Reserve Bank of Australia Annual Report – 2023 2.6 Communication and Community Engagement

The Reserve Bank is committed to being open, transparent and accountable in all its communication. Staff work to understand community priorities and concerns across Australia and, in turn, explain the Bank’s policies and decisions. Our engagement with the community occurs in a number of ways, including via a longstanding regional and industry liaison program, public appearances and community dinners, social media, roundtables and a public education program. Staff also consult with businesses, consumer groups and payments industry participants on issues in payments policy. The Bank communicates its policy decisions, and the context in which these are made, through publications and speeches. It appears before parliamentary committees, responds to public enquiries, supports academic research, publishes a broad range of statistics, and operates a museum where visitors can discover the history of Australia’s banknotes and economic development.

Publications and speeches

The Reserve Bank’s communication about its policy decisions, analysis and operations is primarily through publications, media releases and speeches. Announcements about monetary policy decisions are made shortly after each Reserve Bank Board meeting and minutes are released two weeks later. A media release is likewise published following each Payments System Board meeting, outlining issues discussed at the meeting and foreshadowing any documents to be released by the Bank.

Public appearances provide an opportunity for the Governor, Deputy Governor and other senior staff to communicate the Bank’s analysis of economic and financial developments and how they have influenced monetary policy decisions. During 2022/23, the Governor spoke at nine public events to update the community on monetary policy and other issues and to answer questions from the audience. The Governor also spoke at a media and markets briefing in April 2023, following the release of the Review of the Reserve Bank, to provide an initial response to the Review and to answer questions on this topic.

Audio recordings of each address made by the Governor and Deputy Governor continue to be broadcast live, including the question-and-answer sessions with participants. Transcripts of these are then published on the Bank’s website. Live-streamed video recordings of most speeches have also been made available on the Bank’s website since April 2023.

During 2022/23, the Governor, Deputy Governor and other senior staff gave 27 public speeches. These were on various topics, including monetary policy, the changing economic outlook, payments, a central bank digital currency (CBDC) and climate change. Senior staff also participated in public panel discussions and a number of parliamentary hearings.

The Bank explains its analysis through a number of regular publications:

- the quarterly Statement on Monetary Policy provides information about the Bank’s assessment of current economic and financial conditions, along with the outlook for economic activity and inflation in Australia

- the semi-annual Financial Stability Review provides a detailed assessment of the condition of Australia’s financial system and potential risks to financial stability

- the quarterly Bulletin contains analysis of a broad range of economic and financial issues, as well as aspects of the Bank’s operations; during 2022/23, 34 articles were published in the Bulletin.

The Reserve Bank continues to publish new and refreshed content on its website. A new homepage was introduced in 2022/23 to improve the user experience and visibility of the Bank’s work. Followers of the Bank’s social media accounts on Twitter, LinkedIn, Facebook and Instagram grew to over 230,000 during the year, an increase of 23 per cent; the number of subscribers to our email alert service for publications grew by almost 20 per cent to around 17,200. Visitors to the website also made use of the RSS feeds, which provide alerts about data updates, media releases, speeches, research papers and other publications, including those related to Freedom of Information requests.

Regional and industry liaison

The Reserve Bank’s regional and industry liaison team operates from four state offices around Australia (in Adelaide, Brisbane, Melbourne and Perth) and the Bank’s Head Office in Sydney. Liaison staff meet regularly with businesses and associations from all sectors of the economy, as well as governments and community organisations, across the country, including in regional areas. Around 930 liaison meetings were conducted in 2022/23.

Beyond the state office cities, liaison staff made in-person visits to Tasmania, Darwin, East Arnhem Land and a number of other regional centres during 2022/23. In addition, the embedding of hybrid work and supporting technology at the Bank allowed for a higher level of contact with areas outside the major cities. The visits to East Arnhem Land and Darwin were part of the Bank’s Reconciliation Action Plan commitment to increase our understanding of the economic conditions faced by First Nations businesses around Australia. Liaison staff also interviewed First Nations contacts as part of research that underpinned establishment of the Reserve Bank’s First Nations Advisory Panel (see Chapter 3.2 Our People).

