Bulletin – September 2020 Global Economy Different Approaches to Implementing a Countercyclical Capital Buffer

- Download 622KB

Abstract

The countercyclical capital buffer (CCyB) was one of the measures designed to improve the resilience of the global banking system following the global financial crisis (GFC). It is a bank capital buffer that can be raised or lowered by jurisdictions depending on the level of risk in the financial system. This article describes different approaches to implementing the CCyB. Most jurisdictions set the ‘default’ CCyB rate at zero until risks are elevated; however, recently, several have adopted frameworks where the CCyB is positive through most of the financial cycle. The Australian Prudential Regulation Authority (APRA) has recently announced that it is also considering moving to a non-zero (positive) default CCyB (APRA 2019). This article discusses the possible benefits of a positive default CCyB.

Features of the Countercyclical Capital Buffer (CCyB) Framework

Banks' capital requirements are made up of several components, one of which is the CCyB. In their simplest form, capital requirements specify how much of a bank's funding must come from equity (for example, by issuing shares or retaining earnings) versus liabilities (debt owing to other parties, such as deposits). Capital is therefore a measure of the financial cushion available to a bank to absorb losses on its assets.

The CCyB was part of the Basel III reforms introduced by the Basel Committee on Banking Supervision (BCBS) to address the regulatory gaps revealed by the global financial crisis (GFC). The Basel III framework was an update to the global standards for the prudential regulation of banks, and was intended to improve the resilience of the global banking system. When ‘activated’ by the regulator, the CCyB requires banks to hold an additional buffer of Common Equity Tier 1 (CET1) capital.[1] The CCyB is the only component of capital requirements that regulators can vary according to the ‘financial cycle’,[2] thereby making it an explicit macroprudential instrument. All BCBS member jurisdictions have now implemented a CCyB framework, as have a number of other jurisdictions.

A financial system regulator can raise or lower the CCyB depending on its assessment of the level of systemic risk. Regulators use a number of indicators, including credit and asset price growth, to support this assessment. When the regulator considers that there is an excessive build-up in financial system risk, it can raise the CCyB. Then, following a shock or when risks dissipate, the regulator can reduce the CCyB to support the flow of credit to the economy. By requiring banks to build up the proportion of capital funding when risks are increasing, and allowing them to use relatively less capital funding when risks recede or are realised, the CCyB helps to reduce the likelihood that the banking system will amplify the effects of adverse shocks to the economy.

If a regulator decides to increase the CCyB, it will give banks up to 12 months' notice to comply. In contrast, a reduction in the CCyB applies immediately. The higher capital requirements resulting from a positive CCyB apply only to banks' domestic private sector exposures. However, BCBS member jurisdictions have agreed to reciprocate each other's CCyBs up to 2.5 per cent of risk-weighted assets. This means that if one BCBS jurisdiction imposes a positive CCyB, foreign banks operating in that jurisdiction will also be required by their home regulator to hold a CCyB against their exposures in that jurisdiction.[3]

How Does the CCyB Support Orderly Functioning of the Financial System?

The CCyB is likely to be particularly effective in a downturn because, when it is released, it reduces the likelihood that capital requirements will be a constraint on banks' activities that could support the economy. Its release effectively increases the banks' capital buffers, providing them with greater capacity to absorb losses without breaching their minimum capital requirements, and so supports them to continue lending without the need to raise additional capital. This allows banks to act as a shock absorber for the financial system and the broader economy during a downturn (BCBS 2010).

Under Basel III, an increase in the CCyB is not intended to slow the build-up of credit or ‘lean against the wind’ – this is identified only as a possible side benefit (BCBS 2010).[4] As a result, regulators only activate (i.e. increase) the CCyB when credit growth is considered ‘excessive’ and contributing to a build-up of system-wide risk (BCBS 2010). Evidence from empirical studies of bank capital suggests that an increase in capital requirements (for example, through raising the CCyB) may not be effective at restraining a financial cycle upswing.[5] There are several reasons why this might be the case. First, during that stage of the financial cycle, lending is usually highly profitable and so banks generate internal capital to meet any increased regulatory requirements and to accommodate an expanding balance sheet. Second, in the short term, banks can be incentivised to reduce their voluntary buffers rather than to materially reduce lending. Banks' voluntary buffers mean that at least initially, the CCyB is unlikely to be binding when it is raised, making it less likely that it will be effective at slowing the build-up of credit.[6] Third, the notice period given to banks by the regulator slows the rate at which capital needs to increase, softening the constraint on credit growth to an extent.

