Topic: Global Economy

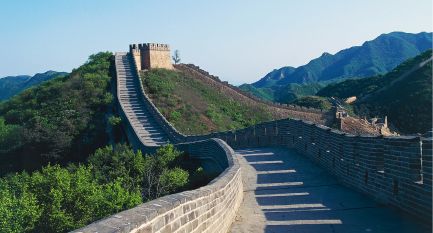

Behind the Great Wall: China’s Post-pandemic Policy Priorities

China is Australia’s largest trading partner so policy decisions in China can have a significant impact on the Australian economy, largely via its effect on Australia’s trade. While there remains considerable uncertainty about policymaking in China, this article describes how Chinese authorities have tended to approach economic policy choices and then considers China’s current economic challenges and their relevance to the Australian economy.

The ABCs of LGFVs: China’s Local Government Financing Vehicles

China’s local government financing vehicles (LGFVs) are a key feature – and risk – of China’s infrastructure investment and financing environment. The scale of their debt has consequences for local governments’ fiscal sustainability and for capacity to continue financing infrastructure development. This article reviews progress and challenges in the transformation of LGFVs from local government off-balance sheet financing vehicles into market-driven entities, and estimates the scale and sustainability of their debt burdens at a regional level. Developments in the debt sustainability and investment outlook at China’s LGFVs potentially has implications outside of China due to the importance of LGFVs to financial stability and long-run growth in China.

Interpreting Chinese Statistics: Extracting Expenditure-side Quarter-on-quarter Growth Contributions

Components for GDP on the expenditure side of the national accounts – expenditure on consumption, investment (including inventories) and exports less imports – can provide an important read on the composition of demand. For China, these components are available in contributions to year-ended GDP growth, which provides insight into trends but makes it difficult to interpret how the economy is operating quarter to quarter. This article discusses a method for deriving contributions to quarter-on-quarter GDP growth using official data that allows for a better understanding of expenditure side drivers of quarter to quarter. The decomposition shows that strong growth in the March quarter of 2024 was driven by a large increase in net exports, but growth in the June quarter was mainly supported by investment, which likely reflected a large contribution from the change in inventories. This suggests that Chinese domestic demand remained sluggish in the first half of the year, despite the strong outcome for GDP growth in the March quarter.

Growth in Global Private Credit

Global private credit has grown rapidly over the past two decades, providing an alternative source of financing for businesses. This article introduces a new estimate of the size of private credit outstanding in Australia, based on data collected by the Australian Prudential Regulation Authority and London Stock Exchange Group. It is estimated that there is around $40 billion in private credit outstanding in Australia, which is around 2½ per cent of total business debt. Globally, the growth in private credit has raised concerns related to a lack of visibility over leverage and interlinkages, with regulators taking steps to strengthen oversight of the market. For Australia, the risks to financial stability appear contained for now, though regulators continue to monitor the sector closely.

Urban Residential Construction and Steel Demand in China

Investment in Chinese urban residential real estate has been declining since 2021, and demand for steel by the sector has also slowed considerably. Despite this decline, overall demand for steel in China has been resilient due to strong growth in manufacturing and infrastructure investment, which looks likely to continue in the near term. This article provides a projection for urban residential construction in China to 2050, suggesting that construction in China has peaked and that demand for steel will decline in the longer term. This will weigh on overall steel demand in China, though there remains considerable uncertainty around the longer term outlook for demand from other sources.

China’s Monetary Policy Framework and Financial Market Transmission

While it has evolved significantly over the years, China’s monetary policy framework continues to differ in some important respects to those in most advanced economies. In contrast to these economies, the People’s Bank of China makes significant use of quantity-based policy instruments, though interest rates now play a greater role than in the past. This article takes stock of China’s current monetary policy framework and its implementation, and discusses the transmission of price-based monetary policy instruments to market and retail interest rates in the economy. In doing so, this article sheds light on the implementation of monetary policy in the world’s second largest economy.

Economic Developments in the South Pacific

Australia has long played a significant role in the regional economy of the South Pacific. This article provides an overview of economic developments in the region, with a focus on recent shocks and medium-term growth challenges. The region’s heavy reliance on external demand meant that South Pacific economies were severely impacted by the COVID-19 pandemic and other concurrent challenges. Expansionary economic policies implemented by governments and central banks, alongside international aid and lending, supported the region through the acute phase of the pandemic. While a recovery is underway, the South Pacific will continue to face challenges to its medium-term growth and development, particularly via high debt levels and climate change.

Correspondent Banking in the South Pacific

Worldwide, many financial institutions make use of correspondent banking services to connect to the global financial system. This article examines the withdrawal of global financial institutions from the provision of correspondent banking services to the South Pacific and the implications for countries in the region. The available evidence suggests that South Pacific nations, like many small island economies globally, have seen a larger-than-average decline in the provision of these services. The decrease in the availability of correspondent banking services appears to be most pronounced for smaller local banks and in the major global currencies. While the available evidence suggests that South Pacific countries have been able to manage this decline thus far, the remaining correspondent banking services are becoming increasingly stretched and further withdrawal may cause financial sector disruption.

Wage-price Dynamics in a High-inflation Environment: The International Evidence

Headline inflation is at multi-decade highs in most advanced economies, reflecting a confluence of factors. Wages growth has also increased, but not to the same extent. This article examines the risk that a wage-price spiral could emerge in these economies by looking at historical experience and the various factors that could make a spiral more likely. It finds that the current episode has many differences to the 1970s, when a wage-price spiral did emerge. Central banks are now focused on ensuring inflation remains low, medium-term inflation expectations remain anchored and structural changes in the labour market reduce the likelihood that wages and inflation chase each other. Nonetheless, authorities need to be mindful of the risk of a wage-price spiral.

Evolving Financial Stress in China's Property Development Sector

Financial stress in China's property development sector has attracted significant attention because it may have systemic consequences for financial stability in the broader Chinese economy. Though China Evergrande Group, one of the country's largest and most leveraged property developers, has received a considerable share of this attention, risks in the sector were building for some time prior to Evergrande's default in 2021. This article reviews contributing factors to the sector's financial fragility and explores the characteristics of the financial stress faced by major developers. It also considers some likely consequences of this fragility for the Chinese property development sector and beyond.

