Filter by Tag

Technology Investment and AI: What Are Firms Telling Us?

Information technology investment by Australian firms has grown strongly over the past decade. A key question is how these technologies are shaping and may continue to shape the Australian economy in the future. We surveyed more than 100 medium–large firms from a range of industries in the RBA liaison program to understand how technology investments are affecting their operations, including their labour productivity and hiring decisions. The results suggest that surveyed firms anticipate these investments, particularly in artificial intelligence tools, to be labour-saving and productivity-enhancing over the long term. Firms also expect to see a substantial transformation of the types of roles and skills needed in the future. Importantly, evidence suggests that the labour-creating effects of past technologies have generally outweighed the labour-replacing effects in aggregate. Firms highlighted that there is considerable uncertainty around the extent and timing of these effects and emphasised that the main barriers to enhancing their productivity over recent years have been the regulatory environment and the ability to access suitable labour.

Small Business Economic and Financial Conditions

The economic environment has improved for small businesses over the past year, although conditions remain subdued. Survey measures of business conditions and confidence have improved but remain weaker for small businesses than for large businesses. Most small businesses remain profitable and many have reportedly supported margins by implementing cost-saving initiatives. While small businesses continue to report challenges in obtaining finance on terms that suit their needs, access to finance appears to have improved over the past year. Credit has become cheaper, with variable lending rates for small businesses declining by a little more than the cash rate this year. Credit has also become more readily available to small businesses, including credit that is unsecured or secured by non-physical assets. This has been driven in part by stronger competition in the business lending market. This article discusses recent trends in economic and financial conditions for small businesses, drawing on insights from the Reserve Bank’s 33rd Small Business Finance Advisory Panel and recent liaisons with lenders focused on the small business lending market.

A New Measure of Job Searchers for Australia

The RBA’s assessment of spare capacity in the labour market incorporates the signal from a broad suite of indicators. The ratio of job vacancies to unemployed persons, which attempts to assess the imbalance between unmet labour demand and the labour supply available to meet this demand, is a standard measure of spare capacity in the labour market. One shortcoming of this measure is that it implicitly assumes that job vacancies are only filled by the unemployed. In practice, job vacancies are also filled by other job searchers who may be outside the labour force or searching on the job. This article describes the construction and characteristics of a more comprehensive measure of job searchers (the Searchers Index) that considers both the unemployed and those who are not classified as being unemployed. The Searchers Index allows us to construct an alternative measure of spare capacity (the vacancies-to-searchers ratio), which exhibits different properties to the vacancies-to-unemployed ratio. The vacancies-to-searchers ratio will be included in the suite of indicators that we monitor to assess spare capacity in the labour market moving forward.

The Global Energy Transition and Critical Minerals

Australia is a key producer of some of the critical minerals that are likely to play an important role in the energy transition away from fossil fuels. Global demand for these minerals could grow significantly over the long term if the transition towards lower emissions progresses. This would support growth in the Australian production of these minerals, potentially increasing their relative importance to the domestic economy. However, this outlook is uncertain and depends on a range of factors such as the speed of the global energy transition, the relative take-up of different technologies and potential development of new technologies, global prices and the competitiveness of domestic production. In the near term, based on projects currently underway and announced, growth in production is likely to remain subdued, though new policy announcements may provide support for investment.

Building Interest in Economics: The Role of Early Exposure

The RBA’s 2024 student survey finds that students across New South Wales continued to view the field of economics as relevant and beneficial to society; however, perceptions of the study of Economics in Years 11 and 12 remained less favourable. New insights from the 2024 survey highlight the role of early exposure to Economics through the Years 7–10 Commerce elective, particularly following the introduction of a core economics topic into the 2019 Commerce syllabus. This early engagement is associated with greater student interest, confidence and understanding of Economics. Notably, the largest improvements were observed for students from lower socio-economic backgrounds, who are under-represented in Economics. These findings suggest that an increased focus on efforts to give more Years 7–10 students the opportunity to engage with Economics could help to broaden participation and improve perceptions of the subject among a more diverse cohort of Years 11–12 students.

A (Closer to) Real Time Labour Quality Index

One explanation that has been put forward for weakness in productivity growth over the past few years is the entry of less experienced or less educated workers to the strong labour market. However, existing labour ‘quality’ statistics that capture such dynamics use delayed information and so can be hard to interpret in real time. To address this problem, we used microdata sources to construct a timely version of the existing labour quality statistics. In doing so, we found evidence that labour quality has actually increased strongly since the COVID-19 pandemic and supported growth in market sector productivity over recent years. While initial work suggests that standard approaches may miss some relevant dimensions of human capital, such as time outside employment, these do not appear substantive enough to overturn the main findings.

International Students and the Australian Economy

International students play a significant role in the Australian economy. They contribute to demand through their spending on goods and services and are an important source of labour for some Australian businesses. This article shows that international students tend to add more to demand in the economy than they do to supply in the short run, in large part reflecting their spending on tertiary education fees. In periods of large swings in international student numbers or when the economy has little spare capacity, this means that changing international student numbers can affect macroeconomic outcomes, particularly in sectors of the economy where supply cannot respond quickly. The rapid growth in international student numbers post-pandemic likely contributed to high inflation over this period, but was not a major driver.

How Do Changes in Global Shipping Costs Affect Australian Inflation?

Australia’s experience during the COVID-19 pandemic showed that developments in international shipping can have a significant effect on domestic inflation. This is because higher global shipping costs can flow through the supply chain for imports and increase costs for Australian firms, who can in turn pass on those higher costs to consumers. This article addresses the question of when and how unexpected changes in global shipping costs have tended to pass through to Australian consumer price inflation since 2003. It finds that the pass-through to ‘shippable’ goods inflation can be material, and that shocks to global shipping costs were large enough to have contributed materially to trimmed mean inflation during the pandemic. That said, there is substantial uncertainty around the estimated pass-throughs, particularly because excluding the pandemic period leads to much smaller and less precise estimates of the pass-through to trimmed mean inflation.

How Useful are ‘Leading’ Labour Market Indicators at Forecasting the Unemployment Rate?

The RBA draws on a wide range of information to form our assessment of current labour market conditions and our outlook for the labour market. One of the key labour market indicators that the RBA monitors and forecasts is the unemployment rate. This article considers whether information contained in indicators that are typically viewed as signalling a change in conditions before it becomes apparent in the official labour market statistics – referred to here as ‘leading indicators’ – are helpful in forecasting the unemployment rate. It finds that information contained in measures of unmet demand, such as job advertisements and vacancies, and consumers’ expectations for unemployment are useful in informing the RBA’s near-term forecasts for the unemployment rate. Models containing these leading indicators can complement our existing framework for forecasting the unemployment rate, which also considers information such as developments in economic activity, insights from firms in the RBA’s liaison program and the experience of economies overseas.

Monetary Policy Transmission through the Lens of the RBA’s Models

Understanding how changes in the cash rate affect economic activity and inflation – so-called monetary policy transmission – is important for the RBA in pursuing its objectives of price stability and full employment. This article explains how the RBA uses its core models of the Australian economy to estimate the overall effects of policy, explore the different channels through which monetary policy transmits, and consider the economic outlook under alternative paths for monetary policy. The findings highlight that: the peak effect of policy is likely to occur after around one to two years; the exchange rate acts as an important transmission channel for policy; housing is a sensitive part of economic activity; and although individual households’ cashflow can be sensitive to changes in the cash rate, in aggregate it plays a smaller role in transmission.

