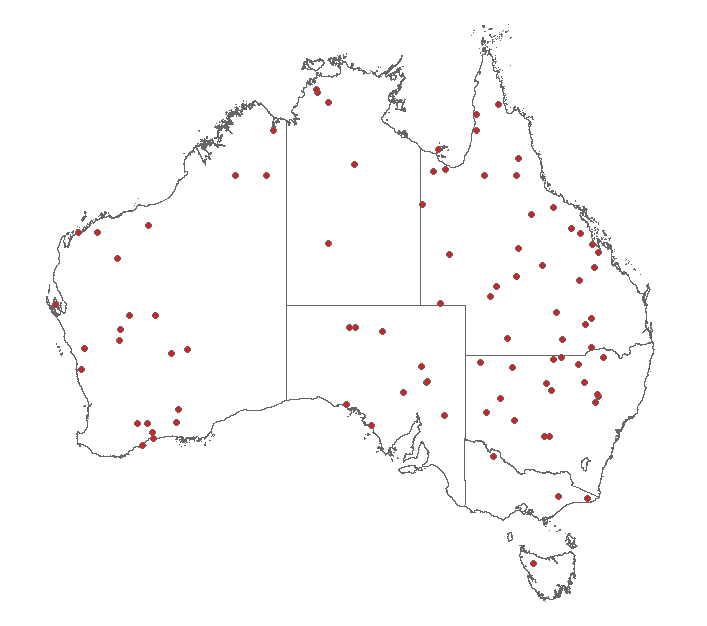

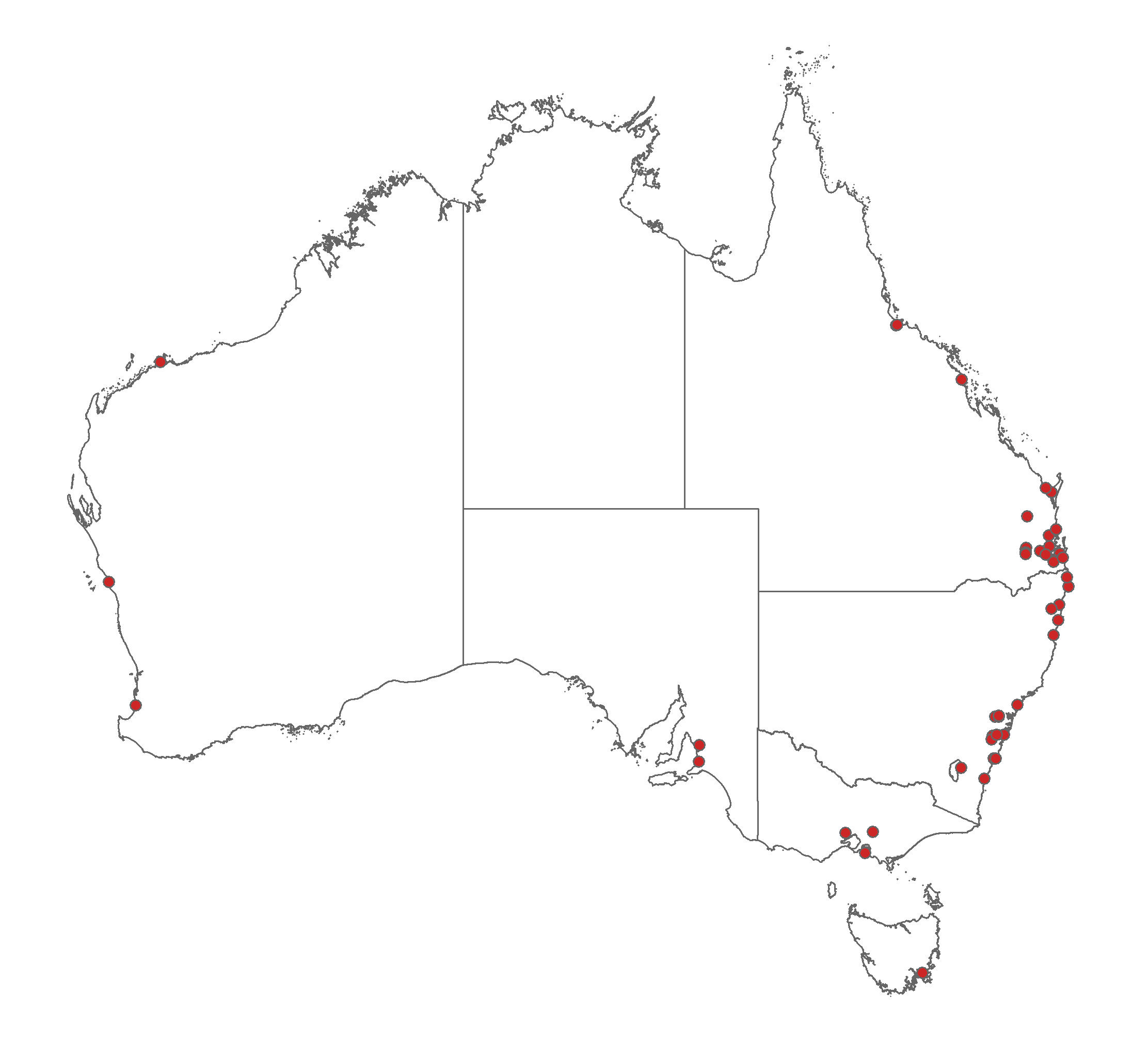

Figures 1 and 2 display these data to show where Australia's population and cash access points are respectively located; it's unsurprising to see that the two maps broadly mirror each other, with a high density of people and cash access points in the major cities and surrounding areas, and declining population and cash access points as the distance from the major metropolitan areas increases.

Sources: ABS; RBA

Sources: APRA; Banktech; RBA

In addition to the APRA and Banktech data, we use partial data on the location of an additional 6,000 or so independent deployer ATMs located outside of metropolitan areas as obtained from the Google Maps platform, although we note that this data-gathering method is imperfect and may under- or over-represent the true number of ATMs somewhat.[4] Overall, and despite the likelihood that we are not capturing all cash access points, our data suggest that the vast majority of Australians have good access to cash withdrawal and deposit services. It will be important to monitor this over time, however, given that the number of ATMs and ADI branches has been falling. It is important to note that these findings relate only to the distributional aspect of cash access; the cost of cash access is not considered. While the cost of cash access is not an issue for most Australians, there are some communities where it has been a major concern. See Box A for a discussion of the joint RBA-Treasury ATM Taskforce, which worked with banks and independent ATM deployers to ensure fee-free access to cash for many remote Indigenous communities.

Box A

