Topic: Australian Economy

Technology Investment and AI: What Are Firms Telling Us?

Information technology investment by Australian firms has grown strongly over the past decade. A key question is how these technologies are shaping and may continue to shape the Australian economy in the future. We surveyed more than 100 medium–large firms from a range of industries in the RBA liaison program to understand how technology investments are affecting their operations, including their labour productivity and hiring decisions. The results suggest that surveyed firms anticipate these investments, particularly in artificial intelligence tools, to be labour-saving and productivity-enhancing over the long term. Firms also expect to see a substantial transformation of the types of roles and skills needed in the future. Importantly, evidence suggests that the labour-creating effects of past technologies have generally outweighed the labour-replacing effects in aggregate. Firms highlighted that there is considerable uncertainty around the extent and timing of these effects and emphasised that the main barriers to enhancing their productivity over recent years have been the regulatory environment and the ability to access suitable labour.

Building Interest in Economics: The Role of Early Exposure

The RBA’s 2024 student survey finds that students across New South Wales continued to view the field of economics as relevant and beneficial to society; however, perceptions of the study of Economics in Years 11 and 12 remained less favourable. New insights from the 2024 survey highlight the role of early exposure to Economics through the Years 7–10 Commerce elective, particularly following the introduction of a core economics topic into the 2019 Commerce syllabus. This early engagement is associated with greater student interest, confidence and understanding of Economics. Notably, the largest improvements were observed for students from lower socio-economic backgrounds, who are under-represented in Economics. These findings suggest that an increased focus on efforts to give more Years 7–10 students the opportunity to engage with Economics could help to broaden participation and improve perceptions of the subject among a more diverse cohort of Years 11–12 students.

The Global Energy Transition and Critical Minerals

Australia is a key producer of some of the critical minerals that are likely to play an important role in the energy transition away from fossil fuels. Global demand for these minerals could grow significantly over the long term if the transition towards lower emissions progresses. This would support growth in the Australian production of these minerals, potentially increasing their relative importance to the domestic economy. However, this outlook is uncertain and depends on a range of factors such as the speed of the global energy transition, the relative take-up of different technologies and potential development of new technologies, global prices and the competitiveness of domestic production. In the near term, based on projects currently underway and announced, growth in production is likely to remain subdued, though new policy announcements may provide support for investment.

A New Measure of Job Searchers for Australia

The RBA’s assessment of spare capacity in the labour market incorporates the signal from a broad suite of indicators. The ratio of job vacancies to unemployed persons, which attempts to assess the imbalance between unmet labour demand and the labour supply available to meet this demand, is a standard measure of spare capacity in the labour market. One shortcoming of this measure is that it implicitly assumes that job vacancies are only filled by the unemployed. In practice, job vacancies are also filled by other job searchers who may be outside the labour force or searching on the job. This article describes the construction and characteristics of a more comprehensive measure of job searchers (the Searchers Index) that considers both the unemployed and those who are not classified as being unemployed. The Searchers Index allows us to construct an alternative measure of spare capacity (the vacancies-to-searchers ratio), which exhibits different properties to the vacancies-to-unemployed ratio. The vacancies-to-searchers ratio will be included in the suite of indicators that we monitor to assess spare capacity in the labour market moving forward.

How Do Changes in Global Shipping Costs Affect Australian Inflation?

Australia’s experience during the COVID-19 pandemic showed that developments in international shipping can have a significant effect on domestic inflation. This is because higher global shipping costs can flow through the supply chain for imports and increase costs for Australian firms, who can in turn pass on those higher costs to consumers. This article addresses the question of when and how unexpected changes in global shipping costs have tended to pass through to Australian consumer price inflation since 2003. It finds that the pass-through to ‘shippable’ goods inflation can be material, and that shocks to global shipping costs were large enough to have contributed materially to trimmed mean inflation during the pandemic. That said, there is substantial uncertainty around the estimated pass-throughs, particularly because excluding the pandemic period leads to much smaller and less precise estimates of the pass-through to trimmed mean inflation.

International Students and the Australian Economy

International students play a significant role in the Australian economy. They contribute to demand through their spending on goods and services and are an important source of labour for some Australian businesses. This article shows that international students tend to add more to demand in the economy than they do to supply in the short run, in large part reflecting their spending on tertiary education fees. In periods of large swings in international student numbers or when the economy has little spare capacity, this means that changing international student numbers can affect macroeconomic outcomes, particularly in sectors of the economy where supply cannot respond quickly. The rapid growth in international student numbers post-pandemic likely contributed to high inflation over this period, but was not a major driver.

A (Closer to) Real Time Labour Quality Index

One explanation that has been put forward for weakness in productivity growth over the past few years is the entry of less experienced or less educated workers to the strong labour market. However, existing labour ‘quality’ statistics that capture such dynamics use delayed information and so can be hard to interpret in real time. To address this problem, we used microdata sources to construct a timely version of the existing labour quality statistics. In doing so, we found evidence that labour quality has actually increased strongly since the COVID-19 pandemic and supported growth in market sector productivity over recent years. While initial work suggests that standard approaches may miss some relevant dimensions of human capital, such as time outside employment, these do not appear substantive enough to overturn the main findings.

Bank Funding in 2024

Bank funding costs are important in the transmission of monetary policy as they are a key determinant of the rates that households and businesses pay on loans. Bank funding costs increased only modestly in 2024, largely because the cash rate remained unchanged. The composition of banks’ funding shifted towards deposits over the same period, continuing a trend seen since the global financial crisis. Banks also managed the final maturities of the Term Funding Facility, issuing wholesale debt into favourable funding conditions. This article updates previous research published by the RBA on developments in the composition and costs of banks’ funding.

Monetary Policy Transmission through the Lens of the RBA’s Models

Understanding how changes in the cash rate affect economic activity and inflation – so-called monetary policy transmission – is important for the RBA in pursuing its objectives of price stability and full employment. This article explains how the RBA uses its core models of the Australian economy to estimate the overall effects of policy, explore the different channels through which monetary policy transmits, and consider the economic outlook under alternative paths for monetary policy. The findings highlight that: the peak effect of policy is likely to occur after around one to two years; the exchange rate acts as an important transmission channel for policy; housing is a sensitive part of economic activity; and although individual households’ cashflow can be sensitive to changes in the cash rate, in aggregate it plays a smaller role in transmission.

How Useful are ‘Leading’ Labour Market Indicators at Forecasting the Unemployment Rate?

The RBA draws on a wide range of information to form our assessment of current labour market conditions and our outlook for the labour market. One of the key labour market indicators that the RBA monitors and forecasts is the unemployment rate. This article considers whether information contained in indicators that are typically viewed as signalling a change in conditions before it becomes apparent in the official labour market statistics – referred to here as ‘leading indicators’ – are helpful in forecasting the unemployment rate. It finds that information contained in measures of unmet demand, such as job advertisements and vacancies, and consumers’ expectations for unemployment are useful in informing the RBA’s near-term forecasts for the unemployment rate. Models containing these leading indicators can complement our existing framework for forecasting the unemployment rate, which also considers information such as developments in economic activity, insights from firms in the RBA’s liaison program and the experience of economies overseas.