An International Perspective on Monetary Policy Implementation Systems

In response to the COVID-19 pandemic and building on policies introduced during the global financial crisis, central banks in advanced economies deployed balance sheet policies to support their economies and address disruptions to the smooth functioning of financial markets. The introduction of these policies has changed how most of these central banks implement their primary policy tool – the policy rate. This article describes how many central banks transitioned from a corridor system of monetary policy implementation to a de facto floor system. It also details the range of implications of choosing a floor system. While this transition may prove to be temporary for some central banks, others have signalled that they expect to retain a floor system in the long term.

Implications of the IMF's SDR Allocation for Australia and the Global Economy

As part of the global policy response to address the economic challenges associated with the COVID-19 pandemic, in August 2021 the International Monetary Fund (IMF) allocated US$650 billion worth of Special Drawing Rights (SDRs) to its members, providing a significant boost to global liquidity. This article details the workings of SDRs and describes how vulnerable countries can use this additional liquidity in a range of ways, including to support spending on their country's crisis response. It also considers how countries that do not have a need for this liquidity, like Australia, may use a share of their SDR allocation to assist more vulnerable countries.

The Indian Banking System

Banks play a key role in India's financial system and underpin economic growth. However, during the 2010s, the health of Indian banks deteriorated significantly and a subsequent decline in credit growth contributed to a slowdown in economic activity. Although Indian authorities have taken a number of steps to strengthen the banking system, progress has been difficult and has been further curtailed by the COVID-19 pandemic. While financial linkages between Australia and India remain limited, India is an increasingly important trading partner for Australia, and continued weakness in its banking system is likely to weigh on India's demand for Australia's exports.

China's Evolving Financial System and Its Global Importance

China's economic policy response to the COVID-19 pandemic has been less stimulatory than the response after the global financial crisis because Chinese authorities have sought to avoid fuelling risks in the financial system. Indeed, the authorities have continued with reforms to make the financial system more market-based so that it can better support China's economy, although the state continues to play a central role in the financial system. At the same time, China has become increasingly important for international financial markets, mainly due to its weight in international trade but also because certain cross-border capital flows are rising.

China's Labour Market: COVID-19 and Beyond

The Chinese labour market has recovered quickly following the sharp economic downturn caused by the COVID-19 pandemic. While widespread lockdown measures in early 2020 pushed large numbers of Chinese workers out of the labour market, successful containment of the virus allowed most of these workers to return relatively quickly. Structural factors – notably a shrinking labour force – are now likely to be the dominant drivers of developments in the Chinese labour market. In the short term, policymakers are considering changes to the retirement age to boost labour supply. In the longer term, the focus of reforms is increasing labour productivity and reducing labour market frictions.

Government Bond Markets in Advanced Economies During the Pandemic

Governments in advanced economies have funded their large fiscal policy responses to the COVID-19 crisis by issuing government debt securities. Except for a period of dysfunction in the early months of the pandemic, government bond markets have functioned well. Despite the substantial increase in debt issuance, the interest rate paid on new government debt has declined to historically low levels. A rise in private sector saving relative to investment has contributed to demand for low-risk assets like government bonds. At the same time, advanced economy central banks have lowered their policy rates and made large-scale purchases of government bonds in secondary markets in pursuit of their inflation and employment goals.

Towards Net Zero: Implications for Australia of Energy Policies in East Asia

China, Japan and South Korea have all set targets to achieve net-zero carbon emissions by around the middle of this century. These three countries account for around two-thirds of Australia's fossil fuel exports. Based on emission scenarios consistent with these commitments, we find that Australia's coal exports could decline significantly by 2050, with a more modest effect likely for liquefied natural gas exports; both may be offset to some degree by increases in green energy exports. The effect on overall Australian GDP is expected to be relatively small and gradual. Significant uncertainty surrounds the speed and manner in which countries will work to achieve net-zero emissions, as well as the technological developments that could change the efficiency and carbon intensity of fossil fuels.

The Global Fiscal Response to COVID-19

Globally, the fiscal policy response to the COVID-19 crisis has been the largest and fastest in peacetime. Governments have prioritised direct fiscal support for private incomes and employment, which has limited economic scarring and established a solid foundation for the recovery. The size and composition of the fiscal response has varied across countries, reflecting differences in automatic stabilisers, pre-pandemic fiscal space, the severity of infections and policy preferences. Fiscal policy is likely to remain supportive for some time after the pandemic subsides, and in many countries is expected to focus increasingly on boosting investment. For as long as governments anchor spending decisions in a sound medium-term fiscal framework and interest rates remain lower than the rate of economic growth, ongoing fiscal support need not pose problems for government debt sustainability.

The Response by Central Banks in Emerging Market Economies to COVID-19

The COVID-19 health and economic crisis has severely affected emerging market economies (EMEs). As a result, emerging market central banks have employed a wide range of tools to support their economies and financial systems, many of which have been used for the first time. These measures have helped to support the functioning of domestic financial markets, lower domestic interest rates and facilitate the flow of credit to households and businesses. The scale of monetary easing by EME central banks was larger, and the pace faster, than in some past crisis periods. This was influenced by the sudden and synchronised nature of the COVID-19-induced economic shock and the large scale policy response in advanced economies that occurred alongside the EME response. It also reflects the significant improvements emerging market central banks have made to their institutional frameworks over recent decades and the development of EME financial markets over the same period.

Determinants of the Australian Dollar over Recent Years

The exchange rate is influenced by a number of domestic and international factors. Two key fundamental determinants of the exchange rate are the terms of trade and differences between interest rates in Australia and those in major advanced economies. Since the end of the mining boom, the decline in the terms of trade and easing in domestic monetary policy, including the recent introduction of quantitative easing measures, have contributed to the depreciation of the Australian dollar. On a shorter-term basis the Australian dollar has also moved closely with prices in other international financial markets in response to changes in global risk sentiment.

Economic Developments in India

Over recent decades, India's rapid economic growth has led to a substantial increase in its demand for Australian exports. However, India is currently facing the most significant setback to its economic development in decades as a result of COVID-19. Like in many other economies, the pandemic has severely affected near-term economic activity and exacerbated existing vulnerabilities in the Indian economy. While it will take some time for the Indian economy to recover, underlying fundamentals should support growth in the long term. This in turn should increase demand for some key Australian exports such as coking coal and education services, and so India will likely remain an important trading partner for Australia. The outlook for other resource exports such as iron ore and thermal coal is less positive because India is expected to be self-sufficient in these commodities.

The Response by Central Banks in Advanced Economies to COVID-19

Central banks in advanced economies have employed a wide range of tools to support their economies and financial systems during the COVID-19 pandemic. Some measures have involved scaling up standard central bank tools or reactivating facilities introduced during the global financial crisis. Other measures are new innovations. The speed at which these tools were deployed and scale of their usage has been unprecedented. These measures have helped to restore functioning of financial markets, lower interest rates, and support the flow of credit to borrowers.

