Drivers of the Australian Dollar Exchange Rate

Download the complete Explainer 378KBAustralia has a floating exchange rate, which means that movements in the Australian dollar exchange rate are determined by the demand for, and supply of, Australian dollars in the foreign exchange market. There are a number of factors that affect demand and supply in this market. Some factors have longer-term effects on the value of the Australian dollar, while others influence its value over shorter periods of time. This Explainer highlights some of the key drivers of the Australian dollar exchange rate. It also discusses foreign exchange intervention and the circumstances in which the Reserve Bank of Australia (RBA) might decide to intervene in the foreign exchange market.

An exchange rate is the value of one unit of a currency relative to the value of another currency (or group of currencies). For instance, the value of the Australian dollar (AUD) relative to the US dollar (USD) is often abbreviated to AUD/USD. It measures how many US dollars are required to purchase one Australian dollar. For example, if the AUD/USD exchange rate is 0.75, this means that USD 0.75 (or 75 US cents) can be exchanged for a payment of AUD 1 (or $1 Australian). When the value of the Australian dollar increases relative to another currency, it ‘appreciates’. When it decreases in value, it ‘depreciates’. (For more information on measuring exchange rates and their effect on the Australian economy see Explainer: Exchange Rates and their Measurement and Explainer: Exchange Rates and the Australian Economy.)

Longer-term Drivers

Interest rate differentials and capital flows

Australia's interest rate differential measures the difference between interest rates in Australia and those in other economies. The interest rate differential is a key driver of the demand for, and supply of, Australian dollars. It is also an important driver of capital flows, which measure the money that flows into, and out of, Australia for investment purposes. (See Explainer: The Balance of Payments.)

For the Australian dollar, the focus is typically on the difference between Australian interest rates and those in the major advanced economies, such as the United States (US), Europe and Japan. Because the interest rate differential is a key driver of exchange rates, the RBA's monetary policy decisions play a key role in influencing the exchange rate. (See Explainer: The Transmission of Monetary Policy and Explainer: Bonds and the Yield Curve for a discussion of how monetary policy affects interest rates and the exchange rate.)

All else being equal, an increase in Australian interest rates contributes to the exchange rate being higher than otherwise. If Australian interest rates increase relative to interest rates in the US, Europe or Japan, Australian assets that pay interest (such as government bonds) become more attractive to foreign investors, as well as Australian investors that may invest overseas. This is because these assets are now paying a higher interest rate than before. If foreign investors purchase more Australian assets, more money flows into Australia. This leads to increased demand for Australian dollars. In addition, if Australian or foreign investors prefer to hold more Australian assets than otherwise (rather than purchasing overseas assets), less money flows out of Australia. This leads to decreased supply of Australian dollars. Both increased demand and reduced supply of Australian dollars support an appreciation in the Australian dollar exchange rate.

In contrast, a decline in Australian interest rates contributes to the exchange rate being lower than otherwise. When Australian interest rates decline, relative to interest rates in other advanced economies, Australian assets become less attractive for foreign investors and Australian investors. Demand for Australian assets declines, leading to a decrease in demand for Australian dollars and an increase in supply. Both of these factors lead to a depreciation.

While the interest rate differential is an important factor for capital flows and the Australian dollar, other factors also matter for investors when deciding how to allocate their investments, such as the risk of investing in Australia relative to other economies.

The terms of trade and commodity prices

There has been a close relationship between the terms of trade and the value of the Australian dollar over a long period of time. The terms of trade measures the ratio of export prices to import prices. In general, an increase in the terms of trade is associated with an appreciation of the Australian dollar, while a decline in the terms of trade is associated with a depreciation of the Australian dollar.

