Reserve Bank of Australia Annual Report – 2023 2.5 International Financial Cooperation

The Reserve Bank participates in international efforts to address the challenges facing the global economy and financial system. It does so through its membership of global and regional forums and its bilateral relationships with other central banks. Over the past year, the war in Ukraine, inflationary pressures and macroeconomic policy settings continued to be at the forefront of international discussions on the global economic and financial outlook. Risks to financial stability, including from the stress that emerged in parts of the global banking system in early 2023, were also in focus. Work continued throughout the year on a range of financial sector issues, including regulation and oversight of crypto-assets and stablecoins, addressing financial risks arising from climate change and non-bank financial intermediation, and enhancing cross-border payments.

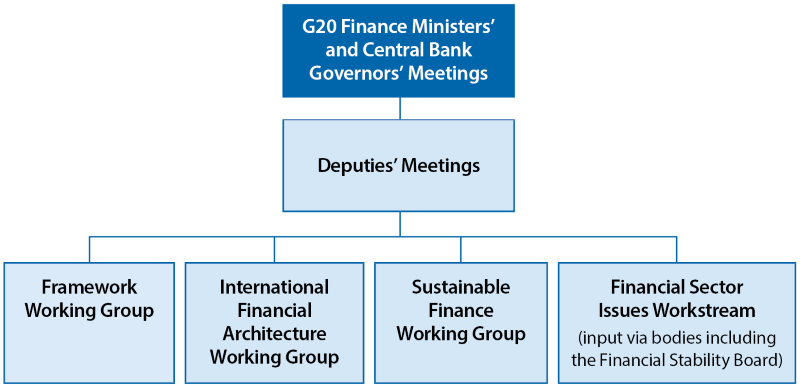

Group of Twenty

Purpose

The Group of Twenty (G20) serves as a key forum for members to discuss major risks to the economic outlook, share experiences on economic and financial policy measures, and explore ways to address global challenges collectively. It was chaired by Indonesia from December 2021 to November 2022, and has been chaired by India since December 2022.

Reserve Bank involvement

The Governor and Assistant Governor (Economic) represent the Bank at high-level meetings of the G20, while other staff participate in G20 working groups and contribute to the G20’s work on financial sector issues.

Reserve Bank staff participated in three G20 working groups during 2022/23:

- The Framework Working Group focused on identifying and monitoring risks to the economic outlook, including: the macroeconomic impacts of climate change and transition pathways; the macroeconomic consequences of food and energy insecurity; inflationary pressures; and financial instability.

- The International Financial Architecture Working Group focused on polices to strengthen support for vulnerable countries, including for multilateral development banks to expand their lending capacity and improving the G20’s Common Framework for Debt Treatments.

- The Sustainable Finance Working Group addresses barriers to financing climate and sustainability goals. Focus areas over the past year included: policies to promote finance for climate and transition goals; finance for the Sustainable Development Goals; and capacity building to support sustainable development financing.

A key goal of the G20 is to address emerging risks to the global financial system. This entails close engagement between G20 countries and relevant international bodies, including the Financial Stability Board (FSB) and the Basel Committee on Banking Supervision (BCBS). Recent international discussions focused on the causes of, and lessons from, the banking stresses in March 2023. Work is now underway to assess where elements of the global regulatory framework for the banking system could be strengthened. In addition, the G20 and the FSB, working with relevant global bodies, continued ongoing work to enhance the resilience of the global financial system. Key areas over 2022/23 included addressing vulnerabilities in non-bank financial intermediation, mitigating climate-related financial risks, regulation and supervision of crypto-assets (including ‘stablecoins’) and enhancing cross-border payments. As discussed below, the Reserve Bank and other agencies on the Council of Financial Regulators (CFR) are involved with aspects of this work. This reflects the CFR’s mandate to promote financial system stability and to support effective and efficient financial regulation.

