Reserve Bank of Australia Annual Report – 2022International Financial Cooperation

The Reserve Bank participates in international efforts to address the challenges facing the global economy and financial system, and improve the international financial architecture. It does so through its membership of global and regional forums and its close bilateral relationships with other central banks. Over the past year, the COVID-19 pandemic, the war in Ukraine, inflationary pressures and macroeconomic policy settings have been at the forefront of international discussions on the global economic and financial outlook. The year has also seen continued international efforts to progress work on a range of issues, including digital currencies, risks arising from non-bank financial intermediation, cross-border payments and climate-related risks.

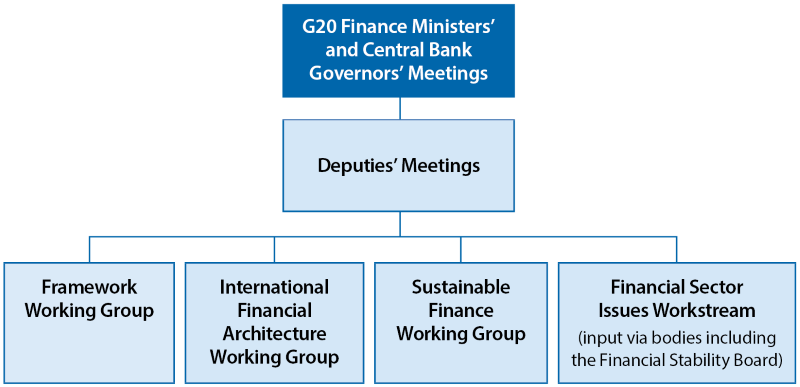

Group of Twenty (G20)

Purpose

The G20 is a forum for cooperation on economic, financial and other policy issues among 20 of the world’s largest economies, including Australia. International organisations, such as the International Monetary Fund (IMF), also participate. The G20 was chaired by Italy from December 2020 to November 2021, and has been chaired by Indonesia since December 2021.

Reserve Bank involvement

The Governor and Assistant Governor (Economic) represent the Bank at high-level meetings of the G20, while other senior staff participate in G20 working groups and contribute to the G20’s work on financial sector issues.

The G20 serves as a key forum for members to discuss major risks to the economic outlook, share experiences on economic and financial policy measures, and explore ways collectively to address global challenges. The main focus of Indonesia’s presidency has been to promote a strong, sustainable, balanced and inclusive global recovery from the COVID-19 pandemic through enhanced international cooperation. The war in Ukraine and its economic effects was also factored into G20 discussions over the latter part of the year in review.

To help support vulnerable countries affected by the pandemic, the G20 has announced a global goal to channel a total of US$100 billion worth of Special Drawing Rights (SDRs) to countries most in need.[1] In addition, material progress has been made on improving the capacity to prevent, prepare for and respond to future pandemics. Together with the Organisation for Economic Co-operation and Development (OECD), the G20 helped secure a historic agreement on international tax reforms. The reforms involve establishing a global minimum corporate tax rate and requiring multinational corporations to reallocate their profits, for tax purposes, to countries based on where those profits were generated.

Reserve Bank staff participated in three G20 working groups during 2021/22:

- The Framework Working Group: This group has focused on identifying and monitoring risks to the economic outlook – including the macroeconomic impacts of climate change, the war in Ukraine, rising inflationary pressures and global supply chain issues – as well as considering macroeconomic policy settings.[2] It has also focused on analysing appropriate strategies to exit from emergency COVID-19 policy settings and addressing scarring effects from the pandemic.

- The International Financial Architecture Working Group: This group has focused on strengthening support to vulnerable countries. Following the IMF’s general allocation of around US$650 billion worth of SDRs in August 2021, the group has worked on developing options for advanced economies to channel a share of their new SDRs to countries most in need. In addition, to help support effective, timely and coordinated debt restructuring in countries facing debt distress, the group has worked to improve the G20’s Common Framework for Debt Treatments. Members have also continued their efforts to understand the drivers of capital flows in emerging market economies and the relative effectiveness of the various policy tools available to manage the vulnerabilities that can arise from these flows.

- The Sustainable Finance Working Group: This group released a multi-year Sustainable Finance Roadmap in 2021, which outlines a set of actions to identify and address barriers to finance that support climate and sustainability goals. The group will report on progress on an annual basis. In 2022, the group has focused on three priority areas: developing a framework for transition finance and improving the credibility of financial institutions’ net zero commitments; scaling up sustainable finance instruments; and discussing policy levers that incentivise financing that supports the transition.

