Reserve Bank of Australia Annual Report – 2022Banknotes

The Reserve Bank is responsible for producing and issuing Australia’s banknotes. In this role, the Bank ensures that banknotes in circulation are of high quality and that the threat of counterfeiting is low. In late 2021, the Bank announced it was conducting a review of banknote distribution arrangements to determine what changes may be required to ensure that distribution is effective, efficient, sustainable and resilient – both now and into the future.

Circulation

The value of banknotes in circulation reached $102.3 billion at the end of June 2022, equivalent to around 4½ per cent of nominal GDP. Growth over 2021/22 was 7.2 per cent, marginally higher than its 10-year average, but below the growth rates seen during the pandemic in 2020 and 2021. Much of the increase in circulating banknotes during 2021/22 reflected a more subdued pace of banknotes being returned to the Reserve Bank, rather than additional banknote purchases. Overall, there were a little under 2 billion banknotes in circulation.

Banknotes returned to the Reserve Bank are deemed ‘out-of-circulation’. Banknotes can be returned because they are either poor-quality banknotes no longer fit for circulation (unfit banknotes) or good-quality banknotes no longer required due to the normal seasonal fluctuations in banknote demand (surplus fit banknotes). Over the past year, around $2.1 billion of unfit banknotes were returned, which was the lowest value of unfit returns since the commencement of the Next Generation Banknote (NGB) program in 2016/17. The return of surplus fit banknotes was also at historical lows. In comparison, banknote purchases by commercial banks were close to the historical average, with around $9.2 billion of banknotes being issued into circulation.

The growth in banknote demand was mostly driven by the higher denominations, highlighting a desire to hold cash for precautionary or store-of-wealth purposes. It also highlights the changing role of cash, with cash increasingly being used for such purposes rather than for transactions. The demand for the lower denominations partially recovered during 2021/22 as pandemic-related impacts on in-person transactions reduced somewhat. Nevertheless, it is expected that the pandemic will have had a lasting effect on cash usage, with a survey of households conducted in late 2021 by the Reserve Bank suggesting around one-quarter of respondents have permanently reduced their preference for cash use as a result of the pandemic.

| $5 per cent |

$10 per cent |

$20 per cent |

$50 per cent |

$100 per cent |

Total per cent |

|

|---|---|---|---|---|---|---|

| FY2021/22 | 1.6 | 1.0 | 5.9 | 7.4 | 7.4 | 7.2 |

| 10-year average(a) | 3.7 | 3.2 | 2.5 | 6.7 | 7.4 | 6.7 |

|

(a) Financial years up to June 2021. Source: RBA |

||||||

An increasing proportion of banknotes in circulation are those of the new NGB series. The proportion of NGB banknotes relative to all banknotes in circulation (the ‘saturation rate’) increased over 2021/22 for all denominations. The NGB $100 banknote now makes up around 10 per cent of all $100 banknotes, up from 2.8 per cent in the previous year. Saturation for the new $20 and $50 banknotes increased by similar amounts, to around 37 per cent and 43 per cent, respectively. The two lower denominations, on the other hand, saw only small increases in their saturation rates. Saturation of new $5 and $10 banknotes are unlikely to rise substantially from their current rates, reflecting the fact that many of the earlier series banknotes are stored, lost or held abroad, and so are unlikely to be returned to the Reserve Bank in the near term.

The Reserve Bank also continues to monitor cash access and merchant cash acceptance. While overall access to cash – measured by the distance people need to travel to ATMs or bank branches – remains good and has been little changed in recent years, vulnerabilities are emerging. These risks are particularly pertinent in regional and remote parts of Australia, where an increasing number of localities have no or only a few cash access points nearby. In terms of merchant acceptance of cash, a Bank survey of merchants in June 2022 found 94 per cent of retail businesses accepted cash. This is a slight decline compared with the previous survey in 2020.

The declining use of cash for payments has placed pressure on the cash distribution system. In November 2021, the Reserve Bank launched a review of the arrangements for banknote distribution in order to examine how the system can remain effective, efficient, sustainable and resilient in the face of declining cash use. The Bank will continue to work with the cash distribution industry to ensure it is able to continue to support cash being available for those who want or need to use it.[1]

Distribution, quality and storage

The Reserve Bank operates as a wholesaler of banknotes and has distribution agreements in place with a number of commercial banks, which provide those banks with access to banknotes; these agreements were renegotiated in 2021/22 in line with the regular cycle of renewal. The commercial banks, in turn, have arrangements in place to distribute banknotes around the country to meet the demands of their customers.