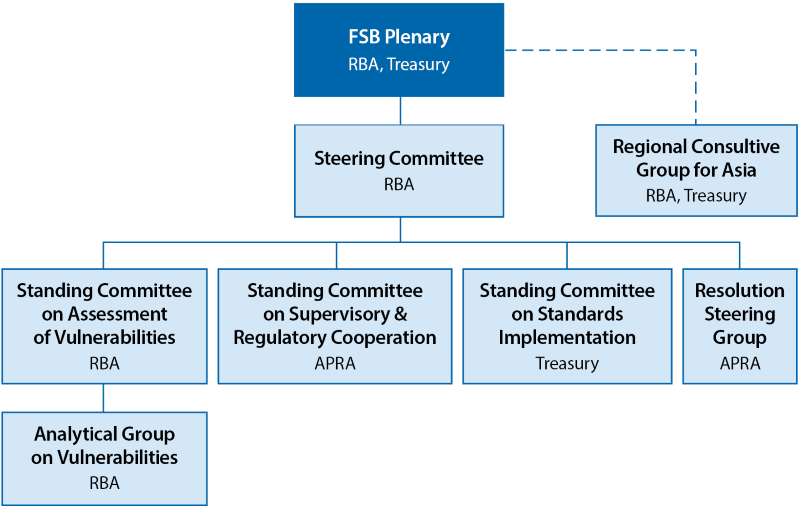

Financial Stability Board

Purpose

The FSB promotes international financial stability by coordinating national financial sector authorities and international standard-setting bodies as they develop strong regulatory, supervisory and other financial sector policies. It also plays a central role in identifying and assessing evolving global trends and risks.

FSB members include representatives from 24 economies and the main international financial institutions – including the Bank for International Settlements (BIS) and the International Monetary Fund (IMF) – and standard-setting bodies such as the BCBS.

Reserve Bank involvement

The decision-making body of the FSB is the Plenary. The Governor is a member of the Plenary, and of the Steering Committee and the Standing Committee on Assessment of Vulnerabilities (SCAV).

Senior Bank staff also participate in meetings of various FSB groups, including the Analytical Group on Vulnerabilities, which supports the work of the SCAV, and the Official Sector Steering Group.

As stresses emerged in parts of the global banking system in early 2023, the FSB discussed evolving developments, risks and the policy actions being taken by jurisdictions. Over 2022/23, the FSB also continued its ongoing work to address vulnerabilities in the global financial system, key elements of which are set out below.

The SCAV is the main FSB body for identifying and assessing risks in the global financial system. A recent focus of this work has been non-bank financial institutions (NBFIs), including their use of leverage and the role of liability-driven investment strategies in the pensions sector. The SCAV also coordinates early warning exercises with the IMF, which consider scenarios that, while unlikely, may be highly disruptive to the functioning of the global financial system.

Over 2022/23, the FSB advanced its Roadmap for Addressing Climate-Related Financial Risks across several areas. In November 2022, the FSB and the Network for Greening the Financial System (NGFS), which the Bank is also a member of, jointly released a report on scenario analyses undertaken by member financial authorities to assess climate-related financial risks. Another key element of the Roadmap is strengthening the monitoring and mitigation of climate-related vulnerabilities, by domestic authorities, firms and the FSB itself. The Bank participates in a SCAV working group, developing common and consistent metrics for climate-related exposures and risks, to improve comparability of climate scenario analysis outputs across FSB jurisdictions.

The Reserve Bank participated in a number of other FSB groups during 2022/23, including:

- The Financial Innovation Network, which monitors and assesses the financial stability implications of financial innovation, including financial technology. Recent focus areas have included crypto-assets, decentralised finance, and the role of technology in the stickiness of bank deposits.

- The Non-bank Monitoring Experts Group, which publishes an annual report assessing NBFI trends, and the risks these may pose. This work is part of a long-standing FSB focus, intensified over recent years, to address vulnerabilities in the non-bank financial sector.

- The Cross-border Crisis Management Group for Financial Market Infrastructures (a sub-group of the Resolution Steering Group), which works on resolution arrangements for central counterparties (CCPs). Recent work has focused on the tools and financial resources available for CCP resolution.

- A country peer review of Switzerland. FSB country reviews focus on the implementation and effectiveness of regulatory, supervisory or other financial sector policies in a member jurisdiction. A report is due in December 2023.

- The Official Sector Steering Group, which has coordinated the transition away from the London Inter-Bank Offered Rates (LIBOR) towards alternative interest rate benchmarks. With the end of the USD LIBOR panel at the end of June 2023, the new reference rate landscape is in place. The FSB will continue to monitor the reference rate environment with the benefit of insights from the International Organization of Securities Commissions (IOSCO).