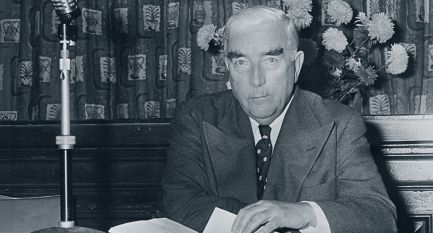

Robert Menzies and the Creation of the Reserve Bank

The Reserve Bank of Australia was created in 1959 by separating the commercial and central banking functions of the original Commonwealth Bank of Australia. An attempt in 1930 to establish a separate central bank in Australia failed when the enabling legislation was blocked in the Senate, but pressure by the private banks in the 1950s led to a renewed attempt to establish one. This attempt was opposed by then Governor of the Commonwealth Bank, Dr HC Coombs, who argued that the Bank’s commercial banking activities strengthened its central bank functions. At first, the Prime Minister, Robert Menzies, supported Coombs, but he changed his mind as political pressure for separation grew. Legislation to create a separate central bank was unsuccessful in 1957 and again in 1958 because the government lacked a majority in the Senate, but was passed in April 1959 following the general election in November 1958 in which the government won a majority in both houses of Parliament. This article discusses the events leading to the creation of the Reserve Bank as a stand-alone central bank and concludes that Menzies’ political acumen and role in the decision to support separation were crucial.

Australia’s Sovereign ‘Green’ Labelled Debt

A significant amount of investment is required to transition to lower emissions in Australia, and financial markets are evolving to facilitate this. The inaugural Green Treasury Bond issued by the Australian Office of Financial Management in June 2024 marked a milestone in the Australian Government’s Sustainable Finance Strategy. This article reviews pricing of Australian sovereign and semi-sovereign labelled debt. There is some evidence of a decline in the historically positive price differential – the ‘greenium’ – between labelled and conventional bonds domestically. The evolution of this greenium has likely been influenced by the low initial supply of labelled bonds in Australia relative to demand but heterogeneity in these products and the relatively small sample size of labelled bonds complicates the identification of the greenium.

An Update on the Household Cash-flow Channel of Monetary Policy

The household cash-flow channel refers to the effect that changes in the cash rate have on households’ debt repayments and interest income, and the subsequent effect that these changes in available cash flow have on households’ spending decisions. This article presents updated evidence on the strength of this channel. In aggregate, the effect of a cash rate change on household disposable income is currently around its pre-pandemic average, after declining temporarily over the pandemic period due primarily to an increase in the share of fixed-rate mortgages. The effect of a cash rate change on aggregate household spending via the cash-flow channel also declined during the pandemic period but is estimated to have returned to around its pre-pandemic level.

Where Have All the Economics Students Gone?

The size and diversity of the economics student population has declined sharply since the early 1990s, raising concerns about economic literacy in society and the long-term health of the economics discipline. Interest in studying economics at university is low, even for those who studied economics in Year 12. This article investigates what students are choosing to study at university – if not economics – using new microdata from the Universities Admissions Centre. While Year 12 economics students tend to enrol in economics at university at much higher rates than other students, they are more likely to study a commerce and finance or arts and social science course than an economics course. Possible initiatives to increase the flow of high school students into university economics include tailored advocacy to emphasise the connections between economics and other preferred fields of study, and a greater focus on encouraging students to study economics subjects within a commerce and finance degree. It may also be worth exploring whether any lessons can be applied from initiatives to promote the take-up of STEM (Science, Technology, Engineering, Mathematics) courses, given the relative rise in enrolments in those subjects over recent years.

Developments in Wages Growth Across Pay-setting Methods

The dynamics of wages growth can differ across pay-setting methods. Understanding these differences is relevant for forecasting wages growth, and for assessing labour market conditions and inflationary pressures. Across each pay-setting method, wages growth picked up following the COVID-19 pandemic, but appears to have peaked. Wages growth is expected to continue to slow as the labour market eases, but the rate of easing is expected to vary across each method. This article explains recent developments in wages growth across pay-setting methods and the RBA’s disaggregated approach to forecasting wages growth, which includes considering the Fair Work Commission’s annual reviews of the minimum wages in modern awards.

Do Housing Investors Pass-through Changes in their Interest Costs to Rents?

Interest rates and rents often move together. Some have argued that this positive relationship is evidence that higher interest rates have been a key driver of increases in rents over the past few years, due to leveraged housing investors passing through increases in their interest costs to their tenants. This article uses anonymised tax return data covering 2006/07–2018/19 to estimate the direct pass-through of interest cost changes to housing investors’ rental income. It finds small pass-through on average, even when interest rates are rising. The largest estimate suggests that direct pass-through results in rents increasing by $25 per month when interest payments increase by $850 per month (the median monthly increase in interest payments for leveraged investors between April 2022 and January 2024). Overall, the results are consistent with the view that the level of housing demand relative to the housing stock is the key driver of rents.

Skills Match Quality Following the COVID-19 Pandemic

The strength in labour market conditions after the COVID-19 pandemic caused many individuals to either enter the labour market or to change jobs. These labour dynamics may have an influence on both recent and longer term productivity outcomes by affecting how well workers’ skills are matched to their new jobs. We use self-reported measures from the Household, Income and Labour Dynamics in Australia Survey to examine whether workers are better or less well matched to their jobs following the pandemic, and whether these skills matches may change in the future. Overall, based on the data, we find there is little evidence that the recent increase in labour mobility affected how well workers are matched to their jobs up until 2022, which suggests that this is not a key driver of recent slow productivity growth.

Assessing Potential Output and the Output Gap in Australia

The output gap – the difference between actual output and potential output – is an important consideration for monetary policy as it is a measure of the extent of spare capacity in the economy. This article explains how RBA staff form an assessment of potential output and the output gap. We draw on a range of model-based estimates, capacity utilisation indicators and activity measures. Model-based estimates give a quantitative assessment of the level of spare capacity in the economy, but there is considerable uncertainty modelling unobserved concepts like potential output and the output gap. Ultimately, assessing spare capacity in the economy requires careful judgement in weighing up all available information, which the RBA sets out in its quarterly Statement on Monetary Policy.

The Private Equity Market in Australia

The Australian private equity market has grown significantly for a number of years, particularly as the economy recovered from pandemic-related disruptions. Consistent with this growth, private equity deals involving Australian companies have increased in value, and private equity funds have raised larger amounts of capital from investors. Recently, however, private equity activity has declined substantially as borrowing costs increased. Over recent years, international private equity firms and investors have also increased their presence in the Australian market. This article discusses these developments in the Australian private equity market and considers the implications that a robust private equity market may have on Australian businesses and public capital markets.

Bank Funding and the Recent Tightening of Monetary Policy

Banks’ funding costs have risen substantially since early 2022, driven by increases in the cash rate. This article explains how increases in the cash rate passed through to banks’ funding sources and how banks adjusted their funding mix. All non-equity sources of bank funding became more expensive over the hiking phase. Banks increased rates on term deposits by more than at-call deposits. Within at-call deposits, banks increased rates most for those savings accounts with conditions attached. Further, banks’ share of funding from term deposits grew and banks issued more debt as the Term Funding Facility started to mature.