Fee-free ATM Services in Remote Indigenous Communities

Introduction

In 2010 the Treasury and the Reserve Bank, in collaboration with participating banks and independent ATM deployers, launched the ATM Taskforce investigation (Treasury and RBA, 2011). The investigation was, in part, prompted by reports of high ATM fees being paid by members of some Indigenous communities in very remote parts of Western Australia, Queensland, South Australia and the Northern Territory. The goal of the taskforce was to find ways to make access to cash more affordable in these communities.

The taskforce found that people living in remote Indigenous communities tended to pay significantly more in ATM fees than those in urban Australia. This reflected a number of factors:

- Unlike in urban areas, there were often no fee-free bank-owned ATMs in remote communities. Rather, many communities contained only one fee-charging ATM, operated by an independent ATM deployer (with the fee income generated by the ATM an important incentive for service provision in these very remote areas).

- Transaction fees for cash out with a card purchase were often also levied, with reports of fees as high as $5 per $50 withdrawal (Financial Counselling Australia, 2010).

- Community members often made repeated balance enquiries and small withdrawals, both of which attracted fees. The ATM Taskforce report noted that this behaviour was driven in part by a lack of financial literacy and, in part, out of necessity (for example due to irregular payments into and out of accounts, and a desire to not hold large amounts of cash).

As a result of this, it was not unusual for community members to incur ATM fees of $20 to $40 on Centrelink payment days.