Throughout the year, the FSB continued to progress the international policy work required to enhance cross-border payments. In October 2020, the G20 endorsed a ‘Roadmap’ for this area of work, which was developed by the FSB in coordination with the Committee on Payments and Market Infrastructures (CPMI) and other international bodies. The Roadmap includes a set of quantitative global targets, to be achieved by 2027, to make cross-border payments cheaper, faster, more transparent and more inclusive. Reserve Bank staff have been participating in a number of international working groups responsible for aspects of the Roadmap (as discussed below), including an FSB working group dealing with data-related issues in cross-border payments. In early 2023, the FSB released a revised plan of priority actions that shift the focus of the Roadmap from analytical work at the international organisations to the implementation of specific initiatives, including by individual countries. The Bank is currently undertaking several key actions to encourage the adoption of new functionality and messaging capabilities for cross-border payments over coming years, in consultation with Australian industry participants and regulatory agencies.

One of the FSB’s key priorities under the current Indian G20 presidency has been the development of an effective global regulatory framework for crypto-assets. The FSB’s final recommendations in this area, including for stablecoins, were released in July 2023. Enhancing cyber resilience was also a particular focus over the year, and in April 2023 the FSB issued recommendations to achieve greater convergence in cyber incident reporting and a proposed common format for reporting and exchanging information about such incidents.

Bank for International Settlements

Purpose

The BIS and its associated committees support collaboration among central banks and other financial regulatory bodies by bringing together officials to exchange information and views about the global economy, vulnerabilities in the global financial system and other issues affecting the operations of central banks.

Reserve Bank involvement

The Reserve Bank is one of 63 central banks and monetary authorities that hold shares in the BIS. The Governor or Deputy Governor participates in the bimonthly meetings of governors and in meetings of the Asian Consultative Council. In 2022/23, Governor Lowe chaired the Committee on the Global Financial System (CGFS) and was on the Advisory Committee of the BIS Innovation Hub. The Assistant Governor (Financial Markets) is a member of the Markets Committee and the CGFS.

The CGFS seeks to identify potential sources of stress in the global financial system and promotes the development of well-functioning and stable financial markets. The Markets Committee considers how economic and other developments, including regulatory reform and technological change, affect financial markets, particularly central bank operations. These committees provide an important means for central banks to share perspectives on the evolving economic and financial landscapes and their policy responses.

Over the year, the committees monitored the challenges posed by the rapid tightening of monetary policy. Other areas of focus included vulnerabilities of NBFIs to rising interest rates and the incorporation of climate risks into asset prices.

During 2022/23, Reserve Bank staff participated in a number of committee sub-groups, including:

- A CGFS working group examining the use of asset purchases by central banks for monetary policy purposes during the pandemic, and the lessons learned from this experience. The final report was published in May 2023.[1]

- A CGFS study group that took stock of the recent experience with macroprudential measures targeting housing markets, including policy effectiveness. The study group will deliver a report later in 2023 that aims to be a practical handbook for managing housing-related risks to macrofinancial stability.

- An Asian Consultative Council working group examining how central banks and other financial authorities in the Asia-Pacific region have operated their macrofinancial stability frameworks to mitigate the impacts of inflation, tight global financial conditions and rising macrofinancial vulnerabilities since late 2021.

The Bank is also part of a new BIS Asia Climate Network, which was established in February 2023 to provide a regional perspective on climate-related issues. In 2023 so far, the Network has held discussions on sustainable finance taxonomies and climate-related considerations for monetary policy. In addition, the Bank co-chairs a BIS Innovation Network working group exploring the application of emerging supervisory and regulatory technologies to common challenges facing member central banks.

Basel Committee on Banking Supervision

Purpose

The BCBS is hosted by the BIS and is the primary international standard-setting body for the banking sector. It provides a forum for regular cooperation on banking supervisory matters among its 28 member jurisdictions. It seeks to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide.

Reserve Bank involvement

The Governor is a member of the Group of Governors and Heads of Supervision, which is the oversight body for the BCBS. The Assistant Governor (Financial System) is a member of the BCBS.