Different Approaches to Implementing a Countercyclical Capital Buffer

The countercyclical capital buffer (CCyB) was one of the measures designed to improve the resilience of the global banking system following the global financial crisis (GFC). It is a bank capital buffer that can be raised or lowered by jurisdictions depending on the level of risk in the financial system. This article describes different approaches to implementing the CCyB. Most jurisdictions set the ‘default’ CCyB rate at zero until risks are elevated; however, recently, several have adopted frameworks where the CCyB is positive through most of the financial cycle. The Australian Prudential Regulation Authority (APRA) has recently announced that it is also considering moving to a non-zero (positive) default CCyB (APRA 2019). This article discusses the possible benefits of a positive default CCyB.

The Global Financial Safety Net and Australia

The Global Financial Safety Net (GFSN) allows for financial assistance to be provided to economies in the event of an economic or financial crisis. Together with the substantial monetary and fiscal policy response globally, the GFSN has played a key role in helping economies respond to the COVID-19 pandemic. The GFSN has a number of elements, including the assistance provided by the International Monetary Fund, regional financing arrangements and some bilateral swap lines established by central banks. This article provides an overview of the GFSN, how it has evolved and been used over recent months, and the role the Reserve Bank of Australia plays in it. Use of the GFSN could increase materially over the period ahead if economic and financial market conditions around the world deteriorate.

Private Sector Financial Conditions in China

Historically it has been challenging to assess financial conditions for private firms in China. This article assembles a range of indicators that shows private firms find it more difficult and expensive to access financing than state-owned firms. Based on these indicators, the private sector had experienced a tightening in financial conditions over the past few years, although more recently conditions have generally eased as a result of new measures that direct more credit to private firms.

China's Residential Property Sector

The property sector is a significant driver of economic growth in China and a key source of demand for Australian commodity exports. Authorities have become increasingly wary of financial risks in the sector, and moved to reduce the importance of policies directed at real estate for managing short-run fluctuations in aggregate demand. The effect of COVID-19 on property sales and developer balance sheets necessitated a moderate easing of policy to support the real estate sector, but it only appears to have delayed rather than halted efforts to de-risk the sector.

Economic Effects of the Spanish Flu

The Spanish flu reached Australia in 1919 and remains the country’s most severe pandemic in terms of health outcomes. At the peak of the pandemic, sickness due to influenza temporarily incapacitated 2 per cent of the labour force. However, despite the social distancing measures used by governments to contain the virus, few job losses in this period were due to a lack of available work. The labour market also recovered quickly, but it is not clear how relevant this experience is for the modern economy.

How Do Global Financial Conditions Affect Australia?

Australia is closely integrated with global capital markets. This integration has been of benefit to the economy, but also means that Australian financial conditions are influenced by developments abroad. The flexible exchange rate regime partially insulates the economy from global financial conditions. In particular, that flexibility means that monetary policy in Australia does not need to move in lock step with policies of the major central banks. However, to meet its objectives for employment and growth, the Reserve Bank can choose to offset pressure on the exchange rate from shifts in foreign monetary policies. Indeed, for much of the past decade or so, forces underpinning the structural decline in global risk-free rates have placed downward pressure on interest rates offshore and in Australia. International investors’ willingness to take risk also has an important bearing on domestic financial conditions.

Long-term Growth in China

Slowing trend growth in China, and the risks around this trajectory, are relevant to the future economic prospects of its major trading partners, including Australia. This article provides a long-term perspective on growth in China, beginning with a review of historical trends. It then examines the drivers of growth since reforms were introduced in the late 1970s and how these drivers are affecting the growth outlook. The article concludes that a range of structural headwinds will constrain growth in the coming decade, posing challenges for policymakers.

Potential Growth in Advanced Economies

Potential growth is the rate of growth that an economy can sustain over the medium term without generating excess inflation. Potential growth has declined in the advanced economies in recent decades due to lower growth in the labour force, capital stock and productivity. Current projections and long-term growth expectations suggest that the low rates of potential growth in advanced economies will persist for some time.

Conditions in China's Corporate Sector

Revenue and profit growth have slowed in China’s corporate sector in recent years, alongside a broader moderation in China’s economic momentum. The slowdown has been most severe for labour-intensive private companies, particularly export-oriented manufacturing firms. The government has responded by announcing a range of measures aimed at easing financial conditions faced by the private sector. Earlier efforts by the Chinese authorities to reduce risks in China’s financial system appear to have been successful in stabilising leverage in the state-owned sector, but the financial position of private sector firms is more fragile, and risks remain elevated in the real estate industry.

Liberalisation of China's Portfolio Flows and the Renminbi

China’s equity and bond markets have grown rapidly to be among the largest in the world, yet, until recently, participation by foreign investors has been limited. Over recent decades, the Chinese authorities have relaxed investment restrictions to allow greater foreign access to these capital markets. This has enabled greater foreign investment and for global equity and bond index providers to increase the weight of Chinese securities in their indices, which are tracked by a range of global investment funds. These developments have contributed to an increase in gross foreign capital flows into China and they are likely to continue to support inflows in the period ahead. At the same time, an increase in Chinese resident portfolio outflows is also likely as domestic investors seek to diversify by investing abroad. The opening of China’s financial markets entails benefits associated with deeper global financial integration, but may also contribute to greater variability in the renminbi.

The Changing Global Market for Australian Coal

Coal is one of Australia’s largest exports, and has accounted for around one-quarter of Australia’s resource exports by value over the past decade. However, demand in the global market for coal has been evolving in recent years, which is creating some uncertainties for the longer-term outlook for coal exports. Looking forward, demand will be shaped by the speed of the transition towards renewable energy sources, changing steel production technologies, and the pace of global economic growth. Over the next few years, Australian coal production and exports are expected to grow fairly modestly.

Spillovers to Australia from the Chinese Economy

China is Australia's largest trading partner. The strong links between the two economies raises the question of how a sizeable slowdown in Chinese activity would affect Australia. Through our research we have attempted to quantify how such a scenario could play out and its implications. We consider the main transmission channels, notably trade and financial market effects, and describe possible scenarios that could lead to a material slowing in China. We apply a stylised shock encapsulating features of these scenarios to a medium-sized macroeconometric model of the Australian economy and analyse how the shock is transmitted through real and financial channels. The potential for the exchange rate and monetary policy to offset some of those effects is also examined.