Russia’s invasion of Ukraine led to a prompt focus on its possible broad financial effects, as well as the wider implications for the G20’s financial sector agenda. The invasion led to isolated financial stress, price fluctuations and supply problems in certain markets, especially commodities. The Financial Stability Board (FSB) worked with other bodies to assess the effects on financial institutions and markets (see below).

Global bodies continued to work on other G20 focus areas over 2021/22, with pandemic-related issues remaining a key focus. Other work areas globally over the year included: developing a better understanding of and responding to the financial risks arising from climate change; improving cross-border payments; and ongoing efforts to address the risks posed by non-bank financial intermediation (NBFI). As discussed below, the Reserve Bank and other Council of Financial Regulators (CFR) agencies are involved with some of this work, given the CFR’s mandate to promote financial system stability and support effective and efficient financial regulation.

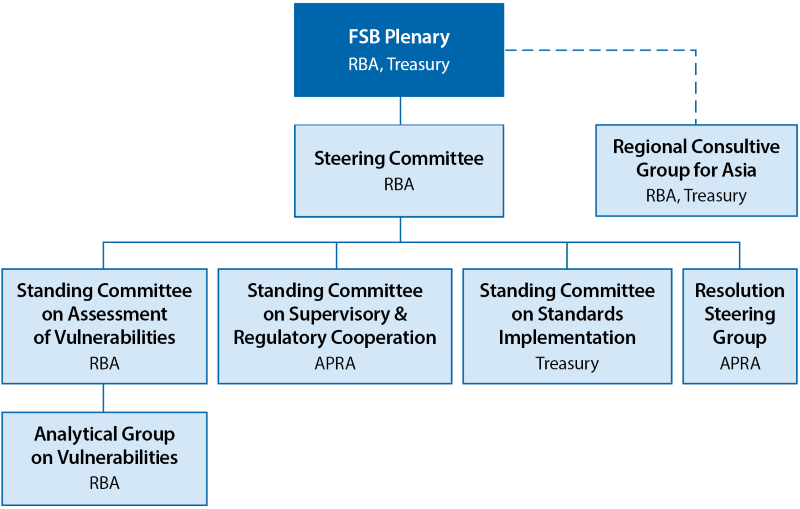

Financial Stability Board (FSB)

Purpose

The FSB promotes international financial stability by coordinating national financial sector authorities and international standard-setting bodies as they develop strong regulatory, supervisory and other financial sector policies. It also plays a central role in assessing new and evolving global trends and risks.

FSB members include representatives from 24 economies, as well as the main international financial institutions – including the Bank for International Settlements (BIS) and the IMF – and standard-setting bodies such as the Basel Committee on Banking Supervision (BCBS).

Reserve Bank involvement

The decision-making body of the FSB is the Plenary. The Governor is a member of the Plenary, as well as the Steering Committee and the Standing Committee on Assessment of Vulnerabilities.

Senior Bank staff, mainly from the Financial Stability and Payments Policy departments, participate in meetings of various FSB groups, including:

- the Analytical Group on Vulnerabilities, which supports the work of the Standing Committee on Assessment of Vulnerabilities

- the Financial Innovation Network

- the Climate Vulnerabilities and Data Group

- the Official Sector Steering Group

- the Working Group on Regulatory Issues of Stablecoins.

As with the pandemic, Russia’s invasion of Ukraine highlighted the FSB’s key roles of: (i) monitoring global financial system developments and vulnerabilities; and (ii) coordinating international responses to threats to financial stability. The FSB’s Standing Committee on Assessment of Vulnerabilities focused on the financial implications of the invasion, given the significant effects on commodity markets, falls in major equity indices and heightened volatility in bond and other markets. Volatility in commodity markets led to large margin calls for commodities derivatives, which placed strains on a number of market participants. Beyond these direct effects, the FSB assessed that the stress also highlighted, and could crystallise, underlying vulnerabilities in the financial system, such as high debt levels and stretched valuations. The Reserve Bank participated in several meetings held by the FSB on these developments over the latter half of the year. The FSB continues to monitor the effects of the war and provides regular updates to the G20. In addition, it is working with other bodies on addressing the fault-lines exposed by the stresses that have arisen, in particular in commodity markets and margining practices.

With health outcomes and access to vaccines still varying across some countries, under the Indonesian G20 presidency there had continued to be a focus on the economic and financial effects of the pandemic. Nonetheless, the improved situation overall in relation to the pandemic has meant the FSB and other bodies continued their work on assessing medium-term effects and implications of the pandemic. In particular, the FSB is examining ways to address the problem of COVID-19 ‘scarring’ effects on the economy and financial system, in order to ‘support a more even, sustainable and inclusive global recovery’.

