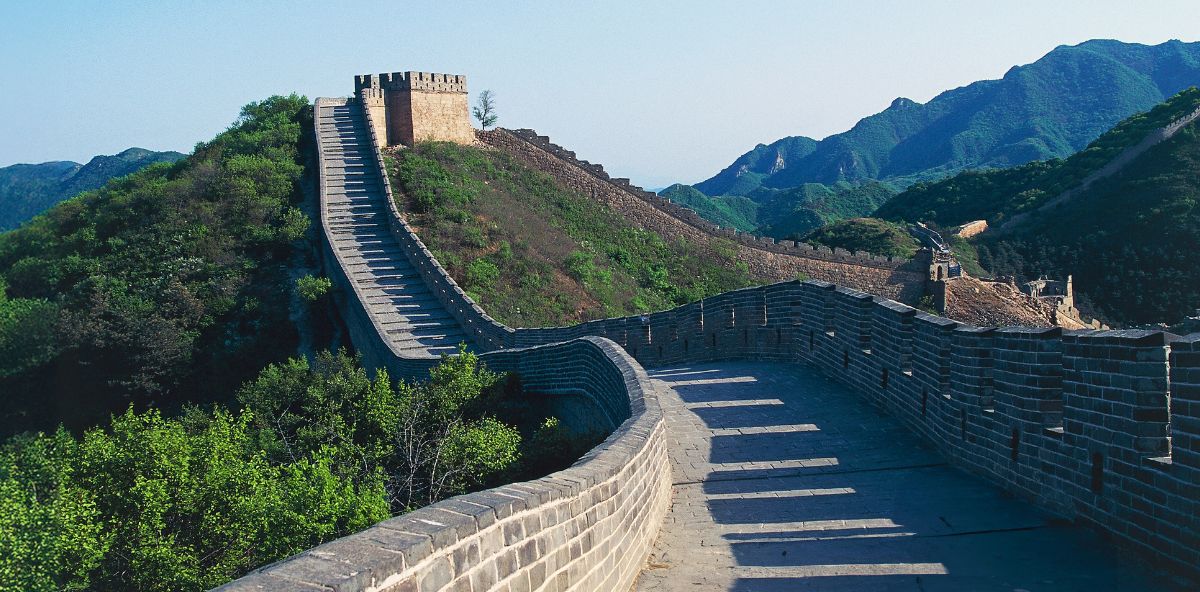

Bulletin – January 2025 Global Economy Behind the Great Wall: China’s Post-pandemic Policy Priorities

- Download 771KB

Abstract

China is Australia’s largest trading partner so policy decisions in China can have a significant impact on the Australian economy, largely via its effect on Australia’s trade. While there remains considerable uncertainty about policymaking in China, this article describes how Chinese authorities have tended to approach economic policy choices and then considers China’s current economic challenges and their relevance to the Australian economy.

Introduction

In recent decades, changes in the policy priorities of Chinese authorities have altered the structure of China’s economy, which in turn has had implications for the global economy. This will affect Australia primarily via China’s demand for Australia’s exports, particularly the price of Australia’s exports and therefore our terms of trade. This was particularly evident following the 2008 global financial crisis, when a sizable Chinese government stimulus package contributed to the Australian mining boom (Kent 2013). Gaining an understanding of China’s economic policy priorities is important for assessing the outlook and risks for the Australian economy.

This article sets out some of the economic policy challenges currently facing China and outlines the possible consequences for the Australian economy. For example, restrictions placed on China’s real estate sector to address financial stability risks have reduced Chinese demand for steel and for Australian iron ore. An increasing focus on expanding the Chinese manufacturing sector to offset the slowdown in real estate has raised international concerns about the level of Chinese exports to the rest of the world. More recently, the effect of China’s latest stimulus program on the Australian economy will depend importantly on its ‘steel intensity’.