China's Local Government Bond Market

China's local government bond market is a key source of financing for local governments, particularly to fund infrastructure investment. The market has grown rapidly in recent years but is still relatively illiquid and has a narrow investor base. It also shows little difference in pricing of credit risk across different bond types and issuers, partly due to the perception that local governments enjoy an implicit guarantee from the central authorities. The Chinese Government has implemented measures to foster the development of these features of the market, bearing in mind risks to financial stability.

The International Trade in Services

Services are becoming increasingly traded globally and technological advances have led to the rise of more modern services such as communications, financial and intellectual property services. While advanced economies continue to account for the bulk of the demand and supply of services traded around the world, the emerging economies' share has been increasing. This article examines the changing global trends and compares them to Australia's experience with services trade, which has been shaped by China's growing demand.

Housing Policy and Economic Growth in China

Housing investment has contributed significantly to Chinese GDP growth in recent decades and, due to the steel-intensive nature of that investment, has also been an important driver of Australian exports of iron ore and metallurgical coal. Trends in Chinese residential investment have been strongly influenced by government policies. Since 2016, the Chinese Government has tightened policies, particularly towards ‘speculative’ housing purchases, to moderate property price inflation. It has simultaneously implemented targeted, incremental measures to improve longer-term housing supply. Even so, construction activity has weakened and prices have continued to rise rapidly. Maintaining this policy mix towards the sector is likely to prove challenging as downside risks to broader economic conditions mount.

Developments in Emerging South-East Asia

A number of economies in South-East Asia have been making significant progress in their economic development. This article focuses on the largest middle-income economies in South-East Asia: Indonesia, Malaysia, Thailand, the Philippines and Vietnam. We examine the developments in these economies over recent decades, explore their relationship with Australia and the global economy and consider their potential to reach a significantly higher level of income. These economies have benefited from favourable demographics over recent decades although some will face pressures from ageing populations. However, there are ample opportunities to gain from further improvement in infrastructure, education and labour force participation.

China's Supply-side Structural Reform

Supply side structural reform is a key component of China's economic policy agenda. The motivation for reform is the view that the supply side of China's economy is out of balance with the demand side and requires adjustment. The reform targets the structure of production, to make it more efficient at the macro and firm level. As well as improving efficiency, firms are being pushed to make production more environmentally friendly. Promoting advanced industries and innovation in existing industries are also key features of the policy.

RMB Internationalisation: Where to Next?

China's push to make its own currency – the renminbi (RMB) – available for use by non-residents was a catalyst for important reforms. Since the RMB internationalisation policy began in 2009, not only is the RMB now in greater use internationally, capital flows more freely across China's borders, the exchange rate is more flexible and domestic interest rates are more market determined. In time, the RMB could emerge as a widely used regional currency in Asia.

Trends in China's Capital Account

Chinese policymakers' approach to liberalising capital flows has been gradual and controlled over time, as the authorities have sought to mitigate volatility in the Chinese renminbi (RMB) and private capital flows. Direct investment flows out of China have grown, become more diversified and have increasingly been accounted for by private investors. Banking-related flows have proved more volatile and are correlated with expectations for the RMB.

Developments in Correspondent Banking in the South Pacific

This article examines the withdrawal of global financial institutions from providing correspondent banking services to the South Pacific region and the implications for remittances. Disruptions to the flow of remittances, an important source of income to many low-income island nations, could limit local consumption and adversely affect economic stability. So far, however, remittances to the South Pacific region have continued to increase.

Economic Trends in India

The Indian economy has experienced a notable turnaround in recent years. Growth has rebounded, inflation has moderated, and the budget and trade deficits have narrowed. The Indian Government has also initiated policies and reforms aimed at encouraging investment, strengthening productivity and ensuring fiscal sustainability. Stronger growth in domestic demand has led to a recovery in India's imports, including from Australia. The recent volatility in foreign exchange markets and the recovery in oil prices pose upside risks to inflation and the current account deficit. However, India's strong long-term potential for growth, driven by demographics, urbanisation and productivity-enhancing reforms, suggests there is scope for trade between Australia and India to expand further in coming years.

Indicators of Labour Market Conditions in Advanced Economies

While the unemployment rate is the most widely used indicator of labour market slack, there are many other measures. This article reports on what a broad range of indicators say about conditions in the labour markets of advanced economies. We summarise the various indicators using a standard statistical technique. The summary measures show labour markets in most advanced economies are tight, although in some cases not as tight as implied by the unemployment rate. The Australian labour market has spare capacity remaining, consistent with readings from the unemployment rate. The summary measures provide additional information about wage developments for most advanced economies, above and beyond the unemployment rate, but do not fully account for the weak wages growth of recent years.

Wage Growth in Advanced Economies

Nominal wage growth in advanced economies has been sluggish, despite unemployment in a number of places falling to levels consistent with full employment. This article finds that, in most economies, low wage growth does not reflect a weaker relationship with unemployment. Instead, lower productivity growth, the difficulty of cutting wages following the global financial crisis and a decline in labour's bargaining power help explain some of the wage sluggishness. There also appears to be a common, but yet unidentified, factor that has weighed on wages over the past two years.

Non-bank Financing in China

The rise of shadow banking activities over the past decade has provided a range of benefits to the Chinese economy and financial system. Yet, it has also raised considerable financial stability risks, prompting Chinese authorities to announce many changes to the regulatory and supervisory framework. This Bulletin article examines the nature and complexity of shadow banking and highlights the challenges facing the Chinese authorities.

Underlying Consumer Price Inflation in China

Underlying inflation measures seek to look through the volatility often inherent in headline inflation, and can be useful for assessing inflationary pressures in a given economy. This article describes new trimmed mean measures of underlying inflation that we have constructed for China and compares their performance with other measures of underlying consumer price inflation. A range of underlying inflation measures suggest that inflationary pressures have increased gradually since early 2016, although they remain low by historical standards.

Ageing and Labour Supply in Advanced Economies

Population ageing is a global trend, which is most evident in advanced economies. This article details the impact of demographic developments on labour supply in advanced economies. The ageing of the workforce has tended to reduce labour supply. This has been mostly offset by increased labour force participation of women and older people. These trends are occurring in Australia, although strong migration has mitigated some of the impact of ageing.

Foreign Exchange Derivative Markets in Asia

Activity in foreign exchange derivative markets in Asia has increased in recent years, along with greater incentives to hedge exchange rate risk. But these markets are more developed for the currencies of advanced Asian economies than emerging Asian economies. Foreign exchange derivative markets also tend to be deeper for Asian economies that are more integrated into global financial markets and have flexible exchange rates.