During 2022/23, the BCBS continued its work to strengthen global banking sector standards and assess the implementation of these standards by its members. Following the emergence of stress in parts of the global banking system in March 2023, the BCBS provided a key forum for members, including the Reserve Bank and the Australian Prudential Regulation Authority (APRA), to discuss developments, risks and related policy responses. The BCBS has since undertaken to examine the lessons arising from the episode, building on existing initiatives already underway. This includes work on strengthening the effectiveness of supervision, liquidity risk management and interest rate risk in the banking book. The BCBS noted that the Basel III reforms implemented to date, including in Australia, which led to stronger capital and liquidity levels, helped shield the global banking system and real economy from a more severe banking crisis.

Throughout the year, the BCBS drew attention to the need for banks and supervisors to remain vigilant to the evolving global outlook. In particular, many borrowers face financial pressures in the environment of higher interest rates and inflation, lower growth and geopolitical tensions.

In December 2022, the BCBS published its prudential treatment for banks’ exposures to crypto-assets. While such exposures are relatively low at present, the standard aims to provide a robust and prudent global regulatory framework that promotes responsible innovation while preserving financial stability. The BCBS also further advanced its climate-related work over the year, in particular the development of a Pillar 3 framework requiring disclosure of bank exposures to climate-related financial risks. A consultation paper on the proposed framework will be released by the end of 2023. The BCBS continued work to identify and assess emerging risks and vulnerabilities to the global banking system. Other work related to the ongoing digitalisation of finance, a major review of its Core Principles for Effective Banking Supervision, and monitoring, implementing and evaluating the Basel III framework.

Committee on Payments and Market Infrastructures

Purpose

The CPMI is hosted by the BIS. It serves as a forum for central banks to monitor and analyse developments in payment, clearing and settlement infrastructures, and sets standards for these facilities. The CPMI has 28 member institutions.

Joint working groups of the CPMI and IOSCO bring together members of these two bodies to coordinate policy work on the regulation and oversight of financial market infrastructures (FMIs).

Reserve Bank involvement

Reserve Bank staff are members of the CPMI, the CPMI-IOSCO Steering Group, the CPMI-IOSCO Implementation Monitoring Standing Group, the CPMI-IOSCO Policy Standing Group and CPMI workstreams contributing to the G20 Roadmap to enhance cross-border payments.

The CPMI published a number of reports during the year to which Reserve Bank staff contributed. These included reports on: CCP practices to address non-default losses; margin practices and margin dynamics in commodity markets; facilitating increased adoption of payment versus payment; harmonisation requirements for cross-border payments; aligning payment system operating hours; and multilateral platforms for cross-border payments. Staff members also contributed to the CPMI-IOSCO implementation monitoring report on FMI cyber resilience.

Cooperative oversight arrangements

Purpose

The Reserve Bank participates in several multilateral and bilateral arrangements to support its oversight of foreign-headquartered FMIs that play an important role in the Australian financial system.

Reserve Bank involvement

Over 2022/23, staff from the Payments Policy Department participated in:

- an arrangement led by the Federal Reserve Bank of New York to oversee CLS Bank International, which provides a settlement service for foreign exchange transactions

- a global oversight college and a crisis management group for LCH Limited, both chaired by the Bank of England

- an information-sharing arrangement with the US Commodity Futures Trading Commission, in relation to CME Inc

- the Society for Worldwide Interbank Financial Telecommunication (SWIFT) Oversight Forum, chaired by the National Bank of Belgium (NBB)

- an information-sharing arrangement with the Commission de Surveillance du Secteur Financier, Banque Centrale du Luxembourg and the Australian Securities and Investments Commission (ASIC) in relation to Clearstream Banking

- an information-sharing arrangement with the Reserve Bank of New Zealand, the NZ Financial Markets Authority and ASIC

- the Multilateral Oversight Group for Euroclear Bank, chaired by the NBB.

International Monetary Fund

Purpose

The IMF oversees the stability of the international monetary system by:

- monitoring, analysing and providing advice on the economic and financial policies of its 190 members and the linkages between them; Article IV consultations are a key mechanism for achieving this and are conducted for Australia every year

- providing financial assistance to member countries experiencing actual or potential balance of payments problems.

