January 2025

- Download the complete Bulletin 4.7MB

Access to Cash in Australia

Cash plays an important role in the community as a means of payment, store of value and a backup to electronic payment methods. Because of this, the RBA places a high priority on Australians continuing to have reasonable access to cash services. Since 2017, the closure of bank branches and bank-owned ATMs has led to increased distances to access cash services provided by banks, particularly in regional and remote areas. However, despite the significant reduction in bank-owned cash access points since 2017, the distance that most Australians have to travel to reach the nearest cash withdrawal point has not changed markedly in recent years. This is mainly because of the strong geographic coverage of Bank@Post and independently owned ATMs. As the number of locations where people can access cash has declined, some communities are vulnerable to a further withdrawal of cash services.

Bank Fees in Australia

This article updates RBA analysis of bank fees charged to Australian households, businesses and government. Over the year to June 2024, the value of total fees increased by around 5 per cent – the first increase in seven years. Fee income from households increased by 10 per cent, mainly reflecting fee income from credit cards and personal loans. A modest rise in fee income from housing loans also contributed. Fees charged to businesses and governments rose modestly due to growth in lending and an increase in fees charged on deposit accounts. Fees from merchant customers for providing payment processing services were unchanged after declining strongly over the previous four years. As a share of assets and deposits, fee revenue remained stable at a relatively low level.

Where Have All the Economics Students Gone?

The size and diversity of the economics student population has declined sharply since the early 1990s, raising concerns about economic literacy in society and the long-term health of the economics discipline. Interest in studying economics at university is low, even for those who studied economics in Year 12. This article investigates what students are choosing to study at university – if not economics – using new microdata from the Universities Admissions Centre. While Year 12 economics students tend to enrol in economics at university at much higher rates than other students, they are more likely to study a commerce and finance or arts and social science course than an economics course. Possible initiatives to increase the flow of high school students into university economics include tailored advocacy to emphasise the connections between economics and other preferred fields of study, and a greater focus on encouraging students to study economics subjects within a commerce and finance degree. It may also be worth exploring whether any lessons can be applied from initiatives to promote the take-up of STEM (Science, Technology, Engineering, Mathematics) courses, given the relative rise in enrolments in those subjects over recent years.

An Update on the Household Cash-flow Channel of Monetary Policy

The household cash-flow channel refers to the effect that changes in the cash rate have on households’ debt repayments and interest income, and the subsequent effect that these changes in available cash flow have on households’ spending decisions. This article presents updated evidence on the strength of this channel. In aggregate, the effect of a cash rate change on household disposable income is currently around its pre-pandemic average, after declining temporarily over the pandemic period due primarily to an increase in the share of fixed-rate mortgages. The effect of a cash rate change on aggregate household spending via the cash-flow channel also declined during the pandemic period but is estimated to have returned to around its pre-pandemic level.

Australia’s Sovereign ‘Green’ Labelled Debt

A significant amount of investment is required to transition to lower emissions in Australia, and financial markets are evolving to facilitate this. The inaugural Green Treasury Bond issued by the Australian Office of Financial Management in June 2024 marked a milestone in the Australian Government’s Sustainable Finance Strategy. This article reviews pricing of Australian sovereign and semi-sovereign labelled debt. There is some evidence of a decline in the historically positive price differential – the ‘greenium’ – between labelled and conventional bonds domestically. The evolution of this greenium has likely been influenced by the low initial supply of labelled bonds in Australia relative to demand but heterogeneity in these products and the relatively small sample size of labelled bonds complicates the identification of the greenium.

Behind the Great Wall: China’s Post-pandemic Policy Priorities

China is Australia’s largest trading partner so policy decisions in China can have a significant impact on the Australian economy, largely via its effect on Australia’s trade. While there remains considerable uncertainty about policymaking in China, this article describes how Chinese authorities have tended to approach economic policy choices and then considers China’s current economic challenges and their relevance to the Australian economy.

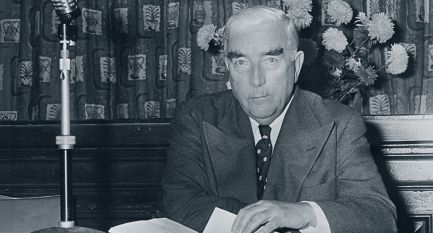

Robert Menzies and the Creation of the Reserve Bank

The Reserve Bank of Australia was created in 1959 by separating the commercial and central banking functions of the original Commonwealth Bank of Australia. An attempt in 1930 to establish a separate central bank in Australia failed when the enabling legislation was blocked in the Senate, but pressure by the private banks in the 1950s led to a renewed attempt to establish one. This attempt was opposed by then Governor of the Commonwealth Bank, Dr HC Coombs, who argued that the Bank’s commercial banking activities strengthened its central bank functions. At first, the Prime Minister, Robert Menzies, supported Coombs, but he changed his mind as political pressure for separation grew. Legislation to create a separate central bank was unsuccessful in 1957 and again in 1958 because the government lacked a majority in the Senate, but was passed in April 1959 following the general election in November 1958 in which the government won a majority in both houses of Parliament. This article discusses the events leading to the creation of the Reserve Bank as a stand-alone central bank and concludes that Menzies’ political acumen and role in the decision to support separation were crucial.

Some graphs in this publication were generated using Mathematica.

ISSN 1837-7211