How Has the CCyB Been Used Around the World?

All 28 BCBS member jurisdictions, including Australia, have implemented a CCyB framework. A number of non-BCBS countries have also implemented the framework. However, before the COVID-19 pandemic, active use of the CCyB was limited. Three-quarters of BCBS jurisdictions and around two-thirds of non-BCBS jurisdictions have never raised their CCyBs above zero.[7] Even in countries that had a positive CCyB, it remained at low levels, often significantly below the 2.5 per cent reciprocity threshold (Figure 1).

Further, CCyBs have been reduced in an even smaller number of countries, with most of these reductions taking place after the onset of COVID-19. Prior to COVID-19, the United Kingdom and Hong Kong were the only jurisdictions that had ever reduced their CCyBs. The Bank of England lowered the CCyB in 2016 to zero due to high levels of uncertainty following the outcome of the Brexit referendum, but this only unwound a pending rate of 0.5 per cent that was still within a 12-month notice period and so had not yet taken effect (BoE 2016a). The Hong Kong Monetary Authority reduced the CCyB in late 2019 (from 2.5 per cent to 2 per cent) in response to a deteriorating economic environment. However, this was only a short time before the COVID-19 pandemic began. Given that the CCyB is primarily intended to support the economy when it is reduced, the limited number of reductions means that there is limited evidence regarding the practical effectiveness of the CCyB.

When the COVID-19 pandemic took hold, most jurisdictions that had a positive CCyB in 2019 reduced it (Graph 1). Jurisdictions' reasons have included deteriorating global and domestic economies, financial market volatility and the desire to encourage banks to continue supporting businesses in various sectors (BoE 2020; BaFin 2020; CNB 2020; HKMA 2020). These recent cuts are examples of jurisdictions using the CCyB largely as intended, namely to support bank lending and the broader financial sector following an adverse shock. However, this current episode has important distinctive features. The CCyB cuts have not been in response to the crystallisation of the known financial sector risks that the CCyB was initially raised to target. The pandemic is first and foremost a health crisis – one that has resulted in economic and financial sector stress. As such, the recent cuts are examples of regulators making use of flexibility in the CCyB framework. As both the health and economic crises are still ongoing, it is too early to know whether the reductions have been effective in supporting the supply of credit in those jurisdictions.

Source: RBA

What Are the Different Approaches to Implementing the CCyB?

The CCyB's ‘default’ setting refers to its level when financial stability risks are neither elevated nor subdued. Global CCyB frameworks fall broadly into two categories: those with a zero default setting and those with a positive default. The Basel III framework originally envisaged a zero default framework. The CCyB was expected to be set at zero for most of the cycle and only ‘activated’ or raised when systemic vulnerabilities were heightened. In recent years some jurisdictions have switched to a pre-announced positive default setting, which the BCBS considers acceptable within the broad flexibility of the Basel III framework.

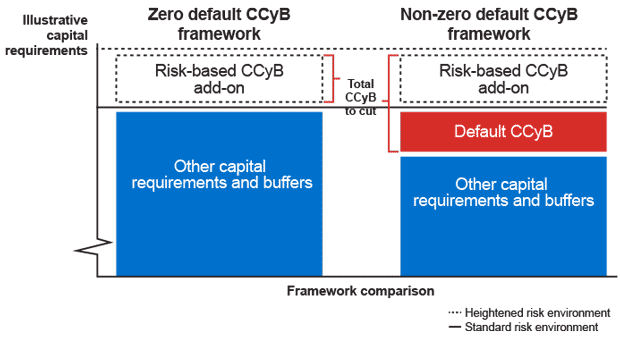

Apart from the default setting, all other aspects of the two frameworks are the same, including their objectives, the reasons for increasing the CCyB, and the notice period of up to 12 months for rate increases. A positive default CCyB does not necessarily mean that overall capital requirements are higher (on average) because many BCBS jurisdictions set minimum capital requirements above BCBS requirements (APRA 2018).[8] Conceptually, a positive default CCyB focuses on making overall capital requirements more countercyclical, rather than on increasing the total ‘level’ of capital requirements. A higher default CCyB may be offset by adjusting other parts of the capital framework, including other buffers (Figure 1) or risk weights.