Cash Rate Pass-through to Outstanding Mortgage Rates

The interest rate paid by outstanding mortgage borrowers increased by around 320 basis points between May 2022 and December 2023, around 105 basis points less than the cumulative increase in the cash rate over this period. This pass-through from cash rate increases to the average outstanding mortgage rate has been slower than in recent tightening episodes due to a high share of outstanding fixed-rate loans and the effects of heightened mortgage lending competition. The average outstanding mortgage rate will increase further as the remaining share of low-rate fixed-rate loans expire and reprice at higher interest rates. By the end of 2024, overall pass-through is expected to be comparable to earlier tightening episodes.

Assessing Full Employment in Australia

Full employment is a longstanding objective of monetary policy in Australia, alongside price stability. The Reserve Bank Board aims to achieve the maximum level of employment consistent with low and stable inflation in the medium term. This article explains how RBA staff form an assessment of how labour market conditions stand relative to full employment. RBA staff draw on a range of labour market indicators, model-based estimates and outcomes for wages growth and inflation. Any single indicator tends to provide a partial view of the labour market and the level of each indicator that is consistent with full employment can change over time as the structure of the economy evolves. Ultimately, assessing how close the labour market is to full employment requires careful judgement, which the RBA sets out in its quarterly Statement on Monetary.

Understanding the Post-Pandemic Demand for Australia’s Banknotes

Banknotes can be used to make legitimate payments, but they can also be hoarded, lost or used to facilitate transactions in the shadow economy. Understanding how banknotes are used can assist policymakers in responding to changes in payment behaviour and demand for cash. This article examines the value of banknotes used for each component of cash demand and how it has changed since the COVID-19 pandemic. The share of banknotes used for transactional purposes is estimated to have fallen by 5 percentage points since early 2020, while cash use in the shadow economy has increased slightly and the proportion of banknotes that are lost has remained unchanged. Overall, the majority of banknotes on issue are currently used for non-transactional purposes, consistent with pre-pandemic trends.

Inflation Expectations and Economic Literacy

The level of community awareness and understanding of basic economic issues can influence a central bank’s ability to achieve its goals, such as by anchoring the public’s inflation expectations in line with its inflation target. This article draws on novel data from a large-scale survey of Australian adults about their knowledge of the Reserve Bank’s inflation target and their expectations for inflation over the short and medium term. Responses to these questions varied significantly according to the socio-demographic characteristics of the survey respondents and their level of economic literacy. The results of this study point to the need for clear communication about the Bank’s inflation objectives that caters for variations in awareness and understanding of economic issues across different socio-demographic groups.

What Do Firms Tell Us About the Inflation Outlook?

The Reserve Bank’s liaison program collects information from firms in Australia about current economic conditions and their expectations for future conditions, including their own prices. Firms’ observations provide a timely read on inflation. Over the past six months, firms have generally expected their prices growth to continue to moderate, but on average to remain above the Bank’s inflation target range of 2–3 per cent. Firms have reported that large cost increases over recent years are still flowing through to some parts of the supply chain and have indicated that this is the primary driver of their decisions to increase prices at a faster-than-normal rate. Slower growth in demand and increased competition are expected to result in a further slowing in growth of firms’ prices over coming quarters.

New Timely Indicators of Wages Growth

Monitoring developments in wages is important for assessing the inflation outlook, as labour costs are a major factor in firms’ pricing decisions. Over recent years, the Reserve Bank has developed a suite of timely wages indicators based on surveys and administrative data. Together with externally developed indicators, these measures provide a fuller view on wages developments ahead of the release of official statistics. This article explains the methodology behind these indicators and what they reveal about labour costs in Australia.

Economic Literacy in Australia: A First Look

Those who are economically literate make more informed economic choices, better understand the world around them and can influence public discourse and the actions of government. Given the importance of economic literacy for individuals and society at large, the Bank commissioned a large-scale survey of Australian adults testing their understanding of some core macroeconomic topics. The results enabled compilation of simple literacy scores that represent the Bank's first attempt to gauge economic literacy in Australia. Being male, older, of higher income, having a degree, and having studied or being engaged with economics are associated with higher scores. By contrast, persons aged 18–24 years, unemployed persons and those without a degree had the lowest scores. Questions that tested abstract macroeconomic concepts appeared more difficult than those about more relatable issues that draw on lived experience. These findings speak to the importance of simple and targeted communication by the Bank and other policymakers to support the understanding of economic concepts across the community.

Adoption of General-purpose Technologies (GPT) in Australia: The Role of Skills

General-purpose technologies (GPT) have the potential to transform how we work, to change the skills we need and to drive productivity growth. It is therefore important to understand the conditions that lead to the successful adoption of GPT. Using a novel database on the adoption of cloud computing and artificial intelligence/machine learning by Australian-listed firms, this article finds that the COVID-19 pandemic led to a short-lived surge in adoption of cloud computing technologies. In addition, there is evidence that profitable adoption is more likely to occur in firms where the Board has members with relevant technological backgrounds, and that firms adopting GPT are more likely to seek staff with related skills. These findings highlight the importance of workers’ and managers’ skills in technology adoption, and the impact this can have on productivity growth.

Recent Trends in Australian Productivity

Productivity growth enables rising living standards and is needed for real wages growth to be consistent with stable inflation over the medium term. Prior to the COVID-19 pandemic, productivity growth in Australia and other advanced economies had been low, because business dynamism, job mobility, global trade and policy reform all slowed. Over the past few years, the pandemic and other shocks distorted productivity outcomes. Even if these shorter term fluctuations wash out, the longer term (and apparently structural) weakness in productivity growth could persist. This would have implications for the rate of nominal wages growth that is consistent with inflation returning to the target band. This article discusses the trends in Australia’s productivity growth before, during and since the pandemic and the implications for the economic outlook.

New Insights into the Rental Market

This article draws out new insights into the private Australian rental market using a new large administrative dataset of rental properties, which is an input to the Consumer Price Index (CPI). CPI rent inflation has picked up recently. Since 2021, rents have increased across inner-city and regional areas throughout all the states. Rent increases have also become more common and larger on average – particularly for the 2–3 per cent of properties each month that have a change in tenants. This is in contrast with the experience during the COVID-19 pandemic where rents fell in many suburbs close to central business districts but increased in regional areas, driven by a preference shift among many households for more space and net population flows.

Estimating the Relative Contributions of Supply and Demand Drivers to Inflation in Australia

Inflation has increased substantially since mid-2021. Understanding the relative contributions of supply and demand factors is important for determining the appropriate monetary policy response; a central bank may at least partly ‘look through’ the price effects of a supply shock if it is expected to be short lived and inflation expectations remain anchored. This article attempts to disentangle and explore the contributions of supply and demand factors to the recent inflationary episode, using three approaches. Similar to the experience of other advanced economies, our estimates suggest that supply-side factors have been the biggest driver of recent inflation outcomes in Australia. These supply-side factors have been persistent, with their contribution to inflation growing over 2022, leading to an extended period of inflation being above target and concerns that inflation expectations could become de-anchored. That said, demand has also played an important role.