Trends in Global Foreign Currency Reserves

Over the decade to 2014, global foreign currency reserves doubled relative to GDP, though balances have declined a little since then. Accompanying this growth has been a shift in the composition of reserves towards higher-yielding assets, including equities and non-traditional reserve currencies, such as the Australian dollar. This article examines the overall growth trend as well as the potential causes of the compositional shift in reserves, including a decline in yields offered by traditional reserve assets and higher reserve balances.

Conditions in China's Listed Corporate Sector

The financial statements of listed companies provide a detailed insight into the broader conditions faced by businesses in China. Listed firms have deleveraged over the past few years, although declining profitability has reduced their capacity to cover interest payments, especially for state-controlled firms. High leverage and declining profitability in the real estate and construction sectors remain a concern, especially given these sectors have been a key driver of economic growth in recent years.

The Chinese Interbank Repo Market

The market for repurchase agreements (repos) is an important source of short-term funding for financial institutions operating in China. This article outlines the key features of Chinese repo markets, focusing on the interbank market, before discussing recent developments and their impact on the bond market. Repo rates have fallen and become less volatile over the past couple of years, encouraging greater risk-taking in financial markets. Policy settings in China have both shaped and responded to these developments.

Inflation Expectations in Advanced Economies

Anchored inflation expectations are important for price stability because expectations affect current actions. Although all inflation expectations measures provide some information about future inflation, professional forecasters have been the most accurate in predicting future inflation, while market-implied and consumer measures have tended to be less so. Recent declines in inflation expectations have been concentrated in the measures that have historically been less accurate predictors. The more accurate measures have been more stable and have remained close to central banks' inflation targets.

The Rise of Chinese Money Market Funds

Money market funds (MMFs) pool funds in an investment vehicle to invest in short-term, highly rated securities. The MMF sector in China has grown rapidly over the past few years and is now the world's second largest by assets, though it is small compared with China's domestic bank deposits. This growth has been driven by investors attracted by high yields relative to bank deposits and technological developments that allow Chinese MMFs to offer a convenient cash management service. Chinese MMFs differ from similar products in many other countries: they tend to be more leveraged, and they offer more liquidity and maturity transformation. Nonetheless, recent regulatory reforms to address vulnerabilities have taken a similar direction to reforms globally.

The Effect of Chinese Macroeconomic News on Australian Financial Markets

Over the past two decades, economic and financial developments in China have become more important for the Australian economy in many ways. This article focuses on the effect of economic data releases in China on financial markets in Australia, and argues that Australian financial markets, particularly the Australian dollar, react more strongly to news about the Chinese economy than in the past.

Chinese Household Income, Consumption and Savings

Household income and spending in China have grown rapidly over the past few decades, and income inequality has also risen. The various measures of China's aggregate household saving rate have all increased since the 1990s, and variation in saving behaviour by income group suggests that increasing the income of poorer households in particular would boost aggregate consumption. Changes in Chinese household consumption patterns as incomes rise have the potential to lead to higher imports of services and food from Australia in the long run. However, uncertainty around the outlook for growth of Chinese household income, consumption and saving is increasing as economic growth moderates in China.

GDP-linked Bonds

A GDP-linked bond is a debt security with repayments that are linked to the issuing country's GDP. These securities have recently attracted some attention, including within the Group of Twenty (G20), in the context of discussions about possible ways to improve the resilience of the international financial system. In view of this, we discuss the potential benefits and challenges associated with issuing GDP-linked bonds and estimate a range of plausible risk premiums using the capital asset pricing model (CAPM). Our analysis suggests that there is significant uncertainty about how these instruments would be priced and, therefore, the borrowing costs that would be faced by governments. Given that borrowing costs play a crucial role in determining what type of debt governments choose to issue, further work could investigate how private market participants are likely to price GDP-linked bonds in practice.

China's Demographic Outlook

The significant increase in the working-age portion of China's population over recent decades was an important contributor to China's rapid economic growth. In coming decades, however, China's working-age population is expected to contract and the dependency ratio, which is the ratio of non-working-age to working-age population, is expected to increase substantially. Other things being equal, such demographic changes will have fiscal implications and tend to reduce the economy's potential growth rate. Scenarios presented in this article suggest that it appears inevitable that China's dependency ratio will rise and the working-age population will not increase from current levels. As such, the boost to economic growth provided by the demographic dividend of the past decades is not likely to be repeated.

Liquidity in Fixed Income Markets

Fixed income markets in many jurisdictions have been going through a period of change, resulting in a debate as to whether they are continuing to function effectively, or will function effectively in times of stress. Changes in dealer business models and increased use of electronic trading platforms are influencing the nature of liquidity in bond markets. These changes are not as prevalent in Australia as they are in some overseas markets. For instance, while dealer inventories in US and European banks have fallen, in Australia they have been broadly steady, although they have undergone some substantial compositional shifts. Similarly, electronic trading and, in particular, high frequency trading (HFT), does not account for as large a share of trading in Australian financial markets as it does in US and some European markets. As these changes have occurred, market liquidity in some bond market segments in Australia has declined and is lower than it has been in the past. In contrast, market liquidity in derivative markets appears to have improved, such that overall market liquidity across bond and related derivative markets does not appear to have deteriorated. While this is a positive assessment, it is also likely that accommodative monetary policies in many major economies have supported market liquidity in recent years and it is difficult to determine how robust market liquidity would be in the absence of these policies.

Currency Risk at Emerging Market Firms

Exchange rate fluctuations can affect the value of emerging market (EM) firms in several ways, including through trade-related and balance sheet channels. This article examines the effects of exchange rate fluctuations on listed EM firms' share prices. Overall, a depreciation of the exchange rate is estimated to lower the share prices of around 25 per cent of EM firms, while 15 per cent of firms benefit and the share prices of the remaining 60 per cent are unaffected by a lower exchange rate. Among firms with share prices that are sensitive to exchange rate fluctuations, those that are more indebted tend to be more adversely affected by depreciation. However, there is no significant association between the sensitivity of a firm's share price to exchange rate fluctuations and the size of that firm's foreign currency-denominated debts, consistent with the prevalence of natural hedging among EM firms with such debt.