Addressing the effects of climate change on the financial sector has been a major focus of global bodies over the year. International work in this area has largely been part of the FSB Roadmap for Addressing Climate-related Financial Risks. Key strands of this work include analysis of vulnerabilities and addressing data gaps in relation to climate risk. The Reserve Bank is co-leading an FSB workstream to develop a framework to monitor and assess vulnerabilities in this area.

Another ongoing focus of the FSB has been to strengthen the resilience of the NBFI sector and address systemic risks arising from NBFIs. A recent focus has been money market funds and other funds given the turmoil experienced during the peak of the pandemic. The Reserve Bank contributes to this work through its ongoing membership of the FSB’s Non-bank Monitoring Experts Group.

The Reserve Bank participates in a number of other FSB groups, including:

- The Financial Innovation Network, which monitors and assesses the financial stability implications of financial innovation, including financial technology (‘FinTech’). Recent focus areas have included crypto-assets and decentralised finance (DeFi).

- The Working Group on Regulatory Issues of Stablecoins, which has been examining evolving approaches to the regulation, supervision and oversight of global stablecoin arrangements.

- The Cross-border Crisis Management Group for Financial Market Infrastructures (a sub-group of the Resolution Steering Group), which has been working on resolution arrangements for central counterparties (CCPs). Recent work has focused on assessing the adequacy of financial resources available for CCP resolution.

- The Official Sector Steering Group, which is progressing reforms of interest rate benchmarks, including coordinating the transition away from the London Inter-Bank Offered Rates (LIBOR) towards alternative interest rate benchmarks. The end of 2021 marked a major milestone in this transition as most LIBOR tenors ceased without any significant disruptions. A key focus of this group is to ensure a smooth transition away from the remaining USD LIBOR settings, which will continue until the end of June 2023 to support the run-off of a substantial portion of legacy contracts.

The FSB is also progressing international policy work to enhance cross-border payments. In October 2020, the G20 endorsed a ‘Roadmap’ developed by the FSB, in coordination with the Committee for Payments and Market Infrastructures (CPMI) and other international bodies, to make cross-border payments cheaper, faster, more transparent and more inclusive. The Roadmap includes a set of quantitative global targets for cost, speed, transparency and access in the cross-border payments market, to aid momentum and accountability around overall outcomes. The G20 has asked the FSB to monitor progress, including with respect to the targets, and report annually – the first progress report was provided in October 2021. Reserve Bank staff were involved in the development of the Roadmap, and are participating in a number of international working groups that deal with aspects of the Roadmap work, including an FSB working group assessing the issue of ‘know-your-customer’ and identity information sharing (see below under ‘CPMI’).

Additionally, the FSB is engaged in other ongoing work areas, including enhancing cyber resilience and better reporting of cyber incidents, resolution and crisis management frameworks, and assessing and addressing the risks posed by crypto-assets for financial stability. More broadly – and as was the case with the global financial crisis, the pandemic and now the invasion of Ukraine – the FSB will continue to play a central coordinating role for the G20 in the face of any emerging risks and issues affecting the global financial system in the period ahead.

Bank for International Settlements (BIS)

Purpose

The BIS and its associated committees play an important role in supporting collaboration among central banks and other financial regulatory bodies. They do so by bringing together officials to exchange information and views about the global economy, vulnerabilities in the global financial system and other issues affecting the operations of central banks.

Reserve Bank involvement

The Reserve Bank is one of 63 central banks and monetary authorities holding shares in the BIS. The Governor or Deputy Governor participate in the bimonthly meetings of governors and in meetings of the Asian Consultative Council. The Governor chairs the Committee on the Global Financial System (CGFS), and the Assistant Governor (Financial Markets) is a member of the Markets Committee and the CGFS.

The CGFS seeks to identify potential sources of stress in the global financial system and promotes the development of well-functioning and stable financial markets. The Markets Committee considers how economic and other developments, including regulatory reform and technological change, may affect financial markets, particularly central bank operations.

These committees have been monitoring the challenges for financial systems and markets from the COVID-19 pandemic and the war in Ukraine. They also provide an important means for central banks to share perspectives on the evolving economic recovery and their policy responses. Areas of focus have included: global financial vulnerabilities, including the effects of inflation and monetary tightening on long-term yields, risks to the future resilience of the banking system and the rapid rise in housing prices during the pandemic; liquidity conditions in government bond markets; and the effectiveness of policy measures to support bank lending during the pandemic.