Recent Developments in the Cash Market

Following the implementation of unconventional monetary policy measures during the COVID-19 pandemic, liquidity in the banking system rose significantly. This led to a fall in cash market activity and a decline in the cash rate to below the cash rate target. Despite the high level of liquidity – as measured by Exchange Settlement (ES) balances – some banks have continued to borrow in the cash market. Over the past year or so, this borrowing has picked up somewhat and the cash rate has risen modestly to be slightly closer to the target, largely owing to an increase in the concentration of ES balances. As the Reserve Bank’s unconventional policy measures unwind and ES balances decline, activity in the cash market is likely to increase further. The extent of any future pick-up in activity, and the level of the cash rate relative to the target, will be influenced by the distribution of ES balances across banks.

Renters, Rent Inflation and Renter Stress

Around one-third of all Australian households rent. Renter households tend to be younger, have lower incomes and less wealth than owner-occupiers. Renter households are also more likely than mortgagors to experience financial stress, although the incidence of financial stress among renter households has declined over the past decade. The rental market is tight and rents have increased more strongly of late, compared with the modest increases in average rents over the 2010s. For some renters, strong growth in incomes will have helped limit the deterioration in housing affordability, although there will be others who will struggle to afford the rent increases. This suggests that affordability will have worsened for some renters, and, in combination with other rising cost-of-living pressures, this is likely to be contributing to financial stress.

A New Measure of Average Household Size

This article introduces a new, timely measure of average household size (AHS) – a key determinant of underlying demand for housing – using the data from the ABS monthly Labour Force Survey. The average number of people living in each household has declined from around 2.9 in the mid-1980s to around 2.5 since the early 2000s. More recently, the AHS declined to historical lows of a little below 2.5 people per household. This was driven by changes in Sydney and Melbourne during the pandemic, which were more exposed to health restrictions, lockdowns and changes in migration flows from overseas.

Can Wage-setting Mechanisms Affect Labour Market Reallocation and Productivity?

Productivity growth has slowed in Australia and overseas in recent decades, with negative implications for wages and incomes. In Australia, at least part of this slowdown reflects the fact that more productive firms have grown and attracted workers more slowly than in the past. This article considers whether the increased use of industry-wide wage agreements could help to explain this slowdown. It finds that in sectors with greater use of industry-wide agreements, the relationship between firm-level wages and productivity tends to be weaker. This weaker relationship between productivity and wages seems to feed through to firm growth, with more productive firms seemingly less likely to attract staff and grow. While many factors can affect the choice of wage-setting mechanism, these results suggest that aggregate productivity growth and living standards could be stronger when firms are incentivised and able to compete for workers.

HC Coombs: Governor of Australia's Central Bank 1949–1968

Dr HC Coombs was Governor of Australia’s central bank for nearly 20 years. His appointment followed significant roles in Australia’s war-time administration and post-war reconstruction, where he was an architect of Australia’s international full employment policy, known as the ‘Positive Approach’. When appointed Governor of the central bank in 1949, Coombs remained committed to the pursuit of full employment. Influenced by Keynes, he sought to maintain aggregate demand and supply in ‘reasonable balance’, something the Reserve Bank continues to do today. After retiring from the Bank in 1968, Coombs continued to promote the arts in Australia and the rights and welfare of First Nations Australians. He became a senior adviser to the Whitlam Government and chaired the Royal Commission on Australian Government Administration – a fitting conclusion for someone often described as the nation’s greatest public servant. This article considers the life and career of HC Coombs, and complements the series of records that have been released on Unreserved.

Economic Literacy: What Is It and Why Is It Important?

One of the core objectives of the Reserve Bank’s public education program is to improve economic literacy. While the social benefits of economic literacy are well established, defining what is meant by this term is not straightforward and has been the subject of debate over many decades. This article explores the meaning of ‘economic literacy’. To arrive at a working definition, it discusses the economic principles that should be understood for someone to be considered economically literate, along with the topics they should be familiar with and the ways of thinking that we would expect them to display. In doing so, it distinguishes between economic and financial literacy. The article concludes by posing questions for future research on how economic literacy in Australia might be measured and how it might be supported.

The Recovery in the Australian Tourism Industry

The Australian tourism industry is gradually recovering from the COVID-19 pandemic that brought global travel to an unprecedented standstill. International tourism fell sharply in early 2020 and has only slowly recovered since restrictions were lifted in the first half of this year. By contrast, domestic tourism spending bounced back quickly as local restrictions eased and is now above pre-pandemic levels. This article outlines the recovery in the Australian tourism industry following the pandemic, the challenges the industry has faced in reopening, and the uncertainties around the outlook for the tourism industry over the next few years.

The Reserve Bank's Liaison Program Turns 21

In 2001, the Reserve Bank established its liaison program – a formal program of economic intelligence gathering, through which Bank staff meet frequently with firms, industry bodies, government agencies and community organisations. The program is systematic in its approach to collecting and assessing information, and the intelligence obtained is a useful complement to published sources of data and economic models in informing the Bank's assessment of economic conditions. In addition, the information gathered is available in near real time, making it useful for ‘nowcasting’ and understanding the implications of short-term shocks to the economy. This article looks at the process of liaison, the nature of the information collected and how it has been used over its 21 years of operation.

Sentiment, Uncertainty and Households' Inflation Expectations

High inflation expectations can have significant consequences for the economy as a whole, and can become self-reinforcing. It is therefore noteworthy that inflation expectations of Australian households are persistently higher than actual inflation. This is partly because when consumers are more uncertain about the economy, they tend to report their inflation expectations in round multiples of 5 per cent, which is higher than inflation has averaged over recent decades. In addition, there is a negative relationship between consumer sentiment and inflation expectations. This article examines the relationship between sentiment, uncertainty and households' inflation expectations in Australia, and considers how this uncertainty might be addressed. It suggests that targeted and clear communication about inflation can help to reduce uncertainty and provide consumers with a better understanding of the path of future inflation.

Job Mobility in Australia during the COVID-19 Pandemic

The COVID-19 pandemic has led to large disruptions to the Australian labour market. Initially, workers were less likely to change jobs because of the uncertain economic environment, the decrease in advertised jobs and the JobKeeper program that helped workers remain attached to their employers. More recently, job mobility has increased as workers have caught up on planned job changes or been encouraged by the strong labour market to change jobs, particularly in high-skilled roles experiencing strong labour demand. This article reviews developments in job mobility in Australia through the pandemic, and compares these outcomes to other advanced economies. It also examines the potential implications for wages; a high rate of job mobility tends to be associated with higher wages growth in a tight labour market, as employers in sectors with high demand for labour compete for new staff or raise wages to retain staff.

First Nations Businesses: Progress, Challenges and Opportunities

Australia's First Nations business sector is growing at a pace of around 4 per cent per year, fuelled by growing demand. However, many budding First Nations entrepreneurs still face substantial barriers to establishing a successful business. This article discusses the need to develop trust for effective policy environments that support First Nations businesses, and describes how ongoing challenges of access to financial, social and symbolic capital continue to test First Nations business owners. Despite this, there are opportunities for First Nations businesses in the forms of Indigenous preferential procurement policies, and First Nations-specific business development programs as well as financial products and services. It is not yet clear how effective the policy environment is in addressing access and discrimination challenges, nor how widespread the benefits are to First Nations businesses. As such, the article concludes by discussing the role of data development for accountability.