Table 1 summarises the key aspects of the zero and positive default CCyB frameworks.

| The zero default framework (Basel III original description) |

The positive default framework |

|---|---|

|

|

The United Kingdom was the first to adopt a positive default approach, after previously operating a standard zero default framework. In December 2015, the Bank of England's Financial Policy Committee (FPC) indicated that it would be setting its CCyB at a positive level before risks become elevated (BoE 2015a). It explicitly announced a 1 per cent default CCyB rate in 2016 (BoE 2016b). In December 2019, the FPC announced that it would be increasing this to a 2 per cent default CCyB, to increase the countercyclical component of its capital requirements (BoE 2019). Outside of the BCBS, Lithuania also has a pre-announced positive default CCyB and in New Zealand the shift is being phased in as part of a broader review of capital requirements.

Similarly, a number of other jurisdictions have changed their approaches to moving earlier in the financial cycle than would be the case under the standard zero default approach. In these frameworks, the CCyB is increased above zero before vulnerabilities become elevated, meaning that the CCyB becomes positive early in the financial cycle. These ‘early’ approaches bear similarities to the positive default framework because it means that the CCyB is positive for a larger proportion of the financial cycle. Jurisdictions using these types of ‘early approach’ frameworks include the Czech Republic, Denmark and Ireland (Hajek, Frait and Plasil 2017; Danish Systemic Risk Council 2017; O'Brien, O'Brien, and Velasco 2018).

Another notable case is Canada's domestic stability buffer (DSB). While this is a different buffer to the CCyB, it is also a countercyclical buffer. The DSB has been set at a positive value since its introduction, while the CCyB has remained at zero. The objective has been to build up the DSB during benign times and release it upon the materialisation of risks. Accordingly, in March 2020, the DSB was lowered from 2.25 per cent to 1.0 per cent of risk-weighted assets in response to the COVID-19 pandemic. The DSB applies only to Canada's domestic systemically important banks; however it applies to their global exposures. Given the scale of Canadian banks' foreign operations, the DSB ends up significantly larger than an equivalent CCyB based on domestic exposures alone.

In December 2019, APRA announced that it is likely to introduce a positive default level for the CCyB in Australia. APRA stated that this would be considered as part of upcoming reforms to further calibrate its capital framework (see APRA 2019). However, these possible changes have been delayed due to the COVID-19 pandemic.

The Advantages of a Positive Default CCyB

There are three key advantages to a positive default CCyB, all relating to the regulator having more flexibility under this framework. Compared with the zero default framework, the benefits of a positive default are that:

- The regulator can cut capital requirements at any point in the financial cycle

- The regulator can cut capital requirements by a relatively larger amount, providing more support to the system

- It has the potential to improve buffer usability.