These committees also carried out work on a number of longer term topics through the year. During 2021/22, Reserve Bank staff participated in a number of committee sub-groups, including:

- a CGFS working group on debt and financial stability, examining drivers of aggregate debt and its main trends, the relationship between household and corporate debt and financial stability, and how policymakers can manage risks to financial stability, with the final report published in May 2022

- a CGFS working group examining the use of asset purchases by central banks for monetary policy purposes during the pandemic, and the lessons learned from this experience

- a Markets Committee working group on market functioning, looking at the tools available to central banks to respond to market dysfunction in core local currency markets, the efficacy of those tools in different scenarios and market structures, and their potential benefits and costs

- an Asian Consultative Council study group on foreign exchange markets in the Asia-Pacific region, looking at market monitoring by central banks, the foreign exchange ecosystem and hedging markets, and links between foreign exchange markets, capital flows and domestic financial conditions.

The Reserve Bank also participated in the BIS Innovation Hub’s Project Dunbar. The project developed prototypes for a shared platform that could enable international settlements using digital currencies issued by multiple central banks. In addition, the Reserve Bank co-chairs a BIS Innovation Network working group exploring the application of emerging supervisory and regulatory technologies to common challenges facing member central banks.

Basel Committee on Banking Supervision (BCBS)

Purpose

The BCBS is hosted by the BIS and is the primary international standard-setting body for the banking sector. It provides a forum for regular cooperation on banking supervisory matters among its 28 member jurisdictions. It seeks to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide.

Reserve Bank involvement

The Governor is a member of the Group of Governors and Heads of Supervision, which is the oversight body for the BCBS. The Assistant Governor (Financial System) is a member of the BCBS.

As with other global bodies, the BCBS’s work over the year was a mixture of ongoing work and, in the latter half, monitoring the financial effects of Russia’s invasion of Ukraine. Given its focus on banks, the BCBS has been a key forum for discussing risks to the global banking system arising from the war. Banks’ direct financial exposures to the key countries involved were relatively limited and manageable. The BCBS also examined other channels by which banking systems could be affected by the war, such as through developments in commodity markets, banks’ operational resilience while processing sanctions and dealing with an increase in cyber threats, and risks stemming from a worsening macroeconomic outlook. The Reserve Bank participated in the discussions on these matters, along with the Australian Prudential Regulation Authority (APRA).

Managing climate-related financial risks has been a major focus over the year. In June 2022, the BCBS released principles for both banks’ risk management and supervisors’ practices related to these risks. The principles cover corporate governance, internal controls, risk assessment and management monitoring and reporting.

Following feedback on preliminary proposals, the BCBS is working to finalise the prudential treatment of banks’ crypto-asset exposures around the end of 2022. This work is particularly timely, given the volatility seen in the crypto-asset ‘ecosystem’ around mid-2022 and hence the need to have a global minimum prudential framework to mitigate risks from crypto-assets. Other work areas over the year included possible adjustments to the framework for global systemically important banks and banks’ operational resilience, including the reliance on third- and fourth-party service providers and the need for banks to improve their resilience in the face of cyber threats.

Committee on Payments and Market Infrastructures (CPMI)

Purpose

The CPMI is hosted by the BIS. It serves as a forum for central banks to monitor and analyse developments in payment, clearing and settlement infrastructures, and sets standards for these facilities. The CPMI has 28 member institutions.

Joint working groups of the CPMI and the International Organization of Securities Commissions (IOSCO) bring together members of these two bodies to coordinate policy work on the regulation and oversight of financial market infrastructures (FMIs).

Reserve Bank involvement

Staff from the Payments Policy Department are members of the CPMI, the CPMI-IOSCO Steering Group, the CPMI-IOSCO Implementation Monitoring Standing Group and the CPMI-IOSCO Policy Standing Group.

Staff members from the Payments Policy and Payments Settlements departments are participating in a number of CPMI workstreams contributing to the G20 Roadmap to enhance cross-border payments, including groups looking at improving cross-border payment providers’ access to payment systems, harmonising cross-border payment message formats and data protocols, and exploring issues involved in possible new infrastructure for cross-border payments (such as global stablecoins and central bank digital currencies).

The CPMI published a number of reports during the year to which Payments Policy Department staff contributed. These included reports on how the Principles for Financial Market Infrastructures apply to stablecoins, default management auctions used by central counterparties, and central counterparty access and client clearing arrangements. Staff members also contributed to CPMI-IOSCO implementation monitoring reports.