The Program

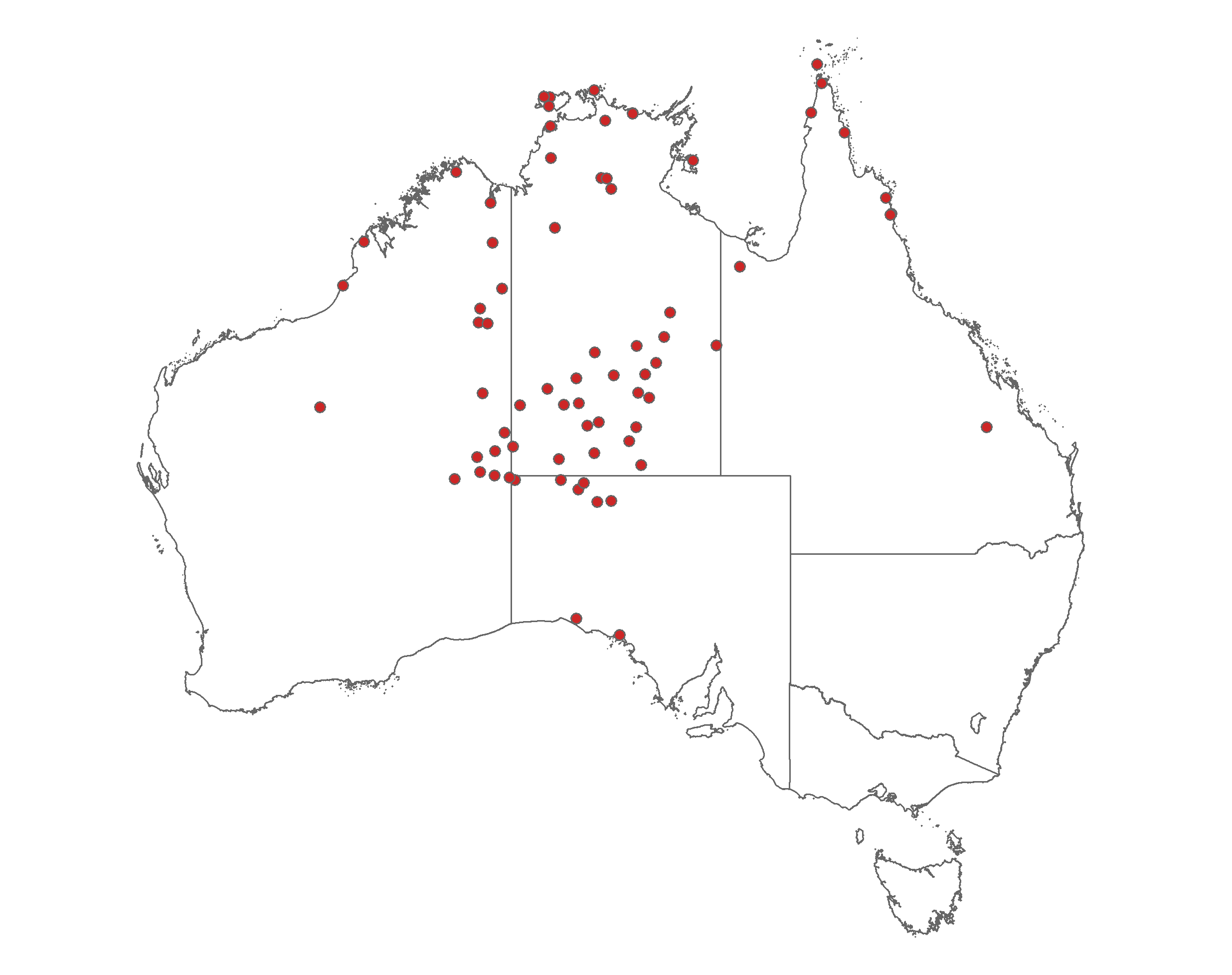

In 2012, following a recommendation of the taskforce, the banking industry launched a 5-year initiative to provide fee-free ATMs to very remote Indigenous communities (Figure A1). The criteria for participation in the initiative were that:

- the ATM is in a very remote Indigenous community as defined by the ABS;

- the ATM is located in a community store (which cannot also provide alcohol or gambling services); and

- the community lacks access to alternative banking services such as bank or credit union branches, ATMs or Bank@Post outlets.