Timely information provided by liaison contacts helps the Bank to monitor trends in the Australian economy and in specific industries in real time. This is especially valuable when assessing the effect of unusual events such as the COVID-19 pandemic, natural disasters and the current episode of high inflation. De-identified high-level, thematic information about economic conditions from liaison is regularly shared with the Reserve Bank Board to better inform members’ understanding of the issues affecting businesses and the wider economy, and in turn the Board’s policy decision-making.[1]

Broad messages from liaison are also communicated to the public through the Bank’s regular statements and publications, and through speeches by senior staff.[2] In 2022/23, liaison information informed discussions on the recovery in the Australian tourism sector, challenges faced by the construction sector, developments in electricity markets, the softening in retail spending, the availability of labour and the factors influencing wages growth. In November 2022, the Bank began publishing a dedicated Box in the Statement on Monetary Policy, titled ‘Insights from Liaison’, which reports on the high-level liaison messages collected each quarter.

Staff in the state offices play an important role in the Bank’s communication with members of the public, as they are well positioned to hold discussions with a broad cross-section of the community. In 2022/23, state office staff presented at schools, business roundtables and regional chambers of commerce. In addition, Bank employees presented summaries of the Statement on Monetary Policy and the Financial Stability Review to more than 450 participants in the liaison program.

The Bank convened its annual Small Business Finance Advisory Panel in July 2023. The Panel, which was established in 1993, discusses issues relating to the provision of finance and the broader economic environment for small businesses. Membership is drawn from a range of industries across the country. An article drawing on the Panel’s discussions and other sources of information on small business finance appeared in the September 2023 Bulletin.[3] The liaison program also meets with representatives from the small business sector throughout the year to better understand the economic conditions they face.

Consultations and public enquiries

The Reserve Bank maintains engagement with a wide variety of groups to inform its policy and operational activities. Senior staff meet regularly with representatives of various domestic and international official agencies, business groups and financial market participants to discuss economic, financial and industry developments.

The Governor, Deputy Governor and senior staff meet four times a year with panels of market economists and academics, to gain their insights on monetary policy and the economy. The Bank met with the panel of academics in September 2022 and April 2023, and with the panel of market economists in October 2022 and May 2023. Each panel included around a dozen participants.

In June 2023, the Bank published an issues paper seeking feedback from relevant stakeholders on some options for further enhancing the competitiveness, efficiency and safety of Australia’s debit card market. The key issues related to the default network routing arrangements of dual-network debit cards and the tokenisation of debit cards for online transactions.

In August 2022, the Bank published the conclusions paper from the Review of Banknote Distribution Arrangements, which began in November 2021. The paper set out various policy actions in response to stakeholder feedback that will improve transparency and flexibility in the distribution arrangements and preserve the high quality of banknotes in circulation.[4] More details are provided in Chapter 2.4 Banknotes.

Throughout the year, staff from Payments Settlements Department conducted regular liaison meetings with RITS members and industry groups, such as the Australian Payments Network (AusPayNet). Staff also participated in various industry forums, including AusPayNet’s High Value Clearing System Management Committee. A senior staff member sits on the Board of AusPayNet, and staff from the Payments Settlements and Banking departments represent the Bank on New Payments Platform operating committees. Participation in these groups, and a number of other industry forums, helps the Bank to remain well informed about developments in these areas and to contribute to innovations in the banking and payments industry.

The Bank sponsors and provides the secretariat to the Australian Foreign Exchange Committee (AFXC), a member committee of the Global Foreign Exchange Committee (GFXC). During 2022/23, the AFXC sought to ensure the adoption of the updated FX Global Code within the Australian market and contributed to further materials developed by the GFXC to promote wider adherence to the Code (see Chapter 2.5 International Financial Cooperation).

During the year, the Bank received approximately 6,000 public enquiries on a broad range of topics, including monetary policy, the economy, financial markets and regulation of the payments system. Responses were provided to the majority of these enquiries. Staff from Note Issue Department continued their engagement with industry and members of the public in support of counterfeit resistance and banknote functionality testing (see Chapter 2.4 Banknotes).

Research

The Reserve Bank publishes the results of longer term research conducted by staff in the form of Research Discussion Papers (RDPs), which stimulate discussion and comment on policy-relevant issues. The views expressed in RDPs are those of the authors and do not necessarily represent those of the Bank. During 2022/23, 11 RDPs were published on a range of topics, including monetary policy, housing prices, low wages growth and bank profitability. Bank staff also published their research in various external journals, including the Journal of Applied Econometrics, Macroeconomic Dynamics and the Journal of Business and Economic Statistics.