Reserve Bank involvement

Australia holds a 1.38 per cent quota share in the IMF and is part of the Asia and the Pacific Constituency, which is represented by one of the IMF’s 24 Executive Directors. Australia also contributes to the IMF’s supplementary borrowed resources, including the Poverty Reduction and Growth Trust and the Resilience and Sustainability Trust (RST). The Reserve Bank supports the Constituency Office at the IMF by seconding an advisor with expertise in economic and financial sector matters and by working with the Australian Treasury to provide support on matters discussed by the IMF’s Executive Board.

During 2022/23, the IMF continued to provide financial assistance to vulnerable member countries. In the 12 months to June 2023, 34 new financing arrangements were approved, with a total value of SDR53.2 billion. This included three precautionary arrangements with a combined value of SDR18.1 billion and a SDR11.6 billion program for Ukraine. Established in April 2022, the RST provides longer term financing to help address deeper structural issues that pose risks to prospective balance of payments stability, including climate change and pandemic preparedness. The IMF approved eight lending programs under this new facility in 2022/23, with a combined value of SDR2.8 billion, all focused on climate change.

The Australian Government directed just under 40 per cent of the SDRs that Australia received in the IMF’s general SDR allocation in 2021 to the RST (and other IMF lending facilities) to help support vulnerable countries.

As part of its review of Australia in 2018 under the Financial Sector Assessment Program, the IMF recommended CFR agencies implement a resolution regime for clearing and settlement facilities and strengthen supervisory and enforcement powers. Legislation implementing these changes is being prepared.

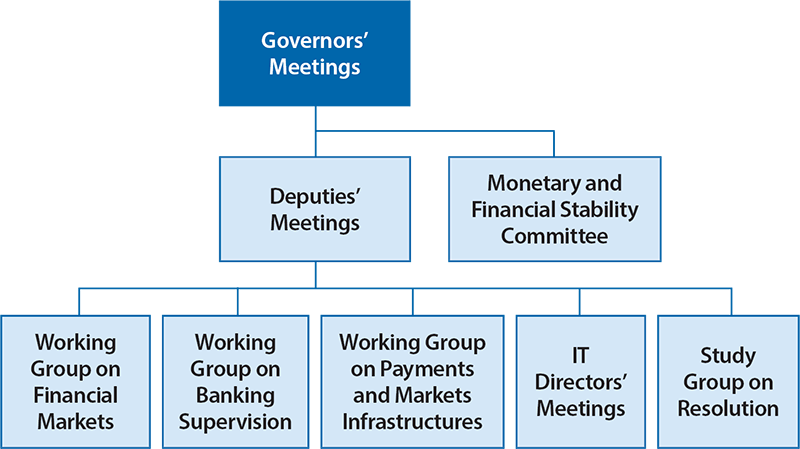

Executives’ Meeting of East Asia-Pacific Central Banks

Purpose

The Executives’ Meeting of East Asia-Pacific Central Banks (EMEAP) brings together central banks in the east Asia-Pacific region to discuss issues relevant to monetary policy, financial markets, financial stability and payment systems. Its members are Australia, China, Hong Kong SAR, Indonesia, Japan, Malaysia, New Zealand, the Philippines, Singapore, South Korea and Thailand.

Reserve Bank involvement

The Reserve Bank participates in EMEAP, including at Governor and Deputy Governor level. In November 2022, the Bank chaired the EMEAP Deputy Governors’ Meeting. Staff also participate in the EMEAP Working Groups on Financial Markets, Banking Supervision, and Payments and Market Infrastructures, the Study Group on Resolution and in meetings of Information Technology Directors.

EMEAP Governors meet annually to discuss key issues in the region. The 2022 EMEAP Governors’ meeting covered the impact of policy rate increases in major advanced economies, the sustainability of the ongoing regional economic recovery, inflationary pressures across the region and potential sources of regional vulnerability. Governors also meet annually with heads of supervisory authorities in the region to discuss issues related to the financial system.