Independent ATM deployers that provide ATMs to the remote communities covered by the initiative can still charge fees to cover their costs, but participating commercial banks – rather than community members – reimburse the ATM operators for the usual withdrawal and balance check fees. With 12 per cent of Indigenous Australians living in very remote Australia, this initiative is important in ensuring equitable cash access for people living in those communities. The original agreement to provide fee-free ATMs has expired, but participating institutions have extended the current arrangements and are working towards renewing the agreement for a further five years.

Sources: ABA; Open Street Maps; RBA

Access to Cash Withdrawal and Deposit Services

Most people can withdraw cash without having to travel very far, with an estimated 95 per cent of Australians living within 4 kilometres of an identified ATM, ADI branch, or Australia Post Bank@Post outlet, and 99 per cent of people living within 15 kilometres as at June 2018 (Table 1 and Graph 3; note that Graphs 3 and 4 plot the cumulative distribution function of the distance to cash withdrawal and deposit locations, respectively, for the Australian population; that is, they show what share of the population (vertical axis) lives within a certain distance (horizontal axis) of a cash withdrawal or deposit location).[5] For most people, especially those living in cities, ATMs are the closet cash withdrawal point, with 95 per cent of Australians living within 6 kilometres of an identified ATM. For those living in more remote areas, however, our data suggest that Bank@Post outlets rather than ATMs or ADI branches may be the closest access point for cash: if one ranked the Australian population on the distance to the nearest cash access point, the person who had to travel further than 99 per cent of all other Australians would be an estimated 24 kilometres from their nearest ATM and 29 kilometres from the nearest ADI branch, but only 18 kilometres from their nearest Bank@Post outlet (Table 1).

| June 2018 | Change from June 2017 | |||||

|---|---|---|---|---|---|---|

| Distance in kilometres(a) | Number(b) | Distance in kilometres(a) | Number(b) | |||

| 95 per cent | 99 per cent | 95 per cent | 99 per cent | |||

| ADI deposit(c) | 5 | 17 | 10,195 | 0.0 | −0.1 | −290 |

| ADI branches(d) | 10 | 29 | 6,630 | 0.3 | 1.0 | −277 |

| Bank@Post outlets | 6 | 18 | 3,565 | 0.0 | −0.1 | −13 |

| ADI withdrawal(e) | 5 | 16 | 22,834 | 0.0 | −0.1 | −1,466 |

| ADI ATMs | 9 | 35 | 12,639 | 0.0 | 0.4 | −1,176 |

| Memo: non-ADI ATMs | ||||||

| All identified withdrawal points(e) | 4 | 15 | ||||

| All identified ATMs | 6 | 24 | ||||

|

(a) Distance within which 95 per cent and 99 per cent

of Australia's usual resident population lives, to nearest kilometre Sources: ABS; APRA; Banktech; Google; RBA |

||||||

Focusing on just ADIs, for which we have two years of data, access as measured by the distance the 95th and 99th percentile person had to travel to withdraw cash remained largely unchanged over the year to June 2018 according to the APRA data, despite the closure of a net 1,466 withdrawal locations.[6] This suggests that the discontinued locations were mostly located in areas with other cash access points close by.

Most Australians can also deposit cash without having to travel too far, with an estimated 95 per cent of the population living within 5 kilometres of a deposit location (defined as branches and Bank@Post outlets) and 99 per cent living within 17 kilometres as at June 2018 (Table 1 and Graph 4). While some ATMs allow people to deposit cash, these machines are typically located at bank branches.

Despite the APRA data showing the closure of a net 290 deposit locations over the year to June 2018, deposit access as measured by the distance to the nearest deposit location for the 95th and 99th percentile person appears to have remained largely unchanged, with an increase in distance to branches offset by a small fall in distance to Bank@Post outlets. This suggests an increase in the efficiency with which deposit locations are distributed, and that closures have for the most part occurred in areas with other deposit locations relatively close by.[7] One year is a relatively short period over which to measure changes in access to cash, however, and it will be important to monitor access over coming years.