Research undertaken at the Bank is frequently presented at external conferences and seminars. In 2022/23, Bank staff presented both in person and virtually at several conferences and institutions in Australia and abroad. These included the Public Sector Economists Conference, Western Economics Association International, RBA ABS, MQBS-e61 Big Data Workshop and the BoJ-IMES Conference.

The Reserve Bank co-hosted a conference with the Australian Bureau of Statistics in May 2023. Both the RBA Annual Conference and the annual Quantitative Macroeconomic Workshop are scheduled to be held in the second half of 2023.

Throughout the year, the Bank hosted policymakers from various domestic and overseas institutions, including the International Monetary Fund, the Bank of England and the Federal Reserve Bank of New York. The Bank also hosted academics from a range of institutions, including the University of Maryland, Harvard University, Dartmouth College, the University of Western Australia and the University of Melbourne. International presenters of note included Mathias Drehmann, Head of Secretariat, Markets Committee at the Bank for International Settlements, David Vines, Professor of Economics at Oxford University, Damjan Pfajfar, Group Manager, Monetary Studies Section at the Federal Reserve Board and Michael McMahon, Professor of Economics at Oxford University.

During 2022/23, the Bank collaborated with the Digital Finance Cooperative Research Centre on a research project to explore use cases for a CBDC in Australia. The project involved the modest issue of a CBDC on a trial basis that could be used by industry participants to understand the potential role for CBDC. A white paper was published in September 2022, which explained the objectives and approach of the project and invited industry participants to make submissions of CBDC use cases. A number of submissions were subsequently selected to participate in the project, which took place from March to July 2023. A report on the findings from the project was published in August.[5] This work is part of ongoing research by the Bank into the policy case for a CBDC.

In 2022/23, the Bank continued its financial support of:

- a monthly survey of inflation expectations, undertaken by the Melbourne Institute of Applied Economic and Social Research at the University of Melbourne

- a quarterly survey of union inflation and wage expectations undertaken by the Australian Council of Trade Unions

- the International Journal of Central Banking, which seeks to disseminate first-class, policy-relevant and applied research on central banking and to promote communication among researchers both inside and outside central banks

- the Group of 30’s program of research into issues of importance to global financial markets

- the Australian Research Council Centre of Excellence in Population Ageing Research (CEPAR), based at the University of New South Wales; a senior official of the Bank also sits on CEPAR’s Advisory Board

- the Economic Society of Australia’s Central Council via renewing its sponsorship for a further three years, which will help to build and strengthen the profession and the debate on economic issues

- a number of conferences in economics and closely related fields, including: the University of New South Wales’ Australasian Finance and Banking Conference; the University of Western Australia’s PhD Conference in Economics and Business; the Workshop of the Australasian Macroeconomic Society hosted by the University of Sydney; the University of Melbourne’s Melbourne Money and Finance Conference; the University of Sydney’s Banking and Financial Stability Conference; Edith Cowan University’s National Indigenous Business Summer School; and the Economic Society of Australia’s Australian Conference of Economists, Australian Gender Economics Workshop and Women in Economics Network Retreat.

In addition, in 2022/23 the Bank renewed its corporate membership of the American Australian Association, the Centre for Independent Studies, the Committee for Economic Development of Australia, the Ethics Alliance, the McKell Institute, the Lowy Institute for International Policy and the South Australian Centre for Economic Studies. The Bank also provided in-kind support for the Grattan Institute by seconding a staff member to the Institute during the year. The Bank continued its associate membership of the South East Asian Central Banks Research and Training Centre.

In conjunction with the Australian Prudential Regulation Authority (APRA), the Reserve Bank continued to sponsor the Brian Gray Scholarship Program, which was initiated in 2002 in memory of a former senior staff member of the Bank and APRA. Two scholarships were awarded under this program in 2022, at a total cost of $15,000. More recently, four new recipients were announced by APRA in July 2023. The Bank is also sponsoring a PhD student under the Digital Finance Cooperative Research Centre’s industry PhD program, at a cost of $38,500 in 2022/23.

The total value of support provided for research in 2022/23 was $485,405.