Commodity prices have a large influence on the terms of trade (commodities are goods such as iron ore, natural gas and agricultural products). This is because commodities account for a large share of Australia's exports and so movements in commodity prices result in movements in export prices. For example, an increase in the price of iron ore typically leads to higher export prices and an increase in the terms of trade. Higher commodity export prices mean more Australian dollars are required to purchase the same amount of Australia's commodity exports (see Box below on ‘Trade prices and quantities’). This is associated with an increase in demand for Australian dollars and an appreciation. Indeed, the Australian dollar is often referred to as a ‘commodity currency’.

Commodity prices and the terms of trade can also affect the Australian economy through increased investment. When commodity prices increase, exporters may decide to invest in expanding their production capacity to take advantage of higher export prices. This investment has typically been funded from money (capital) flowing into Australia from overseas, which supports demand for Australian dollars and can lead to an appreciation.

During the mining investment boom, a very large increase in commodity prices from the mid-2000s through to 2013 led to large inflows of foreign investment to help expand the production capacity in Australia's resources sector. The Australian dollar appreciated significantly during this period, reaching a record high of A$1.10 against the US dollar in 2011. This reflected the increased demand for Australian dollars and the more positive economic outlook for Australia relative to other countries. (See Explainer: Australia and the Global Economy – The Terms of Trade Boom for a detailed discussion of the mining boom and how a higher terms of trade affects the exchange rate and the Australian economy.)

International trade

Australian dollars are also bought and sold to facilitate the international trade of goods and services. When Australians export (or sell) goods or services to an overseas buyer, the overseas buyer purchases Australian dollars to pay the exporter (assuming the export is paid for in Australian dollars). As a result, an increase in the demand for Australian exports also increases demand for Australian dollars in the foreign exchange market and an appreciation of the Australian dollar.

Conversely, when Australians import (or buy) goods and services from an overseas seller, the Australian importer sells Australian dollars to obtain foreign currency to pay the overseas seller. In this case, when Australians demand more imports, the supply of Australian dollars in the foreign exchange market increases and the Australian dollar depreciates.

Box: Trade prices and quantities – an example

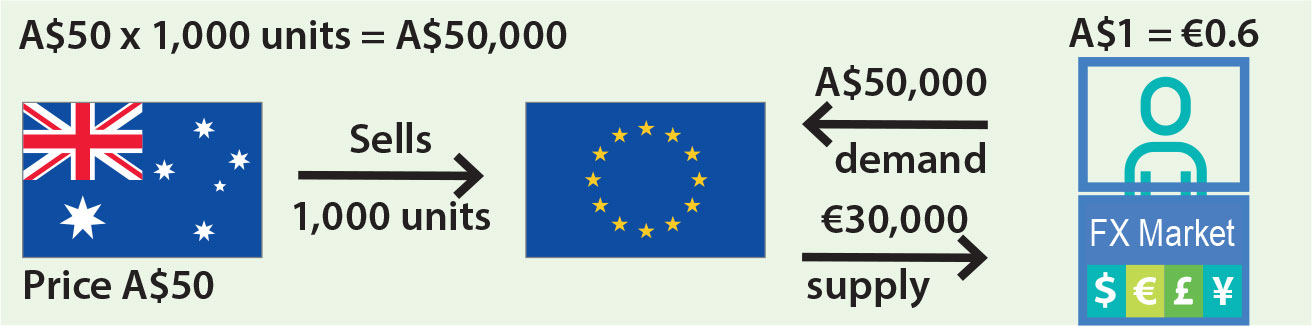

To illustrate how international trade affects the demand for and supply of Australian dollars, consider an Australian exporter who sells 1,000 units to a European customer. The export price is A$50 per unit, so the total value of exports is A$50,000. Assume that one Australian dollar can be exchanged for €0.60.

The European customer demands A$50,000 in the foreign exchange market, and supplies €30,000.

