Exchange Rates and the Australian Economy

Download the complete Explainer 104KBAn exchange rate is the value of one currency in terms of another currency. Exchange rates matter to Australia's economy because of their influence on trade and financial flows between Australia and the rest of the world. Changes in exchange rates affect the Australian economy in two main ways:

- There is a direct effect on the prices of goods and services produced in Australia relative to the prices of goods and services produced overseas.

- There is an indirect effect on economic activity and inflation as changes in the relative prices of goods and services produced domestically and overseas influence decisions about production and consumption.

Together these effects also have implications for the balance of payments. This Explainer describes the effects of exchange rate movements and highlights the main channels through which these changes affect the Australian economy.

If the exchange rate between the Australian dollar and the US dollar is 0.75 then one Australian dollar can be converted into US75c. An increase in the value of the Australian dollar is called an appreciation. A decrease in the value of the Australian dollar is known as a depreciation. (For more information on exchange rates and their measurement, see Explainer: Exchange Rates and their Measurement.)

Direct Effects

The direct effect of an exchange rate movement is to change the prices of goods and services produced in Australia relative to the prices of goods and services produced overseas. When the Australian dollar depreciates, or loses value, less foreign currency is required to purchase a given amount of Australian dollars. This makes Australian produced goods and services cheaper than before when compared with goods and services produced overseas. For example, if the Australian dollar depreciates, tourists visiting Australia will need to change less foreign currency to pay for their meals and hotel rooms in Australia. An appreciation of the Australian dollar will have the opposite effect – Australian produced goods and services will become more expensive compared to goods and services produced overseas. If the Australian dollar appreciates, Australian tourists will need to change fewer Australian dollars to pay for their meals and hotel rooms overseas.

Indirect Effects

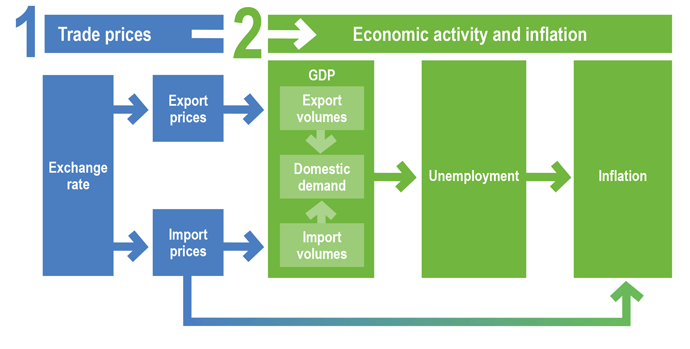

The indirect effects of exchange rate movements arise because changes in the relative prices of Australian and overseas goods and services affect economic activity and inflation in Australia. To highlight this, we use the example of a depreciation of the Australian dollar. (An appreciation of the Australian dollar has the opposite effect on economic activity and inflation.)

Economic activity and the labour market

By reducing the relative price of Australian produced goods and services, a depreciation of the Australian dollar increases the international competitiveness of Australian exporters. Because Australian goods and services have become cheaper relative to overseas goods and services, foreign consumers and firms will demand more Australian goods and services, leading to an increase in the volume (that is, quantity) of Australian exports.

At the same time, following an exchange rate depreciation, imported goods and services become relatively more expensive for Australian consumers and firms. In response, Australian residents are likely to change their consumption patterns to demand more import-competing goods and services produced in Australia, leading to a decrease in the volume of imports.

Relative changes in export and import prices arising from a change in the exchange rate mainly influence demand for tradable goods and services. But exchange rate movements also have implications for the demand for non-tradable goods and services. In the case of depreciation, the resulting increase in export volumes and decrease in import volumes will increase national income in Australia. This, in turn, will increase demand for non-tradable goods and services produced in Australia. In order to meet the increased demand for their products, Australian firms will have to hire more workers, which will increase employment and lower the unemployment rate in Australia.

Inflation and interest rates

In principle, a depreciation of the exchange rate will increase inflation in two ways. First, the prices of imported goods and services will increase, contributing to inflation. Second, the expansion of aggregate demand and increase in employment will cause an increase in wages and other costs that are inputs to production and may be passed on to prices more generally, which will also contribute to higher inflation (see Explainer: Causes of Inflation).

Should these factors contribute to excessive inflation, the Reserve Bank may need to tighten monetary policy in order to achieve its inflation target.