Capacity to cut capital requirements at any point in the financial cycle

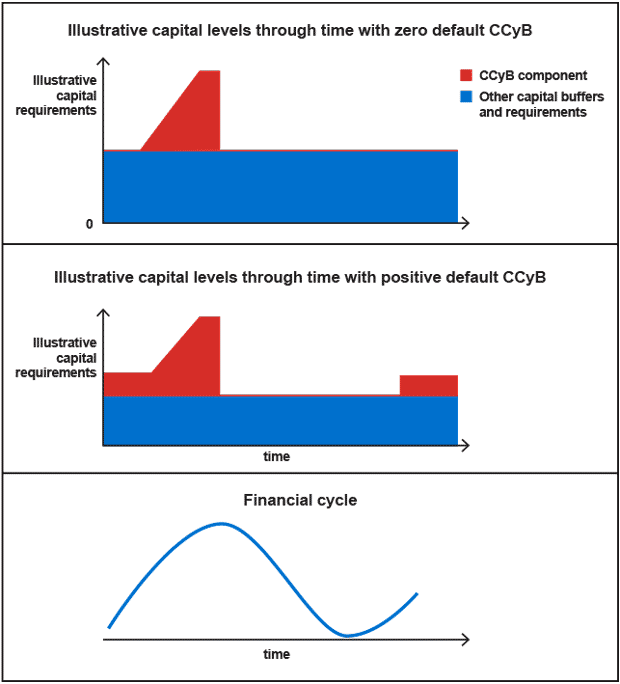

Under a positive default CCyB framework, the CCyB is positive at every point in the financial cycle, except soon after a shock (Figure 2). This means that regulators can cut the CCyB and free up capital at almost any time. It also means that the regulator does not risk giving the signal that a crisis is coming by raising and actively managing CCyB policy. As a result, regulators are better able to respond to a greater variety of shocks, not just those that originate in the financial system. This is important as systemic stress can crystallise in otherwise ‘normal’ financial conditions (when the CCyB is at its default level) following a shock external to the financial system. The COVID-19 pandemic, Brexit, and the 2019 Hong Kong protests are all examples of shocks outside of the financial system that led to economic downturns. Only regulators in jurisdictions that had positive CCyBs were able to lower capital requirements in response to these crises.

Source: RBA

Greater capacity to cut capital requirements

A positive starting point also means that a jurisdiction has a larger CCyB throughout the financial cycle, relative to the zero default CCyB framework. This is because the CCyB makes up a relatively greater proportion of the capital requirements applying to a bank throughout the cycle. A larger CCyB allows a positive default regulator to cut capital requirements by more at the start of a downturn, releasing relatively more capital to support the economy (Figure 1).

The relatively larger CCyB also assists the regulator to manage the inherent uncertainty in identifying points in the financial cycle. Timely identification of growing financial stability risks can be challenging, no matter how closely indicators are monitored (BCBS 2017). Indicators might not always give an accurate signal and the conceptualisation of a financial cycle as the main determinant of risk might not be appropriate in the circumstances. Stress can also occur sooner than expected. A positive default CCyB gives the regulator the flexibility to reduce capital requirements by more than would be possible under a zero default framework, even if the CCyB had not been significantly built up in advance of systemic stress.

Potential to improve buffer usability

Following an adverse shock, regulators may want banks to use capital to absorb losses and continue lending largely unabated. This would mean encouraging banks to operate with lower capital ratios by entering their voluntary buffers and, if necessary, by entering their capital conservation buffers. The BCBS has encouraged regulators and banks to access and use their buffers during the COVID-19 pandemic, while maintaining some buffer capacity over the broader period of uncertainty. However, it has also been noted that banks might face a disincentive to enter their buffers at all (FSB 2020). If this is the case, the buffers may in practice be unusable and banks will therefore restrict the supply of credit to the economy in order to maintain capital ratios in a downturn, even when there is no danger of regulatory requirements being breached.

Currently, there is a concern banks internationally may be reluctant to allow their capital ratios to fall and to ‘enter’ their capital buffers, for a number of reasons. First, there is always an element of uncertainty in a downturn, making banks more cautious about lowering their capital ratios. Second, a bank may be wary of being the first to lower its capital ratio in a downturn. It may worry that this would send a negative signal to investors and rating agencies about its future profitability and even solvency, relative to other banks. Third, it could make it more costly for the bank to raise capital in the future, particularly because under the Basel III framework, entering a regulatory buffer triggers distribution restrictions.

In contrast to other regulatory buffers, banks do not need to ‘enter’ the CCyB in a downturn to operate with lower capital ratios. When a regulator cuts the CCyB, total capital requirements fall, leaving banks with larger voluntary buffers than before. By cutting the CCyB, the regulator can allow banks to maintain the pre-crisis voluntary buffers that the market expects, without losses threatening either new lending or regulatory requirements. As the cut applies to all banks at the same time, lowering the CCyB may also be a way for the regulator to reduce the stigma associated with individual banks operating with reduced capital ratios in a downturn (BCBS 2017). That said, evidence suggests that a large cut in capital requirements may be necessary to encourage banks to operate with lower capital ratios, in order to offset market stigma and uncertainty in a downturn. This is because of the relatively low sensitivity of lending to excess capital (Berrospide and Edge 2010; de-Ramon, Francis and Harris 2016).