Branches, Bank@Post, and rural access to cash services

One striking feature of Table 1 and Graph 4 is that despite there being only around half as many Bank@Post outlets as ADI branches, Bank@Post provides broader geographic coverage than the combined branches of Australia's ADIs. This reflects commercial banks and other ADIs for the most part locating their branches and ATMs in relatively populous areas that can service more customers (that is, in cities and larger towns). Australia Post on the other hand arranges its network of post offices to deliver broad geographic coverage. Indeed, this is mandated by the Australian Postal Corporation Act 1989 which requires that the mail service be ‘reasonably accessible to all people in Australia on an equitable basis’, which the Australian Postal Corporation (Performance Standards) Regulations 1998 in turn interprets to mean that, in non-metropolitan areas, at least 85 per cent of residents be located within 7.5 kilometres of a postal outlet. It is important to note, however, that this universal service obligation relates to the postal service, not Bank@Post, and so the ongoing financial viability of Bank@Post will be a major determinant in Australia Post continuing to provide this service in future (Australia Post, 2019).

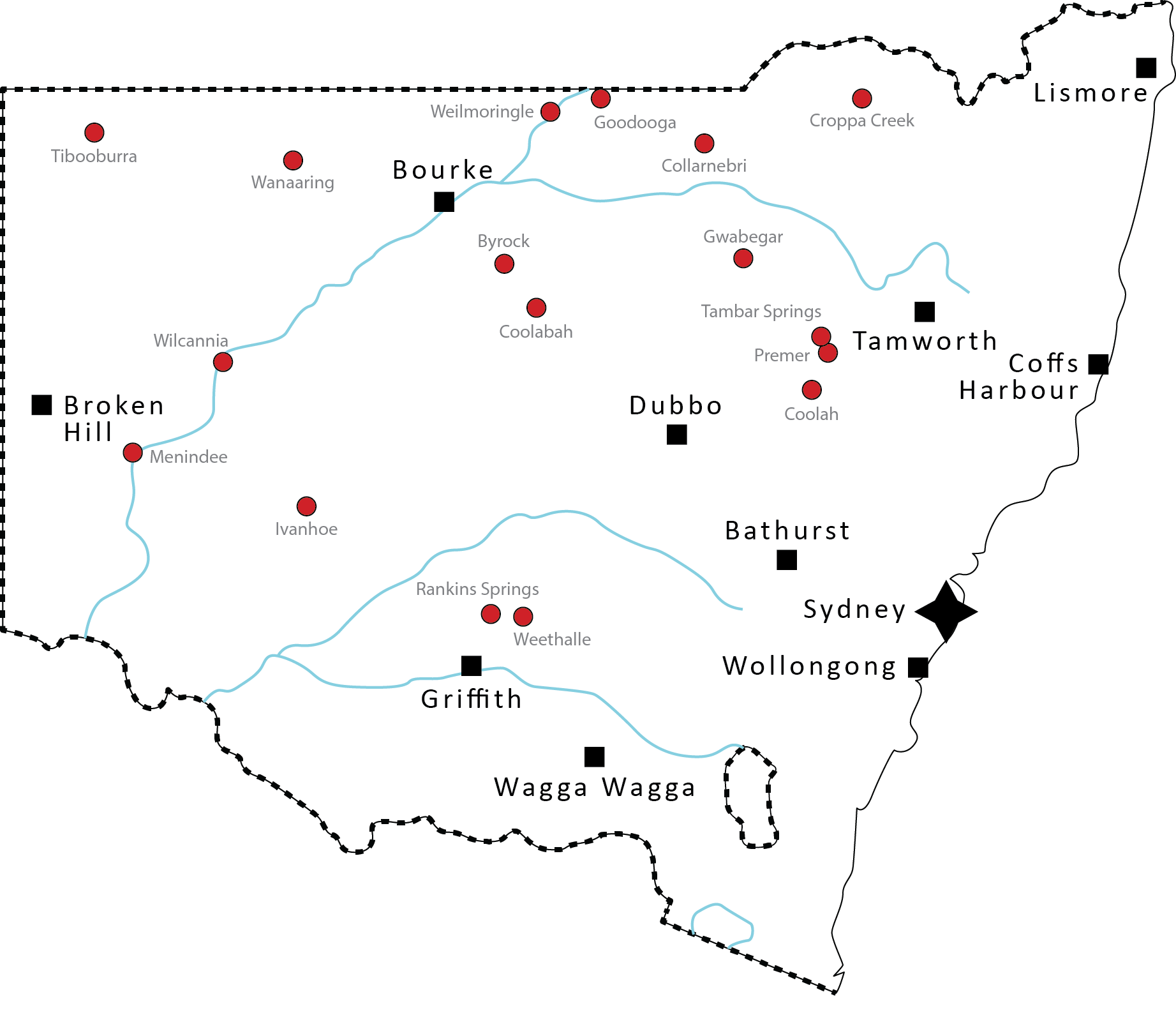

Reflecting this wider geographic spread, Australia Post's Bank@Post service is the only in-person banking facility within a reasonable distance for many Australians living in regional or remote areas. For example, in regional New South Wales we identified 17 Bank@Post outlets which are 50 kilometres or further from the nearest ADI branch, shown as red dots in Figure 3; for the country as a whole, we identified 90 Bank@Post outlets that are 50 kilometres or further from the nearest ADI branch (Figure 4).

Sources: APRA; RBA

Sources: APRA; RBA

Defining towns as all urban centres and localities in Australia with populations greater than 1,000 people (which excludes around 500,000 Australians living in localities of fewer than 1,000 people), we found only 47 towns that did not have a branch, Bank@Post outlet or ATM as at June 2018 (Figure 5). Further, all of these towns had at least three cash access points within a 20 kilometre radius, suggesting that even the removal of one or two access points would not leave these communities without some access to cash. As we do not have an exhaustive list of ATMs or retail cash-out access points in Australia, it is likely that there are even fewer towns without close cash access.

Sources: APRA; Banktech; RBA

More generally, the current network of cash access points appears to be relatively robust. The removal of the closest access point results in a relatively modest increase in distance to the next closest point for most people, although the additional distance grows as more cash access points are removed (Graph 5). Of course, this assessment is based on data from June 2018 and would need to be revisited if the number of cash access points were to fall significantly.