Bank Funding in 2024

Bank funding costs are important in the transmission of monetary policy as they are a key determinant of the rates that households and businesses pay on loans. Bank funding costs increased only modestly in 2024, largely because the cash rate remained unchanged. The composition of banks’ funding shifted towards deposits over the same period, continuing a trend seen since the global financial crisis. Banks also managed the final maturities of the Term Funding Facility, issuing wholesale debt into favourable funding conditions. This article updates previous research published by the RBA on developments in the composition and costs of banks’ funding.

Access to Cash in Australia

Cash plays an important role in the community as a means of payment, store of value and a backup to electronic payment methods. Because of this, the RBA places a high priority on Australians continuing to have reasonable access to cash services. Since 2017, the closure of bank branches and bank-owned ATMs has led to increased distances to access cash services provided by banks, particularly in regional and remote areas. However, despite the significant reduction in bank-owned cash access points since 2017, the distance that most Australians have to travel to reach the nearest cash withdrawal point has not changed markedly in recent years. This is mainly because of the strong geographic coverage of Bank@Post and independently owned ATMs. As the number of locations where people can access cash has declined, some communities are vulnerable to a further withdrawal of cash services.

Bank Fees in Australia

This article updates RBA analysis of bank fees charged to Australian households, businesses and government. Over the year to June 2024, the value of total fees increased by around 5 per cent – the first increase in seven years. Fee income from households increased by 10 per cent, mainly reflecting fee income from credit cards and personal loans. A modest rise in fee income from housing loans also contributed. Fees charged to businesses and governments rose modestly due to growth in lending and an increase in fees charged on deposit accounts. Fees from merchant customers for providing payment processing services were unchanged after declining strongly over the previous four years. As a share of assets and deposits, fee revenue remained stable at a relatively low level.

Where Have All the Economics Students Gone?

The size and diversity of the economics student population has declined sharply since the early 1990s, raising concerns about economic literacy in society and the long-term health of the economics discipline. Interest in studying economics at university is low, even for those who studied economics in Year 12. This article investigates what students are choosing to study at university – if not economics – using new microdata from the Universities Admissions Centre. While Year 12 economics students tend to enrol in economics at university at much higher rates than other students, they are more likely to study a commerce and finance or arts and social science course than an economics course. Possible initiatives to increase the flow of high school students into university economics include tailored advocacy to emphasise the connections between economics and other preferred fields of study, and a greater focus on encouraging students to study economics subjects within a commerce and finance degree. It may also be worth exploring whether any lessons can be applied from initiatives to promote the take-up of STEM (Science, Technology, Engineering, Mathematics) courses, given the relative rise in enrolments in those subjects over recent years.

An Update on the Household Cash-flow Channel of Monetary Policy

The household cash-flow channel refers to the effect that changes in the cash rate have on households’ debt repayments and interest income, and the subsequent effect that these changes in available cash flow have on households’ spending decisions. This article presents updated evidence on the strength of this channel. In aggregate, the effect of a cash rate change on household disposable income is currently around its pre-pandemic average, after declining temporarily over the pandemic period due primarily to an increase in the share of fixed-rate mortgages. The effect of a cash rate change on aggregate household spending via the cash-flow channel also declined during the pandemic period but is estimated to have returned to around its pre-pandemic level.

Australia’s Sovereign ‘Green’ Labelled Debt

A significant amount of investment is required to transition to lower emissions in Australia, and financial markets are evolving to facilitate this. The inaugural Green Treasury Bond issued by the Australian Office of Financial Management in June 2024 marked a milestone in the Australian Government’s Sustainable Finance Strategy. This article reviews pricing of Australian sovereign and semi-sovereign labelled debt. There is some evidence of a decline in the historically positive price differential – the ‘greenium’ – between labelled and conventional bonds domestically. The evolution of this greenium has likely been influenced by the low initial supply of labelled bonds in Australia relative to demand but heterogeneity in these products and the relatively small sample size of labelled bonds complicates the identification of the greenium.

Behind the Great Wall: China’s Post-pandemic Policy Priorities

China is Australia’s largest trading partner so policy decisions in China can have a significant impact on the Australian economy, largely via its effect on Australia’s trade. While there remains considerable uncertainty about policymaking in China, this article describes how Chinese authorities have tended to approach economic policy choices and then considers China’s current economic challenges and their relevance to the Australian economy.

Robert Menzies and the Creation of the Reserve Bank

The Reserve Bank of Australia was created in 1959 by separating the commercial and central banking functions of the original Commonwealth Bank of Australia. An attempt in 1930 to establish a separate central bank in Australia failed when the enabling legislation was blocked in the Senate, but pressure by the private banks in the 1950s led to a renewed attempt to establish one. This attempt was opposed by then Governor of the Commonwealth Bank, Dr HC Coombs, who argued that the Bank’s commercial banking activities strengthened its central bank functions. At first, the Prime Minister, Robert Menzies, supported Coombs, but he changed his mind as political pressure for separation grew. Legislation to create a separate central bank was unsuccessful in 1957 and again in 1958 because the government lacked a majority in the Senate, but was passed in April 1959 following the general election in November 1958 in which the government won a majority in both houses of Parliament. This article discusses the events leading to the creation of the Reserve Bank as a stand-alone central bank and concludes that Menzies’ political acumen and role in the decision to support separation were crucial.

Do Housing Investors Pass-through Changes in their Interest Costs to Rents?

Interest rates and rents often move together. Some have argued that this positive relationship is evidence that higher interest rates have been a key driver of increases in rents over the past few years, due to leveraged housing investors passing through increases in their interest costs to their tenants. This article uses anonymised tax return data covering 2006/07–2018/19 to estimate the direct pass-through of interest cost changes to housing investors’ rental income. It finds small pass-through on average, even when interest rates are rising. The largest estimate suggests that direct pass-through results in rents increasing by $25 per month when interest payments increase by $850 per month (the median monthly increase in interest payments for leveraged investors between April 2022 and January 2024). Overall, the results are consistent with the view that the level of housing demand relative to the housing stock is the key driver of rents.

Developments in Wages Growth Across Pay-setting Methods

The dynamics of wages growth can differ across pay-setting methods. Understanding these differences is relevant for forecasting wages growth, and for assessing labour market conditions and inflationary pressures. Across each pay-setting method, wages growth picked up following the COVID-19 pandemic, but appears to have peaked. Wages growth is expected to continue to slow as the labour market eases, but the rate of easing is expected to vary across each method. This article explains recent developments in wages growth across pay-setting methods and the RBA’s disaggregated approach to forecasting wages growth, which includes considering the Fair Work Commission’s annual reviews of the minimum wages in modern awards.