Cooperative oversight arrangements

Purpose

The Reserve Bank participates in several multilateral and bilateral arrangements to support its oversight of foreign-headquartered FMIs that play an important role in the Australian financial system.

Reserve Bank involvement

Over 2021/22, staff from the Payments Policy Department participated in:

- an arrangement led by the Federal Reserve Bank of New York to oversee CLS Bank International, which provides a settlement service for foreign exchange transactions

- a global oversight college and a crisis management group for LCH Limited, both chaired by the Bank of England

- an information-sharing arrangement with the US Commodity Futures Trading Commission, in relation to CME Inc

- the Society for Worldwide Interbank Financial Telecommunication (SWIFT) Oversight Forum, chaired by the National Bank of Belgium (NBB)

- the Multilateral Oversight Group for Euroclear Bank, chaired by the NBB.

International Monetary Fund (IMF)

Purpose

The IMF oversees the stability of the international monetary system via:

- bilateral and multilateral surveillance, which involves monitoring, analysing and providing advice on the economic and financial policies of its 190 members and the linkages between them; Article IV consultations, which are a key means to do this, are conducted for Australia every year

- the provision of financial assistance to member countries experiencing actual or potential balance of payments problems.

Reserve Bank involvement

Australia holds a 1.38 per cent quota share in the IMF and is part of the Asia and the Pacific Constituency, which is represented by one of the IMF’s 24 Executive Directors. Australia also contributes to the IMF’s supplementary borrowed resources, including the Poverty Reduction and Growth Trust (PRGT). The Reserve Bank supports the Constituency Office at the IMF by seconding an advisor with expertise in economic and financial sector matters; the Bank also works with the Australian Treasury to provide support to the Constituency Office on matters discussed by the IMF’s Executive Board.

During 2021/22, the IMF continued to provide financial assistance to vulnerable member countries to support their recovery from the COVID-19 pandemic. It has also worked to mitigate spillovers from the war in Ukraine. IMF lending at the beginning of the pandemic was largely in the form of emergency financing arrangements that were quickly disbursed and did not have conditionality attached once the funds were lent. Since then, IMF lending has transitioned to longer term programs that are conditional on economic reforms being undertaken by the borrower and precautionary arrangements that can be called upon when needed. In the 12 months to June 2022, 18 non-emergency financing arrangements were approved, with a total value of SDR86.1 billion. This included four precautionary arrangements with a combined value of SDR49.3 billion, a SDR31.9 billion program for Argentina, and 13 other programs with a combined value of SDR4.9 billion. IMF total credit outstanding increased by around 3.9 per cent over 2021/22 to SDR109.2 billion.

As noted above, in August 2021 the IMF made a general SDR allocation worth around US$650 billion to support the global recovery from the pandemic. A general allocation of SDRs is distributed across IMF member countries in proportion to their quota share in the IMF. Australia received SDR6.3 billion (US$8.9 billion at the date of the general allocation). Member countries can exchange their SDRs for ‘hard currency’ such as US dollars. This ‘hard currency’ can then be used as the country chooses – for example, to meet balance-of-payments needs or finance health-related expenditures. The Bank helps to facilitate trade in SDRs via Australia’s voluntary trading arrangement with the IMF (see chapter on ‘Operations in Financial Markets’).

The IMF has also been exploring a number of options for members with strong external positions to channel their SDRs to help support the financing needs of developing or emerging economies. Some members have made pledges to channel SDRs to the IMF’s existing PRGT, which provides concessional financial support to low-income countries. The IMF also agreed in April 2022 to establish a new Resilience and Sustainability Trust (RST), which will provide longer term financing for eligible members to address deeper structural issues that pose risks to prospective balance-of-payments stability. The RST is expected to commence operations later in 2022, and initially will be focused on supporting reforms relating to climate change and pandemic preparedness. The Australian Government has pledged to rechannel SDR1.26 billion to the PRGT and RST lending facilities to support vulnerable countries, which equates to 20 per cent of Australia’s newly allocated SDRs. The government will also lend an additional SDR1.1672 billion (19 per cent of its 2021 allocation) to provide subsidy and reserve resources for these trusts.