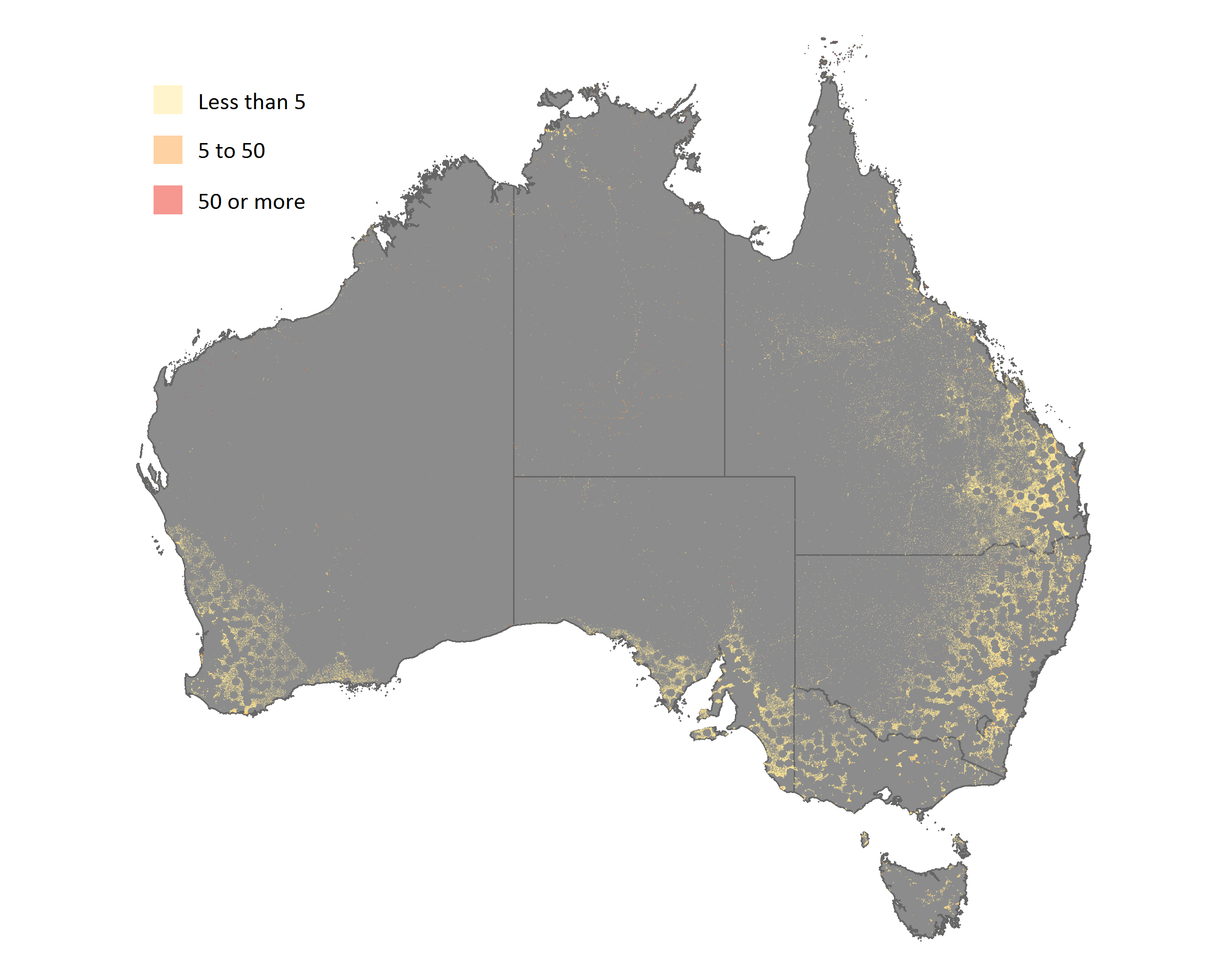

The other 1 per cent

While an estimated 99 per cent of the population has a cash withdrawal location within 15 kilometres (and a cash deposit location within 17 kilometres), the other 1 per cent – about 250,000 people – need to travel more than 15 kilometres to their nearest cash access point. These people live in rural areas, where cash use also tends to be higher and infrastructure that might enable alternative payment methods, such as mobile phone coverage, tends to be less developed, so it will be important to monitor their access over time (Figure 6; see Box B for more information regarding which demographic groups tend to use cash relatively more).

Sources: ABS; APRA; Banktech; RBA

Box B

The Demographics of Intensive Cash Users

Introduction

While cash use at the point of sale has been falling for several years, the Bank's 2016 Consumer Payments Survey indicated that around 20 per cent of Australians used cash for more than four-fifths of their in-person purchases, and 12 per cent of Australians relied on cash for all in-person purchases (Graph B1)[8]. Although the share of people falling into each of these groups has declined over the past decade, there remains a group of citizens who strongly prefer, or need, to use cash.

Demographics of High Cash Users

While many different types of people are intensive cash users, they are disproportionately likely to be older, poorer and less-educated than average. They also tend to reside in regional areas and are less likely to be employed, and a disproportionate share do not regularly access the internet (Table B1).