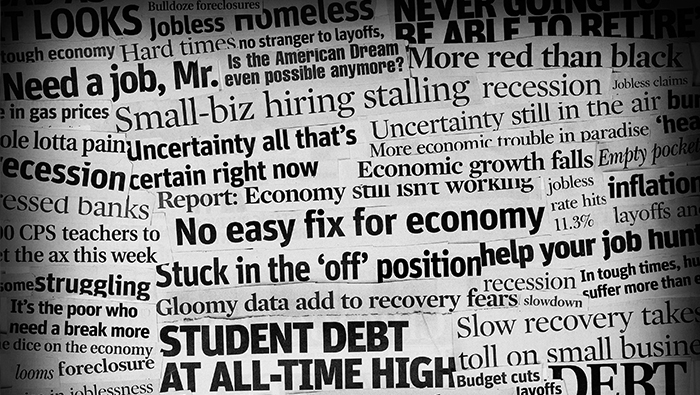

Small Business Economic and Financial Conditions

The economic environment has been challenging for many small businesses over the past year. Growth in demand has slowed while input costs remain elevated, putting pressure on profitability – particularly for businesses reliant on discretionary consumer spending. Even so, profit margins remain around pre-pandemic averages for most small businesses. While access to credit remains a challenge for small businesses, many accumulated sizeable cash buffers during the pandemic, contributing to their resilience over the past few years. The unevenness in small business conditions has been reflected in some continuing to perform well, while others have had to draw down on cash buffers and an increasing share have entered insolvency. However, the number of insolvencies remains below its pre-pandemic trend on a cumulative basis. This article discusses small business conditions in Australia by drawing on information from the Reserve Bank’s 32nd Small Business Finance Advisory Panel, firm-level administrative data and other economic surveys.

The Reliability of Retail Payment Services

Australians are increasingly dependent on the continuous availability of electronic payment systems. As such, every incident or outage can potentially cause inconvenience or economic harm for end-users of those systems. This article presents insights into the reliability of payment systems using information from the RBA’s retail payment incidents dataset. The article notes that retail payment services have an average availability of at least 99.8 per cent each quarter. Online banking and fast payments services are most likely to be affected from outages, with root causes relating to issues with third parties, software and change management. Given the wide-reaching impact of outages, the effective management of operational risk in the payments system has never been more important.

Inflation-linked Financial Markets

Financial instruments with returns that are indexed to inflation allow market participants to hedge against or take positions on future inflation. Inflation-linked bond and swap markets in Australia are small and not very liquid relative to some other advanced economies. Nevertheless, pricing in these markets can provide valuable information about participants’ inflation expectations. Market measures of long-term inflation expectations have increased in many advanced economies since the COVID-19 pandemic. In Australia, this has brought expectations into closer alignment with the RBA’s inflation target.

Growth in Global Private Credit

Global private credit has grown rapidly over the past two decades, providing an alternative source of financing for businesses. This article introduces a new estimate of the size of private credit outstanding in Australia, based on data collected by the Australian Prudential Regulation Authority and London Stock Exchange Group. It is estimated that there is around $40 billion in private credit outstanding in Australia, which is around 2½ per cent of total business debt. Globally, the growth in private credit has raised concerns related to a lack of visibility over leverage and interlinkages, with regulators taking steps to strengthen oversight of the market. For Australia, the risks to financial stability appear contained for now, though regulators continue to monitor the sector closely.

Interpreting Chinese Statistics: Extracting Expenditure-side Quarter-on-quarter Growth Contributions

Components for GDP on the expenditure side of the national accounts – expenditure on consumption, investment (including inventories) and exports less imports – can provide an important read on the composition of demand. For China, these components are available in contributions to year-ended GDP growth, which provides insight into trends but makes it difficult to interpret how the economy is operating quarter to quarter. This article discusses a method for deriving contributions to quarter-on-quarter GDP growth using official data that allows for a better understanding of expenditure side drivers of quarter to quarter. The decomposition shows that strong growth in the March quarter of 2024 was driven by a large increase in net exports, but growth in the June quarter was mainly supported by investment, which likely reflected a large contribution from the change in inventories. This suggests that Chinese domestic demand remained sluggish in the first half of the year, despite the strong outcome for GDP growth in the March quarter.

The ABCs of LGFVs: China’s Local Government Financing Vehicles

China’s local government financing vehicles (LGFVs) are a key feature – and risk – of China’s infrastructure investment and financing environment. The scale of their debt has consequences for local governments’ fiscal sustainability and for capacity to continue financing infrastructure development. This article reviews progress and challenges in the transformation of LGFVs from local government off-balance sheet financing vehicles into market-driven entities, and estimates the scale and sustainability of their debt burdens at a regional level. Developments in the debt sustainability and investment outlook at China’s LGFVs potentially has implications outside of China due to the importance of LGFVs to financial stability and long-run growth in China.

Assessing Potential Output and the Output Gap in Australia

The output gap – the difference between actual output and potential output – is an important consideration for monetary policy as it is a measure of the extent of spare capacity in the economy. This article explains how RBA staff form an assessment of potential output and the output gap. We draw on a range of model-based estimates, capacity utilisation indicators and activity measures. Model-based estimates give a quantitative assessment of the level of spare capacity in the economy, but there is considerable uncertainty modelling unobserved concepts like potential output and the output gap. Ultimately, assessing spare capacity in the economy requires careful judgement in weighing up all available information, which the RBA sets out in its quarterly Statement on Monetary Policy.

Skills Match Quality Following the COVID-19 Pandemic

The strength in labour market conditions after the COVID-19 pandemic caused many individuals to either enter the labour market or to change jobs. These labour dynamics may have an influence on both recent and longer term productivity outcomes by affecting how well workers’ skills are matched to their new jobs. We use self-reported measures from the Household, Income and Labour Dynamics in Australia Survey to examine whether workers are better or less well matched to their jobs following the pandemic, and whether these skills matches may change in the future. Overall, based on the data, we find there is little evidence that the recent increase in labour mobility affected how well workers are matched to their jobs up until 2022, which suggests that this is not a key driver of recent slow productivity growth.

How the RBA Uses the Securitisation Dataset to Assess Financial Stability Risks from Mortgage Lending

The RBA’s Securitisation Dataset provides timely and detailed data on the individual mortgages underlying Australian residential mortgage-backed securities. This dataset complements other data sources the RBA uses to form its assessment of financial stability risks arising from mortgage lending. Understanding the representativeness of the dataset in relation to the broader mortgage market for key risk indicators helps to ensure that assessments are formed on a reliable basis. This article discusses the usefulness of the dataset for complementing the RBA’s broader monitoring and assessment of risks from housing lending. However, caution is needed when using the dataset to assess risks from new lending, and when monitoring arrears. Information from the dataset is one of a number of sources the RBA uses in monitoring financial stability risks and is combined with other sources of complementary data, including that provided by lenders to the Australian Prudential Regulation Authority.

Recent Drivers of Housing Loan Arrears

Housing loan arrears rates have increased from low levels since late 2022, with banks expecting them to rise a little further from here. Understanding what has been driving this increase is important for the RBA’s assessment of risks to financial stability and the economic outlook. Using loan-level data for variable-rate owner-occupier borrowers, we find that the main drivers have been challenging macroeconomic conditions and a modest ageing of the loan pool rather than risks specific to lending in a given year. Overall, highly leveraged borrowers have been most likely to fall into arrears since 2022, consistent with their generally higher arrears rates and greater vulnerability to challenging economic conditions. We assess that financial stability risks remain contained as these borrowers represent a relatively small share of total housing lending and very few loans are estimated to be in negative equity, where the loan amount exceeds the property resale value.