Education

An important part of the Bank’s community engagement is our relationship with students and educators. The Bank has a dedicated team coordinating the efforts of staff across the Bank to deliver a public education program. While the program focuses on economics education at senior high school, activities are also undertaken for different stages of learning, ranging from senior primary school through to university. The program is delivered nationally, both in person and online.

The Bank has a longstanding commitment to economics education. Increased efforts in recent years have been motivated by the falling size and diversity of the economics student population as this weighs on economic literacy in the community and the longer term health of the discipline. Nationally, the number of Year 12 students studying economics has fallen by around 70 per cent since the early 1990s, with fewer schools (particularly government schools) offering economics. Over the same period, there has been a significant and related fall in diversity among economics students, with lower participation by females and students from schools that are culturally diverse or located in lower income areas. A similar pattern is evident in economics enrolments at university. In response, the Bank has provided practical support by creating accessible resources that are aligned with curricula, giving presentations to students and offering professional development opportunities to educators. The Bank has also been conducting research to guide the education program and evaluate its effectiveness.

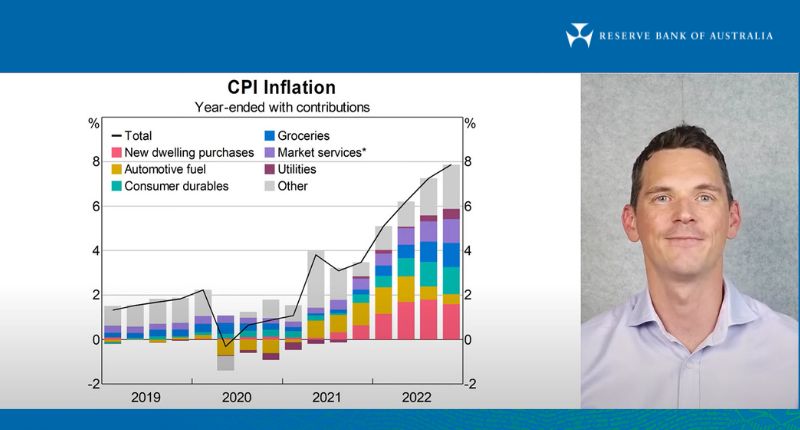

The main feature of the education program is the delivery of talks to students by the Reserve Bank’s Ambassadors (nearly 50 Bank economists who are trained to engage directly with students). Talks are given to individual classes (in person and online) as well as at multi-school events in the form of webinars and in-person student conferences. Topics range from explanations of monetary policy, economic concepts and current economic conditions through to the benefits of studying economics. In total, nearly 8,000 students were reached during 2022/23, of whom around 7,000 were high school students. Furthermore, using online delivery, the program’s geographic reach continued to expand, including to remote and regional areas. To complement the talks to students, the program publishes videos on current economic conditions, including after each quarterly Statement on Monetary Policy.

Over the past year, the public education team expanded the school talks series to include more talks for students in middle high school. The intention is to introduce them to economics (as part of their commerce or business-related studies), so that they might choose economics in senior high school or university. These talks are accompanied by additional resources for teachers, particularly those who are less familiar with teaching economics.

In recognition of an important change in recent economic conditions, a new Explainer on the causes of inflation was added to the Bank’s suite of 24 Explainers on economic concepts, which are linked to curricula and most of which have accompanying videos. The Explainers are widely viewed by both education audiences and the public (with over 2.5 million page views in the past three years). The various Explainers about inflation were the most viewed in 2022/23.

While Explainers are the key resource to support economic literacy, a new Econ-essentials suite of animations was introduced for senior primary and junior high school students to explain core economic principles, including ‘What is money?’, ‘What is an economy?’ and ‘What affects the value of money?’. These are designed to engage younger students with the essential ideas of economics that they may recognise in the world around them or later in their formal study of the subject.

In terms of the advocacy of economics, Ambassadors participated in various panel discussions to explain the benefits of studying economics and the career paths it can provide. Some of these discussions were filmed for use by educators to assist students with subject selection and career planning.