| Age | |

|---|---|

| Less than 65 | 18 |

| 65 and over | 35 |

| Income | |

| Bottom half of distribution | 32 |

| Top half of distribution | 12 |

| Highest level of education obtained | |

| Year 12 or below | 30 |

| Trade, apprenticeship, diploma or certificate | 23 |

| Bachelor degree or above | 12 |

| Area of residence | |

| Metropolitan | 18 |

| Regional | 29 |

| Employment status | |

| Employed | 13 |

| Not employed(a) | 28 |

| Retired | 37 |

| Internet | |

| Regularly access the internet | 19 |

| Do not regularly access the internet | 57 |

|

(a) Employed persons worked full time, part time, or were self-employed; not employed includes the unemployed, students, and others not in the workforce but not retired. Sources: Authors' calculations based on data from Ipsos |

|

Looking Forward

Australians appear to have relatively good access to cash services, especially given the size of the Australian landmass. For example, only 0.5 per cent of the Australian population live further than 25 kilometres from their nearest cash withdrawal point, and 0.5 per cent live further than 25 kilometres from a deposit location. By comparison, in Sweden – the third-largest country by land size in western Europe, but nonetheless 17 times smaller than Australia – the government's Riksbank Committee recommended that a maximum of 0.3 per cent of the population should have to travel more than 25 kilometres to withdraw cash, and a maximum of 1.2 per cent of the population should have to travel more than 25 kilometres to deposit cash (Swedish Government, 2018).