Policy priorities in China

Like other governments around the world, Chinese authorities weigh up both economic and social/political objectives when determining policy. Chinese authorities balance a range of objectives including (but not limited to) stability of the Communist Party’s leadership (which is itself a function of economic growth), financial stability, the environment, foreign policy, social objectives (captured by the concept of ‘common prosperity’), and national security (NDRC 2022a). All these objectives tend to be considered in the development of economic policies, although the weight assigned to each objective by the authorities can be difficult to identify and probably changes over time. Twenty years ago, it may have been desirable to prioritise economic growth, when every percentage point of growth was lifting tens of millions of people out of poverty. However, with China having largely eradicated extreme poverty, the authorities appear to have become more concerned about the financial stability costs associated with the earlier growth strategy (NDRC 2022b; World Bank 2022). In recent years, geopolitical risk has become an increasingly important consideration in economic policymaking, with some major economies increasingly concerned about China’s manufacturing capacity, particularly in critical industries.

The balance between various policy priorities is evident in Chinese authorities’ commitment to reaching particular annual economic targets. Economic outcomes that the authorities believe are closely tied to social stability, such as economic growth and employment, almost always meet or exceed their targets (Graph 1). It is rare for China’s annual GDP growth to fall below the target, with pandemic-related lockdowns the most recent instance of a downside miss. By contrast, other economic outcomes that the authorities see as being less tied to social stability appear to be more flexible. This is particularly evident in China’s inflation target with CPI inflation below target every year for the past decade.[1] Historically, the authorities have been responsive in periods when inflation has been higher than targeted, or when prices of essential items have increased rapidly, because these can exacerbate social tensions (Roberts and Russell 2019). For instance, the authorities responded to concerns about elevated food and energy prices in 2022 with directions to increase the supply of these goods due to their particular importance for livelihoods, even though the formal CPI inflation target had not been exceeded (Xinhua 2022).

China’s economic policy challenges

Understanding how the authorities prioritise policy objectives and balance trade-offs is essential to understanding how China will deal with the range of structural and cyclical economic challenges it currently faces. Chinese authorities tend to consider a longer time horizon (e.g. through the publication of Five-year Plans and Long-term Objectives) than policymakers in many other economies where regular elections tend to constrain economic policies to a shorter time horizon. This means that authorities in China are more inclined to make policy choices that address longer term structural problems, even if those policies may contribute to cyclical weakness in the process.

Structural headwinds

Demographics and productivity

China, like much of the world, faces demographic headwinds from an aging and shrinking population (Baird 2024). A declining working-age population and rising dependency ratio reduces labour supply, productivity growth and the economy’s potential growth (Cai 2021). It can also put pressure on the government’s fiscal position through higher health and pension expenditure and lower income tax revenues, although China currently spends a smaller share of GDP on social security than most developed countries (ILO 2023).[2]

China faces a broader problem of slowing productivity growth, with much of its economy dominated by low-productivity state-owned enterprises that often tend to have less incentive to chase profitable returns than more dynamic private enterprises (Lardy 2019). This productivity slowdown is potentially exacerbated by China’s hukou (household registration) system, which acts as a restriction on labour flowing to the most productive areas of China’s economy (Zhou et al 2024).[3]

Financial imbalances

While the financial system has underpinned China’s growth model, it has also become a significant vulnerability. There are three key features that make the Chinese financial system different from those in other economies and that play a key role in the current vulnerabilities it faces. First, there is a large state-owned banking sector; second, there is a widespread perception that the government will step in to cover financial losses of state-owned enterprises; and, third, there is a role for policy (alongside the market) in determining a wide range of interest rates and the allocation of credit, including through the use of capital controls (Jones and Bowman 2019). These unique features have enabled high levels of debt to accumulate relative to other developing economies, and for riskier forms of lending to make up a larger share of that debt than it would otherwise.