The Australian Repo Market: A Short History and Recent Evolution

In 2019, the repurchase agreement (repo) market became the second largest onshore short-term wholesale funding market in Australia. In addition to its size, the range of participants and diversity of collateral used to obtain funds under repo has grown in recent years. As a result, the repo market provides valuable information about conditions in short-term wholesale funding markets. This article describes the recent growth in the Australian repo market and discusses the pricing in the repo market relative to other benchmarks.

Assessing Full Employment in Australia

Full employment is a longstanding objective of monetary policy in Australia, alongside price stability. The Reserve Bank Board aims to achieve the maximum level of employment consistent with low and stable inflation in the medium term. This article explains how RBA staff form an assessment of how labour market conditions stand relative to full employment. RBA staff draw on a range of labour market indicators, model-based estimates and outcomes for wages growth and inflation. Any single indicator tends to provide a partial view of the labour market and the level of each indicator that is consistent with full employment can change over time as the structure of the economy evolves. Ultimately, assessing how close the labour market is to full employment requires careful judgement, which the RBA sets out in its quarterly Statement on Monetary.

Cash Rate Pass-through to Outstanding Mortgage Rates

The interest rate paid by outstanding mortgage borrowers increased by around 320 basis points between May 2022 and December 2023, around 105 basis points less than the cumulative increase in the cash rate over this period. This pass-through from cash rate increases to the average outstanding mortgage rate has been slower than in recent tightening episodes due to a high share of outstanding fixed-rate loans and the effects of heightened mortgage lending competition. The average outstanding mortgage rate will increase further as the remaining share of low-rate fixed-rate loans expire and reprice at higher interest rates. By the end of 2024, overall pass-through is expected to be comparable to earlier tightening episodes.

Bank Funding and the Recent Tightening of Monetary Policy

Banks’ funding costs have risen substantially since early 2022, driven by increases in the cash rate. This article explains how increases in the cash rate passed through to banks’ funding sources and how banks adjusted their funding mix. All non-equity sources of bank funding became more expensive over the hiking phase. Banks increased rates on term deposits by more than at-call deposits. Within at-call deposits, banks increased rates most for those savings accounts with conditions attached. Further, banks’ share of funding from term deposits grew and banks issued more debt as the Term Funding Facility started to mature.

The Effect of Least-cost Routing on Merchant Payment Costs

The RBA supports all merchants being able to choose the card network used to process debit transactions – a functionality known as least-cost routing (LCR) – with the aim of increasing competition and reducing the cost of accepting card payments. This article presents the RBA’s first estimates of the effects of LCR on a merchant’s cost of accepting debit card payments. Using merchant-level data, we estimate that the cost of accepting debit card transactions is nearly 20 per cent lower for merchants that have LCR turned on compared with those with LCR turned off, though the results differ across merchant size and choice of pricing plans. Once LCR for online and mobile wallet payments is widely available and taken up by merchants, the potential cost savings are likely to be even larger.

Financial Stability Risks from Non-bank Financial Intermediation in Australia

Risks to financial stability posed by the non-bank financial intermediation (NBFI) sector in Australia remain relatively contained. In comparison to overseas, the size of the NBFI sector (excluding superannuation) is relatively small, and its interconnectedness with the traditional banking sector has continued to decline. However, as has been shown in recent periods of stress in overseas markets, vulnerabilities in the NBFI sector can have implications for financial stability. In particular, there remains a risk of disorderly movements in some international asset markets, which could be exacerbated by the role of overseas NBFIs and spill over into Australian markets. Lending by Australian non-banks remains small as a share of outstanding credit, but has recently shifted towards riskier market segments and there is less detailed information about this lending than that done by prudentially regulated banks. As part of its monitoring of evolving risks in the NBFI sector, Australia’s Council of Financial Regulators has sought to improve visibility over domestic NBFIs’ activities, including in commercial real estate and the growing use of over-the-counter derivatives. This article provides an analysis of recent developments and evolving risks posed by NBFIs in Australia.

Assessing Physical Climate Risk in Repo-eligible Residential Mortgage-backed Securities

This article assesses physical climate risk in Australian residential mortgage-backed securities (RMBS) using two risk metrics. Based on these metrics, RMBS with higher levels of physical climate risk tend to be issued by small regional banks and credit unions. In addition, RMBS with higher physical climate risk do not appear to have additional credit enhancement. This could suggest that securitisation markets have yet to fully incorporate physical climate risk exposures into their assessments of RMBS, or that current climate risks are perceived to be small. However, the measure of climate risk used in this analysis is subject to several limitations and there is significant uncertainty about the future path and impact of climate change. This analysis is a first attempt at quantifying climate risk present in Australian RMBS and is part of ongoing work at the RBA to assess the effect of climate change on the financial system.

The Private Equity Market in Australia

The Australian private equity market has grown significantly for a number of years, particularly as the economy recovered from pandemic-related disruptions. Consistent with this growth, private equity deals involving Australian companies have increased in value, and private equity funds have raised larger amounts of capital from investors. Recently, however, private equity activity has declined substantially as borrowing costs increased. Over recent years, international private equity firms and investors have also increased their presence in the Australian market. This article discusses these developments in the Australian private equity market and considers the implications that a robust private equity market may have on Australian businesses and public capital markets.

Migration to Public Cloud: Risks and Regulatory Requirements for Clearing and Settlement Facilities

Public cloud technologies are increasingly being adopted by firms in the financial industry, including clearing and settlement facilities (CS facilities). Using public cloud offers a range of opportunities, but also presents risks for a CS facility’s operations. Because CS facilities play a critical role in supporting the smooth functioning of financial markets, they need to manage these risks to ensure that they continue to provide resilient and secure services. This article discusses the opportunities and risks for CS facilities in using public cloud, and outlines the related regulatory requirements that apply to CS facilities in their management of risks, consistent with their obligations to promote efficiency and stability in the financial system.

China’s Monetary Policy Framework and Financial Market Transmission

While it has evolved significantly over the years, China’s monetary policy framework continues to differ in some important respects to those in most advanced economies. In contrast to these economies, the People’s Bank of China makes significant use of quantity-based policy instruments, though interest rates now play a greater role than in the past. This article takes stock of China’s current monetary policy framework and its implementation, and discusses the transmission of price-based monetary policy instruments to market and retail interest rates in the economy. In doing so, this article sheds light on the implementation of monetary policy in the world’s second largest economy.

Urban Residential Construction and Steel Demand in China

Investment in Chinese urban residential real estate has been declining since 2021, and demand for steel by the sector has also slowed considerably. Despite this decline, overall demand for steel in China has been resilient due to strong growth in manufacturing and infrastructure investment, which looks likely to continue in the near term. This article provides a projection for urban residential construction in China to 2050, suggesting that construction in China has peaked and that demand for steel will decline in the longer term. This will weigh on overall steel demand in China, though there remains considerable uncertainty around the longer term outlook for demand from other sources.

Understanding the Post-Pandemic Demand for Australia’s Banknotes

Banknotes can be used to make legitimate payments, but they can also be hoarded, lost or used to facilitate transactions in the shadow economy. Understanding how banknotes are used can assist policymakers in responding to changes in payment behaviour and demand for cash. This article examines the value of banknotes used for each component of cash demand and how it has changed since the COVID-19 pandemic. The share of banknotes used for transactional purposes is estimated to have fallen by 5 percentage points since early 2020, while cash use in the shadow economy has increased slightly and the proportion of banknotes that are lost has remained unchanged. Overall, the majority of banknotes on issue are currently used for non-transactional purposes, consistent with pre-pandemic trends.