The Term Structure of Commodity Risk Premiums and the Role of Hedging

A standard theory used to explain commodity futures prices decomposes the futures price into the expected spot price at maturity of the futures contract and a risk premium. This article investigates the term structure of commodity risk premiums. We find that risk premiums vary across futures contract maturities, and that the term structure of commodity risk premiums differs between commodities. Furthermore, the risk premiums on crude oil and heating oil have fallen since the mid 2000s, consistent with increased financial investment in these futures markets. This article also outlines evidence to suggest that the existence of a commodity risk premium is related to the hedging activities of market participants.

Assessing China's Merchandise Trade Data Using Mirror Statistics

Given their timeliness, Chinese trade data have the potential to provide a useful early read on conditions in the Australian and global traded sectors. However, the reliability of China's merchandise trade data has come under scrutiny in recent years, particularly following reports of over-invoicing of exports to Hong Kong. This article considers the accuracy of China's trade data by comparing the merchandise trade statistics with the reciprocal trade statistics or ‘mirror’ statistics published by its major trading partners (MTPs). In broad terms, growth in trade suggested by the mirror statistics aligns relatively closely with published Chinese data, though the Chinese figures are found to imply more volatile and somewhat higher growth in exports over the past three years than the corresponding trading partner data. While this largely reflects differences with mirror statistics for Hong Kong, it is also due to discrepancies with data from other economies, primarily in the Asian region.

Chinese Capital Flows and Capital Account Liberalisation

Chinese private capital flows are dominated by foreign direct investment and banking-related flows, with portfolio flows remaining relatively small (as a share of GDP). Of these components, banking-related flows account for the majority of the cyclical variation in total flows and seem to be driven by expected changes in the exchange rate. Both the composition of capital flows and the factors that drive their variation are likely to change as the Chinese authorities gradually open the capital account in line with their stated intention. Given the size of China's economy, the implications of a continued opening of its capital account and a significant increase in capital flows are potentially very large. They include a greater influence of global financial conditions on China (and vice versa), a change in the composition of China's net foreign assets, and a change in the nature of the economic and financial risks facing China.

US Dollar Debt of Emerging Market Firms

US dollar-denominated borrowings by emerging market (EM) corporations have increased rapidly in recent years, raising concerns about possible currency mismatch risk. This article uses firm-level data from the top 100 EM corporate bond issuers and Bank for International Settlements data on cross-border bank lending at the economy level to gauge such risk. These data indicate that around two-thirds of the largest issuers of US dollar-denominated corporate bonds are at least in part naturally hedged (based on company-specific information), and a significant share of the remaining borrowers are state-owned enterprises. The largest recipients of foreign currency bank loans by country also appear to derive significant US dollar export revenues. This suggests that most EM corporations that have borrowed in US dollars are well placed to weather an appreciation of the US dollar, particularly given the possibility that some have hedged their exposures via financial markets. However, Chinese property developers may be an exception and some EM resource companies may face difficulties as a result of the current low global commodity prices. Corporations will also face higher financing costs on their US dollar-denominated debt as the US Federal Reserve moves to increase its policy rate.

Explaining the Slowdown in Global Trade

Following the global financial crisis, global trade contracted sharply and, after an initial recovery, grew at an unusually slow pace relative to global GDP. This article reviews cyclical and structural explanations for this phenomenon, and finds econometric evidence that cyclical factors – namely shifts in the composition of aggregate demand toward less import-intensive components and heightened economic uncertainty – can explain most of the slowdown in trade in a panel of advanced economies. Although the slowdown in aggregate global trade is well explained by the model used, the results vary by country. For Australia, the model performed well until 2012, after which it over-predicted import growth, most likely because it did not adequately capture the import intensity of mining investment and resource exports.

Developments in Thermal Coal Markets

Thermal coal prices increased markedly over the decade to 2011, driven by a substantial increase in global demand. That led to significant investments in thermal coal mine and port capacity, particularly in Australia and Indonesia. The resulting increases in the seaborne supply of thermal coal have underpinned a significant fall in global thermal coal prices. However, an easing of the pace of growth of global demand for thermal coal, reflecting a move towards cleaner energy sources and a slowing in the growth of aggregate electricity demand, has also weighed on prices. The outlook for prices and production over the next few years depends on a number of factors, particularly the response of Chinese demand to policy measures.

Potential Growth and Rebalancing in China

In rapidly growing emerging economies such as China, it can be difficult to distinguish changes in long-term trends in growth from short-term macroeconomic cycles. This article provides a narrative account of recent phases in Chinese economic growth, and explores the role of cyclical and structural factors in shaping China's recent growth performance. It reviews evidence documented by Lu and Cai (2014) suggesting that the slowing of GDP growth in recent years has resulted from a decline in the potential growth rate rather than being a cyclical downturn. The article emphasises the positive impact that reforms which raise labour force participation and productivity could have on the growth of potential output in China. It suggests that ‘rebalancing’ the economy's demand from investment and exports towards consumption may not be sufficient to prevent a decline in potential growth but that, at a minimum, such rebalancing would probably be conducive to a more stable macroeconomic cycle.

Wealth Management Products in China

Wealth management products (WMPs) in China are investments that offer fixed rates of return well above regulated interest rates for deposits and are often used to fund investments in sectors where bank credit is restricted. They are typically actively managed by banks, with other firms commonly used as ‘channels’, but few are recorded on banks' balance sheets. A key concern about such products is the moral hazard created by a history of banks bailing out unguaranteed WMPs.

Australia and the Global LNG Market

Australian exports of liquefied natural gas (LNG) will rise significantly over the next few years as a number of large-scale investment projects reach completion. The bulk of these exports will be to Asian customers under long-term contracts, with their price linked to the price of oil. The Asia-Pacific LNG market over the next decade will be influenced by potential changes to the composition of Asian energy demand, the magnitude of the increase of US LNG exports to Asia and any changes to the traditional oil-based pricing mechanism. The ramp-up in LNG production will boost Australian output and incomes over the next few years; however, the effect on Australia's living standards will be lessened to some extent by the high level of foreign ownership and the relatively low labour intensity of LNG production.

China's Property Sector

Property development, especially of residential property, represents a sizeable share of China's economic activity and has made a considerable contribution to overall growth over recent history. Residential property cycles in China have been larger than cycles in commercial real estate, and may pose risks to activity and financial stability. The current weakness in the property market differs somewhat from previous downturns as there are indications that developers may be much more highly geared than in the past, contributing to financial stability risks. Although urbanisation in China may provide support for property construction in coming years, weakness in the residential property market is likely to persist. Policymakers have taken actions to support activity and confidence in the market, and have scope to respond with further support if needed. However, broader concerns about achieving sustainable growth may limit the scale of any stimulus they are willing to provide to the sector.