As noted above, the volume of fit banknotes returned to the Reserve Bank by commercial banks has been relatively low in recent years. As a result, almost all of the issuance by the Bank in 2021/22 were new banknotes; around 7 per cent of the $9.2 billion issued to commercial banks in 2021/22 were banknotes that were previously in circulation but had since been returned to the Bank and were deemed fit for reissue.

The purpose-built National Banknote Site (NBS) at Craigieburn, Victoria is the primary centre for the Reserve Bank’s processing, distribution and storage of banknotes. The Bank retains contingency distribution sites in Sydney and Craigieburn to ensure it can continue to meet public demand for banknotes in the event distribution cannot occur from the NBS. In 2021/22, the vast majority of transactions were carried out from the NBS. There were only a couple of days during the year when transactions either needed to be relocated to the Craigieburn contingency site or deferred by one day as a result of COVID-19 inhibiting the ability of the NBS to operate.

The Reserve Bank aims to have only high-quality banknotes in circulation as these are more readily handled by machines and make it more difficult for counterfeits to be passed. Accordingly, the Bank has arrangements that encourage the cash-in-transit companies and the commercial banks that are part of the Bank’s wholesale banknote distribution arrangements to sort the banknotes they handle to agreed quality standards. Based on this sorting, banknotes that remain fit for circulation are redistributed, while those that are deemed unfit are returned to the Bank. There are two core features of the quality sorting framework:

- Different levels of ‘quality’ for banknotes are defined by the Reserve Bank, based on the absence or presence of defects such as tears, folds and inkwear. This allows banknote quality to be measured and guidance is provided to the banks about whether a banknote can be recirculated or returned to the Bank for destruction. Once returned to the Bank, these unfit banknotes are assessed to confirm their authenticity and quality; they are then destroyed and recycled into other plastic products.

- The commercial banks involved in wholesale banknote distribution are paid according to how well they sort to the quality standards. To do this, the Reserve Bank samples quality-sorted ‘fit’ banknotes at cash depots and makes payments to the banks based on the assessed quality score of the worst 15 per cent of the banknotes sampled. The maximum payment the banks can collectively receive is capped at $15 million per annum.

In 2021/22, the Bank received $2.1 billion worth of banknotes deemed unfit for recirculation and paid just over $13 million to the commercial banks involved in wholesale distribution for quality sorting under the quality-sorting framework.

Another way the Reserve Bank incentivises the industry to quality-sort banknotes is through payments to those commercial banks involved in wholesale distribution for the banknotes they store in private cash depots. This arrangement, which involves the Reserve Bank paying interest on these amounts, is only paid for banknotes that have been quality sorted. In 2021/22, the amount of interest payments to the banks for this purpose was very low, reflecting the low interest rate environment. That said, the opportunity cost of holding banknotes has also fallen in line with low interest rates.