Practical Considerations for a Positive Default CCyB Framework

There are a number of practical issues for regulators to consider if moving to a positive default framework. First, while the positive default approach may have benefits, it is not clear what the appropriate positive default level would be, and whether this would vary by jurisdiction. For example, the Bank of England initially set the default CCyB at 1 per cent in 2016, but subsequently raised that to 2 per cent in 2019 (BoE 2019). Larger concerns regarding buffer usability might suggest a higher CCyB default level may be appropriate in a given jurisdiction. Finding the appropriate default level may be an iterative process as frameworks are refined. It will also be up to individual jurisdictions to decide whether they implement a maximum ceiling in their CCyB framework, and how this may change under a positive default framework.

Second, in order for a positive default CCyB to be effective in a downturn, regulators would need to commit to keeping the CCyB low for some time after reducing it. Banks would likely need this reassurance in order to be incentivised to operate with lower capital ratios in a downturn because they would need to have some certainty about how long they would have to rebuild their capital. It is unclear how long the CCyB would need to remain low, partly because there would be uncertainty around the duration of the downturn, and partly because banks may still need to be incentivised to continue lending during the recovery. Regulators operating a positive default framework may need to review what indicators they use to decide when to increase the CCyB back to the default rate given the approach used to increase it above the default may not be appropriate.

Finally, the regulator would need to clearly communicate that the shift alone would not result in an increase in capital requirements for banks on average, and that the higher default CCyB does not reflect a higher level of systemic risk. It would be important to communicate that, while it differs somewhat from the original Basel III approach, it is still consistent with the Basel III framework.

Conclusion

Following the GFC, the BCBS introduced the CCyB as part of the Basel III capital framework. The CCyB is the only capital buffer that is explicitly intended to vary depending on the macrofinancial environment. The Basel III framework originally envisaged a zero default, and this is the approach still used by the majority of countries. However, a number of countries have implemented a positive default. The primary objectives of both the zero and positive default CCyB approaches are the same: to absorb losses and support lending in a downturn, thereby smoothing the financial (and economic) cycle. Events during the COVID-19 pandemic suggest that there may be advantages to a positive default approach. In particular, it allows regulators to reduce capital requirements at any point in the financial cycle, and by more. Thus it may be better able to support the supply of credit to the economy in a downturn. It will be important to assess the effectiveness of the positive approach as more evidence is built up over time. Prior to the COVID-19 pandemic, CCyB frameworks around the world had not been tested through a complete financial cycle. The different experiences of countries with positive CCyBs prior to the pandemic, compared with those that relied solely on other tools, could be a valuable input into CCyB framework considerations in the future.

Footnotes

Katarina Stojkov is from Financial Stability Department [*]

CET1 capital is considered the highest quality capital because it does not result in any repayment or distribution obligations on the institution. As a result, it is also the riskiest for capital owners (shareholders) and therefore carries the highest cost. It is an unrestricted commitment of funds that is available to absorb losses without triggering legal proceedings, and ranks behind the claims of depositors and other creditors in the event that the issuer is wound up. [1]

The ‘financial cycle’ refers to a common cycle in financial variables. There is an extensive literature as to whether the financial cycle is synchronous with the business cycle, or differs in timing, length or amplitude – see Cagliarini and Price (2017). The extent to which the business and financial cycles are synchronised influences how the CCyB interacts with other policies, but is not central to the discussion in this article. [2]

This requirement on foreign banks means that their total global exposures are weighted by the different CCyB rates imposed by various jurisdictions. [3]

When an authority attempts to use policy to slow a financial cycle upswing, this is termed ‘leaning against the wind’. A side benefit of increasing the CCyB may be that it leans against the wind because the increase in capital requirements makes it relatively more expensive for a bank to lend. [4]

