November 2025

Technology Investment and AI: What Are Firms Telling Us?

Information technology investment by Australian firms has grown strongly over the past decade. A key question is how these technologies are shaping and may continue to shape the Australian economy in the future. We surveyed more than 100 medium–large firms from a range of industries in the RBA liaison program to understand how technology investments are affecting their operations, including their labour productivity and hiring decisions. The results suggest that surveyed firms anticipate these investments, particularly in artificial intelligence tools, to be labour-saving and productivity-enhancing over the long term. Firms also expect to see a substantial transformation of the types of roles and skills needed in the future. Importantly, evidence suggests that the labour-creating effects of past technologies have generally outweighed the labour-replacing effects in aggregate. Firms highlighted that there is considerable uncertainty around the extent and timing of these effects and emphasised that the main barriers to enhancing their productivity over recent years have been the regulatory environment and the ability to access suitable labour.

October 2025

- Download the complete Bulletin October 2025 2.95MB

Small Business Economic and Financial Conditions

The economic environment has improved for small businesses over the past year, although conditions remain subdued. Survey measures of business conditions and confidence have improved but remain weaker for small businesses than for large businesses. Most small businesses remain profitable and many have reportedly supported margins by implementing cost-saving initiatives. While small businesses continue to report challenges in obtaining finance on terms that suit their needs, access to finance appears to have improved over the past year. Credit has become cheaper, with variable lending rates for small businesses declining by a little more than the cash rate this year. Credit has also become more readily available to small businesses, including credit that is unsecured or secured by non-physical assets. This has been driven in part by stronger competition in the business lending market. This article discusses recent trends in economic and financial conditions for small businesses, drawing on insights from the Reserve Bank’s 33rd Small Business Finance Advisory Panel and recent liaisons with lenders focused on the small business lending market.

A New Measure of Job Searchers for Australia

The RBA’s assessment of spare capacity in the labour market incorporates the signal from a broad suite of indicators. The ratio of job vacancies to unemployed persons, which attempts to assess the imbalance between unmet labour demand and the labour supply available to meet this demand, is a standard measure of spare capacity in the labour market. One shortcoming of this measure is that it implicitly assumes that job vacancies are only filled by the unemployed. In practice, job vacancies are also filled by other job searchers who may be outside the labour force or searching on the job. This article describes the construction and characteristics of a more comprehensive measure of job searchers (the Searchers Index) that considers both the unemployed and those who are not classified as being unemployed. The Searchers Index allows us to construct an alternative measure of spare capacity (the vacancies-to-searchers ratio), which exhibits different properties to the vacancies-to-unemployed ratio. The vacancies-to-searchers ratio will be included in the suite of indicators that we monitor to assess spare capacity in the labour market moving forward.

The Global Energy Transition and Critical Minerals

Australia is a key producer of some of the critical minerals that are likely to play an important role in the energy transition away from fossil fuels. Global demand for these minerals could grow significantly over the long term if the transition towards lower emissions progresses. This would support growth in the Australian production of these minerals, potentially increasing their relative importance to the domestic economy. However, this outlook is uncertain and depends on a range of factors such as the speed of the global energy transition, the relative take-up of different technologies and potential development of new technologies, global prices and the competitiveness of domestic production. In the near term, based on projects currently underway and announced, growth in production is likely to remain subdued, though new policy announcements may provide support for investment.

Building Interest in Economics: The Role of Early Exposure

The RBA’s 2024 student survey finds that students across New South Wales continued to view the field of economics as relevant and beneficial to society; however, perceptions of the study of Economics in Years 11 and 12 remained less favourable. New insights from the 2024 survey highlight the role of early exposure to Economics through the Years 7–10 Commerce elective, particularly following the introduction of a core economics topic into the 2019 Commerce syllabus. This early engagement is associated with greater student interest, confidence and understanding of Economics. Notably, the largest improvements were observed for students from lower socio-economic backgrounds, who are under-represented in Economics. These findings suggest that an increased focus on efforts to give more Years 7–10 students the opportunity to engage with Economics could help to broaden participation and improve perceptions of the subject among a more diverse cohort of Years 11–12 students.

July 2025

- Download the complete Bulletin July 2025 2.3MB

A (Closer to) Real Time Labour Quality Index

One explanation that has been put forward for weakness in productivity growth over the past few years is the entry of less experienced or less educated workers to the strong labour market. However, existing labour ‘quality’ statistics that capture such dynamics use delayed information and so can be hard to interpret in real time. To address this problem, we used microdata sources to construct a timely version of the existing labour quality statistics. In doing so, we found evidence that labour quality has actually increased strongly since the COVID-19 pandemic and supported growth in market sector productivity over recent years. While initial work suggests that standard approaches may miss some relevant dimensions of human capital, such as time outside employment, these do not appear substantive enough to overturn the main findings.