Developments in Income and Consumption Across Household Groups

Data on spending by income and mortgagor status suggest that growth in consumption has slowed significantly over the past year or so across most household groups as cost-of-living pressures have weighed on household finances. High inflation has decreased the purchasing power of all households and has had a relatively similar effect on real disposable incomes across different groups. While higher interest rates have also weighed heavily on the incomes of mortgagor households, many of these households have larger financial buffers, which have helped to offset the aggregate impact of interest rates on their spending so far. Resilient growth in nominal incomes has helped to support the spending of many lower income households and renters. Nonetheless, many of these households have lower financial buffers and so increases in their cost of living are more likely to have caused financial stress with all its adverse impacts on their wellbeing. Indeed, many households are experiencing acute challenges in the face of high inflation and higher interest rates. This article explores these recent developments in consumption across household groups.

Inflation Expectations and Economic Literacy

The level of community awareness and understanding of basic economic issues can influence a central bank’s ability to achieve its goals, such as by anchoring the public’s inflation expectations in line with its inflation target. This article draws on novel data from a large-scale survey of Australian adults about their knowledge of the Reserve Bank’s inflation target and their expectations for inflation over the short and medium term. Responses to these questions varied significantly according to the socio-demographic characteristics of the survey respondents and their level of economic literacy. The results of this study point to the need for clear communication about the Bank’s inflation objectives that caters for variations in awareness and understanding of economic issues across different socio-demographic groups.

What Do Firms Tell Us About the Inflation Outlook?

The Reserve Bank’s liaison program collects information from firms in Australia about current economic conditions and their expectations for future conditions, including their own prices. Firms’ observations provide a timely read on inflation. Over the past six months, firms have generally expected their prices growth to continue to moderate, but on average to remain above the Bank’s inflation target range of 2–3 per cent. Firms have reported that large cost increases over recent years are still flowing through to some parts of the supply chain and have indicated that this is the primary driver of their decisions to increase prices at a faster-than-normal rate. Slower growth in demand and increased competition are expected to result in a further slowing in growth of firms’ prices over coming quarters.

Bank Fees in Australia

This article updates Reserve Bank research on bank fees charged to Australian households, businesses and government. Over the year to June 2023, total fees charged by banks fell by around 4 per cent. Fees comprised just 5 per cent of banks’ total revenue over the period, while over 50 per cent came from interest earnings on loans. By customer, most fees were paid by large businesses, as was the case in previous years. However, fee earnings from businesses and government declined over 2022/23, in part reflecting lower merchant services fees. On the other hand, fee income from households increased, driven by higher revenue from charges on credit cards related to international travel and increased revenue from break fees on term deposits.

The Committed Liquidity Facility: 2015–2022

The Reserve Bank’s Committed Liquidity Facility (CLF) was used from 2015–2022 to enhance the resilience of the banking system to times of liquidity stress. Banks must hold high-quality liquid assets (HQLA), including government securities, as a buffer against liquidity stress. Historically, the low level of government debt in Australia limited the amount that banks could reasonably hold, and so the CLF was introduced in 2015 as an alternative. Over time, however, the amount of government debt on issue and system liquidity increased significantly due to fiscal and monetary policy measures implemented to support the Australian economy during the COVID-19 pandemic. In response to this significant increase in HQLA, the size of the CLF was gradually reduced so that it was no longer in use at the beginning of 2023. This article provides an overview of the CLF and discusses its introduction and why it is no longer in use.

Recent Developments in the Semi-government Bond Market

The market for Australian state and territory government bonds is often referred to as the market for ‘semis’. Semi-government bonds are a key source of government funding and they form an important share of high-quality liquid assets in the Australian financial system. The COVID-19 pandemic, and state and territory government policies implemented in response, increased the size of the semi-government bond market significantly. During this period, there have also been compositional changes in the types of issuance and investors of semis. This article explores recent trends in the issuance, ownership and pricing of semi-government bonds.

Recent Trends in Australian Productivity

Productivity growth enables rising living standards and is needed for real wages growth to be consistent with stable inflation over the medium term. Prior to the COVID-19 pandemic, productivity growth in Australia and other advanced economies had been low, because business dynamism, job mobility, global trade and policy reform all slowed. Over the past few years, the pandemic and other shocks distorted productivity outcomes. Even if these shorter term fluctuations wash out, the longer term (and apparently structural) weakness in productivity growth could persist. This would have implications for the rate of nominal wages growth that is consistent with inflation returning to the target band. This article discusses the trends in Australia’s productivity growth before, during and since the pandemic and the implications for the economic outlook.

Adoption of General-purpose Technologies (GPT) in Australia: The Role of Skills

General-purpose technologies (GPT) have the potential to transform how we work, to change the skills we need and to drive productivity growth. It is therefore important to understand the conditions that lead to the successful adoption of GPT. Using a novel database on the adoption of cloud computing and artificial intelligence/machine learning by Australian-listed firms, this article finds that the COVID-19 pandemic led to a short-lived surge in adoption of cloud computing technologies. In addition, there is evidence that profitable adoption is more likely to occur in firms where the Board has members with relevant technological backgrounds, and that firms adopting GPT are more likely to seek staff with related skills. These findings highlight the importance of workers’ and managers’ skills in technology adoption, and the impact this can have on productivity growth.

Green and Sustainable Finance in Australia

Australia has committed to achieving net zero greenhouse gas emissions by 2050. This will require significant amounts of investment and financing as we move away from a carbon-intensive economy. Prior to the COVID-19 pandemic, productivity growth in Australia and other advanced economies had been low, because business dynamism, job mobility, global trade and policy reform all slowed. Over the past few years, the pandemic and other shocks distorted productivity outcomes. Even if these shorter term fluctuations wash out, the longer term (and apparently structural) weakness in productivity growth could persist. This would have implications for the rate of nominal wages growth that is consistent with inflation returning to the target band. This article discusses the trends in Australia’s productivity growth before, during and since the pandemic and the implications for the economic outlook.

Economic Literacy in Australia: A First Look

Those who are economically literate make more informed economic choices, better understand the world around them and can influence public discourse and the actions of government. Given the importance of economic literacy for individuals and society at large, the Bank commissioned a large-scale survey of Australian adults testing their understanding of some core macroeconomic topics. The results enabled compilation of simple literacy scores that represent the Bank's first attempt to gauge economic literacy in Australia. Being male, older, of higher income, having a degree, and having studied or being engaged with economics are associated with higher scores. By contrast, persons aged 18–24 years, unemployed persons and those without a degree had the lowest scores. Questions that tested abstract macroeconomic concepts appeared more difficult than those about more relatable issues that draw on lived experience. These findings speak to the importance of simple and targeted communication by the Bank and other policymakers to support the understanding of economic concepts across the community.

Recent Developments in Small Business Finance and Economic Conditions

The economic environment has become more challenging over the past year, including for small businesses. High inflation, slower growth of demand and difficulties in finding suitable labour have contributed to declines in small business conditions and confidence. Demand for business finance has slowed, consistent with the rise in interest rates and slower growth in economic activity. Small businesses report that accessing funding through banks remains a challenge. The article considers these recent developments, drawing on the discussions of the Small Business Finance Advisory Panel and information from the Bank’s liaison program.