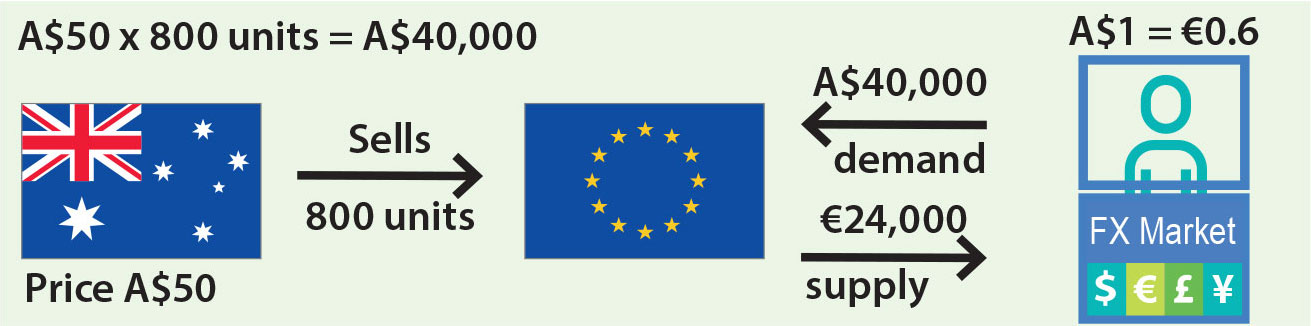

If the customer decided to purchase only 800 units:

Australian dollar demand would decline to A$40,000, and the customer supplies €24,000.

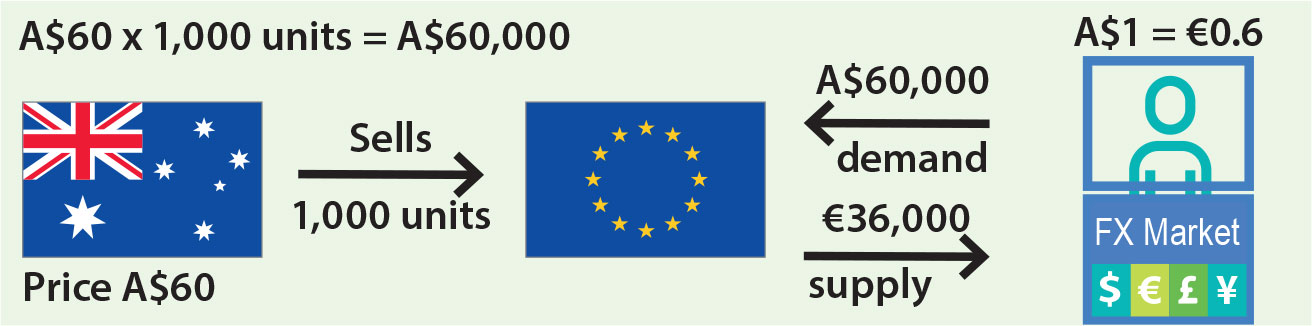

If the export price increased to A$60:

Australian dollar demand would increase to A$60,000, and the customer supplies €36,000.

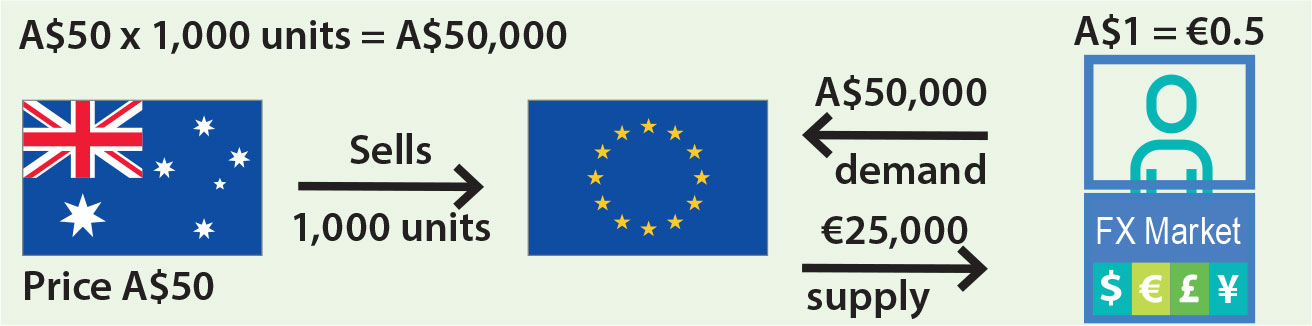

If the Australian dollar depreciated to €0.50:

Australian dollar demand would remain A$50,000, but the customer now only supplies €25,000.