The IMF periodically undertakes Financial Sector Assessment Program (FSAP) reviews of its members’ financial systems and regulatory frameworks. The Reserve Bank and other CFR agencies have continued to implement the 2018 FSAP review’s recommendations, as appropriate. This has included work on a resolution regime for clearing and settlement facilities and to strengthen supervisory and enforcement powers. Proposals in this area were provided to the Australian Government by the Bank and the Australian Securities and Investments Commission, as joint regulators for clearing and settlement facilities, before the then Government announced it would proceed with these reforms. The resolution regime would allow the Bank to intervene in a distressed clearing and settlement facility in order to ensure that the facility’s critical services continue to operate. Relevant legislation implementing these changes has yet to be introduced into the Parliament. The IMF also recommended that the Bank formalise its emergency liquidity assistance (ELA) framework. In September 2021, the Bank published guidance on ELA, including its assessment criteria and the expectations towards eligible counterparties applying for ELA. Australia’s next FSAP review is likely to take place in the next few years.

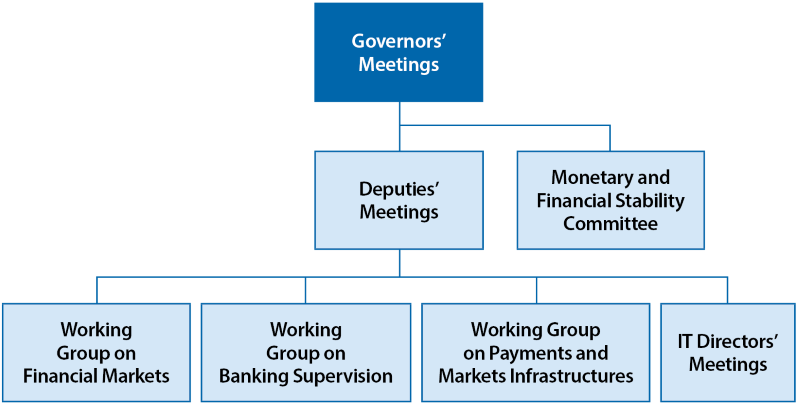

Executives’ Meeting of East Asia-Pacific Central Banks (EMEAP)

Purpose

EMEAP brings together central banks from 11 economies in the east Asia-Pacific region – Australia, China, Hong Kong SAR, Indonesia, Japan, Malaysia, New Zealand, the Philippines, Singapore, South Korea and Thailand – to discuss issues relevant to monetary policy, financial markets, financial stability and payments systems in the region.

Reserve Bank involvement

The Reserve Bank participates in EMEAP, including at the Governor and Deputy Governor levels. In July and August 2021, the Bank chaired the EMEAP Governors’ Meeting and a meeting of EMEAP Governors and Heads of Supervisory Authorities. In 2021/22, the Deputy Governor continued to be the Chair of the EMEAP Monetary and Financial Stability Committee. Staff also participate in the EMEAP Working Groups on Financial Markets, Banking Supervision, and Payments and Market Infrastructures, and in meetings of Information Technology Directors. These groups maintain close relationships with other international institutions, such as the IMF and the BIS, through regular dialogue on topical issues.

EMEAP Governors meet annually to discuss key issues in the region. The 2021 EMEAP Governors’ meeting covered the asynchronous nature of the global recovery, recent COVID-19 outbreaks and developments in financial conditions, inflationary pressures across the region, as well as communication challenges faced by central banks during the pandemic. Governors also meet annually with Heads of Supervisory Authorities in the region to discuss issues related to the financial system. These meetings were chaired by the Reserve Bank via videoconference in July and August 2021.

The EMEAP Monetary and Financial Stability Committee has provided an important forum to discuss current economic and financial market developments and the associated policy challenges for EMEAP members. In 2021/22, the Committee discussed topics including the reopening of member economies following the pandemic, rising inflationary pressures and the tightening in global financial conditions. The Committee met four times in 2021/22.

The Working Group on Financial Markets focuses on the analysis and development of foreign exchange, money and bond markets in the region. Every second meeting of this group is held in conjunction with the BIS Financial Markets Forum. During the year, the group continued its work on developing local currency bond markets, through the Asian Bond Fund Initiative (see chapter on ‘Operations in Financial Markets’). Areas of focus in 2021/22 also included the green bond market in Asia, financial benchmark reform and bond market functioning following the onset of COVID-19.

The Working Group on Banking Supervision (which also includes representatives of EMEAP members’ prudential regulators, including APRA) meets to share information, discuss banking supervision issues and conduct joint work on relevant topics. In 2021/22, the group shared information on financial system and regulatory developments, including on macroprudential policies used during the pandemic and discussed policy matters of interest to members.

The EMEAP Working Group on Payments and Market Infrastructures is a forum for sharing information and experiences relating to the development, oversight and regulation of retail payment systems and FMIs. During 2021/22, discussions in the group focused on a number of issues, including: initiatives to enhance the speed, cost and transparency of cross-border payments; access arrangements for payment systems; market and regulatory developments related to stablecoins and crypto-assets more broadly; and evolving views and research into central bank digital currencies.