Exploring the ‘Confidence Gap’

Previous Reserve Bank research has shown that female students and students from less advantaged backgrounds are more likely to report having a poor understanding of economics and lower confidence in their economics proficiency than other students. This is consistent with their falling participation in the subject. Using data from a survey administered by the Bank, this article investigates whether these negative perceptions are in line with students' observed proficiency or whether there is a ‘confidence gap’. It finds that females continue to report having poorer understanding and less confidence even after accounting for their observed proficiency, indicating a confidence gap. By contrast, students' self-perceptions by socio-economic status look to be in line with variations in their observed proficiency. These findings have implications for the design of interventions to encourage greater participation by these students and support increased diversity amongst the economics student body.

Tracking Consumption during the COVID-19 Pandemic

The COVID-19 pandemic was an unprecedented shock to the economy that caused large and unexpected changes in household spending behaviour. Restrictions on household activity limited opportunities to consume services and people switched to purchasing more goods. The recovery in consumption was much stronger than expected earlier in the pandemic because households quickly adapted to the pandemic shock with the support of significant fiscal and monetary policy measures. This article examines household spending during the pandemic using a range of sources of information that have enabled the Reserve Bank of Australia to track consumption in a timely way.

COVID-19 Health Risks and Labour Supply

There is evidence that concerns about becoming infected with COVID-19 at work have affected people's willingness to participate in the labour force in some countries. This article examines whether similar health concerns have contributed to a reduction in labour supply in Australia. It finds no evidence that these concerns had a discernible effect on labour supply during the COVID-19 outbreaks in 2020 and 2021. In early 2022, however, the substantial escalation in cases of the Omicron variant led a small number of people to avoid the workplace, at least temporarily.

The Significant Shift in Australia's Balance of Payments

Over recent years Australia has seen a large shift in its external accounts. In contrast to long-running deficits, the current account balance has now been in surplus for over two years, supported by record trade surpluses. The corollary of this is that the level of national savings has surpassed investment and Australia has become a net exporter of capital. This article examines these changes and highlights some key trends that are associated with this shift. These include the decline of foreign direct investment following the end of the mining boom, as well as an increase in purchases of foreign equities by Australian superannuation and investment funds. These developments have contributed to a significant decline in Australia's net foreign liability position as a percentage of GDP, which is at its lowest levels in a number of decades.

Which Firms Drive Business Investment? New Evidence on the Firm-size Distribution

Business investment plays a key role in our current and future economic prosperity. Aggregate investment can be difficult to predict, however. This may be because different firms face different investment environments, and the factors behind their decisions can vary. This gives rise to the question: which types of firms are most important for driving aggregate outcomes? Detailed, firm-level data shows that large firms account for a significant share of investment in Australia, and are the major drivers of the patterns in aggregate non-mining investment. Understanding how firms of various sizes contribute to overall outcomes will help us to gauge the potential impact of any differences they might face, including via policies, on investment outcomes and the economy.

Why Are Investment Hurdle Rates So Sticky?

Firms commonly evaluate potential investment projects by comparing expected returns to a hurdle rate. Survey evidence suggests that hurdle rates have remained high and well above the weighted average cost of capital (WACC) in recent years, as has the ex post return on invested capital for Australian-listed companies. This stickiness is a marked contrast to the decline in interest rates. This article reviews the evidence for why hurdle rates are so far above the WACC, and why they have remained so sticky over time. Proposed reasons include the perception that returns available on potential projects are unrelated to the level of interest rates. In addition, firms may avoid reducing hurdle rates to minimise the risk of regret, and some business managers could view long-term declines in interest rates as temporary.

Do RBA School Talks Improve Student Outcomes?

As part of our education program, the Reserve Bank of Australia (RBA) conducts school talks to promote economic literacy and encourage a larger and more diverse group of students to study economics. To formally evaluate this aspect of our education program, we surveyed students before and after school talks in a randomised control trial and the results were assessed relative to a control group. We found that RBA school talks improve both perceived and actual understanding of key economic concepts and increase the confidence of students, including those who are less socially advantaged. Importantly, smaller talks conducted online were perceived to be just as useful as those conducted in person, which suggests that the geographic reach of the school talks program could potentially be expanded considerably without sacrificing quality or student outcomes.

The Central Bank's First Economist

In 1930, when officials from the Bank of England came to Australia to assist Australian governments with their budgetary problems, they found that the original Commonwealth Bank, then Australia's central bank, did not have an economist on its staff. They urged the Bank's Governor to appoint a qualified economist and recommended Leslie Melville, Professor of Economics at the University of Adelaide. Melville joined the Bank in March 1931. Some two decades later, when he left to become Vice-Chancellor at the Australian National University, Dr HC Coombs wrote to him saying that he had ‘made a contribution to the theory and practice of central banking which is without equal in the world’. As Melville's 100th birthday approached in 2002, the Australian National University decided to hold a public lecture in his honour. Governor Ian Macfarlane was invited to give the inaugural lecture. He concluded that Melville was ‘one of the most distinguished Australians of the past century’. The 20th Melville Lecture will be given in early 2022 by the Treasury Secretary, Dr Steven Kennedy. Ahead of this event, the latest records to be released in the Bank's new digital archive, Unreserved, include Melville's papers in digitised form. This article traces Melville's life and career, and his significance as the Bank's first economist.

Climate Change Risks to Australian Banks

Climate change affects banks because of the impact it has on the value of assets used as collateral for loans and the incomes borrowers use to repay their loans. There is significant uncertainty about the magnitude of risks to banks from climate change. This is because of the uncertainty about how climate change will alter future weather patterns, how policies will change globally and how economies adapt. This article uses one approach to provide preliminary estimates of the possible scale of risks climate change poses to banks' housing and business exposures. This approach suggests that a small share of housing in regions most exposed to extreme weather could experience price falls that might subsequently result in credit losses, but the overall losses for the financial system are likely manageable. Banks are also exposed to transition risks from their lending to emissions-intensive industries, but their portfolios appear to be less emissions-intensive than the economy as a whole. Further estimates of the impact of climate change on banks will be provided by the Climate Vulnerability Assessment currently being undertaken by the Australian Prudential Regulation Authority and the five largest banks.

The Financial Cost of Job Loss in Australia

Workers who lose a job tend to experience large and persistent earnings losses. On average, real earnings are around one-third lower in the year of job loss, and it takes at least four years for an individual's annual earnings to recover. Earnings losses are particularly persistent following the loss of a long-term job. Workers who find new employment tend to work fewer hours at lower hourly rates of pay.

Underemployment in the Australian Labour Market

Underemployment in Australia has been moving higher for several decades. This article reviews the trends that have been driving this, including the long-run increase in part-time employment and changes in how the labour market adjusts to fluctuations in labour demand. The article also discusses the implications of the upwards trend in the underemployment rate for assessing spare capacity in the labour market. One implication is that the unemployment rate may need to decline by more than has previously been the case before wage pressures start building strongly.