The EMEAP Monetary and Financial Stability Committee provides an important forum to discuss current economic and financial market developments and the associated policy challenges for EMEAP members. In 2022/23, the Committee discussed topics including the impact of recent banking turmoil in the United States and Switzerland, regional inflationary pressures, the outlook for growth and developments in cross-border payment systems. The Committee met twice in 2022/23.

The Working Group on Financial Markets focuses on the analysis and development of foreign exchange, money and bond markets in the region. During the year, the group continued its work on developing local currency bond markets, through the Asian Bond Fund Initiative (see Chapter 2.2 Operations in Financial Markets). The green bond market in Asia continued to be an area of focus in 2022/23.

The Working Group on Banking Supervision (which also includes prudential regulators, with APRA attending from Australia) meets to share information, discuss banking supervision issues and conduct joint work on relevant topics. In 2022/23, the group shared information on financial system and regulatory developments, including lessons learnt from the stress in parts of the global banking system in March 2023. The group also shared information on macroprudential policies and climate-related financial risks, including on how jurisdictions conduct scenario analysis and on differing approaches to supervising and assessing climate risk.

The EMEAP Working Group on Payments and Market Infrastructures is a forum for sharing information and experiences relating to the development, oversight and regulation of retail payment systems and FMIs. During 2022/23, discussions focused on: initiatives to strengthen the operational resilience of payment systems and FMIs; interlinking fast payment systems across countries; market and regulatory developments in relation to stablecoins; the future of cash and access to cash services; and evolving views and research into central bank digital currencies.

The Study Group on Resolution is a forum for central banks, resolution authorities and deposit insurers to share knowledge in relation to practical and technical resolution matters in a cross-border context.

The Information Technology Directors’ Meeting provides a forum for discussions on developments in IT and its implications for central banks. Topics discussed during 2022/23 included: cybersecurity and cloud adoption; incident reduction; building IT staff capacity and technology support for hybrid workplaces; digital operating models and use of common platforms; and increased investments in data management and governance.

Trans-Tasman Council on Banking Supervision

Purpose

The Trans-Tasman Council on Banking Supervision (TTBC) provides a platform for cooperation and information sharing between the respective regulators of the banking sectors in Australia and New Zealand. It supports the development of a single economic market in banking services and promotes a joint approach to trans-Tasman banking supervision that delivers a seamless regulatory environment. It considers issues relating to financial stability, efficiency and integration throughout the financial sector, with a particular focus on the banking system and bank supervision, including crisis preparedness.

TTBC membership is comprised of the CFR agencies, the New Zealand Treasury, the Reserve Bank of New Zealand and the New Zealand Financial Markets Authority.

Reserve Bank involvement

The Reserve Bank is represented on the TTBC by the Governor and Assistant Governor (Financial System).

Over the year, the TTBC considered matters related to trans-Tasman bank supervision and regulation, climate risks to the financial system and developments in cybersecurity and crypto assets. The TTBC discussed economic conditions and housing markets in Australia and New Zealand, noting the challenges faced by the economies, including high inflation and rising interest rates. TTBC members continued to collaborate in relation to cybersecurity events and have been reviewing the potential for harmonisation of regulation and supervision in relation to cyber risk.

Network for Greening the Financial System

Purpose

The purpose of the NGFS is to share best practices, contribute to the development of climate and environment-related risk management in the financial sector, and mobilise mainstream finance to support the transition towards a sustainable economy. At the end of June 2023, membership included 127 central banks and supervisors.

Reserve Bank involvement

The Reserve Bank joined the NGFS in July 2018. Over 2022/23, the Bank participated in several workstreams.

A key contribution of the NGFS is the development of climate scenarios. These scenarios provide a common starting point for analysing climate risks to the economy and the financial system. The Reserve Bank participates in the workstream on scenario design and analysis, which published the joint FSB-NGFS ‘Climate Scenario Analysis by Jurisdictions: Initial Findings and Lessons’.[2] Over 2022/23, the Bank also participated in workstreams on monetary policy, net zero for central banks, the task force on nature-related financial risks and the expert group on legal issues.

Global Foreign Exchange Committee

Purpose

The Global Foreign Exchange Committee (GFXC) brings together central banks and private sector participants in the wholesale foreign exchange market to promote a robust and liquid market. It does this in part through the maintenance of the FX Global Code, which is a set of principles of good practice for market participants.