Financial Stability Risks from Commercial Real Estate

Current conditions in global commercial real estate (CRE) markets are challenging. Weak leasing demand and higher interest rates are weighing on CRE owners’ loan servicing ability and asset values. Globally, appetite to lend to CRE investors is softening and signs of financial stress are emerging especially among office owners in the United States. While CRE markets are less likely to pose risks to the banking system given improved lending standards following the global financial crisis (GFC), systemic risks are higher in jurisdictions where the banking system is more exposed to CRE, such as in the United States and Sweden. Australian CRE markets face similar challenging fundamentals, though signs of financial stress appear low at present and systemic risks are lower than in the past. This is a result of Australian banks’ reduced CRE exposures as a share of their total assets and tighter lending standards since the GFC. However, risks would increase in the event of a sharp economic downturn or if systemic risks were to spill over from overseas CRE markets.

New Timely Indicators of Wages Growth

Monitoring developments in wages is important for assessing the inflation outlook, as labour costs are a major factor in firms’ pricing decisions. Over recent years, the Reserve Bank has developed a suite of timely wages indicators based on surveys and administrative data. Together with externally developed indicators, these measures provide a fuller view on wages developments ahead of the release of official statistics. This article explains the methodology behind these indicators and what they reveal about labour costs in Australia.

Financial Health and Employment in the Business Sector: A Non-linear Relationship

This article examines how increased financial stress in the business sector negatively impacts employment through the behaviour of firms. It highlights the non-linearity of the relationship between firms' financial health and employment and identifies thresholds that can serve as useful reference points when assessing the resilience of the business sector and risks to macrofinancial stability. Using data at the individual business level, this article finds that employment outcomes are significantly worse for firms with a profit margin below 5 percent or with a cash surplus (i.e. cash assets plus cash profit) of less than 10 per cent relative to sales.

Reading through the Lines: Price-setting Indicators from Earnings Calls

This article explores how information in earnings call transcripts from Australian firms can contribute to the Reserve Bank's understanding of their price-setting behaviour, as a complement to information gathered from the Bank's liaison program. A large language model is used to process and analyse earnings call transcripts and construct new sentiment indicators for input costs, demand, prices and supply shortages from them. These indicators, starting in 2007 and updated to capture the latest August earnings season, provide useful information about economic conditions and price-setting behaviour, including about developments during the recent period of unusually high inflation.

Measuring Government Bond Turnover in Australia Using Austraclear Data

This article provides new estimates using Austraclear data for monthly turnover ratios for Australian Government Securities (AGS) and semi-government bonds (semis). Previous Reserve Bank estimates used Austraclear data that included repo transactions, as acknowledged at the time. In November 2021 Austraclear implemented a change to reporting standards that excluded repo transactions more effectively. This change allows for more accurate estimates of turnover for AGS and semis. The new turnover estimates are considerably lower, suggesting repo activity was a significant part of the previous estimates. The new estimates, with repo transactions excluded, better align with survey data on turnover published by the Australian Office of Financial Management.

Climate Change and Financial Risk

Climate change, and the actions taken in response to it, introduces both risks and opportunities for financial institutions. The Reserve Bank continues to monitor the build-up of climate-related financial stability risks, including how these risks are priced and who ultimately bears the physical and transition risks arising from climate change. Globally and in Australia, most analysis has found limited direct effects of climate risks on the financial system as a whole. Those that do arise fall unevenly, with the largest risks concentrated in specific geographic regions and sectors. Much of the analysis to date has been exploratory in nature and analytical frameworks continue to develop. This reflects, in part, the complexity of bringing together elements of climate science, economics, finance and regulation. Commonly identified areas for improvement relate to data availability and coverage, consistent disclosure requirements, and the design of scenarios used to assess climate-related risks to financial stability. Ongoing engagement and coordination between the public and private sectors, domestically and internationally, will be required to effectively monitor and ultimately manage the physical and transition risks arising from climate change.

New Insights into the Rental Market

This article draws out new insights into the private Australian rental market using a new large administrative dataset of rental properties, which is an input to the Consumer Price Index (CPI). CPI rent inflation has picked up recently. Since 2021, rents have increased across inner-city and regional areas throughout all the states. Rent increases have also become more common and larger on average – particularly for the 2–3 per cent of properties each month that have a change in tenants. This is in contrast with the experience during the COVID-19 pandemic where rents fell in many suburbs close to central business districts but increased in regional areas, driven by a preference shift among many households for more space and net population flows.

Consumer Payment Behaviour in Australia

The results of the Reserve Bank’s 2022 Consumer Payments Survey show that consumers continue to shift from using cash to electronic payment methods – a trend that was accelerated by the COVID-19 pandemic and consumers’ preference towards using debit and credit cards and making payments online. Consumers are also increasingly using more convenient payment methods, particularly contactless card payments, by tapping their card or phone. Cards are now used for most in-person payments, even for small transactions that used to be made mostly with cash.

Cash Use and Attitudes in Australia

The 2022 Consumer Payments Survey reveals that the ongoing decline in cash use in Australia has accelerated since the COVID-19 pandemic. The share of in-person transactions made with cash halved, from 32 per cent to 16 per cent, over the three years to 2022. The decline in cash use was particularly pronounced for smaller payments; cash is now used less than electronic methods for all transaction sizes. The demographic groups that traditionally used cash more frequently for payments – such as the elderly, those on lower incomes and those in regional areas – saw the largest declines in cash use. Privacy and security concerns with electronic payment methods continued to be the main reason for needing cash, while barriers to using electronic payment methods have become less important since 2019.

Estimating the Relative Contributions of Supply and Demand Drivers to Inflation in Australia

Inflation has increased substantially since mid-2021. Understanding the relative contributions of supply and demand factors is important for determining the appropriate monetary policy response; a central bank may at least partly ‘look through’ the price effects of a supply shock if it is expected to be short lived and inflation expectations remain anchored. This article attempts to disentangle and explore the contributions of supply and demand factors to the recent inflationary episode, using three approaches. Similar to the experience of other advanced economies, our estimates suggest that supply-side factors have been the biggest driver of recent inflation outcomes in Australia. These supply-side factors have been persistent, with their contribution to inflation growing over 2022, leading to an extended period of inflation being above target and concerns that inflation expectations could become de-anchored. That said, demand has also played an important role.

Leverage, Liquidity and Non-bank Financial Institutions: Key Lessons from Recent Market Events

Non-bank financial institutions (NBFIs) can pose risks to financial stability due to their size, complexity and global interconnectedness. Vulnerabilities present in some NBFIs include high levels of leverage, liquidity mismatches and weaknesses in risk management practices. This article discusses how these vulnerabilities have been exposed in multiple episodes overseas since early 2020, resulting in dysfunction in some financial markets and losses for some NBFI counterparties. While Australian markets and institutions were largely unaffected by these episodes, regulators in Australia and overseas remain vigilant to the potential future risks posed by the sector.

Syndicated Lending

Syndicated lending involves a group of lenders providing a single loan to one borrower. This article considers the purposes and workings of syndicated loans in the Australian market, and the advantages of this type of lending for both lenders and borrowers. It finds that syndicated loans are a significant source of funding for large Australian businesses and for borrowers with large financing needs, especially as such loans are often more accessible and flexible than public debt markets. For lenders, syndication allows them to diversify their exposures, as well as to monitor loans and negotiate covenants efficiently.