Prices and inflation

The theory of purchasing power parity (PPP) connects the level of exchange rates to the level of prices between economies. PPP suggests that, over time, exchange rates adjust so that the cost of an identical basket of goods and services is the same in any two countries. For example, if goods and services in Australia are expensive relative to the same goods in other economies, over time, demand for Australian goods and services should decrease. This lowers the demand for Australian dollars and causes the Australian dollar to depreciate (as explained above). A lower value of the Australian dollar then decreases the price of Australian goods and services for foreigners, who now require less of their own currency to purchase Australian goods and services. PPP states that this process of adjustment should occur until Australian goods and services are no longer expensive relative to those in other economies.

To see PPP theory in action, take a look at The Economist magazine's ‘Big Mac Index’. The Big Mac index relates the exchange rate in many countries to the relative price of a Big Mac hamburger, a good that is available almost everywhere in the world.

Short-term Drivers

Over shorter periods of time, or on a day-to-day basis, the value of the Australian dollar can move closely with a variety of factors, including changes in risk sentiment and speculation.

The value of the Australian dollar tracks movements in other financial markets and changes in ‘risk sentiment’ (how much risk investors are willing to take on in their investments). For example, if investors feel that the outlook for economic growth is more positive than before, they will be prepared to take on more risk. Often this coincides with an increase in the demand for Australian dollars. Investors in other financial markets are observed to respond in similar ways to changes in risk sentiment, such as in global equity markets. This means that movements in the Australian dollar exchange rate have broadly followed those observed in global equity markets at different points in time. Typically, the Australian dollar appreciates when prices in global equity markets increase, and depreciates when prices in equity markets decline.

Investors also may speculate about future movements in the exchange rate for a range of reasons, and buy and sell Australian dollars to make a profit, which affects the exchange rate.

Market Functioning and Foreign Exchange Intervention

The RBA's approach to foreign exchange market intervention has evolved as the Australian foreign exchange market has matured. Despite having a floating exchange rate, the RBA can still intervene in the foreign exchange market. It may decide to do so if the market becomes disorderly or dysfunctional, or if the Australian dollar becomes grossly misaligned from a value implied by Australia's economic fundamentals. Intervention by the RBA has become less frequent over time and more targeted. The RBA last intervened in the foreign exchange market in 2007-08 during the global financial crisis, when it bought Australian dollars. This was in response to evidence that large, rapid depreciations in the Australian dollar had led to excessive volatility in the exchange rate. In other words the market was ‘dysfunctional’.

Market dysfunction can occur when sharp changes in demand or supply cause the market for Australian dollars to become ‘one-sided’. A one-sided market means that the number of sellers far exceeds buyers for Australian dollars, or vice versa. In this environment, the Australian dollar can become volatile; that is, it can appreciate or depreciate by a large amount very quickly. For example, a sharp increase in the supply of Australian dollars onto the foreign exchange market may result from sellers of Australian dollars having difficulty finding buyers at an agreed price. In this instance, the Australian dollar can depreciate by a large amount in a short time.

Foreign exchange intervention by the RBA can help reduce volatility and improve market function by balancing the one-sidedness of the market. The RBA may buy or sell Australian dollars, typically in exchange for US dollars, to influence supply and demand in the foreign exchange market. For this purpose, the RBA manages a portfolio of foreign exchange reserves.

For a history of the RBA's intervention into foreign exchange markets and the floating of the Australian dollar, see the RBA Bulletin article on Understanding Exchange Rates and Why They Are Important and former Governor Stevens's speech on The Australian Dollar: Thirty Years of Floating.