China’s debt is large relative to other developing economies, but it is also concentrated in a few sectors. China’s household debt is low and its public debt is high – especially if the sizable share of non-financial corporate debt held by state-owned enterprises is included (Graph 2). This means debt-servicing challenges are even larger than they appear from the aggregate debt-to-GDP ratio alone. There are also large imbalances within individual sectors. For example, within the public sector, local government debt (particularly when local government financing vehicles (LGFV) debt is included) is high relative to central government debt.[4]

In recent years, authorities have implemented a range of policies to address the build-up of risks in the real estate sector, as they viewed that the financial stability risks had begun to outweigh the contribution of the property sector to economic growth (Hendy 2022; Baird 2024). These risks include the concentration of household assets in property, rising inequality from rapid housing price growth, the reliance of local governments on land sales revenue, and financial stability risks from highly leveraged property developers. These imbalances resulted from: a combination of long-term economic and demographic trends that led to high demand for housing (including restrictions on households’ ability to invest offshore); the highly leveraged business models that developers adopted to meet this demand; and policy stimulus in response to the global financial crisis (Hendy 2022). In 2021, authorities implemented regulations aimed at reducing leverage in the real estate development sector, such as the three-red-lines policy, which placed restrictions on developer finances that meant many developers needed to deleverage to comply with the policy. The regulatory changes led to a series of high-profile property developer bond defaults, which exacerbated pressure on healthier developers as markets became increasingly concerned about solvency risk and the unwinding of perceived state support (RBA 2021).

Authorities have so far managed this process of deleveraging and rising defaults in the property sector without triggering a broader financial crisis. This is partly due to the actions of authorities (e.g. by allowing distressed developers to default while minimising losses for households), but also unique features of the Chinese system, such as capital controls that make it hard for residents to move their money elsewhere. The process has nevertheless still been disruptive and has weighed on economic growth.

As well as attempting to limit financial risks in the property sector, authorities have also been working to reduce the scale and opacity of local government debt. This is a key structural issue for the economy because local governments’ capacity to respond to a range of cyclical challenges is constrained by both falling total government revenue in China and vertical fiscal imbalances where local governments face a revenue shortfall relative to their expenditure obligations (Graph 3). With the impact of local government debt burdens on economic growth becoming an increasing concern to the authorities, in late 2024 they announced a CNY10 trillion debt-swap program over five years to refinance hidden local government debt held by LGFVs. This program is expected to reduce local government debt servicing costs and release funds to address overdue local government salary and contractor payments. This followed from a willingness at the 2024 Third Plenum to address the underlying causes of local government debt problems through reform of the fiscal system.

Despite efforts to address financial imbalances, the aggregate debt-to-GDP ratio has continued to increase (Graph 4). Progress on deleveraging has become even more challenging in recent years as nominal GDP growth has slowed. This link between the growth and deleveraging policy priorities is evident in recent economic policy announcements, which contained measures to support growth alongside measures to address longer term financial risks.

The banking system has played a central role in managing China’s financial imbalances. Banks are often directed by the authorities to increase lending on favourable terms to priority sectors and to offer loan forbearance when loan obligations are not met. These factors have contributed to declining profitability and a deterioration in asset quality, although Chinese banks’ non-performing loans (NPLs) are widely considered to be under-reported. These lending practices shift risk from other parts of the system onto the banks and mean that banks face a trade-off between profitability and asset quality when considering how to manage losses on their lending to priority sectors. If banks choose not to roll-over lending to unprofitable sectors, they may have to categorise more loans as non-performing and provision the loans accordingly, which could result in some banks being undercapitalised. Resolving the profitability and asset quality issues in China’s banking system will be key for improving the efficiency of credit allocation in the economy and for driving economic growth in the years ahead. Authorities recognise this and have signalled that they intend to recapitalise the largest banks to ensure that they can continue to effectively serve this function going forward.

Cyclical and sectoral headwinds

Real estate sector

Real estate investment has been an important source of economic growth in China in recent decades, and a major source of steel demand that has underpinned strong demand for Australian resources exports.[5] However, real estate investment, along with its contribution to domestic steel demand, has declined since 2021 following the introduction of policies to address the build-up of risks in the real estate sector (Hendy 2022; Baird 2024).