International Students and the Australian Economy

International students play a significant role in the Australian economy. They contribute to demand through their spending on goods and services and are an important source of labour for some Australian businesses. This article shows that international students tend to add more to demand in the economy than they do to supply in the short run, in large part reflecting their spending on tertiary education fees. In periods of large swings in international student numbers or when the economy has little spare capacity, this means that changing international student numbers can affect macroeconomic outcomes, particularly in sectors of the economy where supply cannot respond quickly. The rapid growth in international student numbers post-pandemic likely contributed to high inflation over this period, but was not a major driver.

How Do Changes in Global Shipping Costs Affect Australian Inflation?

Australia’s experience during the COVID-19 pandemic showed that developments in international shipping can have a significant effect on domestic inflation. This is because higher global shipping costs can flow through the supply chain for imports and increase costs for Australian firms, who can in turn pass on those higher costs to consumers. This article addresses the question of when and how unexpected changes in global shipping costs have tended to pass through to Australian consumer price inflation since 2003. It finds that the pass-through to ‘shippable’ goods inflation can be material, and that shocks to global shipping costs were large enough to have contributed materially to trimmed mean inflation during the pandemic. That said, there is substantial uncertainty around the estimated pass-throughs, particularly because excluding the pandemic period leads to much smaller and less precise estimates of the pass-through to trimmed mean inflation.

April 2025

- Download the complete Bulletin April 2025 2.2MB

How Useful are ‘Leading’ Labour Market Indicators at Forecasting the Unemployment Rate?

The RBA draws on a wide range of information to form our assessment of current labour market conditions and our outlook for the labour market. One of the key labour market indicators that the RBA monitors and forecasts is the unemployment rate. This article considers whether information contained in indicators that are typically viewed as signalling a change in conditions before it becomes apparent in the official labour market statistics – referred to here as ‘leading indicators’ – are helpful in forecasting the unemployment rate. It finds that information contained in measures of unmet demand, such as job advertisements and vacancies, and consumers’ expectations for unemployment are useful in informing the RBA’s near-term forecasts for the unemployment rate. Models containing these leading indicators can complement our existing framework for forecasting the unemployment rate, which also considers information such as developments in economic activity, insights from firms in the RBA’s liaison program and the experience of economies overseas.

Monetary Policy Transmission through the Lens of the RBA’s Models

Understanding how changes in the cash rate affect economic activity and inflation – so-called monetary policy transmission – is important for the RBA in pursuing its objectives of price stability and full employment. This article explains how the RBA uses its core models of the Australian economy to estimate the overall effects of policy, explore the different channels through which monetary policy transmits, and consider the economic outlook under alternative paths for monetary policy. The findings highlight that: the peak effect of policy is likely to occur after around one to two years; the exchange rate acts as an important transmission channel for policy; housing is a sensitive part of economic activity; and although individual households’ cashflow can be sensitive to changes in the cash rate, in aggregate it plays a smaller role in transmission.

Bank Funding in 2024

Bank funding costs are important in the transmission of monetary policy as they are a key determinant of the rates that households and businesses pay on loans. Bank funding costs increased only modestly in 2024, largely because the cash rate remained unchanged. The composition of banks’ funding shifted towards deposits over the same period, continuing a trend seen since the global financial crisis. Banks also managed the final maturities of the Term Funding Facility, issuing wholesale debt into favourable funding conditions. This article updates previous research published by the RBA on developments in the composition and costs of banks’ funding.

January 2025

- Download the complete Bulletin January 2025 4.7MB

Access to Cash in Australia

Cash plays an important role in the community as a means of payment, store of value and a backup to electronic payment methods. Because of this, the RBA places a high priority on Australians continuing to have reasonable access to cash services. Since 2017, the closure of bank branches and bank-owned ATMs has led to increased distances to access cash services provided by banks, particularly in regional and remote areas. However, despite the significant reduction in bank-owned cash access points since 2017, the distance that most Australians have to travel to reach the nearest cash withdrawal point has not changed markedly in recent years. This is mainly because of the strong geographic coverage of Bank@Post and independently owned ATMs. As the number of locations where people can access cash has declined, some communities are vulnerable to a further withdrawal of cash services.