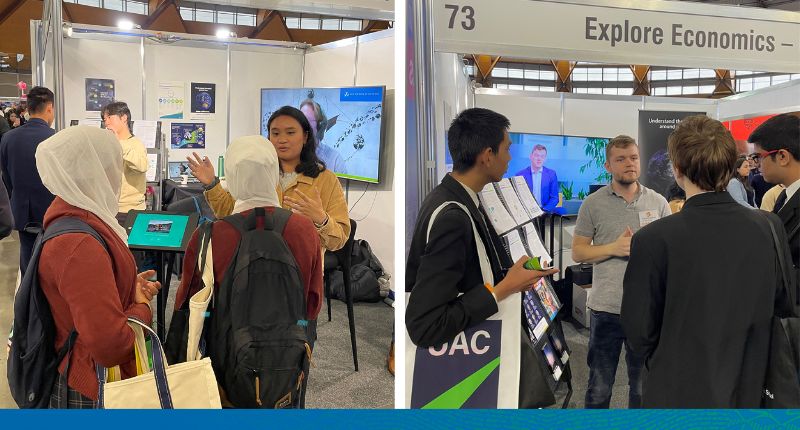

Bank staff participated in large-scale careers fairs throughout the year, which were attended by over 40,000 students, along with teachers and parents. These fairs allowed the Bank to engage directly with students. Around 1,400 substantive discussions were conducted with individual students about their subject and career choices.

The Bank continued to support educators through professional development activities. In 2022/23, an in-person teacher immersion event was held, which included addresses by the Governor and Deputy Governor and was attended by teachers from across the country. The Bank also offered educators a ‘topical talk’ – that is, a lecture on a topic about which teachers face challenging queries from students – on digital assets, focusing on CBDC. Key sessions of all Bank-hosted professional development activities were filmed and made available on the Bank’s website. In addition, staff presented at various professional development events hosted by peak teaching bodies and other education service providers.

Further research continued to be undertaken to shape the strategic direction of the public education program and evaluate its effectiveness. Over the past year, research focused on economic literacy and diversity.[6] To complement the qualitative research on economic literacy, a survey was conducted of 3,000 Australian adults in a first attempt to measure their economic literacy.

The Educators Advisory Panel – which comprises external education experts who advise on the Bank’s public education program – met three times during the year to review the education program’s progress and the future needs of students and educators.

Museum

The Reserve Bank’s Museum has traditionally housed a permanent collection of artefacts related to the history of currency in Australia and hosted periodic exhibitions. However, the Museum has been closed for an extended period, owing initially to the pandemic and then to the renovation of the Bank’s Head Office. Consequently, the Museum has shifted to sharing its collections virtually, including via online presentations and new digital displays.

With the passing of Queen Elizabeth II, there was high visitation of a revised online exhibition that depicted her representation on each Australian banknote series issued during her reign (titled ‘Queen Elizabeth II’); the exhibition illustrated both the continuity and progressive change in the design of the nation’s banknotes.[7] With the announcement that a new $5 banknote would include a design to represent the culture and history of First Nations peoples, there was also significant visitation of the online exhibition ‘First Nations Peoples and Australian Banknotes’.[8]

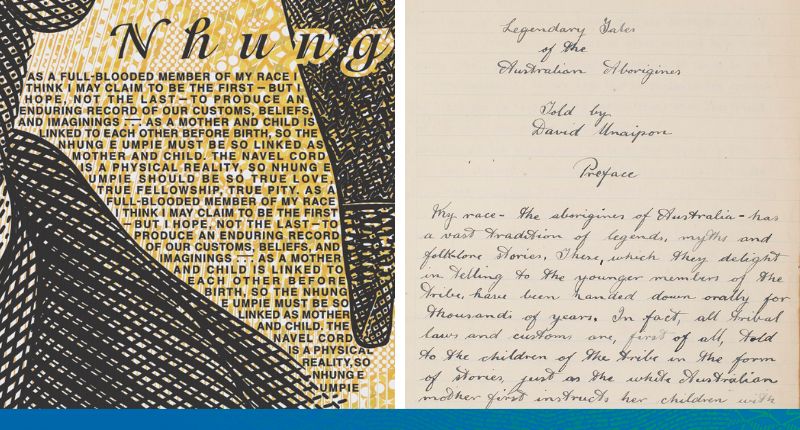

During the year, a new online feature was published, called ‘Portraits of Value’. This explores the history of banknote portraiture and illustrates the portraits of significant Australians, by significant artists, that have appeared on the nation’s banknotes over the past century.[9] It explains that while the current Next Generation Banknotes (issued 2016–2020) incorporates highly sophisticated technology in their design and security features, the portraits are still drawn by hand.