The authorities have recently signalled a stronger commitment to stabilising conditions in the real estate sector, announcing further measures of support. This suggests the authorities are growing increasingly concerned about weakness in the sector, which is weighing on consumer sentiment and local government revenue. However, authorities have indicated that China needs to make continued efforts to shift its growth model away from its traditional drivers towards more ‘high quality’ sectors, suggesting they do not want real estate investment to return as the primary driver of economic growth (Pan 2024).

Manufacturing sector

One part of the policy response to property market weakness has been to stimulate other sectors of the economy such as manufacturing and investment to offset the decline in economic activity. This is evident in the resilience of Chinese steel demand since 2021, with the drag from real estate investment largely offset by increased demand from infrastructure, manufacturing investment and, to a lesser extent, machinery production (Graph 5). This policy response is also evident in the pick-up in lending to the industrial sector in recent years (Graph 6). This raises the question of whether authorities are repeating the same credit-driven cycle again but in a new sector. If this is the case, a key difference from investing heavily in real estate is that manufactured goods are exportable, which provides an additional channel for the production capacity to be absorbed, in contrast to investment in the housing stock, which needs to be absorbed by the domestic market.

Geopolitics

Tariff barriers to Chinese export growth have increased in recent years. In 2018, the United States imposed new tariffs on a wide range of Chinese imports in response to alleged trade practices that were giving China an unfair trade advantage, including intellectual property right infringements and currency manipulation. More recently, the United States, Europe and Canada and several other countries have argued that China is competing unfairly through the support it is providing to its manufacturing sector, and have imposed additional tariffs to limit the possible impact on their domestic industries. New tariffs to date have mainly targeted the ‘new three’ trio of solar panels, electric vehicles and batteries, but they are also being applied on Chinese exports of products from legacy industries like steel where domestic demand in China has been adversely affected by ongoing weakness in its real estate sector. The United States has also promoted restrictions on exports of sensitive semiconductor manufacturing equipment to China since 2022, and the US President, Donald Trump, has indicated his intention to raise tariffs on all Chinese imports into the country.

As international trade frictions have increased, authorities in China are considering ways to make their economy more resilient to such developments. Authorities have prioritised security since the mid-2010s and have come to see self-sufficiency as increasingly important to the country’s future economic growth and security. The ‘dual circulation’ strategy, announced in 2020 and embedded in China’s 14th Five-year Plan (2021–2025), targets growth in both Chinese domestic demand and manufacturing capacity to help insulate China from external shocks (NDRC 2022c). Over time, the pursuit of self-sufficiency could lead to a decline in China’s trade with the rest of the world, which would directly affect the Australian economy through weaker demand for our exports that are deemed strategically important, and indirectly to the extent that a decline in trade contributes to slower economic growth in China.[6]

Spillovers to Australia

Economic developments in China primarily impact the Australian economy through trade channels (Guttmann et al 2019). In 2023, the share of Australia’s goods exports that were sent to China was 36 per cent – which is significantly higher than any other of Australia’s export destinations – while the share of services exports to China was around 13 per cent (Graph 7). Most of Australia’s goods exports to China are resource exports – particularly iron ore, which made up over half of all Australia’s merchandise exports in 2023. This means changes in Chinese policy that impact steel-intensive production have particularly large implications for the Australian economy.

Chinese demand for Australia’s iron ore has remained resilient, despite the sharp decline in demand from the real estate sector, largely due to the resilience of manufacturing investment and strong growth in Chinese steel exports to the rest of the world. Growth in manufacturing investment has been supported by policy directed toward high-tech industries and – more recently – policies that incentivise businesses to replace existing industrial equipment. Authorities have signalled an intention to continue supporting these industries as they look to promote ‘the new quality productive forces’.