The Transition from High School to University Economics

To promote economic literacy and ensure the long-term health of the economics discipline, it is important to address the sharp decline in the size and diversity of the economics student population. Administrative data from the University Admissions Centre (UAC) provides information about how students transition from high school to university economics. These pathways suggest that interventions to increase the number and diversity of students studying economics in Year 12 can strengthen the pipeline of students into university economics. Interventions to improve the economic literacy of Year 12 economics students who are less socially advantaged are important to encourage more diversity in university economics; in contrast, female students appear to need less academic support and may instead benefit more from tailored interventions that pique their interest in and confidence with economics. More advocacy of economics should also increase its uptake at university, particularly among students already studying economics and/or a STEM subject in Year 12 and higher performers.

Understanding the East Coast Gas Market

Wholesale gas prices on the east coast have become linked to LNG export prices since 2015. This is because local gas producers can now sell into international markets through the 3 Queensland LNG export terminals. Wholesale prices will continue to be influenced by LNG export prices as long as this option is available. Contracted prices apply to the bulk of east coast gas demand and production. Contracted gas prices are likely to remain structurally higher than their pre-2015 levels over coming decades, reflecting higher marginal costs of domestic production.

The Anatomy of a Banking Crisis: Household Depositors in the Australian Depressions

Looking into archival material can provide a new lens through which to view historical events. With the launch of Unreserved, the RBA has released archival records to the public, including longitudinal data on individual bank depositors that uncovers new facts about the behaviour of Australian households during the economic depressions of the 1890s and 1930s. Depositors responded to both depressions by withdrawing more money, consistent with households drawing down on their saving buffers in the face of rising unemployment and falling incomes. The net withdrawal rate of depositors also increased when deposit interest rates fell and when public confidence in the banking system deteriorated, with clear evidence of a run on a savings bank in the 1930s. In more normal times, most saving deposits were ‘sticky’ with transactions being very rare. This high degree of deposit stickiness appears to be because most people held these bank accounts to save for significant life events. While it is difficult to draw policy implications from the historical analysis, some features of the depositor behaviour are likely to hold true today.

From the Archives: The London Letters

The Reserve Bank has a rich and unique archives that captures almost 2 centuries of primary source material about Australia's economic, financial and social history. To enhance public access to these records, we have launched a digital platform, Unreserved. Unreserved enables users to browse information about our archival collection and directly access our digitised records. Unreserved will be regularly populated with new records as the digitisation of the Bank's archives progresses. The first release of records is a ‘sampler’ of the diversity of information in our archives. This article introduces Unreserved and highlights a particular series – the London Letters – which comprises the information exchanged between the Bank's head office and its London Office from 1912 to 1975. The London Letters provide insights into the development of Australia's central bank, along with its role and experiences during some of the most significant events of the 20th century.

Long-term Unemployment in Australia

Are your future employment prospects affected by past periods of unemployment? And does it matter how long you were unemployed? The average duration of unemployment has increased steadily over the 2010s. At the same time, the rate at which unemployed people are able to find a job has slowed. Long-term unemployed people are more likely to be older and male and have lower levels of formal education than those who have been unemployed for a shorter period. We use micro-level labour market data to show that future employment prospects are closely tied to the duration of unemployment: people who are unemployed for longer are less likely to find a job. We also find some evidence that an extended period of unemployment can harm people's employment chances for a long time afterwards.

The COVID-19 Outbreak and Australia's Education and Tourism Exports

International travel restrictions to contain the spread of COVID-19 and precautionary behaviour on the part of travellers have significantly disrupted the movement of people globally. Education and tourism were Australia's fourth and fifth largest exports prior to the pandemic, and exports of these services have fallen sharply. This article documents the effects of the virus on Australia's education and tourism exports and draws on information from the Reserve Bank's regional and industry liaison program to discuss the uncertainties around the medium-term outlook once international travel resumes.

Labour Market Persistence from Recessions

The COVID-19 pandemic has led to a rapid deterioration in labour market outcomes, some of which may be long-lasting. This article examines the long-lived effects of previous downturns on unemployment in Australia, including by assessing how regional labour market outcomes varied during and after the GFC and early 1990s recession. We find that recessions have enduring effects on unemployment rates: regions that experienced larger-than-average downturns had significantly higher unemployment rates for around a decade afterwards.

The Rental Market and COVID-19

The COVID-19 pandemic is an unprecedented shock to the rental housing market, reducing demand for rental properties at the same time as supply has increased. Households most affected by the economic impact are more likely to be renters, and border closures have reduced international arrivals. The number of vacant rental properties has increased as new dwellings have been completed and some landlords have offered short-term rentals on the long-term market, particularly in inner Sydney and Melbourne. Government policies have supported renters and landlords. Rents have declined, partly because of discounts on existing rental agreements and it is likely that rent growth in many areas will remain subdued over coming years.

The Economic Effects of Low Interest Rates and Unconventional Monetary Policy

The cash rate is currently at its effective lower bound and the Reserve Bank has put in place a suite of alternative monetary policy tools. This article uses the Bank’s macroeconometric model of the Australian economy, MARTIN, to analyse the implications of a constrained cash rate and illustrate how unconventional monetary policies can support the Australian economy. By lowering interest rates that are typically affected indirectly through changes in the cash rate, unconventional policies can stimulate economic activity through many of the same channels as conventional monetary policy.

Household Wealth prior to COVID-19: Evidence from the 2018 HILDA Survey

This article examines the distribution of wealth in Australia prior to the COVID-19 pandemic and considers the implications for the financial resilience of households during the associated economic downturn. In terms of their wealth, most Australian households appear well placed to withstand a temporary fall in income. However, younger households and those working in industries most affected by activity restrictions are likely to be more vulnerable to income loss; only around half of these households could cover three months of expenses out of their liquid assets. Highly indebted households that experience shocks to their income and have limited liquid assets will also find this period particularly challenging. Policies to support household income, as well as those aimed at rescheduling debt repayments, should cushion these effects. The resilience of households will also depend on the timing and sustainability of the economic recovery.

Quality Change and Inflation Measurement

Households’ perceptions of inflation can differ from inflation as measured by the Consumer Price Index (CPI). One factor that may contribute to this difference is that the CPI seeks to take into account changes in the quality of many items that households buy. Around 2–3 per cent of the CPI basket is adjusted for quality change each quarter, with the prices of consumer durables most affected. While a range of methods have been developed to help statisticians identify and quantify quality change, it remains a challenging area of price measurement.

Why Study (or Not Study) Economics? A Survey of High School Students

There has been a stark decline in the size and diversity of the Year 12 Economics student population since the early 1990s. The Reserve Bank has commissioned a comprehensive survey of students to gain quantitative evidence of the factors contributing to this decline. The survey responses highlight that while economics in general is perceived to be important for society, many students lack an interest in, or understanding of, Economics as a subject. This finding is even more pronounced for students who are female, those from a lower socio-economic background and those from regional schools.