Bank Fees in Australia

This article updates RBA analysis of bank fees charged to Australian households, businesses and government. Over the year to June 2024, the value of total fees increased by around 5 per cent – the first increase in seven years. Fee income from households increased by 10 per cent, mainly reflecting fee income from credit cards and personal loans. A modest rise in fee income from housing loans also contributed. Fees charged to businesses and governments rose modestly due to growth in lending and an increase in fees charged on deposit accounts. Fees from merchant customers for providing payment processing services were unchanged after declining strongly over the previous four years. As a share of assets and deposits, fee revenue remained stable at a relatively low level.

Where Have All the Economics Students Gone?

The size and diversity of the economics student population has declined sharply since the early 1990s, raising concerns about economic literacy in society and the long-term health of the economics discipline. Interest in studying economics at university is low, even for those who studied economics in Year 12. This article investigates what students are choosing to study at university – if not economics – using new microdata from the Universities Admissions Centre. While Year 12 economics students tend to enrol in economics at university at much higher rates than other students, they are more likely to study a commerce and finance or arts and social science course than an economics course. Possible initiatives to increase the flow of high school students into university economics include tailored advocacy to emphasise the connections between economics and other preferred fields of study, and a greater focus on encouraging students to study economics subjects within a commerce and finance degree. It may also be worth exploring whether any lessons can be applied from initiatives to promote the take-up of STEM (Science, Technology, Engineering, Mathematics) courses, given the relative rise in enrolments in those subjects over recent years.

An Update on the Household Cash-flow Channel of Monetary Policy

The household cash-flow channel refers to the effect that changes in the cash rate have on households’ debt repayments and interest income, and the subsequent effect that these changes in available cash flow have on households’ spending decisions. This article presents updated evidence on the strength of this channel. In aggregate, the effect of a cash rate change on household disposable income is currently around its pre-pandemic average, after declining temporarily over the pandemic period due primarily to an increase in the share of fixed-rate mortgages. The effect of a cash rate change on aggregate household spending via the cash-flow channel also declined during the pandemic period but is estimated to have returned to around its pre-pandemic level.

Australia’s Sovereign ‘Green’ Labelled Debt

A significant amount of investment is required to transition to lower emissions in Australia, and financial markets are evolving to facilitate this. The inaugural Green Treasury Bond issued by the Australian Office of Financial Management in June 2024 marked a milestone in the Australian Government’s Sustainable Finance Strategy. This article reviews pricing of Australian sovereign and semi-sovereign labelled debt. There is some evidence of a decline in the historically positive price differential – the ‘greenium’ – between labelled and conventional bonds domestically. The evolution of this greenium has likely been influenced by the low initial supply of labelled bonds in Australia relative to demand but heterogeneity in these products and the relatively small sample size of labelled bonds complicates the identification of the greenium.

Behind the Great Wall: China’s Post-pandemic Policy Priorities

China is Australia’s largest trading partner so policy decisions in China can have a significant impact on the Australian economy, largely via its effect on Australia’s trade. While there remains considerable uncertainty about policymaking in China, this article describes how Chinese authorities have tended to approach economic policy choices and then considers China’s current economic challenges and their relevance to the Australian economy.

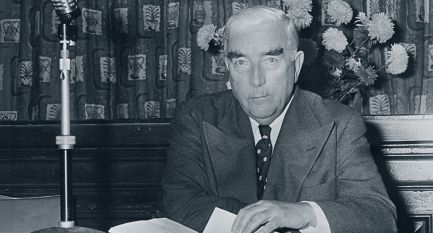

Robert Menzies and the Creation of the Reserve Bank

The Reserve Bank of Australia was created in 1959 by separating the commercial and central banking functions of the original Commonwealth Bank of Australia. An attempt in 1930 to establish a separate central bank in Australia failed when the enabling legislation was blocked in the Senate, but pressure by the private banks in the 1950s led to a renewed attempt to establish one. This attempt was opposed by then Governor of the Commonwealth Bank, Dr HC Coombs, who argued that the Bank’s commercial banking activities strengthened its central bank functions. At first, the Prime Minister, Robert Menzies, supported Coombs, but he changed his mind as political pressure for separation grew. Legislation to create a separate central bank was unsuccessful in 1957 and again in 1958 because the government lacked a majority in the Senate, but was passed in April 1959 following the general election in November 1958 in which the government won a majority in both houses of Parliament. This article discusses the events leading to the creation of the Reserve Bank as a stand-alone central bank and concludes that Menzies’ political acumen and role in the decision to support separation were crucial.

Some graphs in this publication were generated using Mathematica.

ISSN 1837-7211