The Museum also launched a series of animations aimed at children, introducing the people on Australia’s banknotes.[10] Titled ‘On the Money’, each animation describes how the identity overcame adversity to make a major contribution to the country. The first episode describes the transformation of Francis Greenway from convict to the rank of first government architect, responsible for creating the colony’s new built environment.

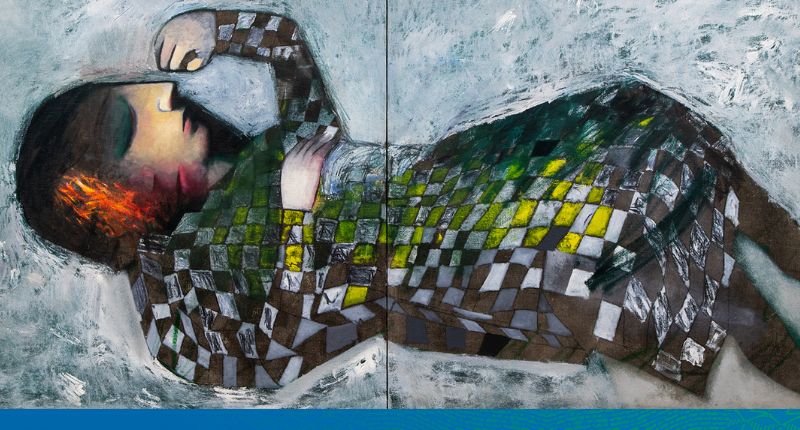

Among other parts of the Museum’s collection, an ‘Introduction to the Coombs Collection of Australian Paintings’ was published,[11] presenting the Reserve Bank’s art collection as a cultural legacy. It also documents the active support and promotion of Australian art by the Bank’s first Governor, Dr HC Coombs, and continued by his successor, Sir John (Jock) Phillips. As a new national institution, the Bank conveyed a sense of modernity and progress in its architecture and art, and its collection remains a rich source for understanding both the nation’s artistic heritage and the history of its central bank. The collection is complemented by a comprehensive online catalogue of the artworks in the Bank’s digital archive, Unreserved.[12]

Archives

The Reserve Bank has a unique and rich archives collection, containing records on the Bank’s own operations as well as Australia’s economic, financial and social history over nearly 200 years. The Bank has been digitising its archival records and progressively releasing them to the public through the digital archive, Unreserved.[13] Unreserved enables users to independently browse, research and download digital versions of archival records, learn about the nature and scope of the Bank’s archival collection, and lodge requests for information or assistance from the archivists. Since the launch of Unreserved in March 2021, there have been nearly 49,000 views of volumes of records, individual records and collection items via this platform.

Two additional tranches of digitised records were released during the past year. These included:

- Coombs Release: records and collection items relating to Dr HC ‘Nugget’ Coombs who was Governor of the Commonwealth Bank and the Reserve Bank from 1949–1968

- Coombs Collection of Australian Paintings: digitised images of artworks acquired chiefly from the 1950s to the mid-1970s by Dr Coombs and his successor Sir John (Jock) Phillips, along with details of their provenance

- Research Department: the early economic analysis conducted by the central bank over the period 1918 to 1979, including RDPs written between 1969 and 1978 and specification of the Reserve Bank forecasting model

- Advertising Department: materials produced by the Bank between 1913 and 1959 to promote awareness of the Bank and its services to the public, including the Bank’s internal staff magazines Bank Notes and Currency

- Mid-Century Photographs: new photographs dating from the 1950s and 1960s that capture snapshots of daily life at the Bank.

To showcase the value of the archival records, a Bulletin article on the career of Dr HC Coombs was published in December 2022.[14] It was accompanied by a corresponding Research Guide on Dr Coombs, which directs users to the records not previously in the public domain in support of original research.[15]

The Reserve Bank Archives continued to provide public access to Bank records in the open access period (20 years from the closure of a record). While there has been some disruption to the Archives repositories due to the Head Office building works, the level of service to the public has been maintained. This has been supported by the ongoing digitisation of archival records and active use of the Bank’s secure external collaboration tool, RBA Box, which allows records to be sent to researchers quickly and efficiently.

Over the past year, the Archives dealt with over 130 research requests, entailing more than 400 hours of research by the archivists. Topics of interest included historical aspects of Reserve Bank Board meetings, the exchange control functions of the Bank, unissued banknote designs, Dr Coombs and the Economic Society of Australia, along with photographs of Bank branches in regional areas of Australia.