News Sentiment and the Economy

The large and immediate effect of the COVID-19 pandemic on economic activity has increased the need for more real-time indicators of the economy. This article discusses a new indicator of `news sentiment’, which uses a combination of text analysis, machine learning and newspaper articles. The news sentiment index complements other timely economic indicators and has the advantage of potentially being updated on a daily basis. The news sentiment index captures key macroeconomic events, such as economic downturns, and typically moves ahead of survey-based measures of sentiment. Related indicators, such as the news uncertainty index, similarly help to better understand real-time developments in the Australian economy.

Renewable Energy Investment in Australia

Renewable energy investment has increased significantly in Australia over recent years, contributing to a continuing shift in the energy generation mix away from traditional fossil fuel sources. Current estimates suggest that investment in renewable energy has moderated from its recent peak and is likely to decline further over the next year or two. In the longer term, the transition towards renewable energy is expected to continue. Significant coal-fired generation capacity will be retired over coming decades and is likely to be replaced mainly by distributed energy resources and large-scale renewable energy generators, supported by energy storage.

Regional Variation in Economic Conditions

Differences in economic conditions between capital cities and regional areas have widened since the early 2000s. Some regional areas, particularly outer regional and remote areas, have faced considerable structural changes and have taken longer than other regions to adapt to these developments. Most regional labour markets appear to have adjusted quite well to the differences in regional economic conditions, though the adjustment process may have been more difficult for some regions.

Demographic Trends, Household Finances and Spending

The share of the population in their peak earning and spending years (ages 35–54) has decreased over the past decade, while the share aged 65 and above has increased. Demographic change has tended to reduce aggregate growth in household income and consumption, but by less than what previous patterns of household spending would suggest. This is because older households have earned and consumed more than in the past, and they have become wealthier. By contrast, growth in spending by younger households has been subdued, consistent with their weak income growth. The different earning and spending behaviour of households across different age groups will continue to affect trends in aggregate household consumption and income as the population ages further.

Being Unreserved: About the Reserve Bank Archives

The Reserve Bank of Australia has a unique and rich archives. In addition to records about the nation’s central bank, the archives contain records about Australia’s economic, financial and social history over almost two centuries. The extent of the collection reflects the Bank’s lineage, with its predecessor (the original Commonwealth Bank of Australia) having absorbed banks with a colonial history. Consequently, the Bank’s archival collection spans convict banking records through to information about contemporary episodes in Australia’s history. This article explains why the archives exist, how they are managed and plans to make them more accessible to the public.

Education Choices and Labour Supply During the Mining Boom

The mining boom led to large increases in wages for many lower-skilled jobs in mining regions. This raised the opportunity cost of remaining in school, TAFE or university for many students, particularly those in mining areas. I show that this led fewer people in those areas to pursue tertiary study. These educational responses were an important source of labour market adjustment during the boom. It accommodated most of the strong rise in the labour force participation rate of 15–24 year olds in the resource-rich states, and 5–10 per cent of the total additional labour supply needed in those states.

The Framework for Monetary Policy Implementation in Australia

The Reserve Bank of Australia's domestic market operations are designed to ensure that the cash rate is consistent with the target set by the Reserve Bank Board. The most important tools to guide the cash rate to the target are the interest rate corridor and daily transactions to manage liquidity in the interbank overnight cash market. The RBA also ensures that there is sufficient liquidity in the cash market for it to function smoothly. This article provides an overview of the RBA's operational framework for implementing monetary policy.

Wages Growth by Pay-setting Method

Using job-level micro data, we show that the dynamics of wages growth differ across pay-setting methods. In recent years, wages growth has been strongest for award-reliant workers, stable at low levels for those on enterprise bargaining agreements (EBAs), and low but rising for those on individual arrangements. These trends reflect differences in the arrangements governing each pay-setting method, and differences in the types of workers covered by them. For instance, individual agreements react most flexibly to changes in labour market spare capacity, while government policies have kept public sector wages growth in EBAs relatively unchanged of late. This new disaggregation of wages growth allows for an estimation of the pass-through of award wage increases to other wage outcomes in the economy. We also find that the new breakdown provides a useful framework for forecasting aggregate wages growth.

Competition and Profit Margins in the Retail Trade Sector

Net profit margins have declined for both food and non-food retailers over recent years. This has been driven by a decline in gross margins suggesting a reduction in firms' pricing power. This is consistent with information from the Reserve Bank's business liaison program about heightened competition in the retail trade sector. Liaison indicates that firms are seeking to offset the decline in margins through measures such as vertically integrating supply chains and adjusting product mixes. Retailers also report a push to reduce operating expenses such as rent and labour, though with mixed success.

Can Structural Change Account for the Low Level of Non-mining Investment?

No, it cannot. Non-mining firms have invested less over the past decade, relative to their output, than they did over the previous two decades, and this decline in investment intensity has been broad based across firms. This reduced investment could contribute to slower economic growth, if, for example, it is associated with decreased adoption of new technologies. This article looks into potential driving forces behind the decline in the rate of investment, finding that it cannot be explained by shifts in industry structure, or the composition of firms by age or date of formation. The size of the decline is consistent with what would be expected given slower technological progress and lower depreciation rates. But there might be other, more cyclical reasons for the observed slowdown in non-mining investment.

Explaining Low Inflation Using Models

The Reserve Bank's inflation forecast models can help assess which factors have contributed most to low inflation over recent years. The models find that spare capacity in the economy and the associated low wages growth can account for much of recent low inflation outcomes. This article outlines the inflation forecast models used at the Bank, and looks at the recent performance of the Bank's inflation forecasts.

Exploring the Supply and Demand Drivers of Commodity Prices

Quantifying the relative importance of supply and demand in price movements of commodities can help inform how changes in these prices might impact the Australian economy, via exports, business investment and the exchange rate. Isolating the extent to which a change in commodity prices is driven by demand also provides a timely indicator of global economic activity. In this article, we use a dynamic factor model to help interpret changes in commodity prices as being driven by supply and/or demand developments. Results from the model are consistent with prior understanding of several notable episodes of commodity prices movements.

Firm-level Insights into Skills Shortages and Wages Growth

Despite increased reports of skills shortages from contacts in the RBA's regional and industry liaison program since 2016, national wages growth has picked up only a little and remains subdued. Information collected through the liaison program since the early 2000s suggests Australian firms use a range of practices in addition to, and sometimes before, increasing wages to address skills shortages. In the short run, this may constrain the effect of skills shortages on wages growth.

Wealth and Consumption

Do households consume more when their wealth increases? Our research identifies a positive and stable relationship between household wealth and consumption, largely reflecting changes in spending on motor vehicles, durable goods and other discretionary spending. Increases in household wealth supported household spending between 2013 and 2017, when growth in disposable income was weak. Similarly, declines in household wealth typically weigh on consumption. However, a decline in household wealth is less likely to coincide with weaker consumption growth if it occurs at a time when the labour market is strong and household income growth is firm.

The Labour and Capital Shares of Income in Australia

In Australia, the share of total income paid to workers in wages and salaries (the ‘labour share’) rose over the 1960s and 1970s but has gradually declined since then. The corollary is that the share of income going to capital owners in profits (the ‘capital share’) has risen. The long-run increase in the capital share largely reflects higher returns accruing to owners of housing (primarily rents imputed to home owners, particularly before the 1990s) and financial institutions (since financial deregulation in the 1980s). Estimates of the capital share of the financial sector are affected by measurement issues, though structural factors, such as a high rate of investment in information technology, have reduced employment and increased capital in the sector.