Including Cohen and Scantigna (2014), O'Brien, O'Brien, and Velasco (2018), and World Bank (2019). The conclusion that the CCyB may be of limited effectiveness in restraining an upswing is based on pre-existing literature applying to aggregate capital, rather than specifically to just the CCyB. Empirical evidence for just the CCyB is sparse as the CCyB is a relatively new tool that has been activated infrequently since it was developed by the BCBS. [5]

Banks hold voluntary buffers in excess of regulatory minima at all stages of the financial cycle. These give the market more confidence about the financial health of banks. [6]

For the BCBS jurisdictions, the main reasons prompting authorities to raise the CCyB in the years prior to COVID-19 were imbalances in the residential real estate market and excessive credit growth (BCBS 2017). [7]

A regulator could also decide to increase capital requirements as well as implementing a positive default CCyB, but this would be a separate policy decision. [8]

References

APRA (Australian Prudential Regulation Authority) (2015), ‘International capital comparison study’, Information Paper, July.

APRA (2019), ‘Countercyclical capital buffer’, Information Paper, December.

BaFin (2020), ‘General Administrative Act regarding a decrease in the domestic countercyclical capital buffer rate’, IFR 2-QA 2102-2020/0002, April.

BCBS (Basel Committee on Banking Supervision) (2010), ‘Guidance for national authorities operating the countercyclical capital buffer’, December.

BCBS (2017), ‘Implementation: Range of practices in implementing the countercyclical capital buffer policy’, Report, June.

BCBS (2020), Basel Committee meets; discusses impact of Covid-19; reiterates guidance on buffers, Press Release, 17 June.

Berrospide J and R Edge (2010), ‘The Effects of Bank Capital on Lending: What Do We Know, and What Does It Mean?’, Federal Reserve Board, Finance and Economics Discussion Series no 2010-44.

BoE (Bank of England) (2015a), Financial Stability Repor t, Issue No. 37, July.

BoE (2015b), Financial Stability Repor t, Issue No. 38, December.

BoE (2016a), Financial Stability Report, Issue No. 39, July.

BoE (2016b), ‘The Financial Policy Committee's approach to setting the countercyclical capital buffer’, Policy Statement, April.

BoE (2019), Financial Stability Report, December.

BoE (2020), Bank of England measures to respond to the economic shock from Covid-19, March.

Cagliarini A and F Price (2017), ‘Exploring the Link between Macroeconomic and Financial Cycles’, in J Hambur and J Simon (eds), Monetary Policy and Financial Stability in a World of Low Interest Rates, Proceedings of a 2017 Conference held by the RBA, Sydney, pp 7–50.

CNB (Czech National Bank) (2020), Provision of a general nature II/2020 on setting the countercyclical capital buffer rate for the Czech Republic, No. II/2020, June.

FSB (Financial Stability Board) (2020), ‘COVID-19 Pandemic: Financial Stability Implications and Policy Measures Taken’, Report submitted to the G20 Finance Ministers and Governors, July.

Cohen BH and M Scatigna (2014), ‘Banks and Capital Requirements: Channels of Adjustment’, BIS Working Paper No 443.

Danish Systemic Risk Council (2017), ‘The countercyclical capital buffer’, Framework document.

de-Ramon S, W Francis and Q Harris (2016), ‘Bank capital requirements and balance sheet management practices: has the relationship changed after the crisis?’, Bank of England Staff Working Paper No. 635, December.

Hajek J, J Frait and M Plasil (2017), ‘The countercyclical capital buffer in the Czech Republic’, Czech National Bank, Financial Stability Papers 2016/17.

HKMA (Hong Kong Monetary Authority) (2020), ‘Monetary Authority Announces Countercyclical Capital Buffer for Hong Kong’, Press Release, 16 March.

O'Brien O, M O'Brien and S Velasco (2018), ‘Measuring and mitigating cyclical systemic risk in Ireland: the application of the countercyclical capital buffer’, Central Bank of Ireland Financial Stability Note No.4.

World Bank (2019), ‘Bank Capital Regulation’, Global Financial Development Report, pp 78–100.