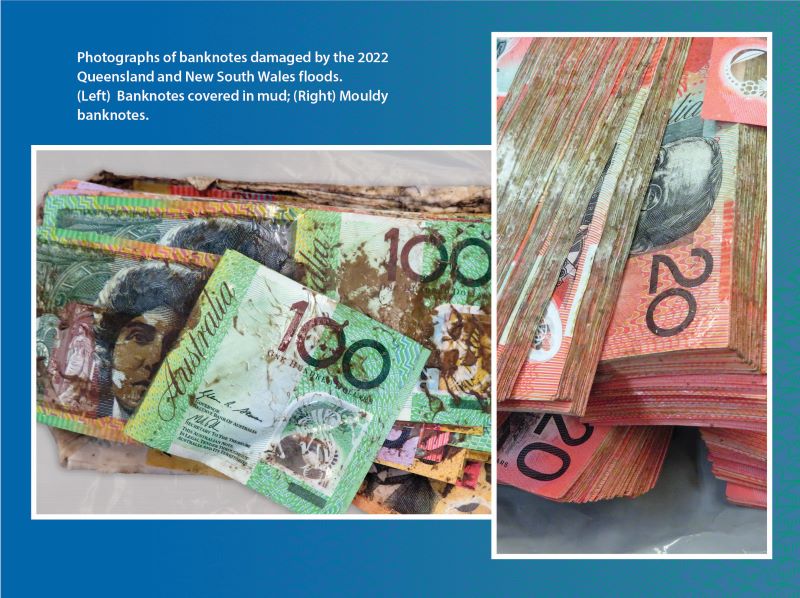

The Reserve Bank also removes banknotes from circulation through its Damaged Banknotes Facility. The facility is offered to holders of Australian banknotes who have unwittingly come into possession of damaged banknotes or whose banknotes are accidentally damaged. Claims that meet the requirements set out in the Bank’s Damaged Banknotes Policy are paid based on their assessed value.[2] In 2021/22, the Bank updated the Damaged Banknotes Policy to provide more clarity about the claims process and the basis on which certain claims might be rejected.

During 2021/22, the Damaged Banknotes Facility processed around 8,400 claims and made $14.5 million in payments. Of these, around 100 claims worth around $9.2 million involved banknotes that were damaged during the 2022 Queensland and NSW floods, mainly from businesses and financial institutions. Due to longevity and widespread devastation of the floods, the Reserve Bank continued to receive flood claims several months after the events. As at the end of June 2022, around half of the volume of claims received from the floods had been assessed. To increase awareness of the Damaged Banknotes Facility within communities affected by the floods, the Bank shared information about how to lodge claims for flood-affected banknotes through its website and industry liaison.

Counterfeiting rates

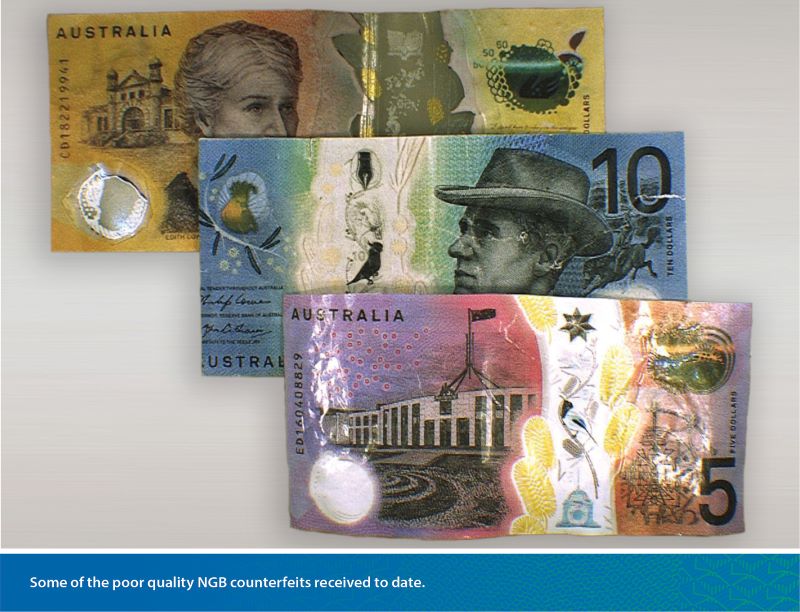

The level of counterfeiting in Australia remains low compared with historical norms. In 2021/22, around 12,000 counterfeits, with a nominal value of $900,000, were detected in circulation. This corresponds to a counterfeiting rate of around six counterfeits detected per million genuine banknotes in circulation; however, this is expected to rise a little once the analysis of all counterfeits detected in 2021/22 has been completed. The low counterfeiting rate likely reflects a combination of the COVID-19-induced lockdowns, effective law enforcement activities and increased saturation of the NGB series of banknotes.[3] Counterfeiting of the $100 denomination remains elevated, with counterfeiters primarily targeting the previous polymer series, rather than the new NGB banknote series.