While iron ore is by far Australia’s largest export to China, there are other important commodity trade links that could be affected by decisions Chinese authorities make. The volume of lithium that Australia exports to China has grown quickly in recent years (although remains a small share – less than 10 per cent – in value terms), in line with growth in Chinese battery and electric vehicle production. This may increase further as Chinese policymakers continue to express support for these sectors and emphasise China’s role in the global push to net zero (Graph 8). Ongoing strength in renewable energy investment in China, and efforts to increase its self-sufficiency in energy production could also affect China’s demand for imported fossil fuels including coal and gas – exports of liquified natural gas (LNG) and thermal coal to China made up 10 and 4 per cent of Australia’s total goods exports to China respectively in 2023 (Graph 9). Through their effect on commodity prices, these decisions directly affect the revenue and therefore the fiscal position of state and federal governments.

Chinese demographic trends, including the ageing of its population, may also create opportunities in other Australian export sectors, such as health care and pharmaceuticals, while a pivot towards more consumption in the Chinese economy could see a further boost to Australian services exports to China. China’s share of Australian services exports was also the highest among Australia’s trading partners at 13 per cent in 2023, driven mainly by exports of education-related services. Short-term visitor arrivals into Australia from China – which include tourists – have grown considerably in recent years, although they remain lower than before the pandemic. These could plausibly pick up further if policy in China supports growth in consumption, though Australia will be competing with other regions to supply consumption-related exports to China.

By contrast to the sizable trade links between the two economies, financial links, such as the level of foreign direct and portfolio investment from China into Australia, remain small (Graph 10). This is true of China’s direct financial links with the world more generally and at least partly reflects the use of capital controls and a managed exchange rate regime. It is also possible that shocks originating in China could transmit to Australia indirectly – for example, by affecting global sentiment, which may transmit to Australian asset prices (RBA 2023). Prices of other global commodities such as oil could also be impacted, which could feed through to headline inflation in Australia via fuel prices.

The Australian economy also benefits from the fact that the Australian dollar has historically played an important role as a shock absorber for the Australian economy in response to developments in China. Australia’s flexible exchange rate regime contributes to macroeconomic stability by cushioning the Australian economy from shocks and allows Australian monetary policy to be focused on targeting domestic economic conditions. For example, during the mining boom, strong global demand for Australia’s resources saw the terms of trade rise sharply and the exchange rate appreciate significantly. The appreciation of the Australian dollar was an important factor helping to dissipate inflationary pressures stemming from the additional demand.

Conclusion

The Chinese economy faces several structural and cyclical challenges, including an ageing population, a slowdown in the real estate sector, unsustainable local government debt burdens, and increasing trade frictions globally. In assessing economic policy choices to meet these challenges, Chinese authorities will make trade-offs against a range of economic and social/political priorities.

The policy choices taken will affect the Australian economy primarily through our trade linkages with China. As has been the case historically, Australia will benefit to a greater extent if any further economic stimulus is directed towards more steel-intensive paths, such as infrastructure and investment, than if it is directed towards boosting consumption, although the latter could benefit Australia’s services exports. Decisions Chinese authorities make on how to manage the green transition will also create challenges and opportunities for the Australian economy.

Endnotes

The authors are from Economic Analysis Department, RBA’s China Office, and International Department. The authors are grateful for feedback provided by Patrick Hendy, Morgan Spearritt, Ben Beckers and Jarkko Jaaskela on this article, to John Boulter for his earlier insights on these topics and to Warren Lam and Cameron McLoughlin for producing some of the charts used in this article. [*]

The People’s Bank of China does not have an explicit inflation-targeting mandate and does not have operational independence since it operates under the leadership of the State Council. [1]

See Lim and Cowling (2016) for more details on the economic implications of China’s demographic trends. [2]

China’s hukou system splits the population into either urban or rural residents. The level of social services provided differs depending on whether an individual holds a rural or urban hukou. Social service provision also tends to favour those who hold a hukou of the province they reside in over migrants who hold a hukou from another province. This acts to restrict population movement between provinces. [3]

LGFVs are state-owned investment companies established by China’s local governments. See Hendy, Ryan and Taylor (2024) for more information. [4]

Baird (2024) estimates the direct contribution to Chinese growth from the sector peaked at 17 per cent in 2013, but had fallen to 11 per cent in 2022. Kemp, Suthakar and Williams (2020) estimated the combined direct and indirect contribution at 18 per cent in 2020, down from a peak of 20 per cent in 2016. [5]

See Chari, Henry and Reyes (2021) for a review of the evidence on the relationship between trade and economic growth. [6]

References

Baird A (2024), ‘Urban Residential Construction and Steel Demand in China’, RBA Bulletin, April.