The IMF's ‘Surveillance’: How Has It Changed since the Global Financial Crisis?

The International Monetary Fund (IMF) is mandated by its members to oversee the international monetary system. One of the key ways it does this is through bilateral and multilateral ‘surveillance’ – monitoring, analysing and providing advice on the economic and financial policies of its 188 members and the linkages between them. This article discusses three broad issues identified with the IMF's pre-2008 surveillance by the IMF and IMF watchers – analytical weaknesses (though these were not confined to the IMF alone), ineffective communication of key surveillance messages in public reports, and governance issues and practical constraints – and examines the steps taken by the IMF to address them. Significant improvements have been made in addressing analytical weaknesses, and efforts to improve the effectiveness of the IMF's communication are ongoing. However, issues around governance remain unresolved, which risks reducing the credibility and influence of IMF surveillance.

Chinese Rebalancing and Australian Exports

The Chinese authorities plan to gradually rebalance the composition of Chinese economic growth from investment towards household consumption. This article uses the World Input-Output Database (WIOD) to give a general sense of how this rebalancing might affect Australian exports and economic activity. Dollar for dollar, Chinese investment appears to absorb more than twice as much Australian value-added output as Chinese household consumption. This largely reflects the significant role of resource commodities in Australia's exports to China, which are used more intensively in investment than consumption. Simple analysis using the WIOD suggests that a shift from investment to consumption in China is likely to weigh on the growth of demand for Australia's mineral resources, although a rise in demand by Chinese households for food products and services could provide some offset.

The Offshore Renminbi Market and Australia

The Chinese authorities have continued to make progress in internationalising China's currency, the renminbi (RMB). In particular, the use of RMB for cross-border trade and investment transactions has increased noticeably over recent years and the market for RMB in a number of jurisdictions outside of mainland China – known as ‘offshore centres’ – has developed further. As part of this broader trend, the use of RMB by Australian entities has also increased somewhat, although there remains considerable scope for further growth. In order to facilitate this, a number of policy initiatives designed to allow the local RMB market to develop have recently been agreed with the Chinese authorities. Most notably, these include the establishment of an official RMB clearing bank in Australia and a quota that will allow Australian-based entities to invest in mainland China's financial markets as part of the RMB Qualified Foreign Institutional Investor (RQFII) program.

Identifying Global Systemically Important Financial Institutions

A key element of the G20 response to the global financial crisis has been to develop policies to address the ‘too-big-to-fail’ problem posed by systemically important financial institutions (SIFIs). The first step is to identify such entities. To that end, there has been extensive work undertaken in recent years, especially at the global level in view of the cross-country impact of large international financial institutions should they fail or become distressed. This article examines the methodologies developed by standard-setting bodies for identifying global SIFIs among banks, insurers and non-banks, drawing out common elements as well as important differences among them. Policy work addressing the ‘too-big-to-fail’ problem is ongoing. At the recent G20 Summit in Brisbane, leaders built on these reforms by endorsing two further proposals to improve the ability to resolve failing or distressed global systemically important banks.

Sovereign Debt Restructuring: Recent Issues and Reforms

Over the past decade, 14 countries have undertaken a total of 18 debt restructurings. Concerns surrounding some of these restructurings have led policymakers and capital market participants to review their policies and practices on restructuring sovereign debt. In particular, court rulings as a result of litigation against Argentina have raised fears that a small minority of creditors could block or frustrate a restructuring deal even when it has been agreed to by a supermajority of creditors. This article outlines the case for strengthening the current approach to debt restructuring and assesses recent proposals put forward by the International Monetary Fund (IMF), sovereign governments and capital market participants.

Measures of Inflation in India

India has experienced persistently high inflation in recent years, despite a period of below-trend economic growth. As a result, controlling inflation has become a key objective for policymakers. The two main indicators of inflation in India are the wholesale price index (WPI) and the consumer price index (CPI). Although the WPI has traditionally been the most widely used measure for assessing inflationary pressures, the Reserve Bank of India (RBI) recently conducted a review of its monetary policy framework, which recommended adopting a flexible inflation-targeting regime, based on headline CPI inflation. This article outlines the two main price measures available for the Indian economy and discusses their role in India's monetary policy.

A Century of Stock-Bond Correlations

The correlation between movements in equity prices and bond yields is an important input for portfolio asset allocation decisions. Throughout much of the 20th century, the correlation between equity prices and government bond yields in the United States and other countries, including Australia, fluctuated but tended to be negative. However, stock-bond yield correlations have been largely positive since the late 1990s, rose strongly during the global financial crisis and have since remained at a high level for a prolonged period. The more recent period of positive correlation in part reflects the pronounced and persistent effect of the financial crisis on the economic outlook, though it may also owe in part to an increase in the importance of uncertainty about real economic activity in driving both government bond yields and stock prices. Changes in US monetary policy look to have exerted an opposing force on the correlation at times, driving it lower.

Infrastructure Investment in China

Infrastructure investment in China has increased significantly in recent decades and has been a significant driver of economic growth and improved standards of living. Nonetheless, the level of infrastructure in China remains below that in developed countries, suggesting that the growth of infrastructure investment is likely to remain strong for some time. This outlook has implications for Australian commodity exports, as infrastructure investment is intensive in its use of steel, which in turn relies on iron ore and coking coal as inputs. While infrastructure investment in China is not without its risks, these may be mitigated to some extent by reforms proposed by the authorities, such as increasing the private sector's participation in the allocation, execution and financing of this investment.

Cross-border Capital Flows since the Global Financial Crisis

Global gross capital flows remain well below their peak before the global financial crisis, which was reached after a period of unusual expansion. Much of the decline can be attributed to a reduced flow of lending by banks – particularly to, from and within the euro area – as banks have unwound many of the cross-border positions they built up before the crisis. Capital inflows to some economies, however, are now larger than they were before the crisis. The international regulatory response to the crisis aims to address some of the risks associated with increased capital flows, while maintaining the benefits of an integrated financial system.

Housing Trends in China and India

Residential construction has made an important contribution to China's economic growth over recent decades. Given China's large population and the extensive use of steel in its urban residential development, this investment has also been an important driver of growing demand for Australia's exports of iron ore and coking coal. India's population is of a comparable size to that of China. However, despite its faster population growth, India's slower pace of urbanisation and less intensive use of steel in its housing construction has meant that housing activity in India has not been a major source of demand for iron ore and coal. This article explores the trends in the main factors that influence the amount and nature of investment in housing in China and India, and assesses the long-term outlook for residential construction in these two economies.