The archivists continued to support the Bank’s Historian, Associate Professor Selwyn Cornish of the Australian National University, who is documenting the Bank’s official history between 1975–2000.

Banknotes

The Reserve Bank actively engages with a range of stakeholders spanning the entire lifecycle of banknotes, from design and planning through to manufacturing and public usage.

The Bank’s communication with the cash-handling industry – which includes equipment manufacturers, financial institutions and other high-volume cash handlers – is an important part of ensuring Australian banknotes remain secure and reliable. In 2022/23, staff continued to support the industry in ongoing research and development, as well as equipment upgrades to maintain confidence against counterfeiting. It is estimated there are over half a million pieces of banknote-handling equipment in Australia – including ATMs, self-service checkouts, gaming machines and vending. Staff also attended industry events and delivered presentations to share information about Australian banknotes and the program of industry engagement.

As noted in Chapter 2.4 Banknotes, the Bank made the decision to remove the image of the reigning monarch from the $5 banknote. A redesigned $5 banknote will feature a new design that honours the culture and history of First Nations peoples on one side; the Australian Parliament will continue to feature on the reverse. A program of work is being developed to support this change, which will place consultation with First Nations peoples at the centre of the design process. Design and production are expected to take a number of years.

Charitable activities

During 2022/23, the Reserve Bank made its 21st annual contribution of $50,000 to the Financial Markets Foundation for Children, which is chaired by the Governor. In September 2023, the Governor will deliver his seventh address to the Anika Foundation’s annual event to raise funds to support research into adolescent depression and suicide. This will be the 18th such event supported by the Bank.

The Reserve Bank supports several staff-led charitable initiatives, key among which is dollar-matching staff payroll deductions organised by the Reserve Bank Benevolent Fund. The Fund supports 14 recognised charities, chosen based on the preferences of staff, the effectiveness and transparency of the charities themselves, and in order to support a diverse range of activities. The current set of charities supported operate in the areas of welfare, education, mental health, illness, disability, international medical aid and animal protection. The Bank also facilitates staff salary sacrificing under a Workplace Giving Program. Dollar-matching of staff payroll deductions totalled $137,006 in 2022/23.

Other staff-led initiatives over the year included matching staff donations for the Benevolent Fund’s Christmas appeal for Foodbank Australia and Barnados Australia, and providing volunteer leave for teams which provide their time to charitable activities.

The Bank’s total contribution to charitable activities, including these and other modest one-off donations, totalled $199,431.

Endnotes

See Dwyer J, K McLoughlin and A Walker (2022), ‘The Reserve Bank‘s Liaison Program Turns 21’, RBA Bulletin, September. [1]

See, for example, Bruno A, K Davis and A Staib (2022), ‘The Recovery in the Australian Tourism Industry’, RBA Bulletin, December. [2]

Chan P, A Chinnery and P Wallis (2023), ‘Recent Developments in Small Business Finance and Economic Conditions’, RBA Bulletin, September. [3]

See RBA (2022), ‘Review of Banknote Distribution Arrangements: Conclusions Paper’, August. [4]

See RBA and DFCRC (2023), ‘Australian CBDC Pilot for Digital Finance Innovation’, August. [5]

See McCowage M and J Dwyer (2022), ‘Economic Literacy: What Is It and Why Is It Important?’, RBA Bulletin, December; Dwyer J (2022), ‘A Matter of Diversity’, Guest Lecture at Macquarie University, Sydney, 28 September. [6]

RBA Museum, ‘Queen Elizabeth II’. [7]

RBA Museum, ‘First Nations Peoples and Australian Banknotes’. [8]

RBA Museum, ‘Portraits of Value’. [9]

RBA Museum, ‘On the Money’. [10]

RBA Museum, ‘Introduction to the Coombs Collection of Australian Paintings’. [11]

RBA, ‘Series Guide: The Coombs Collection of Australian Paintings’, Unreserved. [12]

RBA, ‘Unreserved’. [13]

Cornish S (2022), ‘HC Coombs: Governor of Australia’s Central Bank 1949−1968’, RBA Bulletin, December. [14]

RBA, ‘Research Guide: Dr Herbert Cole Coombs’, Unreserved. [15]