Looking to the future, it seems likely that the number of ATMs deployed in Australia will continue to fall. As discussed by Mitchell and Thompson (2017) and Richards (2018), to the extent that this occurs in metropolitan areas that are already well served by ATMs, and/or it occurs alongside the creation of a so-called ‘ATM utility’ that pools ATMs from a number of financial institutions under a single operator, this is probably to be expected and need not be a concern. Indeed, the establishment of an ATM utility could prove desirable from an efficiency and accessibility viewpoint if it sought to remove duplicate machines from over-serviced locations and increase provision in under-serviced locations. However, cash access could become a significant issue in regional and remote communities, where the cost of providing ATM services is highest, people tend to rely on cash more, and alternative banking services are often less accessible.

Focusing on the ability to deposit cash, which is important to businesses as well as households, our analysis suggests that, for many regional and remote communities, Australia Post's Bank@Post service is the only reasonably accessible cash deposit point. Although government owned, Australia Post is required to make a commercial rate of return and be self-funded, and so the ongoing financial viability of Bank@Post will be important to the continued existence of this service (Australia Post, 2019).

Footnotes

The authors are from Note Issue Department and would like to thank James Caddy, Lowenna Clemence, Nicolas Rebuli, Tony Richards and Max Wakefield for their help and suggestions. [*]

ADIs include banks, credit unions, and building societies. More than 70 ADIs offer deposit and withdrawal services through Bank@Post. [1]

Other independent ATM deployers were invited to contribute data on the location of their ATMs but declined. [2]

The maps in this article are © OpenStreetMap contributors; see <https://www.openstreetmap.org/copyright> for further information. The APRA points of presence data are available from <https://www.apra.gov.au/publications/authorised-deposit-taking-institutions-points-presence>. [3]

While Google Maps provides a valuable additional data source on the location of ATMs not otherwise captured, we cannot be sure that all such ATMs have been located, or that ATMs listed as existing in Google Maps have not subsequently been removed. The existence of a ‘cash-out’ option when one pays by card at some retail outlets is another potential source of cash access. We do not have comprehensive data on the locations of retailers providing cash out with a card purchase, but we have identified the locations of the major supermarket and service station chains, which provide this option, and incorporating these partial data does not change our results. [4]

Note that all distances in this article are calculated as the shortest distance between two points, i.e. as the crow flies. [5]

The 95th percentile person is the person who has to travel further than 95 per cent of all other Australians (but less distance than 5 per cent of Australians) to access cash, with the 99th percentile person similarly defined. [6]

It is worth noting that the Australian Banking Association's Branch Closure Protocol calls for member banks to give 24 weeks' notice to customers in the event that a branch is closed and alternative face-to-face banking services within 20 kilometres are not available (Australian Banking Association, 2015). [7]

See also (Doyle et al 2017). [8]

References

Australia Post (2019), ‘Statement responding to comments by the Customer Owned Banking Association’, 24 January.

Australian Banking Association (2015), ‘Branch Closure Protocol’, October.

Doyle M-A, C Fisher, E Tellez and A Yadav (2017), ‘How Australians Pay: Evidence from the 2016 Consumer Payments Survey’, RBA Research Discussion Paper No 2017-04.

Financial Counselling Australia (2010), ‘ATM Fees in Indigenous Communities’, 3 November.

Mitchell S and C Thompson (2017), ‘Recent Developments in the ATM Industry’, RBA Bulletin, December, pp 47–54.

Richards T (2018), ‘Opening Panel Remarks on the Regulatory Landscape for Payments’, Australian Payment Summit, Sydney, 27 November.

Swedish Government (2018), ‘Secured Access to Cash’, Media Release No 2018: 42, 11 June.

Treasury and RBA (2011), ‘ATM Taskforce – Report on Indigenous ATM Issues’, 28 February. Available at <https://treasury.gov.au/publication/atm-taskforce-report-on-indigenous-atm-issues>.