Recent Developments in the Cash Market

Following the implementation of unconventional monetary policy measures during the COVID-19 pandemic, liquidity in the banking system rose significantly. This led to a fall in cash market activity and a decline in the cash rate to below the cash rate target. Despite the high level of liquidity – as measured by Exchange Settlement (ES) balances – some banks have continued to borrow in the cash market. Over the past year or so, this borrowing has picked up somewhat and the cash rate has risen modestly to be slightly closer to the target, largely owing to an increase in the concentration of ES balances. As the Reserve Bank’s unconventional policy measures unwind and ES balances decline, activity in the cash market is likely to increase further. The extent of any future pick-up in activity, and the level of the cash rate relative to the target, will be influenced by the distribution of ES balances across banks.

Economic Developments in the South Pacific

Australia has long played a significant role in the regional economy of the South Pacific. This article provides an overview of economic developments in the region, with a focus on recent shocks and medium-term growth challenges. The region’s heavy reliance on external demand meant that South Pacific economies were severely impacted by the COVID-19 pandemic and other concurrent challenges. Expansionary economic policies implemented by governments and central banks, alongside international aid and lending, supported the region through the acute phase of the pandemic. While a recovery is underway, the South Pacific will continue to face challenges to its medium-term growth and development, particularly via high debt levels and climate change.

Correspondent Banking in the South Pacific

Worldwide, many financial institutions make use of correspondent banking services to connect to the global financial system. This article examines the withdrawal of global financial institutions from the provision of correspondent banking services to the South Pacific and the implications for countries in the region. The available evidence suggests that South Pacific nations, like many small island economies globally, have seen a larger-than-average decline in the provision of these services. The decrease in the availability of correspondent banking services appears to be most pronounced for smaller local banks and in the major global currencies. While the available evidence suggests that South Pacific countries have been able to manage this decline thus far, the remaining correspondent banking services are becoming increasingly stretched and further withdrawal may cause financial sector disruption.

Renters, Rent Inflation and Renter Stress

Around one-third of all Australian households rent. Renter households tend to be younger, have lower incomes and less wealth than owner-occupiers. Renter households are also more likely than mortgagors to experience financial stress, although the incidence of financial stress among renter households has declined over the past decade. The rental market is tight and rents have increased more strongly of late, compared with the modest increases in average rents over the 2010s. For some renters, strong growth in incomes will have helped limit the deterioration in housing affordability, although there will be others who will struggle to afford the rent increases. This suggests that affordability will have worsened for some renters, and, in combination with other rising cost-of-living pressures, this is likely to be contributing to financial stress.

Fixed-rate Housing Loans: Monetary Policy Transmission and Financial Stability Risks

Fixed-rate borrowing increased significantly during the COVID-19 pandemic, which has delayed the effect of the higher cash rate on borrowers’ cash flows. A key issue for the economic outlook, and by implication financial stability, relates to the ability of borrowers with fixed-rate loans to adjust to substantially higher borrowing costs when their fixed-rate mortgages expire. Borrowers with fixed-rate loans have had a considerable period to adjust their finances to prepare for the increase in their mortgage payments and many appear to have similar savings to borrowers on variable rates. However, on some metrics fixed-rate loans have higher risk characteristics than variable-rate loans. With many fixed-rate mortgages expiring in the period ahead, the Reserve Bank will continue to closely monitor the implications for household consumption and financial stability.

A New Measure of Average Household Size

This article introduces a new, timely measure of average household size (AHS) – a key determinant of underlying demand for housing – using the data from the ABS monthly Labour Force Survey. The average number of people living in each household has declined from around 2.9 in the mid-1980s to around 2.5 since the early 2000s. More recently, the AHS declined to historical lows of a little below 2.5 people per household. This was driven by changes in Sydney and Melbourne during the pandemic, which were more exposed to health restrictions, lockdowns and changes in migration flows from overseas.

Non-bank Lending in Australia and the Implications for Financial Stability

Non-bank lenders help to finance some forms of economic activity that might otherwise go unfinanced by traditional banks. However, as the global financial crisis demonstrated, non-bank lending activities have the potential to undermine financial stability, in part because they are less constrained by regulation. Risks to financial stability can include the amplification of credit and asset price cycles, increased competition for borrowers that prompts banks to weaken their own lending standards, and the potential of stress spilling over into the prudentially regulated financial system. Unlike in some other economies, non-bank lending accounts for a small share of total credit in the Australian economy and banks have relatively limited exposure to non-bank lenders. Non-bank lending therefore poses little systemic risk to financial stability in Australia at present. However, it has grown strongly in recent years, particularly for housing. Regulators and policymakers therefore need to continue monitoring developments in this space. This article provides a primer on non-bank lending in Australia, focusing on lending for housing and the potential risks to financial stability.

The Cash-use Cycle in Australia

The use of cash for day-to-day transactions has been declining for many years and this has implications for all aspects of the cash system. This article illustrates the interrelationships between consumers’ use of cash for transactions, access to cash services and merchants’ acceptance of cash as a payment mechanism through a ‘cash-use cycle’. Recent data suggest that the cash-use cycle in Australia is functioning adequately at present. However, the ongoing adequacy of cash access is vulnerable to further withdrawal of access points; this issue warrants regular monitoring.

Can Wage-setting Mechanisms Affect Labour Market Reallocation and Productivity?

Productivity growth has slowed in Australia and overseas in recent decades, with negative implications for wages and incomes. In Australia, at least part of this slowdown reflects the fact that more productive firms have grown and attracted workers more slowly than in the past. This article considers whether the increased use of industry-wide wage agreements could help to explain this slowdown. It finds that in sectors with greater use of industry-wide agreements, the relationship between firm-level wages and productivity tends to be weaker. This weaker relationship between productivity and wages seems to feed through to firm growth, with more productive firms seemingly less likely to attract staff and grow. While many factors can affect the choice of wage-setting mechanism, these results suggest that aggregate productivity growth and living standards could be stronger when firms are incentivised and able to compete for workers.

Bank Fees in Australia

This article updates previous Reserve Bank research on bank fees charged to Australian households, businesses and government. Over the year to June 2022, total fees charged by banks through their domestic operations were little changed from the previous reporting period. Strong growth in business credit added to fee income in the year, while overall fee income from households declined amid heightened lending competition in the housing market. Lending growth continued to outpace growth in fee earnings, and total fee income as a share of banks’ incomes decreased slightly.

Developments in Banks' Funding Costs and Lending Rates

Banks’ funding costs rose over 2022, driven by increases in the cash rate and in expectations for the future path of the cash rate. In turn, lending rates have increased considerably for the first time in over a decade. The increases in the average rate charged on all outstanding loans was limited by the large share of fixed-rate housing loans and ongoing competition in housing lending. This article updates previous research published by the Reserve Bank on developments in banks’ funding costs and lending rates.