Cai F (2021), ‘A Tale of Two Sides: How Population Ageing Hinders Economic Growth in China’, China: An International Journal, 19(3), pp 79–90.

Chari A, PB Henry and H Reyes (2021) ‘The Baker Hypothesis: Stabilization, Structural Reforms, and Economic Growth’, Journal of Economic Perspectives, 35(3), 83–108.

Guttman R, K Hickie, P Rickards and I Roberts (2019), ‘Spillovers to Australia from the Chinese Economy’, RBA Bulletin, June.

Hendy P (2022), ‘Evolving Financial Sector Stress in China’s Property Development Sector’, RBA Bulletin, September.

Hendy P, E Ryan and G Taylor (2024), ‘The ABCs of LGFVs: China Local Government Financing Vehicles’, RBA Bulletin, October.

ILO (International Labour Organisation) (2023), ‘World Social Protection Data Dashboards’, available at <https://www.social-protection.org/gimi/WSPDB.action?id=55>.

Jones B and J Bowman (2019), ‘China’s Evolving Monetary Policy Framework in International Context,’ RBA Research Discussion Paper No 2019-11, December.

Kemp J, A Suthakar and T Williams (2020), ‘China’s Residential Property Sector’, RBA Bulletin, June.

Kent C (2013), ‘Reflections on China and Mining Investment in Australia’, Speech to the Committee for Economic Development of Australia, 15 February.

Lardy N (2019), The State Strikes Back: The End of Economic Reform in China?, Peterson Institute for International Economics, Washington, D.C.

Lim J and A Cowling (2016), ‘China’s Demographic Outlook’, RBA Bulletin, June.

NDRC (National Development and Reform Commission) (2022a), ‘Chapter 2: Guiding Principles’, The 14th Five Year Plan, 10 March, available at <https://en.ndrc.gov.cn/policies/202203/P020220315511368523883.pdf>.

NDRC (2022b), ‘The Outline of the 14th Five-Year Plan for Economic and Social Development and Long-range Objectives Through the Year 2035 of the People’s Republic of China’, 10 March, available at <https://en.ndrc.gov.cn/policies/202203/P020220315511326748336.pdf>.

NDRC (2022c), ‘Chapter 13: Promoting Dual Circulation’, The 14th Five Year Plan, 10 March, available at <https://en.ndrc.gov.cn/policies/202207/P020220706584756046412.pdf>.

Pan G (2024), ‘Strike the Right Balance and Pursue High-quality Development of the Chinese Economy’, Speech at the Annual Conference of the Financial Street Forum, Beijing, 18 October 2024.

RBA (Reserve Bank of Australia) (2021), ‘Box A: Stress in the Chinese Property Development Sector’, Statement on Monetary Policy, November.

RBA (2023), ‘5.1 Focus Topic: Vulnerabilities in China’s Financial System’, Financial Stability Review, October.

Roberts I and B Russell (2019), ‘Long-term Growth in China’, RBA Bulletin, December.

World Bank (2022), ‘Four Decades of Poverty Reduction in China – Drivers, Insights for the World, and the Way Ahead’, Report.

Xinhua (2022), ‘Li Keqiang Presided Over the Executive Meeting of the State Council’, Xinhua, 4 January, available at <http://www.news.cn/politics/2023-01/04/c_1129256593.htm>.

Zhou Z, C Hong, Q Lu, X Liu and Z Li (2024), ‘Building a Unified and Inclusive Labor Market’, in CICC Research and CICC Global Institute, Building an Olive-Shaped Society: Economic Growth, Income Distribution and Public Polices in China, Springer, pp 27–48.