Reserve Bank involvement

The Reserve Bank sponsors the Australian Foreign Exchange Committee (AFXC) – one of the 20 regional committees that comprise the membership of the GFXC. The Assistant Governor (Financial Markets) is Chair of the AFXC and the Bank’s representative on the GFXC.

Throughout 2022/23, the GFXC focused on developing tools and related material to simplify adherence to the FX Global Code for those market participants with less complex activities. It also continued to discuss evolving trends in foreign exchange settlement methods and ways to measure the amount of settlement risk within the market more accurately.

Organisation for Economic Co-operation and Development

Purpose

The Organisation for Economic Co-operation and Development (OECD) is an international organisation of 38 countries that promotes policies to improve the economic and social wellbeing of people worldwide. It provides a forum in which governments can work together to share experiences and seek solutions to the economic, social and governance challenges they face.

Reserve Bank involvement

On behalf of the Australian Treasury, the Reserve Bank’s Chief Representative in Europe participates in the OECD’s Committee on Financial Markets and the Advisory Task Force on the OECD Codes of Liberalisation.

The OECD Committee on Financial Markets examines a range of financial market issues and aims to promote efficient, open, stable and sound financial systems, based on high levels of transparency, confidence and integrity, so as to contribute to sustainable and inclusive growth. Key focus areas in 2022/23 were: environmental, social and governance investment and climate transition risks; the economic and financial impact of the war in Ukraine; developments in the digitalisation of financial assets; and financial literacy.

The OECD’s Codes of Liberalisation promote the freedom of cross-border capital movements and financial services. In particular, the Codes provide a balanced framework for countries to progressively remove barriers to the movement of capital, while providing flexibility to cope with situations of economic and financial instability. The Advisory Task Force meets to address questions and discuss policy issues related to the Codes and examines specific measures by individual adherents with relevance to their obligations under the Codes.

Technical cooperation and bilateral relations

The Reserve Bank provides technical assistance to foreign central banks. While the Bank’s technical cooperation activities focus on capacity building in the areas of monetary policy and financial stability, its scope extends to other areas of central banking, including payment systems, note issue operations and risk management. In 2022/23, the Reserve Bank assisted the central banks of a number of countries, including those in South America, south-east and central Asia and eastern Europe. The Bank also participates in the Australian Government’s ‘Prospera’ Program to help build the capacity of government institutions in Indonesia.

Engagement in the South Pacific

The Reserve Bank fosters close ties with South Pacific countries through participation in high-level meetings, staff exchanges and the provision of technical assistance across a wide range of central banking issues.

In November 2022, the Bank participated in the annual meeting of the South Pacific Central Bank Governors. The Governors discussed recent economic and financial developments and the challenges presented by de-risking and the loss of correspondent banking relationships in the region.

At a June 2022 meeting of the South Pacific Central Bank Governors it was decided that South Pacific central banks will each prioritise developing strategies for their own national electronic ‘know-your-customer’ (eKYC) capability, with the development of a regional eKYC facility to be considered in the future. To help to support this work, in 2022/23 the Reserve Bank worked with two South Pacific central banks to organise eKYC workshops in their national capitals. These workshops involved participation from a range of local financial institutions and public sector agencies, as well as multinational organisations working on KYC or national identity initiatives in the region.

Since 1992, the Reserve Bank has provided financial support for Bank of Papua New Guinea officers to undertake postgraduate studies in economics, finance or computing at an Australian university. At the request of the Bank of Papua New Guinea, these funds will be reallocated to support secondments of Bank of Papua New Guinea officers to the Reserve Bank. The aim of this new program is to support the development and ‘on-the-job learning’ of officers from the Bank of Papua New Guinea.

International visitors and secondments

International visits to the Reserve Bank increased towards pre-pandemic levels in 2022/23. These visits covered the full range of the Bank’s activities and included delegations from countries in the Asia-Pacific region.

During the past year, the Bank hosted secondees from the Bank of England. In turn, Reserve Bank staff were seconded to other central banks and international organisations, including the Bank of Canada, the Bank of England, the IMF and the BIS. These arrangements provide a valuable opportunity for the exchange of skills and expertise between the Bank and the broader global economic and financial policymaking community.