In practice, there is typically a lag between an exchange rate movement and its effect on economic activity and inflation. In the discussion above we have assumed exchange rate changes are immediately reflected in the prices of imported goods and services. But firms selling imported items often price them in Australian dollars, so it is up to the firm selling the item to decide when to pass on the higher cost (from the depreciation) to those buying the product. Exchange rates are volatile, and firms may be reluctant to change their prices until they are sure that an exchange rate movement will not reverse. Even after prices adjust, it may take time for households and firms to adjust their spending patterns. The extent and timing of the responses will also depend on how easy it is for households and firms to substitute between goods and services produced in Australia and goods and services produced overseas. Most estimates suggest that it takes between one and three years for exchange rate movements to have their maximum effect on economic activity and inflation.

Balance of Payments

Exchange rates and the balance of payments

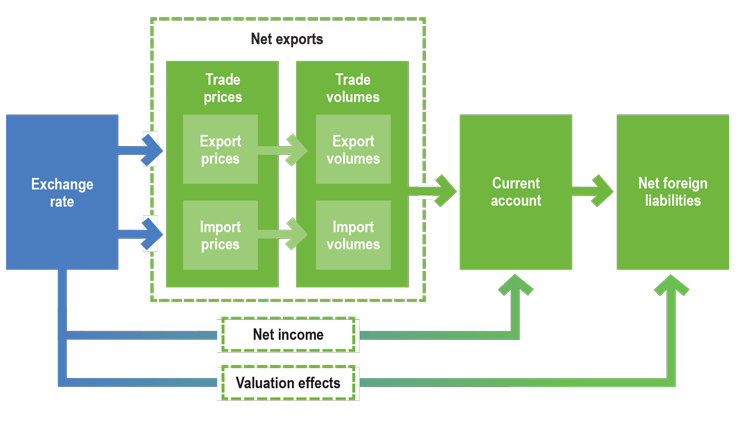

When considering the implications of exchange rate movements for economic activity what matters is the change in the volume, or quantity, of exports and imports. In determining the consequences of exchange rate movements for the balance of payments, however, it is the value – that is the prices as well as the quantity – of exports and imports that matters. Once again, we use the example of a depreciation of an Australian dollar to describe these effects.

The direct effect of an exchange rate depreciation is to increase the price of imports relative to exports, which will tend to decrease the value of net exports (exports less imports) and widen the current account deficit. However, the indirect effects of an exchange rate depreciation increase the volume of exports and reduce the volume of imports. This will tend to increase net exports and diminish the current account deficit.

These two effects differ in their timing. The direct effect of an exchange rate depreciation occurs immediately, while the indirect effects on export and import volumes typically occur with a lag. Because of this, in the short run, an exchange rate depreciation is likely to reduce the value of net exports. But over time, as export and import volumes start to respond, an exchange rate depreciation is likely to increase the value of net exports. This pattern is sometimes referred to as the ‘J-curve’.

Exchange rate movements also affect the other major component of the current account – the net income deficit. An exchange rate depreciation will increase the cost to Australian residents of servicing foreign debt that is denominated in foreign currency. This is because the amount of Australian dollars required to purchase the foreign currency needed to pay the interest owed on the debt has increased. This increases net income outflow and widens the current account deficit. On the other hand, an exchange rate depreciation will increase the income that Australian residents receive on their foreign asset holdings, as the returns on those assets are now larger in terms of Australian dollars. This reduces net income outflow and narrows the current account deficit. (Although Australia's foreign liabilities exceed its foreign assets, a large proportion of the foreign liabilities are denominated in Australian dollars so that a depreciation of the Australian dollar will actually tend to diminish Australia's net income deficit. This is because the interest owed on the foreign liabilities is not affected by the change in the exchange rate but the returns on the foreign assets are.)

An exchange rate depreciation has an additional effect on the balance of payments through valuation effects on Australia's net foreign liabilities. Valuation effects occur because a depreciation of the Australian dollar increases the value in Australian dollars of assets and liabilities denominated in foreign currency. As was the case for the net income deficit, because the foreign assets of Australian residents that are denominated in foreign currency exceed the liabilities of Australian residents denominated in foreign currency, an exchange rate depreciation will tend to reduce the value of Australia's net foreign liabilities.

To learn more about the balance of payments, see the Explainer: The Balance of Payments.