Business Concentration and Mark-ups in the Retail Trade Sector

The share of industry sales accounted for by the largest Australian businesses (or ‘business concentration’) has gradually risen since the start of this century. This increase in concentration has been mainly driven by the retail trade sector, particularly in recent years. In contrast, estimates of the ratio of retail prices to marginal cost (or ‘mark-ups’) rose over the 2000s but have declined in recent years. Taken together, the evidence suggests that the retail trade sector has become more competitive in recent times, following a period of declining competition through the 2000s.

Which Firms Get Credit? Evidence from Firm-level Data

To improve our understanding of how lenders assess firms' creditworthiness, this article relates the characteristics of firms to whether their applications for credit were approved. We find evidence to suggest that firms with relatively low profitability, high debt servicing burdens or limited credit histories were less likely to have their applications approved than other comparable firms. However, the decision to approve an application for credit also appears to be influenced by a range of other unmeasured factors, which possibly reflects the complexity of the approval process in practice.

The Effect of Minimum Wage Increases on Wages, Hours Worked and Job Loss

Australia has a detailed system of ‘awards’ that specify different minimum wages depending on the industry, location and skill of an employee. I find that legislated adjustments to award wages in Australia between 1998 and 2008 were almost fully passed on to wages in award-reliant jobs. There is no evidence that modest, incremental increases in award wages had an adverse effect on hours worked or the job destruction rate.

Access to Small Business Finance

The Reserve Bank has conducted additional outreach this year to hear a broad range of perspectives on small business finance. Many small businesses looking to grow still find it challenging to access finance, particularly without providing real estate as security. Lenders highlight that they are keen to lend to small businesses, but that unsecured finance involves more risk. This article considers these issues and outlines some initiatives market participants have suggested that could help to improve access to finance for small businesses.

Does It Pay to Study Economics?

Economics graduates work in a broad range of occupations and industries, often beyond the discipline of economics itself. The earnings of economics graduates are higher than in most other fields of study, including business studies. By estimating wage premiums for various skills, we assert that the comparatively strong earnings of economics graduates comes from the development of analytical thinking and quantitative skills which are highly rewarded in the labour market.

Firm-level Insights into IT Use

Firms in Australia have used advances in information and communication technology (IT) to become more productive, reduce costs, and improve their understanding of customers. The rate at which new technology has been adopted by firms differs greatly, as do the benefits from using IT. The way firms are using IT can help to explain trends in the broader economy. Firms' expenditure on computer software has grown faster than other forms of investment. The adoption of new technology is also changing the composition of jobs in the economy.

The Cyclical Behaviour of Labour Force Participation

When economic conditions improve, more people enter the labour force. Understanding the nature of this cyclical relationship between participation and economic activity is important for determining the amount of slack in the labour market and predicting how the economy will respond to changes in economic conditions. The participation rates of young people, 25–54-year-old females and older males are the most responsive to changes in economic conditions. If the participation rate did not adjust, expansions would be more inflationary, while recessions would be more disinflationary and lead to larger increases in involuntary unemployment.

Banking Fees in Australia

The Reserve Bank has conducted a survey on bank fees each year since 1997. The most recent survey suggests that banks' fee income from both households and businesses rose in 2017, due to a combination of growth in the volume of services for which fees are charged and higher unit fees on some products. Deposit fee income continued to decline relative to the value of outstanding deposits, while lending fee income as a share of assets was steady. Greater use of electronic payment methods continued to support strong growth in merchant service fee income

Labour Market Outcomes for Younger People

Monitoring developments in the labour market for younger people is important, because they make up a large share of unemployment in the economy, and because early-career labour market outcomes can affect future outcomes. This article outlines the demand and supply factors that have affected 15–24 year old workers in Australia. In particular, we analyse the factors affecting their participation in the labour force, such as increased education attainment. We also show how younger workers are more adversely affected than the rest of the population when economic conditions slow. Over the past decade, increases in the unemployment and underemployment rates for younger people have been over twice as large as for the overall labour market. The share of 20–24 year olds that have become disengaged from either study or work has also increased.

Private Non-mining Investment in Australia

While mining investment has risen in importance over recent decades, the non-mining investment share of output has fallen. This article explores some of the factors that have contributed to the downward trend in the non-mining investment share over time. The article finds that the future non-mining investment share could be around 1–2 percentage points lower on average than it was in the two decades before the financial crisis.

Mining Investment Beyond the Boom

The construction phase of Australia's mining boom is now almost complete. In this article, we use two complementary approaches to investigate what mining investment might look like look over the next decade or so. The first approach explores the long-run determinants of mining investment and its likely long-run share of GDP. We then take a bottom-up approach, focusing on the amount of investment that will be required to maintain firms' existing productive capacity; in this approach we focus on Australia's three major commodities (coal, iron ore and liquefied natural gas). The analysis suggests that mining investment will likely make up a larger share of GDP than it did before the boom, and that it will continue to play an important role in driving movements in Australia's economic activity.

Structural Change in the Australian Economy

The structure of the Australian economy has changed significantly over the past 50 years. Services have become an increasingly important part of the economy. Supply chains have lengthened as traditional goods-producing industries have become more specialised in their core activities and outsourced their non-core activities to the business services sector. These developments have had significant implications for the composition of employment and the skill requirements of the Australian labour force.

Perceptions of Job Security in Australia

A concern that low job security is constraining wage growth has been expressed in many countries. Using data on Australian households over time, this article finds that workers' perceptions of their own job security have declined in recent years. This deterioration has occurred across many job and personal characteristics. These weaker job security perceptions have provided a small drag on wage growth.

The Distribution of Mortgage Rates

Mortgage interest rates can vary considerably across borrowers and are typically less than the standard variable rates (SVRs) advertised by banks. This article uses loan-level data to explore the relationships between interest rates and the characteristics of borrowers and their loans. Mortgages with riskier characteristics tend to have higher interest rates. Discounts applied to SVRs have tended to increase over recent years, and are also influenced by the type of loan and its size.

Meet MARTIN, the RBA's New Macroeconomic Model

The Reserve Bank has begun using a new full-system macroeconomic model called MARTIN in policy analysis and forecasting. It is designed to be used as part of the Bank's existing processes for forecasting and analysis that use a range of information, models and staff assessments. MARTIN is already being used in these processes to help understand economic developments and quantify risks, and in time it will be used to extend forecasts beyond the usual two-to-three-year horizon.

Reporting Australia's Foreign Reserve Holdings

The Reserve Bank of Australia reports details of Australia's official reserve assets, foreign currency liquidity and net foreign reserves on a monthly basis. This article details changes that will make the Bank's reporting methodology consistent with current guidelines published by the International Monetary Fund (IMF). Data will be revised back to January 2015. While the new methodology implies a reduction in the reported gross level of Australia's official reserve assets, net foreign reserves will remain unchanged.

The Transmission of Monetary Policy: How Does It Work?