Korea's Manufacturing Sector and Imports from Australia

The Korean economy has grown rapidly over the past half century, driven in part by the development of an export-oriented manufacturing sector. While the electronics industry has expanded rapidly since the 1970s, there has also been a shift towards more steel-intensive industries, such as transport equipment and metal products. This shift, combined with Korea's reliance on resource imports, led Korea to become Australia's third largest export destination.

Foreign Currency Exposure and Hedging in Australia

The 2013 Australian Bureau of Statistics (ABS) Foreign Currency Exposure survey confirms that Australian entities' financial asset and liability positions remain well hedged against a depreciation of the Australian dollar, either through the use of foreign currency hedging derivatives or through offsetting foreign currency asset and liability positions. Even before taking into account the use of hedging derivatives, Australian entities as a whole have a net foreign currency asset position with the rest of the world. After accounting for hedging derivatives, this overall net foreign currency asset position increases slightly. This is primarily because the banking sector hedges all of its net foreign currency liability exposure, although this is partly offset by other financial corporations hedging part of their overall net foreign currency asset exposure. As a result of this net foreign currency asset position, the Australian economy's net overall foreign liability position would not in itself be a source of vulnerability in the event of a sudden depreciation of the Australian dollar.

The Relationship between Bulk Commodity and Chinese Steel Prices

Iron ore and coking coal are complementary inputs for steelmaking and therefore their prices are closely related to steel prices. Historically, trade in iron ore and coking coal was based on long-term contracts, but in recent years there has been a shift towards shorter-term pricing, including on the spot market, and consequently prices reflect market developments more quickly. This article analyses the relationship between the spot prices for iron ore, coking coal and Chinese steel products, and finds that in the short run the spot price for iron ore has tended to overshoot its long-run equilibrium following an unexpected change in Chinese steel prices.

The Performance of Resource-exporting Economies

The surge in demand for resources over the past decade led to sharp increases in the terms of trade not just for Australia, but also for other economies with comparable resource exports such as Brazil, Canada, Chile, Russia and South Africa. Each of these economies experienced an increase in investment, although the surge in resources investment in Australia has been particularly large. The real exchange rates in these economies appreciated, weighing on other trade-exposed industries, while parts of the non-traded sector benefited from the boost to income and activity from the resources boom. In general, the resource-exporting economies experienced relatively strong growth in economic activity and inflation remained well contained, particularly compared with previous booms in resource prices.

East Asian Corporate Bond Markets

East Asian corporate bond markets have grown significantly over the past decade. The expansion of these markets has been underpinned by strong economic growth and regulatory initiatives that have helped to improve market infrastructure and encourage participation. These developments have helped corporations to diversify their funding and are likely to have played a part in supporting the economies in the region during the global financial crisis.

Financing Infrastructure: A Spectrum of Country Approaches

Over recent decades, there has been a shift away from public infrastructure financing towards private infrastructure financing, particularly in advanced economies. In this article, infrastructure financing in four countries – China, India, Australia and the United Kingdom – is examined to illustrate the different approaches taken by governments to finance infrastructure and encourage private financing. In all four countries, public financing of infrastructure remains significant, ranging from one-third in the United Kingdom to almost all financing in China.

Macroeconomic Management in China

China's economy has expanded at a rapid pace over the past three decades, underpinned by a range of economic reforms. While many of these reforms have focused on the supply side of the economy, the authorities have employed a range of policies to manage aggregate demand and control the build-up of inflationary pressures and financial risks. The operation of macroeconomic policy in China differs from that typically used in developed economies, reflecting China's particular institutional and economic environment. Macroeconomic policy is implemented in a coordinated manner with authorities using a range of monetary, fiscal and regulatory policy instruments to achieve economic objectives.

Demand for Manufacturing Imports in China

Fluctuations in Chinese imports are often viewed by analysts as containing information about domestic demand in China. However, identifying the extent to which imports of manufactured goods depend on domestic demand is difficult given the integration of Chinese trade in regional manufacturing supply networks. This article analyses Chinese imports of manufactured goods and assesses whether the determinants of manufactured goods imports have changed over the past few years. Over time, imports have declined as a share of Chinese sales of manufactured goods and appear to have become less affected by domestic demand and instead become more sensitive to exports.

Shifts in Production in East Asia

Over the past few decades, manufacturing production has shifted from the higher to the lower income economies in east Asia. This article uses input-output analysis to explore how total value added in manufacturing has shifted around the region. It finds that for most economies, the domestic content of manufacturing production has decreased over time, reflecting the increasing complexity of supply chains and the growth of intra-industry trade in the region. Also, a rising share of the region's production has been taking place in China, and this trend is expected to continue for some time yet.

Developments in Renminbi Internationalisation

The ‘internationalisation’ of the Chinese renminbi (RMB) is proceeding at a measured pace, with a sequence of reforms designed to increase its use in international trade and investment. Over the longer term – as the exchange rate becomes more market determined and as capital account liberalisation progresses – the RMB has the potential to become a major global currency. This article builds on the work of Cockerell and Shoory (2012) by describing developments in the onshore and offshore RMB markets, and the linkages between them, over the past year. In light of China's position as Australia's largest trading partner, the article also discusses the implications of these developments for Australian firms, drawing on the results of a survey conducted for the inaugural Australia-Hong Kong RMB Trade and Investment Dialogue in April 2013.

Value-added Trade and the Australian Economy

Australia's trade linkages have been affected by the expansion of global production networks, with Australia typically exporting commodities that are used to produce goods and services that are, in turn, exported to other markets. In this article, estimates of value-added trade are presented for Australia that complement conventional trade statistics. The value-added trade estimates suggest that the United States and Europe are more important for export demand than implied by conventional trade statistics, as some Australian content is exported to those locations indirectly via east Asia through global supply chains. The value-added trade estimates also highlight the importance of the services sector to Australian trade, as the services sector is integral to producing goods exports.

Trends in Mobile Payments in Developing and Advanced Economies

As mobile phones have become commonplace throughout the world there has been an increasing focus on their potential use for making payments. Adoption of mobile payments in developing economies has occurred well ahead of that in advanced economies, reflecting the particularly large benefits these systems can provide in some economies. Advanced economies, including Australia, are now seeing the emergence of mobile payments, but generally following very different models to those that have become popular in developing economies. This divergence highlights the fact that mobile payments encompass a range of quite different payment types, each of which appeals in different circumstances.

Some graphs in this publication were generated using Mathematica.

ISSN 1837-7211