The Information Technology Directors’ Meeting provides a forum for discussions on developments in information technology (IT) and its implications for central banks. Topics discussed during 2021/22 included: cybersecurity and cloud adoption; building IT staff capacity and technology support for hybrid workplaces; digital operating models and use of common platforms; and increased investments in data management and governance.

Network for Greening the Financial System (NGFS)

Purpose

The NGFS is a group of central banks and supervisors whose purpose is to share best practices, contribute to the development of climate and environment-related risk management in the financial sector, and mobilise mainstream finance to support the transition towards a sustainable economy. By the end of June 2022, the Network had grown to 116 central banks and supervisors around the world.

Reserve Bank involvement

The Reserve Bank joined the NGFS in July 2018. Over 2021/22, the Bank actively participated in a number of workstreams, which published reports throughout the year. In November 2021, the Reserve Bank and APRA released a joint NGFS pledge that outlined the actions they are taking to ensure that financial institutions and the Australian financial system are prepared to respond to the financial risks of climate change.

One key contribution of the NGFS is the development of climate scenarios. These scenarios are intended to provide a common starting point for analysing climate risks to the economy and the financial system, and facilitate globally consistent analysis of risks by regulators and firms. In October 2021, the NGFS produced a report that surveyed members’ recent experiences in using climate scenarios to assess climate-related risks in their own jurisdictions. APRA’s Climate Vulnerability Assessment (CVA) was one example featured in the report. The Reserve Bank has assisted APRA with the elements of the CVA, which seeks to assess the nature and extent of the financial risks that large banks in Australia may face due to climate change.

The NGFS produced several other reports in 2021/22, including: an assessment of progress made by supervisors on integrating climate-related and environmental risks into their supervisory frameworks; an overview of trends in climate-related litigation and ways to address associated risks; a guide on climate-related disclosure for central banks; a report on enhancing market transparency in green and transition finance; a study on how climate-related risks are reflected in credit ratings from a monetary policy perspective; and a summary of efforts to quantify potential credit risk differentials between green and non-green assets and activities.

Global Foreign Exchange Committee (GFXC)

Purpose

The GFXC brings together central banks and private sector participants in the wholesale foreign exchange market. The GFXC promotes a robust and liquid market. One means by which it does this is through the maintenance of the FX Global Code as a set of principles of good practice for market participants.

Reserve Bank involvement

The Reserve Bank sponsors the Australian Foreign Exchange Committee (AFXC) – one of the 20 regional committees that comprise the membership of the GFXC. The Assistant Governor (Financial Markets) is Chair of the AFXC and the Bank’s representative on the GFXC. Former Deputy Governor Guy Debelle’s term as Chair of the GFXC ended in December 2021.

An updated version of the FX Global Code was published in mid-2021. Since that time, the GFXC has focused on publicising and explaining the Code changes to industry participants and encouraging firms to renew their Statement of Commitment to the Code. The Bank renewed its Statement of Commitment to the Code in December 2021. The Committee has also continued to discuss evolving trends in foreign exchange settlement methods and ways for participants to reduce their settlement risk.

Organisation for Economic Co-operation and Development (OECD)

Purpose

The OECD is an international organisation of 38 countries that promotes policies to improve the economic and social wellbeing of people worldwide. It provides a forum in which governments can work together to share experiences and seek solutions to the economic, social and governance challenges they face.

Reserve Bank involvement

On behalf of the Australian Treasury, the Reserve Bank’s Chief Representative in Europe participates in the OECD’s Committee on Financial Markets and the Advisory Task Force on the OECD Codes of Liberalisation.

The OECD Committee on Financial Markets examines a range of financial market issues and aims to promote efficient, open, stable and sound financial systems, based on high levels of transparency, confidence and integrity, so as to contribute to sustainable and inclusive growth. Key focus areas for the Committee in 2021/22 were: environmental, social and governance (ESG) investment and climate transition risks; the economic and financial impact of the war in Ukraine; and the provision of financing to small and medium-sized enterprises from marketplace lending platforms. The Committee also continued to review and contribute to the OECD’s work on blockchain, asset tokenisation, digitalisation and financial literacy.

The OECD’s Codes of Liberalisation promote the freedom of cross-border capital movements and financial services. In particular, the Codes provide a balanced framework for countries progressively to remove barriers to the movement of capital, while providing flexibility to cope with situations of economic and financial instability. The Advisory Task Force meets to address questions and discuss policy issues related to the Codes, and examines specific measures by individual adherents with relevance to their obligations under the Codes.