There have been very few detections of NGB counterfeits in circulation so far. Since the first NGB banknote was released in 2016, there have only been 81 NGB counterfeits detected, compared with just over 122,000 counterfeits of the previous series of banknotes. The average quality of the NGB counterfeits is also lower than the average quality of the previous series counterfeits for the same period. These figures indicate that the new banknotes are significantly more secure than the first polymer banknote series, as a result of their innovative new security features. This demonstrates that one of the key aims of the NGB program has been achieved, which was to improve the security of Australia’s banknotes.

| $5 | $10 | $20 | $50 | $100 | Total | |

|---|---|---|---|---|---|---|

| Total number | 4 | 6 | 130 | 6,120 | 5,921 | 12,181 |

| First Polymer series | 1 | 5 | 128 | 6,059 | 5,914 | 12,107 |

| NGB series | 3 | 0 | 2 | 60 | 2 | 67 |

| Paper series | 0 | 1 | 0 | 1 | 5 | 7 |

| Total nominal value ($) | 20 | 60 | 2,600 | 306,000 | 592,100 | 900,780 |

| Counterfeiting rate (counterfeits per million banknotes in circulation) | 0.02 | 0.04 | 0.7 | 6.2 | 13.0 | 6.2 |

|

(a) Figures are preliminary and subject to upward revision because of lags in counterfeit submissions to the Reserve Bank. Source: RBA |

||||||

Law-enforcement efforts to investigate and prosecute counterfeiting operations play a significant role in managing the threat of counterfeiting.[4] The Reserve Bank supports court proceedings around Australia through the provision of information about counterfeit currency and expert witness statements. In 2021/22, the Bank completed 95 statements relating to 1,391 counterfeits. In addition, the Bank is aware of 20 court proceedings that occurred during the year relating to the possession, passing and making of counterfeit currency.

Banknote research and development

The Reserve Bank maintains an active banknote research and development program to develop cost-effective counterfeit-resistant security features and detection technologies for Australian banknotes. The primary purpose of this program is to ensure that Australia’s banknotes remain durable and secure against counterfeiting and are easy to authenticate for a wide variety of users. This is achieved in part through collaboration with domestic and international experts from various external organisations, including universities, public and private companies, research institutes and other central banks.

Fundamental to this program is a continuing assessment of the vulnerability of banknotes to different forms of counterfeiting, the mechanisms by which banknotes wear in circulation, production capability, and how the public and banknote-processing machines use and authenticate banknotes. This work has been complemented by the design and manufacture of new instrumentation for quality assurance and damaged banknote assessment, and the development of testing methodologies for the assessment of banknotes. Over 2021/22, there was also a strong focus on potential product and process improvements for the NGB series in order to reduce costs and improve circulation life of banknotes.

Note Printing Australia Limited (NPA)

NPA is a wholly owned subsidiary of the Reserve Bank that produces banknotes and passports for Australia. It also prints banknotes and other security products for other countries. In 2021/22, NPA delivered 431 million Australian banknotes to the Bank, comprising 40 million NGB series $5 banknotes, 14 million NGB series $20 banknotes, 221 million NGB series $50 banknotes, and 156 million NGB series $100 banknotes. In comparison, in 2020/21, a total of 234 million Australian banknotes were delivered to the Bank by NPA. For more details about NPA, see the chapters on ‘Governance and Accountability’ and ‘Operational Structure’.

The total amount paid by the Reserve Bank to NPA in 2021/22 for the supply of banknotes and related services was $121 million, compared with $74 million in the previous year.

NPA also provided printing services to other Australian Government agencies and overseas central banks in 2021/22. In particular:

- NPA produced around 371,000 P Series passports and 73,000 new R series passports for Australia’s Department of Foreign Affairs and Trade.

- NPA printed 1.1 million Births, Deaths and Marriages Certificates for all state governments in Australia.

- NPA delivered 12.5 million banknotes under contract to Singapore, Solomon Islands and the Philippines, dealing directly with the central banks in those countries.

Endnotes

See RBA (2021), ‘Review of Banknote Distribution Arrangements: Issues Paper’, November. [1]

See Burton A and H Winata (2022), ‘What Can You Do With Your Damaged Banknotes?’, RBA Bulletin, June. [2]

See Mann L and S Roche (2022), ‘Recent Trends in Banknote Counterfeiting’, RBA Bulletin, June. [3]

See Miegel K and K Symeonakis (2020), ‘A Counterfeit Story: Operation Gridline’, RBA Bulletin, December. [4]