Developments in Foreign Exchange and Over-the-counter Derivatives Markets

This article discusses the key results from the 2022 Triennial Central Bank Survey of Foreign Exchange and Over-the-counter Derivatives Markets. Global activity in foreign exchange (FX) markets increased over the three years to April 2022, driven by increased turnover of FX swaps with short maturities and trading between dealers. The volume of FX trading activity in the Australian market also grew, although this was largely driven by increased trading between related parties. The Australian dollar was the sixth most traded currency globally, down from fifth in 2019. Turnover of over-the-counter (OTC) interest rate derivatives declined globally, reflecting the transition away from the London interbank offered rate (Libor); however, activity increased in the Australian OTC interest rate derivative market, reflecting an increase in turnover of interest rate swaps. For Australian banks, the value of OTC derivatives increased sharply, driven by interest rate and commodity derivatives.

Foreign Currency Exposure and Hedging in Australia

The 2022 Survey of Foreign Currency Exposure confirms that Australian entities’ financial positions, in aggregate, are well protected against a depreciation of the Australian dollar. The composition of Australia’s foreign currency denominated assets and liabilities means that, overall, Australian entities have a net foreign currency asset position. This has increased over a number of years, largely reflecting an increase in the value of foreign currency equity assets associated with superannuation funds. Meanwhile, the banking sector accounts for a large share of Australia’s foreign currency liabilities because of their offshore funding activities. However, the bulk of the banking sector’s foreign currency debt liabilities have been hedged. After hedging, the sector has a net foreign currency asset position and no significant currency mismatches, both of which reduce the risks associated with a large depreciation of the Australian dollar.

Reassessing the Costs and Benefits of Centrally Clearing the Australian Bond Market

This article considers the costs and benefits of centrally clearing the Australian bond market, in light of developments in the market since the Reserve Bank’s last review in 2015. On balance, our analysis suggests that changes to the size and structure of the Australian bond market have strengthened the case for central clearing. These changes include substantial growth in the size of the market, increased participation of non-resident investors and increased complexity resulting from the growing number of bilateral clearing arrangements. Central clearing would simplify the market structure and could yield other benefits, especially in times of stress. For example, our estimates suggest multilateral netting has the potential to lower settlement obligations by $60 billion per day. This is more than can be achieved with bilateral netting. Further, market resilience and liquidity conditions might also be improved by multilateral netting as interbank participants’ balance sheet constraints are reduced. The key challenge for a potential central counterparty would be to develop a sufficiently wide network of products and participants to achieve overall benefits. Some participants face a lower incentive to join and in their absence the potential benefits from central clearing would be reduced.

HC Coombs: Governor of Australia's Central Bank 1949–1968

Dr HC Coombs was Governor of Australia’s central bank for nearly 20 years. His appointment followed significant roles in Australia’s war-time administration and post-war reconstruction, where he was an architect of Australia’s international full employment policy, known as the ‘Positive Approach’. When appointed Governor of the central bank in 1949, Coombs remained committed to the pursuit of full employment. Influenced by Keynes, he sought to maintain aggregate demand and supply in ‘reasonable balance’, something the Reserve Bank continues to do today. After retiring from the Bank in 1968, Coombs continued to promote the arts in Australia and the rights and welfare of First Nations Australians. He became a senior adviser to the Whitlam Government and chaired the Royal Commission on Australian Government Administration – a fitting conclusion for someone often described as the nation’s greatest public servant. This article considers the life and career of HC Coombs, and complements the series of records that have been released on Unreserved.

Economic Literacy: What Is It and Why Is It Important?

One of the core objectives of the Reserve Bank’s public education program is to improve economic literacy. While the social benefits of economic literacy are well established, defining what is meant by this term is not straightforward and has been the subject of debate over many decades. This article explores the meaning of ‘economic literacy’. To arrive at a working definition, it discusses the economic principles that should be understood for someone to be considered economically literate, along with the topics they should be familiar with and the ways of thinking that we would expect them to display. In doing so, it distinguishes between economic and financial literacy. The article concludes by posing questions for future research on how economic literacy in Australia might be measured and how it might be supported.

The Recovery in the Australian Tourism Industry

The Australian tourism industry is gradually recovering from the COVID-19 pandemic that brought global travel to an unprecedented standstill. International tourism fell sharply in early 2020 and has only slowly recovered since restrictions were lifted in the first half of this year. By contrast, domestic tourism spending bounced back quickly as local restrictions eased and is now above pre-pandemic levels. This article outlines the recovery in the Australian tourism industry following the pandemic, the challenges the industry has faced in reopening, and the uncertainties around the outlook for the tourism industry over the next few years.

New Measures of Financial Stress from Non-traditional Data

Household and business financial stress has significant implications for financial stability and monetary policy. However, high-frequency and timely indicators of emerging signs of financial stress are not readily available. To address this information gap, the Reserve Bank has developed novel measures of financial stress based on news, search and social media data. This article describes these new metrics and how they can capture meaningful changes in financial conditions and, in some cases, predict traditional measures of financial stress, such as loan arrears. Going forward, these indices will continue to be monitored for early signs of financial difficulties.

Stablecoins: Market Developments, Risks and Regulation

Stablecoins – a type of crypto-asset designed to maintain a stable value – have grown in popularity over recent years. Market developments, however, have highlighted the risks stablecoins can pose to investors, particularly if they are not fully backed by high-quality liquid assets. Stablecoins currently pose limited risks to the broader Australian financial system, but this could change if they become more widely used in the future – for example, in payments and other financial services. As such, regulators across the world are seeking to bring greater clarity to the regulatory treatment of stablecoins, not only to manage risks but also to support innovation in the market. This article considers the rise of stablecoins, the risks they pose and the response of regulators so far.

The RBA and AOFM Securities Lending Facilities

Australian Government Securities (AGS) play an important role in the transmission of monetary policy given that yields on these securities provide a benchmark for other interest rates across the economy. The Bank has a large amount of AGS and ‘semi-government’ bonds issued by state and territory borrowing authorities (semis) on its balance sheet as a result of purchases to support the economy through the COVID-19 pandemic. To support the efficient functioning of these markets, the Bank operates a securities lending facility (SLF) from which eligible counterparties can borrow AGS and semis; the Bank also operates an SLF on behalf of the Australia Office of Financial Management (AOFM). The use of these SLFs picked up noticeably following the end of the Bank’s yield target and bond purchase program. This article discusses these facilities in detail, including why market participants might use them and the recent increase in borrowing.

The Reserve Bank's Liaison Program Turns 21

In 2001, the Reserve Bank established its liaison program – a formal program of economic intelligence gathering, through which Bank staff meet frequently with firms, industry bodies, government agencies and community organisations. The program is systematic in its approach to collecting and assessing information, and the intelligence obtained is a useful complement to published sources of data and economic models in informing the Bank's assessment of economic conditions. In addition, the information gathered is available in near real time, making it useful for ‘nowcasting’ and understanding the implications of short-term shocks to the economy. This article looks at the process of liaison, the nature of the information collected and how it has been used over its 21 years of operation.

The Current Climate for Small Business Finance

Economic conditions for small and medium enterprises (SMEs) have been relatively strong since the second half of 2021, and demand for business finance is high. However, the environment remains challenging and uncertain, and interest rates on loans for SMEs are rising from historical lows. Small businesses continue to report that accessing funding through banks is a challenge, although new lenders and products are providing alternative sources of finance. The article considers these recent developments, drawing in particular on the discussions of the Small Business Finance Advisory Panel, which met in July this year.

The Cost of Card Payments for Merchants