Technical cooperation and bilateral relations

Australia Indonesia Partnership for Economic Development (Prospera)

The Bank participates in the Australian Government’s ‘Prospera’ Program to build up the capacity of institutions in Indonesia. Under the Prospera Program, the Reserve Bank engages with Bank Indonesia on a broad range of activities undertaken by central banks. In 2021/22, Reserve Bank staff met with Bank Indonesia staff to discuss issues relating to the digitalisation and automation of cash management, accounting treatment of central bank foreign exchange transactions, and lessons from the Reserve Bank’s digital transformation program.

Engagement in the South Pacific

The Reserve Bank fosters close ties with South Pacific countries through participation in high-level meetings, staff exchanges and the provision of technical assistance across a wide range of central banking issues.

In November 2021, the Reserve Bank attended the annual meeting of the South Pacific Central Bank Governors. The Governors discussed recent economic and financial developments and the work under way to jointly develop a regional electronic ‘know-your-customer’ (eKYC) facility to support the provision of remittances services to the South Pacific. The Governors held an additional meeting in June 2022 to discuss the final report from the steering committee for the eKYC Project. It was determined that South Pacific central banks will each prioritise developing strategies for their own national eKYC capability. The development of a regional eKYC facility may be considered as a possible extension of national eKYC capabilities in the future.

The Reserve Bank also provides financial support for an officer of the Bank of Papua New Guinea to undertake postgraduate studies in economics, finance or computing at an Australian university. This support is provided via the Reserve Bank of Australia Graduate Scholarship, which was first awarded in 1992. The most recent scholar completed studies at the University of Queensland in July 2020 and has since returned to Papua New Guinea. The continuing COVID-19 pandemic has delayed selection of the next scholar; however, the Reserve Bank and the Bank of Papua New Guinea intend to resume the program as soon as practicable and are aiming for the second half of 2022.

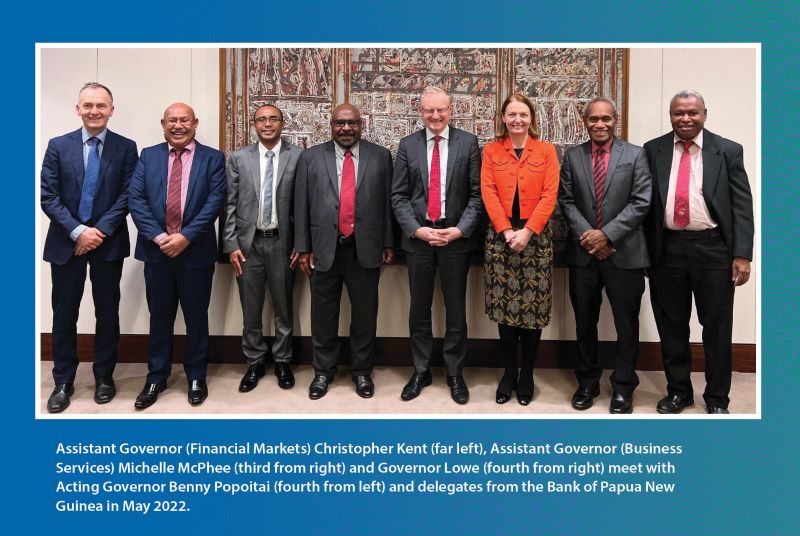

International visitors and secondments

The COVID-19 pandemic continued to hamper international visits to the Reserve Bank throughout the year, but they have slowly resumed in 2022. A delegation from the Bank of Papua New Guinea in May 2022 was the first international delegation welcomed since the start of the pandemic, and two scholars (also from Papua New Guinea) visited the Bank under the auspices of the Archer Leadership Program in June.

Over 2021/22, the Bank hosted secondees from the Bank of England and Reserve Bank staff were seconded to other central banks and international organisations, including the Bank of England, the IMF and the BIS. These arrangements facilitate a valuable exchange of skills and expertise between the Bank and the broader global economic and financial policymaking community.

Endnotes

SDRs are an international reserve asset used to settle transactions between countries and help balance international liquidity. As part of the global policy response to address the economic challenges associated with the COVID-19 pandemic, in August 2021 the IMF allocated around US$650 billion worth of SDRs to its members. This provided a significant boost to global liquidity and allowed scope for the SDR reallocation goal agreed by the G20. [1]

The Framework Working Group helps to implement the G20’s ‘Framework for Strong, Sustainable and Balanced Growth’. [2]